Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview can anyone help me with this?? i really need help to submit this. i would really appreciate to you guys if can

Old MathJax webview

can anyone help me with this?? i really need help to submit this. i would really appreciate to you guys if can help me with this in an hour. i need to submit

answer in xcell

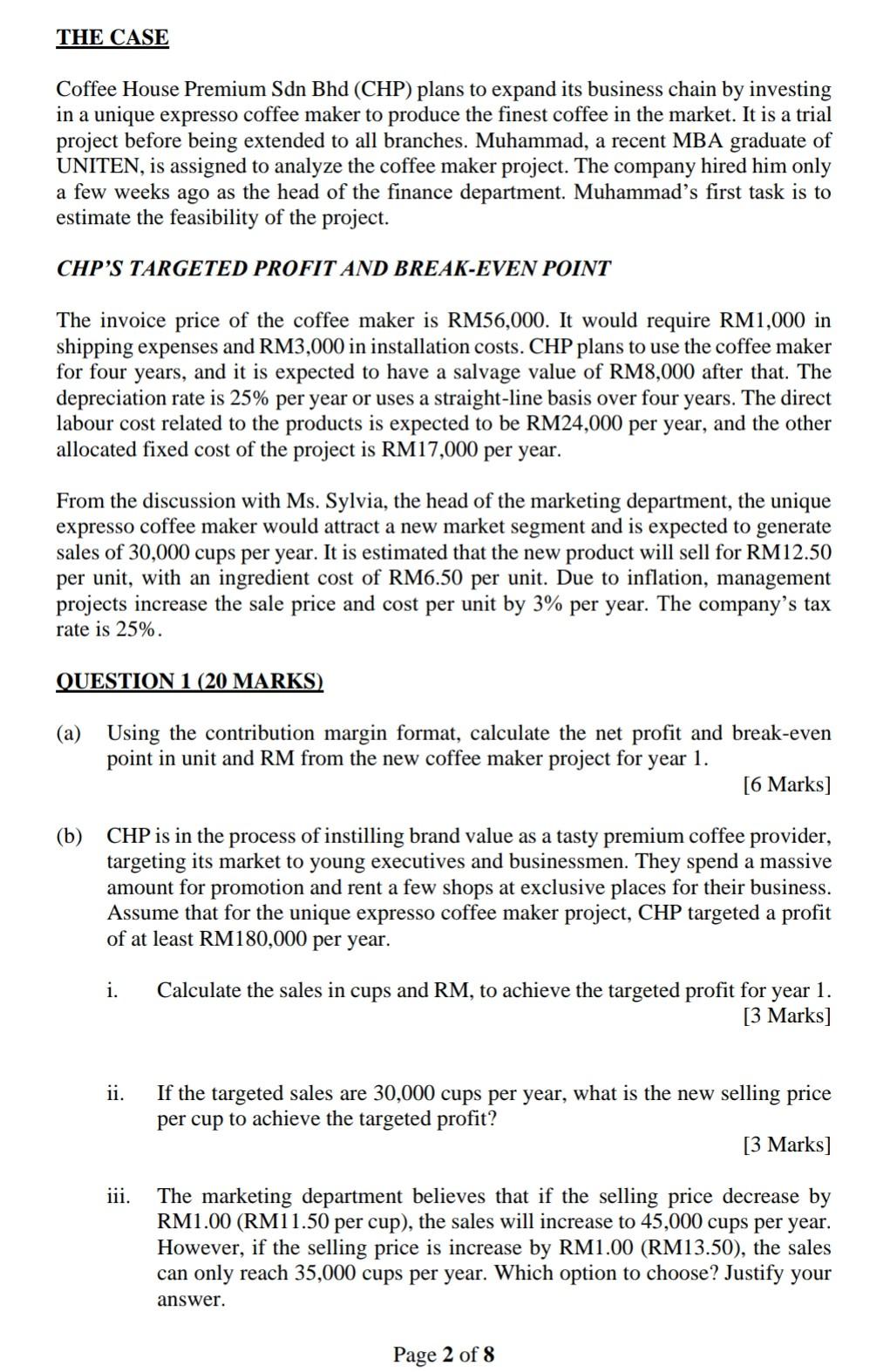

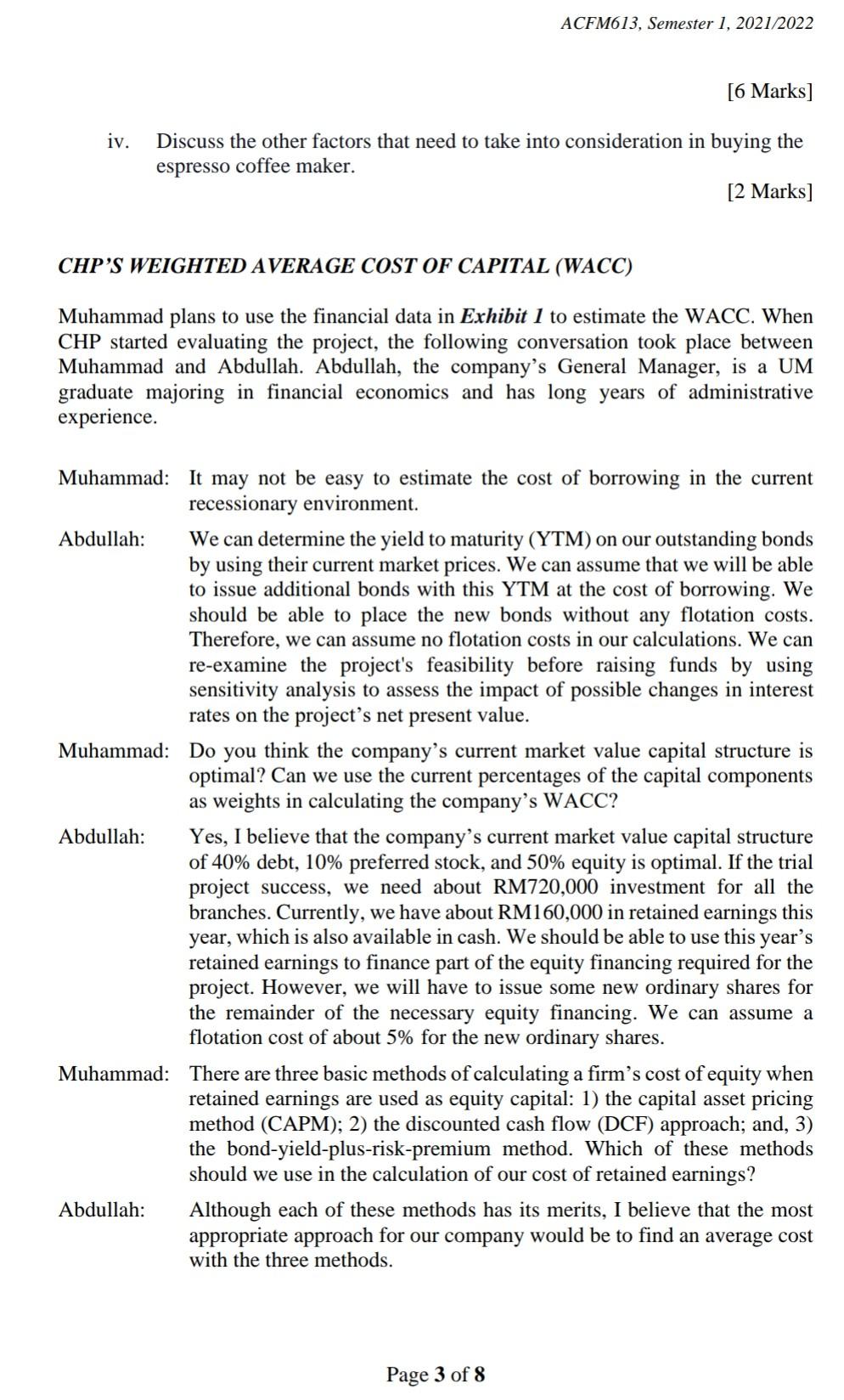

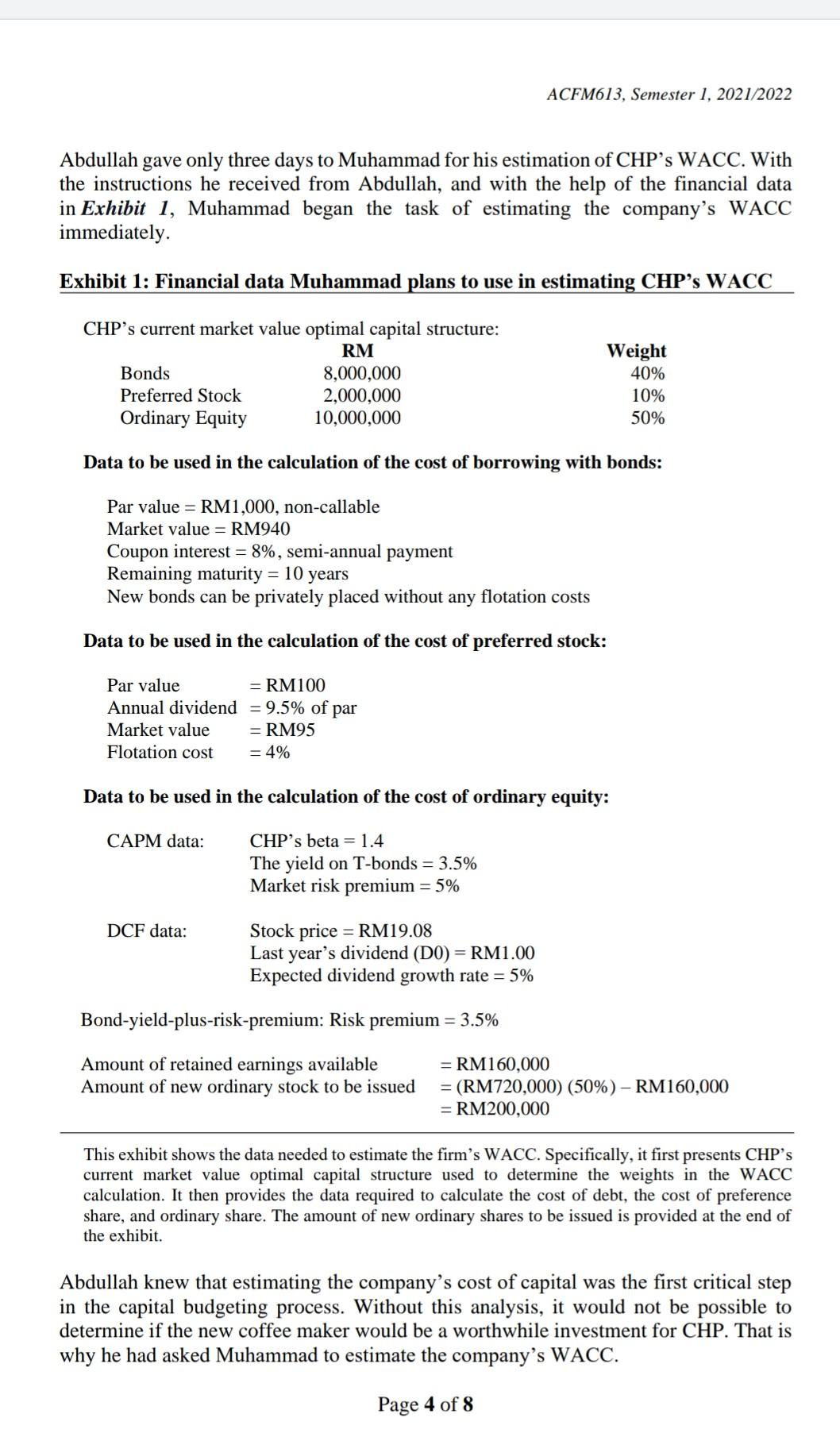

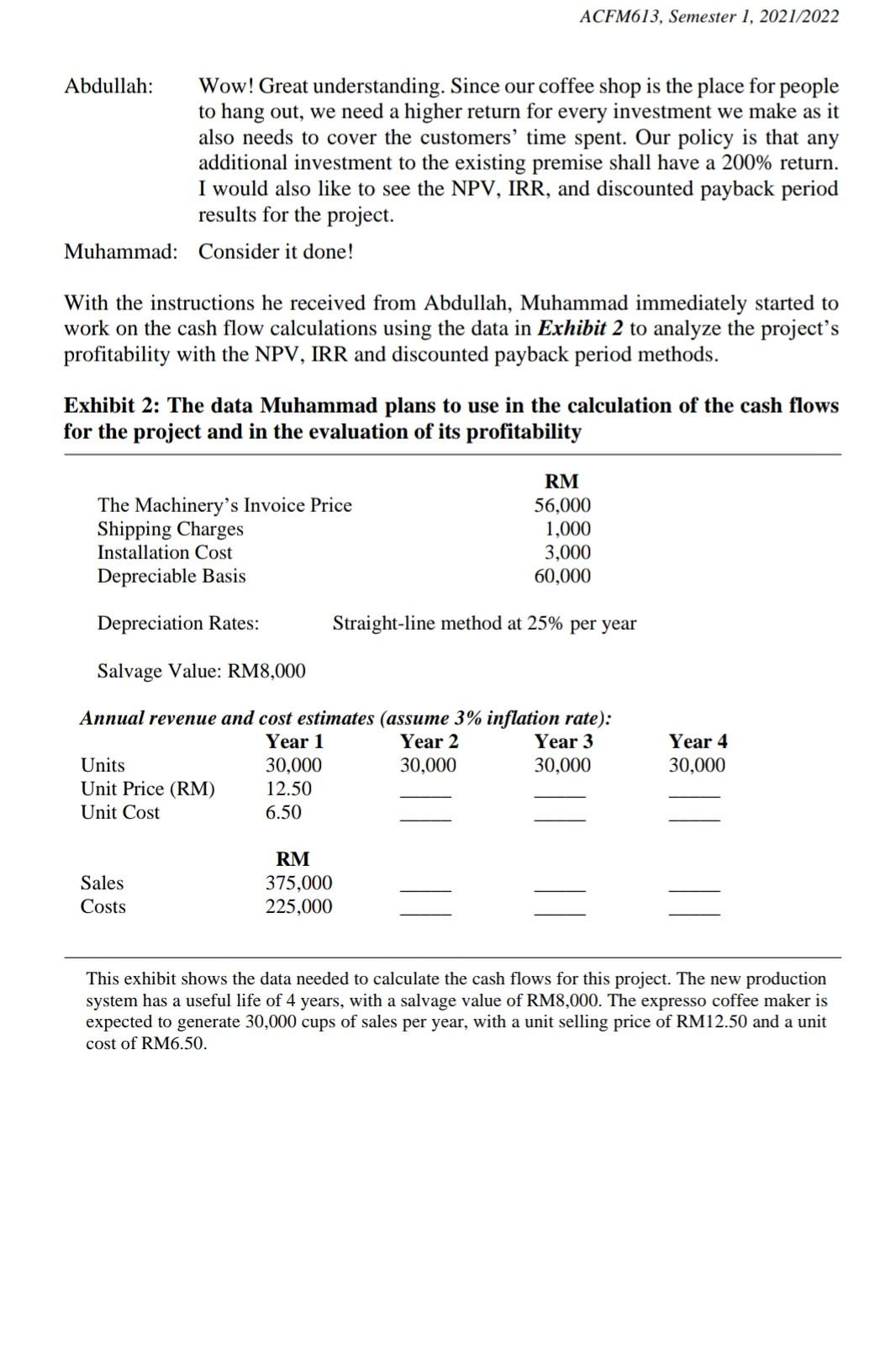

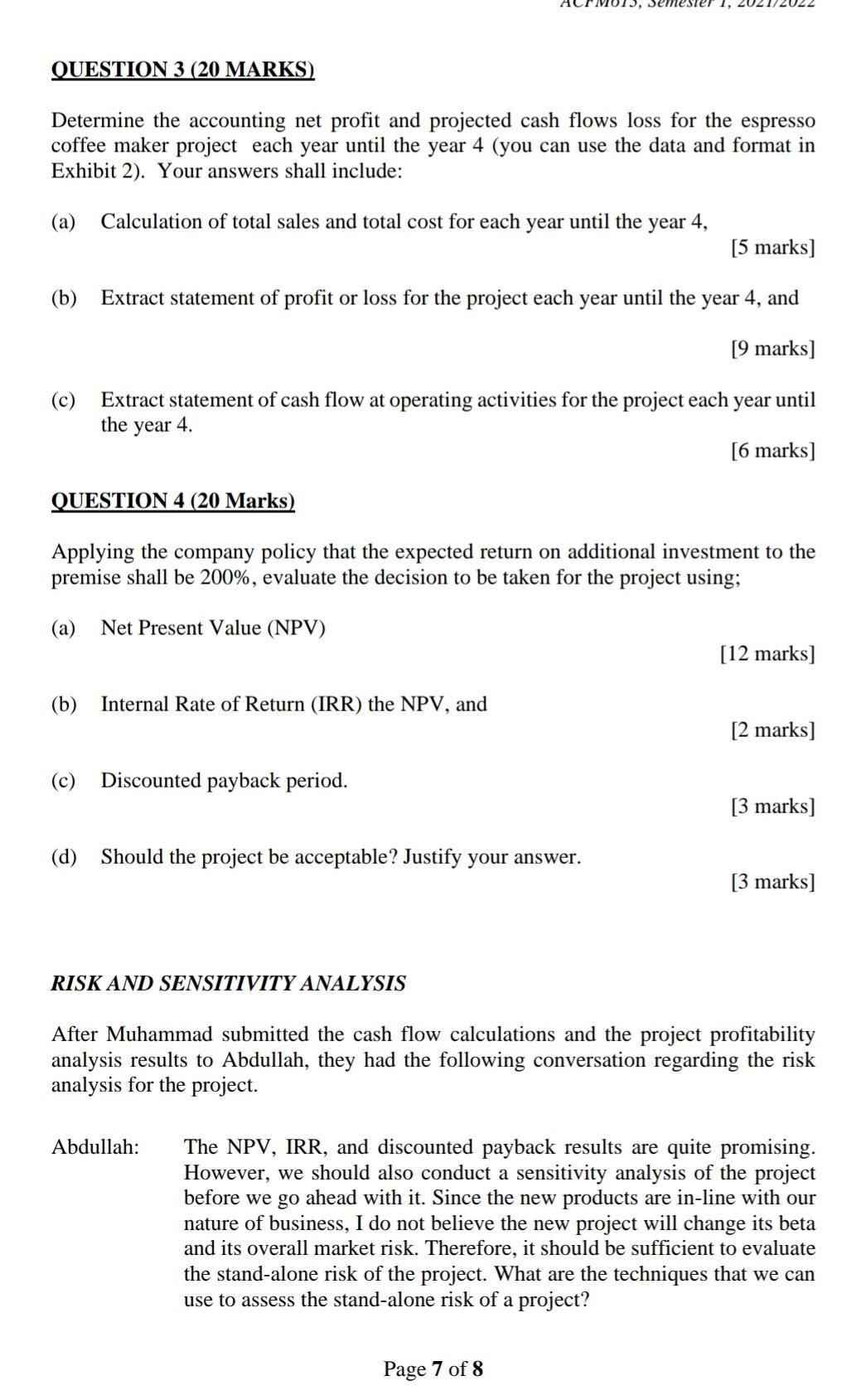

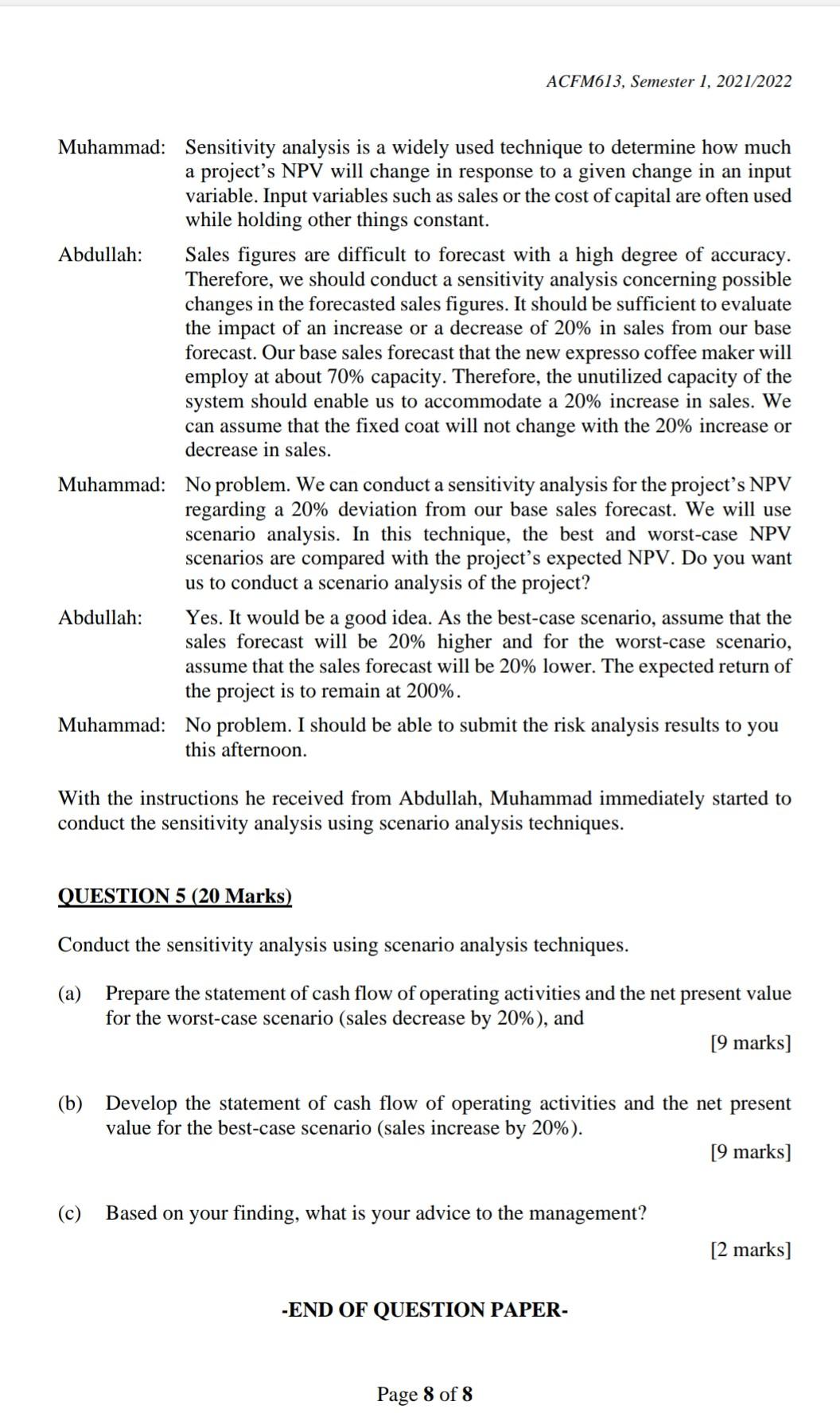

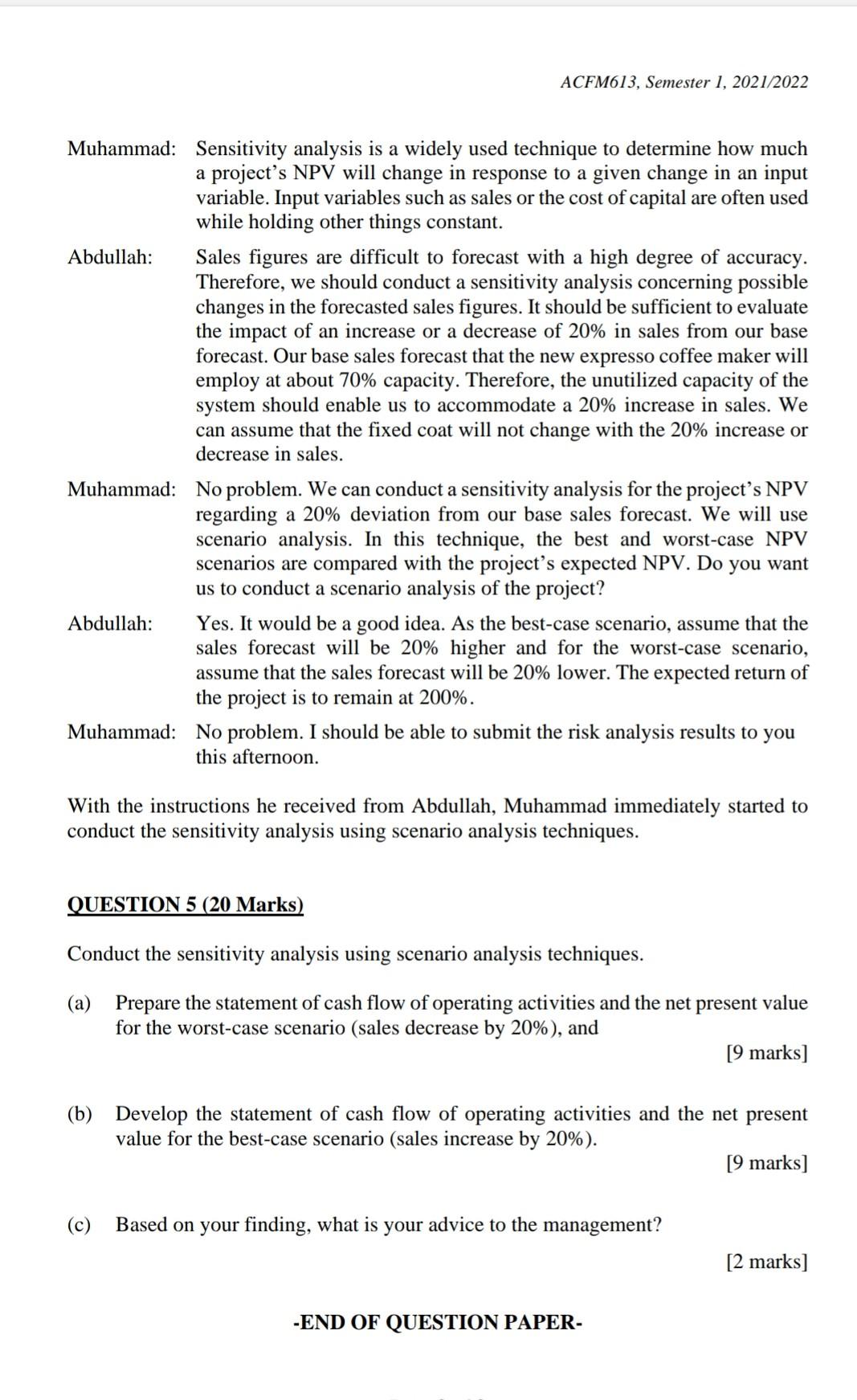

THE CASE Coffee House Premium Sdn Bhd (CHP) plans to expand its business chain by investing in a unique expresso coffee maker to produce the finest coffee in the market. It is a trial project before being extended to all branches. Muhammad, a recent MBA graduate of UNITEN, is assigned to analyze the coffee maker project. The company hired him only a few weeks ago as the head of the finance department. Muhammad's first task is to estimate the feasibility of the project. CHPS TARGETED PROFIT AND BREAK-EVEN POINT The invoice price of the coffee maker is RM56,000. It would require RM1,000 in shipping expenses and RM3,000 in installation costs. CHP plans to use the coffee maker for four years, and it is expected to have a salvage value of RM8,000 after that. The depreciation rate is 25% per year or uses a straight-line basis over four years. The direct labour cost related to the products is expected to be RM24,000 per year, and the other allocated fixed cost of the project is RM17,000 per year. From the discussion with Ms. Sylvia, the head of the marketing department, the unique expresso coffee maker would attract a new market segment and is expected to generate sales of 30,000 cups per year. It is estimated that the new product will sell for RM12.50 per unit, with an ingredient cost of RM6.50 per unit. Due to inflation, management projects increase the sale price and cost per unit by 3% per year. The company's tax rate is 25%. QUESTION 1 (20 MARKS) (a) Using the contribution margin format, calculate the net profit and break-even point in unit and RM from the new coffee maker project for year 1. [6 Marks] (b) CHP is in the process of instilling brand value as a tasty premium coffee provider, targeting its market to young executives and businessmen. They spend a massive amount for promotion and rent a few shops at exclusive places for their business. Assume that for the unique expresso coffee maker project, CHP targeted a profit of at least RM180,000 per year. i. Calculate the sales in cups and RM, to achieve the targeted