Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview Armadale Company manufactures and sells three video games consoles: The Alpha X, the Beta Y, and the Gamma Z game systems. The

Old MathJax webview

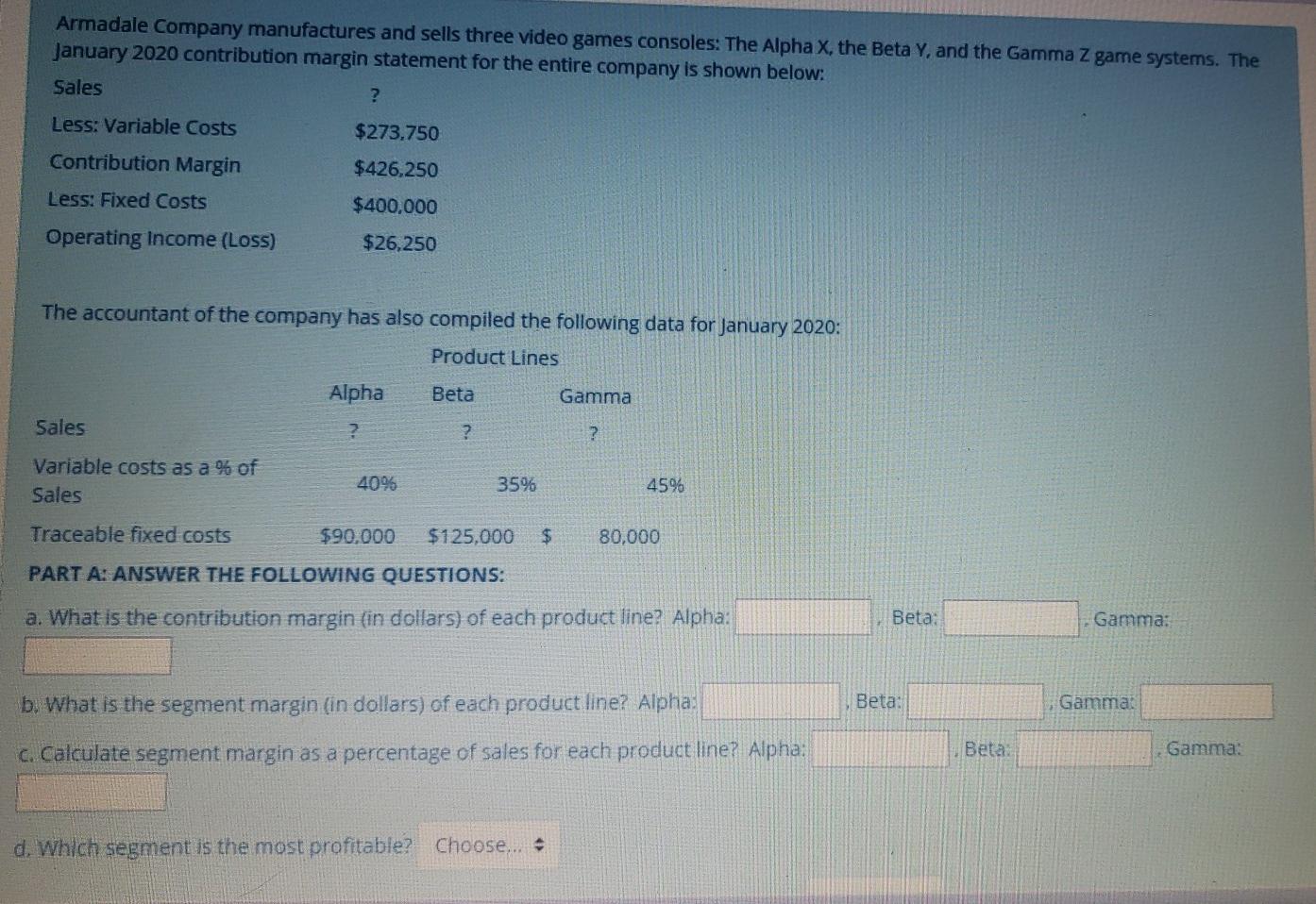

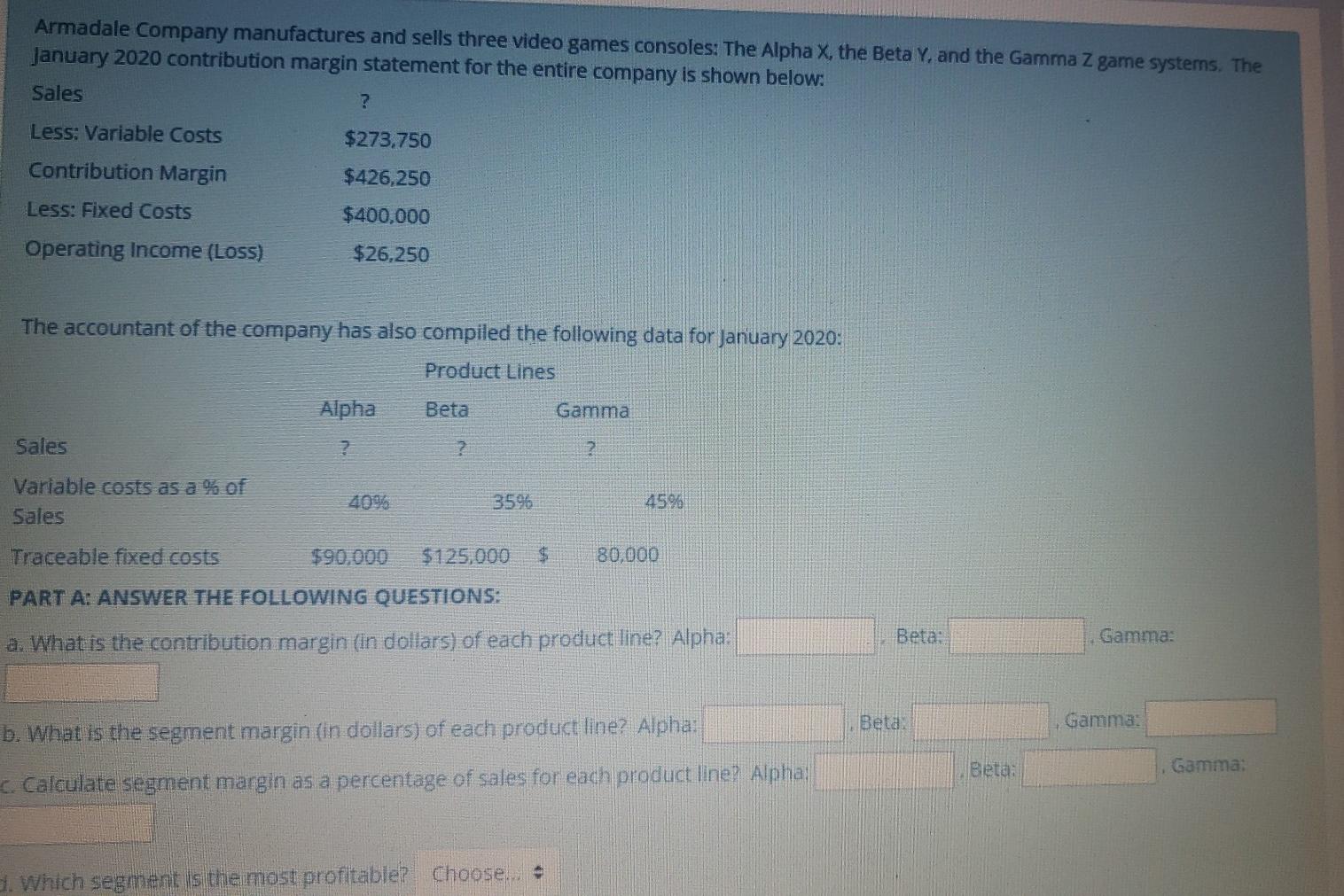

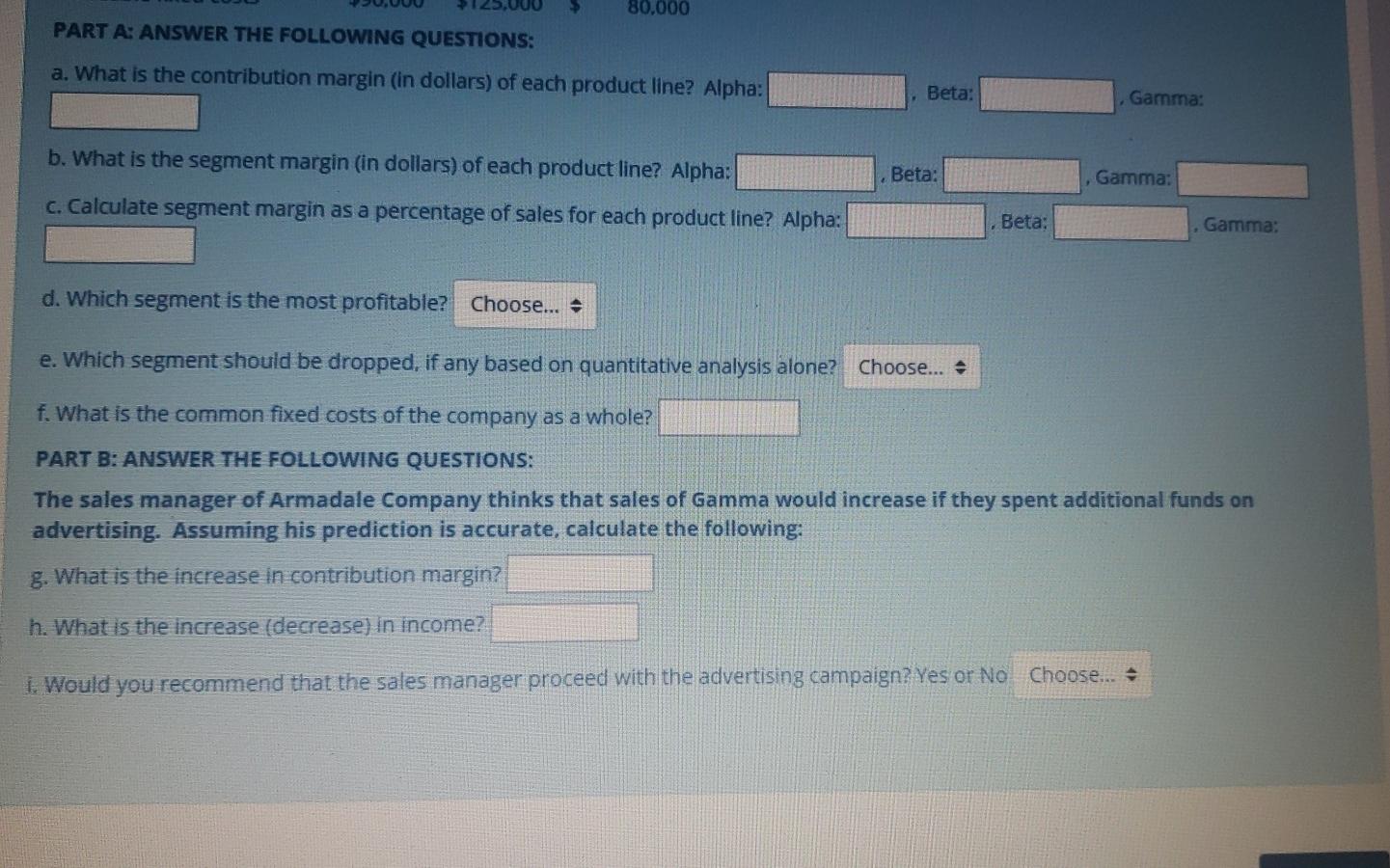

Armadale Company manufactures and sells three video games consoles: The Alpha X, the Beta Y, and the Gamma Z game systems. The January 2020 contribution margin statement for the entire company is shown below: Sales ? Less: Variable Costs $273.750 Contribution Margin $426,250 Less: Fixed Costs $400,000 Operating Income (Loss) $26,250 The accountant of the company has also compiled the following data for January 2020: Product Lines Alpha Beta Gamma Sales ? ? ? Variable costs as a % of Sales 4096 35% 45% Traceable fixed costs $90,000 $125,000 $ 80,000 PART A: ANSWER THE FOLLOWING QUESTIONS: a. What is the contribution margin (in dollars) of each product line? Alpha: Beta: Gamma: b. What is the segment margin (in dollars) of each product line? Alpha Beta: Gammat Beta Gamma: C. Calculate segment margin as a percentage of sales for each product line? Alpha: d. Which segment is the most profitable? Choose... - Armadale Company manufactures and sells three video games consoles: The Alpha X, the Beta Y. and the Gamma Z game systems. The January 2020 contribution margin statement for the entire company is shown below: Sales ? Less: Variable Costs $273,750 Contribution Margin $426,250 Less: Fixed Costs $400,000 Operating Income (Loss) $26,250 The accountant of the company has also compiled the following data for January 2020: Product Lines Alpha Beta Gamma Sales 2 2 2. Variable costs as a % of Sales 35% 45% Traceable fixed costs $90,000 $125,000 80,000 PART A: ANSWER THE FOLLOWING QUESTIONS: a. What is the contribution margin (In dollars) of each product line? Alpha: Beta: Gamma: Beta Gamma: b. What is the segment margin (in dollars) of each product line? Alpha: Gamma: c. Calculate segment margin as a percentage of sales for each product line? Alpha 3. Which segment is the most profitable? Choose... . 80.000 PART A: ANSWER THE FOLLOWING QUESTIONS: a. What is the contribution margin (in dollars) of each product line? Alpha: Beta: Gamma: b. What is the segment margin (in dollars) of each product line? Alpha: Beta: Gamma: C. Calculate segment margin as a percentage of sales for each product line? Alpha: Beta: Gamma: d. Which segment is the most profitable? Choose... - e. Which segment should be dropped, if any based on quantitative analysis alone? Choose... * f. What is the common fixed costs of the company as a whole? PART B: ANSWER THE FOLLOWING QUESTIONS: The sales manager of Armadale Company thinks that sales of Gamma would increase if they spent additional funds on advertising. Assuming his prediction is accurate, calculate the following: g. What is the increase in contribution margin? h. What is the increase (decrease) in income? 