Answered step by step

Verified Expert Solution

Question

1 Approved Answer

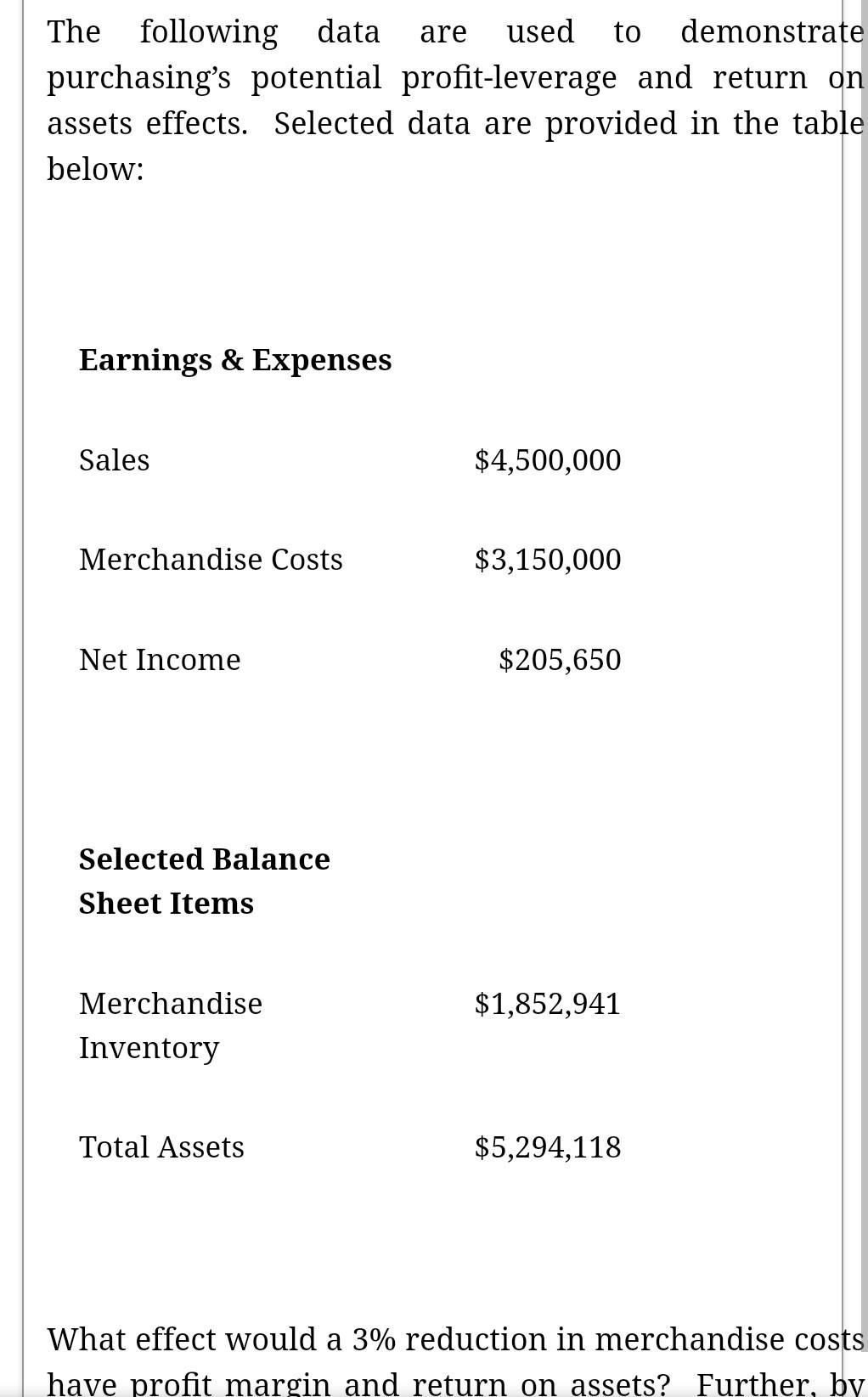

Old MathJax webview are The following data used to demonstrate purchasing's potential profit-leverage and return on assets effects. Selected data are provided in the table