profit for year 1. [3 Marks] ii. If the targeted sales are 30,000 cups per year, what is the new selling price per cup to achieve the targeted profit? [3 Marks] iii. The marketing department believes that if the selling price decrease by RM1.00 (RM11.50 per cup), the sales will increase to 45,000 cups per year. However, if the selling price is increase by RM1.00 (RM13.50), the sales can only reach 35,000 cups per year. Which option to choose? Justify your answer. Page 2 of 8 ACFM613, Semester 1, 2021 2022 [6 Marks] iv. Discuss the other factors that need to take into consideration in buying the espresso coffee maker. [2 Marks] CHPS WEIGHTED AVERAGE COST OF CAPITAL (WACC) Muhammad plans to use the financial data in Exhibit 1 to estimate the WACC. When CHP started evaluating the project, the following conversation took place between Muhammad and Abdullah. Abdullah, the company's General Manager, is a UM graduate majoring in financial economics and has long years of administrative experience. Muhammad: It may not be easy to estimate the cost of borrowing in the current recessionary environment. Abdullah: We can determine the yield to maturity (YTM) on our outstanding bonds by using their current market prices. We can assume that we will be able to issue additional bonds with this YTM at the cost of borrowing. We should be able to place the new bonds without any flotation costs. Therefore, we can assume no flotation costs in our calculations. We can re-examine the project's feasibility before raising funds by using sensitivity analysis to assess the impact of possible changes in interest rates on the project's net present value. Muhammad: Do you think the company's current market value capital structure is optimal? Can we use the current percentages of the capital components as weights in calculating the company's WACC? Abdullah: Yes, I believe that the company's current market value capital structure of 40% debt, 10% preferred stock, and 50% equity is optimal. If the trial project success, we need about RM720,000 investment for all the branches. Currently, we have about RM160,000 in retained earnings this year, which is also available in cash. We should be able to use this year's retained earnings to finance part of the equity financing required for the project. However, we will have to issue some new ordinary shares for the remainder of the necessary equity financing. We can assume a flotation cost of about 5% for the new ordinary shares. Muhammad: There are three basic methods of calculating a firm's cost of equity when retained earnings are used as equity capital: 1) the capital asset pricing method (CAPM); 2) the discounted cash flow (DCF) approach; and, 3) the