1. Would you recommend that the sales manager proceed with the advertising campaign? Yes or No Choose... Armadale Company manufactures and sells three video games consoles: The Alpha X, the Beta Y, and the Gamma Z game systems. The January 2020 contribution margin statement for the entire company is shown below: Sales ? Less: Variable Costs $273.750 Contribution Margin $426,250 Less: Fixed Costs $400,000 Operating Income (Loss) $26,250 The accountant of the company has also compiled the following data for January 2020: Product Lines Alpha Beta Gamma Sales ? ? ? Variable costs as a % of Sales 4096 35% 45% Traceable fixed costs $90,000 $125,000 $ 80,000 PART A: ANSWER THE FOLLOWING QUESTIONS: a. What is the contribution margin (in dollars) of each product line? Alpha: Beta: Gamma: b. What is the segment margin (in dollars) of each product line? Alpha Beta: Gammat Beta Gamma: C. Calculate segment margin as a percentage of sales for each product line? Alpha: d. Which segment is the most profitable? Choose... - Armadale Company manufactures and sells three video games consoles: The Alpha X, the Beta Y. and the Gamma Z game systems. The January 2020 contribution margin statement for the entire company is shown below: Sales ? Less: Variable Costs $273,750 Contribution Margin $426,250 Less: Fixed Costs $400,000 Operating Income (Loss) $26,250 The accountant of the company has also compiled the following data for January 2020: Product