Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview answers: A) NPV estimate is -15,060 B) 20,677 C) Yes The answers are provided but I don't know the steps to get

Old MathJax webview

answers:

A) NPV estimate is -15,060 B) 20,677 C) Yes

The answers are provided but I don't know the steps to get these answers. please explain all steps so I can fully understand how to solve. thank you!

Assume cost of capital is 12%

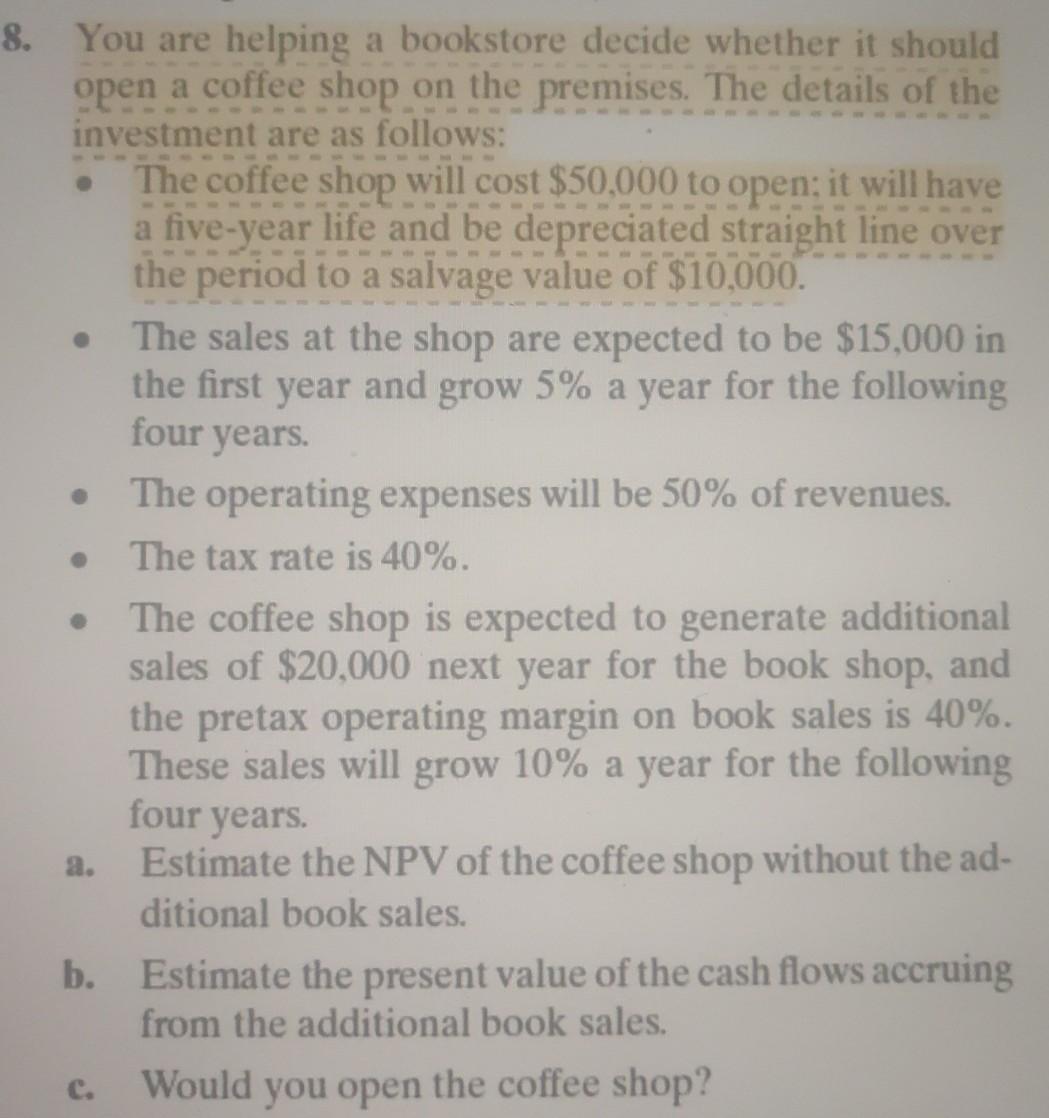

8. You are helping a bookstore decide whether it should open a coffee shop on the premises. The details of the investment are as follows: The coffee shop will cost $50,000 to open; it will have a five-year life and be depreciated straight line over the period to a salvage value of $10,000. The sales at the shop are expected to be $15,000 in the first year and grow 5% a year for the following four years. The operating expenses will be 50% of revenues. The tax rate is 40%. The coffee shop is expected to generate additional sales of $20,000 next year for the book shop, and the pretax operating margin on book sales is 40%. These sales will grow 10% a year for the following four years. a. Estimate the NPV of the coffee shop without the ad- ditional book sales. b. Estimate the present value of the cash flows accruing from the additional book sales. Would you open the coffee shop? CStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started