bond-yield-plus-risk-premium method. Which of these methods should we use in the calculation of our cost of retained earnings? Abdullah: Although each of these methods has its merits, I believe that the most appropriate approach for our company would be to find an average cost with the three methods. Page 3 of 8 ACFM613, Semester 1, 2021/2022 Abdullah gave only three days to Muhammad for his estimation of CHP's WACC. With the instructions he received from Abdullah, and with the help of the financial data in Exhibit 1, Muhammad began the task of estimating the company's WACC immediately. Exhibit 1: Financial data Muhammad plans to use in estimating CHP's WACC CHP's current market value optimal capital structure: RM Bonds 8,000,000 Preferred Stock 2,000,000 Ordinary Equity 10,000,000 Weight 40% 10% 50% Data to be used in the calculation of the cost of borrowing with bonds: Par value = RM1,000, non-callable Market value = RM940 Coupon interest = 8%, semi-annual payment Remaining maturity = 10 years New bonds can be privately placed without any flotation costs Data to be used in the calculation of the cost of preferred stock: Par value = RM100 Annual dividend = 9.5% of par Market value = RM95 Flotation cost = 4% Data to be used in the calculation of the cost of ordinary equity: CAPM data: CHP's beta = 1.4 The yield on T-bonds = 3.5% Market risk premium = 5% DCF data: Stock price = RM19.08 Last year's dividend (DO) = RM1.00 Expected dividend growth rate = 5% Bond-yield-plus-risk-premium: Risk premium = 3.5% - Amount of retained earnings available Amount of new ordinary stock to be issued = RM160,000 = (RM720,000) (50%) - RM160,000 = RM200,000 This exhibit shows the data needed to estimate the firm's WACC. Specifically, it first presents CHP's current market value optimal capital structure used to determine the weights in the WACC calculation. It then provides the data required to calculate the cost of debt, the cost of preference share, and ordinary share. The amount of new ordinary shares to be issued is provided at the end of the exhibit. Abdullah knew that estimating the company's cost of capital was the first critical step in the capital budgeting process. Without this analysis, it would not be possible to determine if the new coffee maker would be a worthwhile investment for CHP. That is why he had asked Muhammad to estimate the company's WACC. Page 4 of 8 QUESTION 2 (20 MARKS) Assess the CHP's Weighted Average Cost of Capital (WACC) using the data in Exhibit 1. Your assessment shall include: (a) Cost of debt, [4 Marks] (b) Cost of preference share, [3 Marks] (c) Cost of ordinary share using (i) CAPM, (ii) DCF, and Own-Bond Yield-Plus-Risk Premium, and [9 Marks] (d) Weighted