Question

Old MathJax webview 2) Cyclical firms have high betas because: Multiple Choice their earnings are particularly sensitive to the state of the economy. their earnings

Old MathJax webview

2)

Cyclical firms have high betas because:

Multiple Choice their earnings are particularly sensitive to the state of the economy. their earnings are more volatile than those of other firms in the economy. their stocks are overpriced. their asset-specific risks are high.

3)

You have a portfolio consisting of 16% in Treasury bills, 25% in Stock A, and 59% in Stock B. Stock A has a risk level equivalent to that of the overall market. If your portfolio has a beta of 1.63, what is the beta of Stock B?

Multiple Choice

2.25

.43

2.34

.88

4)

A stock has a reward-to-risk ratio of 6.03% and a beta of 1.21. If the risk-free rate is 3.6%, what is the stock's expected return?

Multiple Choice

10.90%

10.48%

10.06%

9.53%

JUST ANSWER IS ENOUGH, DONT GIVE A DETAIL

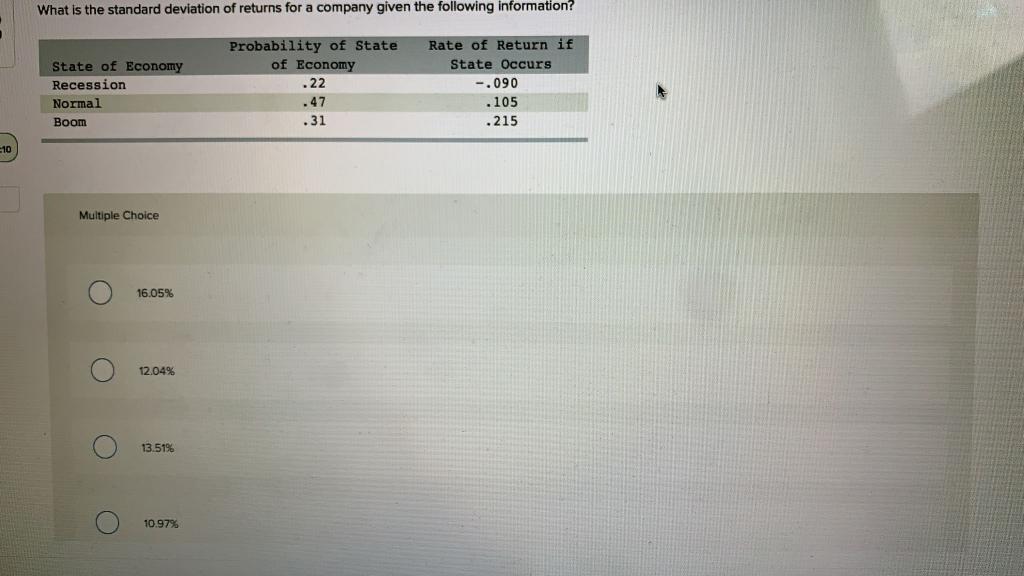

What is the standard deviation of returns for a company given the following information? State of Economy Recession Normal Boom Probability of State of Economy .22 .47 .31 Rate of Return if State Occurs -.090 .105 .215 10 Multiple Choice 16.05% 12.04% 13.51% 10.97%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started