Lines Alpha Beta Gamma Sales 2 2 2. Variable costs as a % of Sales 35% 45% Traceable fixed costs $90,000 $125,000 80,000 PART A: ANSWER THE FOLLOWING QUESTIONS: a. What is the contribution margin (In dollars) of each product line? Alpha: Beta: Gamma: Beta Gamma: b. What is the segment margin (in dollars) of each product line? Alpha: Gamma: c. Calculate segment margin as a percentage of sales for each product line? Alpha 3. Which segment is the most profitable? Choose... . 80.000 PART A: ANSWER THE FOLLOWING QUESTIONS: a. What is the contribution margin (in dollars) of each product line? Alpha: Beta: Gamma: b. What is the segment margin (in dollars) of each product line? Alpha: Beta: Gamma: C. Calculate segment margin as a percentage of sales for each product line? Alpha: Beta: Gamma: d. Which segment is the most profitable? Choose... - e. Which segment should be dropped, if any based on quantitative analysis alone? Choose... * f. What is the common fixed costs of the company as a whole? PART B: ANSWER THE FOLLOWING QUESTIONS: The sales manager of Armadale Company thinks that sales of Gamma would increase if they spent additional funds on advertising. Assuming his prediction is accurate, calculate the following: g. What is the increase in contribution margin? h. What is the increase (decrease) in income? 1. Would you recommend that the sales manager proceed with the advertising campaign? Yes or No Choose

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started