Average Cost of Capital (WACC) [4 Marks] ANALYSIS OF THE PROFITABILITY VS CASHFLOW OF THE PROJECT Abdullah was delighted when he received Muhammad's calculation results and the WACC estimate. He thought that he had made a good decision in hiring Muhammad. For further analysis, Abdullah and Muhammad had the following conversation regarding how they should evaluate the potential profitability of the project. Muhammad: With the sales and cost estimates, I have obtained from the marketing and accounting departments in Exhibit 2, we should be able to estimate the project's cash flows for the four-year horizon. Abdullah: Excellent! Since we are in the beverage business, all our sales are in cash, and we settle all the expenses in the month incurred. How are we going to evaluate the project's profitability to determine if it is feasible? Muhammad: The Net Present Value (NPV) and Internal Rate of Return (IRR) methods are generally used to evaluate project. The financial goal of a firm is to maximize market value. The NPV of a project shows its contribution to the market value of the firm. Abdullah: Correct! However, the NPV is a dollar amount. It is difficult to explain the profitability of a project as a dollar amount to the company's shareholders. It is easier to compare the project's IRR with the firm's WACC to convince the shareholders that we can earn a higher percentage return on the investment than what it would cost to finance it. Muhammad: Currently, our company's WACC is around 10%. It is inappropriate to use the WACC as the rate of return for a stand-alone project like this. It needs to have its owed required rate of return to cover the allocated cost imposed later on. Page 5 of 8 ACFM613, Semester 1, 2021/2022 Abdullah: Wow! Great understanding. Since our coffee shop is the place for people to hang out, we need a higher return for every investment we make as it also needs to cover the customers' time spent. Our policy is that any additional investment to the existing premise shall have a 200% return. I would also like to see the NPV, IRR, and discounted payback period results for the project. Muhammad: Consider it done! With the instructions he received from Abdullah, Muhammad immediately started to work on the cash flow calculations using the data in Exhibit 2 to analyze the project's profitability with the NPV, IRR and discounted payback period methods. Exhibit 2: The data Muhammad plans to use in the calculation of the cash flows for the project and in the evaluation of its profitability The Machinery's Invoice Price Shipping Charges Installation Cost Depreciable Basis RM 56,000 1,000 3,000 60,000 Depreciation Rates: Straight-line method at 25% per year