Old MathJax webview

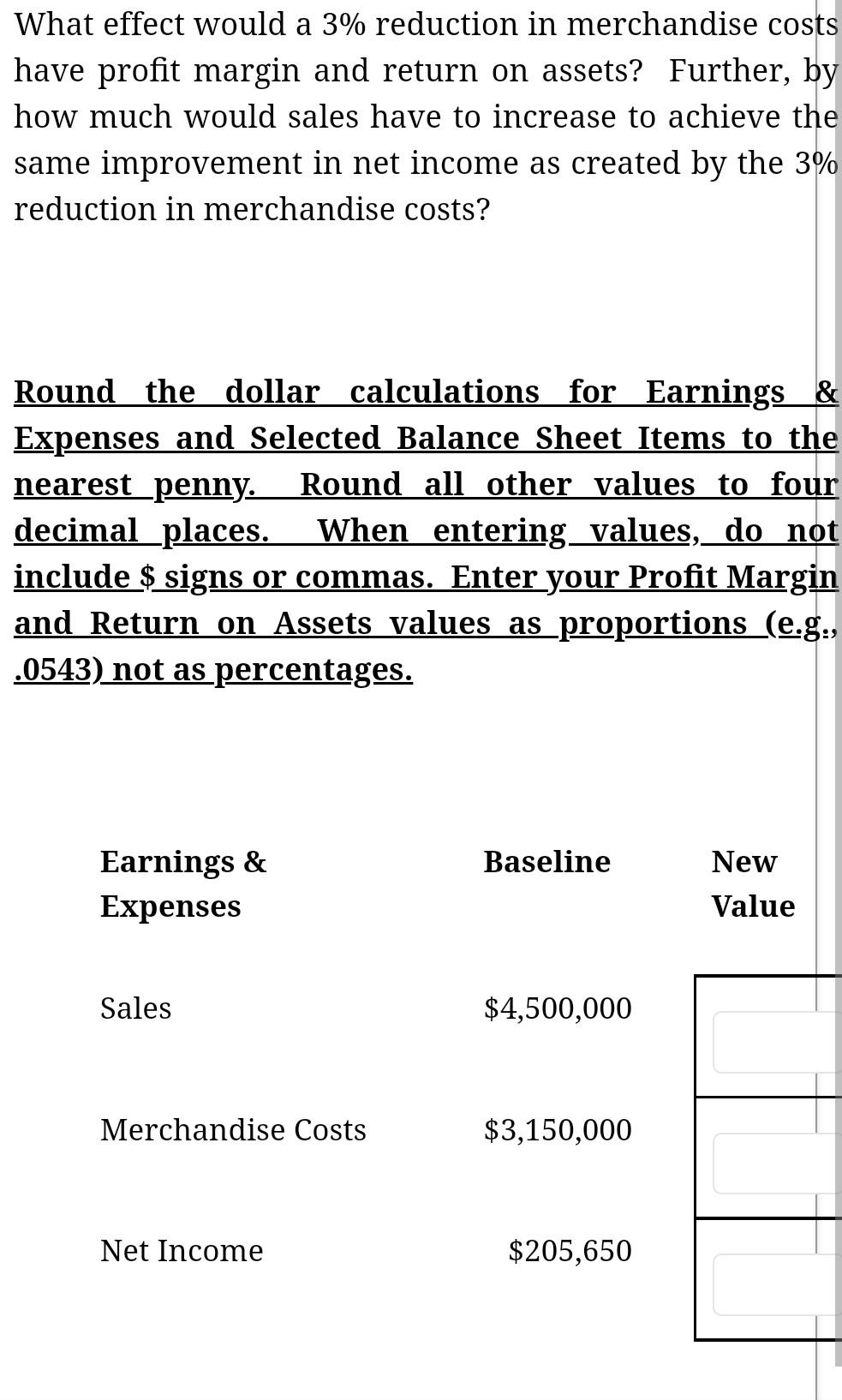

are The following data used to demonstrate purchasing's potential profit-leverage and return on assets effects. Selected data are provided in the table below: Earnings & Expenses Sales $4,500,000 Merchandise Costs $3,150,000 Net Income $ 205,650 Selected Balance Sheet Items $1,852,941 Merchandise Inventory Total Assets $5,294,118 What effect would a 3% reduction in merchandise costs have profit margin and return on assets? Further, by What effect would a 3% reduction in merchandise costs have profit margin and return on assets? Further, by how much would sales have to increase to achieve the same improvement in net income as created by the 3% reduction in merchandise costs? Round the dollar calculations for Earnings & Expenses and Selected Balance Sheet Items to the nearest penny. Round all other values to four decimal places. When entering values, do not include $ signs or commas. Enter your Profit Margin and Return on Assets values as proportions (e.g., .0543) not as percentages. Baseline Earnings & Expenses New Value Sales $4,500,000 Merchandise Costs $3,150,000 Net Income $205,650

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started