Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview 8. Mr. Alpha needs Rs. 300,000 for the marriage of her daughter. He approached one of the money lenders for borrowing loan.

Old MathJax webview

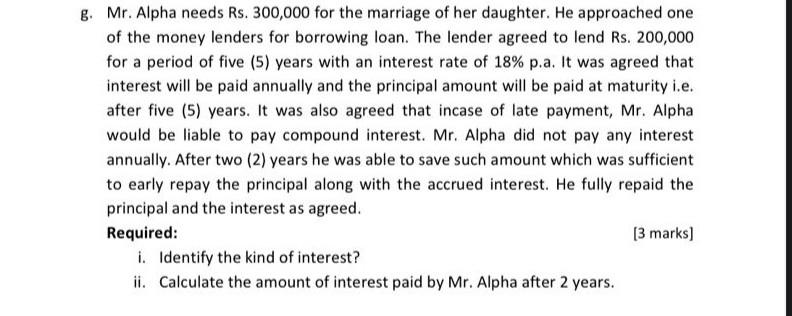

8. Mr. Alpha needs Rs. 300,000 for the marriage of her daughter. He approached one of the money lenders for borrowing loan. The lender agreed to lend Rs. 200,000 for a period of five (5) years with an interest rate of 18% p.a. It was agreed that interest will be paid annually and the principal amount will be paid at maturity i.e. after five (5) years. It was also agreed that incase of late payment, Mr. Alpha would be liable to pay compound interest. Mr. Alpha did not pay any interest annually. After two (2) years he was able to save such amount which was sufficient to early repay the principal along with the accrued interest. He fully repaid the principal and the interest as agreed. Required: [3 marks) i. Identify the kind of interest? ii. Calculate the amount of interest paid by Mr. Alpha after 2 years. 8. Mr. Alpha needs Rs. 300,000 for the marriage of her daughter. He approached one of the money lenders for borrowing loan. The lender agreed to lend Rs. 200,000 for a period of five (5) years with an interest rate of 18% p.a. It was agreed that interest will be paid annually and the principal amount will be paid at maturity i.e. after five (5) years. It was also agreed that incase of late payment, Mr. Alpha would be liable to pay compound interest. Mr. Alpha did not pay any interest annually. After two (2) years he was able to save such amount which was sufficient to early repay the principal along with the accrued interest. He fully repaid the principal and the interest as agreed. Required: i. Identify the kind of interest? ii. Calculate the amount of interest paid by Mr. Alpha after 2 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started