Salvage Value: RM8,000 Annual revenue and cost estimates (assume 3% inflation rate): Year 1 Year 2 Year 3 Units 30,000 30,000 30,000 Unit Price (RM) 12.50 Unit Cost 6.50 Year 4 30,000 Sales RM 375,000 225,000 Costs This exhibit shows the data needed to calculate the cash flows for this project. The new production system has a useful life of 4 years, with a salvage value of RM8,000. The expresso coffee maker is expected to generate 30,000 cups of sales per year, with a unit selling price of RM12.50 and a unit a cost of RM6.50. 1, Semester 1, 2021 QUESTION 3 (20 MARKS) Determine the accounting net profit and projected cash flows loss for the espresso coffee maker project each year until the year 4 (you can use the data and format in Exhibit 2). Your answers shall include: (a) Calculation of total sales and total cost for each year until the year 4, [5 marks) (b) Extract statement of profit or loss for the project each year until the year 4, and [9 marks] (c) Extract statement of cash flow at operating activities for the project each year until the year 4. [6 marks] QUESTION 4 (20 Marks) Applying the company policy that the expected return on additional investment to the premise shall be 200%, evaluate the decision to be taken for the project using; (a) Net Present Value (NPV) [12 marks] (b) Internal Rate of Return (IRR) the NPV, and [2 marks] (c) Discounted payback period. [3 marks] (d) Should the project be acceptable? Justify your answer. [3 marks] RISK AND SENSITIVITY ANALYSIS After Muhammad submitted the cash flow calculations and the project profitability analysis results to Abdullah, they had the following conversation regarding the risk analysis for the project. Abdullah: The NPV, IRR, and discounted payback results are quite promising. However, we should also conduct a sensitivity analysis of the project before we go ahead with it. Since the new products are in-line with our nature of business, I do not believe the new project will change its beta and its overall market risk. Therefore, it should be sufficient to evaluate the stand-alone risk of the project. What are the techniques that we can use to assess the stand-alone risk of a project? Page 7 of 8 ACFM613, Semester 1, 2021/2022 a Muhammad: Sensitivity analysis is a widely used technique to determine how much a project's NPV will change in response to a given change in an input variable. Input variables such as sales or the cost of capital are often used while holding other things constant. Abdullah: Sales figures are difficult to forecast with a high degree of accuracy. Therefore, we should conduct a sensitivity analysis concerning possible changes in the forecasted sales figures. It should be sufficient to evaluate the impact of an increase or a decrease of 20% in sales from our base forecast. Our base sales forecast that the new expresso coffee maker will employ at about 70% capacity. Therefore, the unutilized capacity of the system should enable us to accommodate a 20% increase in sales. We can assume that the fixed coat will not change with the 20% increase or decrease in sales. Muhammad: No problem. We can conduct a sensitivity analysis for the project's NPV regarding a 20% deviation from our base sales forecast. We will use scenario analysis. In this technique, the best and worst-case NPV scenarios are compared with the project's expected NPV. Do you want us to conduct a scenario analysis of the project? Abdullah: Yes. It would be a good idea. As the best-case scenario, assume that the sales forecast will be 20% higher and for the worst-case scenario, assume that the sales forecast will be 20% lower. The expected return of the project is to remain at 200%. Muhammad: No problem. I should be able to submit the risk analysis results to you this afternoon. With the instructions he received from Abdullah, Muhammad immediately started to conduct the sensitivity analysis using scenario analysis techniques. QUESTION 5 (20 Marks) Conduct the sensitivity analysis using scenario analysis techniques. (a) Prepare the statement of cash flow of operating activities and the net present value for the worst-case scenario (sales decrease by 20%), and [9 marks] (b) Develop the statement of cash flow of operating activities and the net present value for the best-case scenario (sales increase by 20%). [9 marks) (c) Based on your finding, what is your advice to the management? [2 marks] -END OF QUESTION PAPER- Page 8 of 8 ACFM613, Semester 1, 2021/2022 Muhammad: Sensitivity analysis is a widely used technique to determine how much a project's NPV will change in response to a given change in an input variable. Input variables such as sales or the cost of capital are often used while holding other things constant. Abdullah: Sales figures are difficult to forecast with a high degree of accuracy. Therefore, we should conduct a sensitivity analysis concerning possible changes in the forecasted sales figures. It should be sufficient to evaluate the impact of an increase or a decrease of 20% in sales from our base forecast. Our base sales forecast that the new expresso coffee maker will employ at about 70% capacity. Therefore, the unutilized capacity of the system should enable us to accommodate a 20% increase in sales. We can assume that the fixed coat will not change with the 20% increase or decrease in sales. Muhammad: No problem. We can conduct a sensitivity analysis for the project's NPV regarding a 20% deviation from our base sales forecast. We will use scenario analysis. In this technique, the best and worst-case NPV scenarios are compared with the project's expected NPV. Do you want us to conduct a scenario analysis of the project? Abdullah: Yes. It would be a good idea. As the best-case scenario, assume that the sales forecast will be 20% higher and for the worst-case scenario, assume that the sales forecast will be 20% lower. The expected return of the project is to remain at 200%. Muhammad: No problem. I should be able to submit the risk analysis results to you this afternoon. With the instructions he received from Abdullah, Muhammad immediately started to conduct the sensitivity analysis using scenario analysis techniques. QUESTION 5 (20 Marks) Conduct the sensitivity analysis using scenario analysis techniques. (a) Prepare the statement of cash flow of operating activities and the net present value for the worst-case scenario (sales decrease by 20%), and [9 marks] (b) Develop the statement of cash flow of operating activities and the net present value for the best-case scenario (sales increase by 20%). [9 marks] (c) Based on your finding, what is your advice to the management? [2 marks] -END OF QUESTION PAPER- THE CASE Coffee House Premium Sdn Bhd (CHP) plans to expand its business chain by investing in a unique expresso coffee maker to produce the finest coffee in the market. It is a trial project before being extended to all branches. Muhammad, a recent MBA graduate of UNITEN, is assigned to analyze the coffee maker project. The company hired him only a few weeks ago as the head of the finance department. Muhammad's first task is to estimate the feasibility of the project. CHPS TARGETED PROFIT AND BREAK-EVEN POINT The invoice price of the coffee maker is RM56,000. It would require RM1,000 in shipping expenses and RM3,000 in installation costs. CHP plans to use the coffee maker for four years, and it is expected to have a salvage value of RM8,000 after that. The depreciation rate is 25% per year or uses a straight-line basis over four years. The direct labour cost related to the products is expected to be RM24,000 per year, and the other allocated fixed cost of the project is RM17,000 per year. From the discussion with Ms. Sylvia, the head of the marketing department, the unique expresso coffee maker would attract a new market segment and is expected to generate sales of 30,000 cups per year. It is estimated that the new product will sell for RM12.50 per unit, with an ingredient cost of RM6.50 per unit. Due to inflation, management projects increase the sale price and cost per unit by 3% per year. The company's tax rate is 25%. QUESTION 1 (20 MARKS) (a) Using the contribution margin format, calculate the net profit and break-even point in unit and RM from the new coffee maker project for year 1. [6 Marks] (b) CHP is in the process of instilling brand value as a tasty premium coffee provider, targeting its market to young executives and businessmen. They spend a massive amount for promotion and rent a few shops at exclusive places for their business. Assume that for the unique expresso coffee maker project, CHP targeted a profit of at least RM180,000 per year. i. Calculate the sales in cups and RM, to achieve the targeted profit for year 1. [3 Marks] ii. If the targeted sales are 30,000 cups per year, what is the new selling price per cup to achieve the targeted profit? [3 Marks] iii. The marketing department believes that if the selling price decrease by RM1.00 (RM11.50 per cup), the sales will increase to 45,000 cups per year. However, if the selling price is increase by RM1.00 (RM13.50), the sales can only reach 35,000 cups per year. Which option to choose? Justify your answer. Page 2 of 8 ACFM613, Semester 1, 2021 2022 [6 Marks] iv. Discuss the other factors that need to take into consideration in buying the espresso coffee maker. [2 Marks] CHPS WEIGHTED AVERAGE COST OF CAPITAL (WACC) Muhammad plans to use the financial data in Exhibit 1 to estimate the WACC. When CHP started evaluating the project, the following conversation took place between Muhammad and Abdullah. Abdullah, the company's General Manager, is a UM graduate majoring in financial economics and has long years of administrative experience. Muhammad: It may not be easy to estimate the cost of borrowing in the current recessionary environment. Abdullah: We can determine the yield to maturity (YTM) on our outstanding bonds by using their current market prices. We can assume that we will be able to issue additional bonds with this YTM at the cost of borrowing. We should be able to place the new bonds without any flotation costs. Therefore, we can assume no flotation costs in our calculations. We can re-examine the project's feasibility before raising funds by using sensitivity analysis to assess the impact of possible changes in interest rates on the project's net present value. Muhammad: Do you think the company's current market value capital structure is optimal? Can we use the current percentages of the capital components as weights in calculating the company's WACC? Abdullah: Yes, I believe that the company's current market value capital structure of 40% debt, 10% preferred stock, and 50% equity is optimal. If the trial project success, we need about RM720,000 investment for all the branches. Currently, we have about RM160,000 in retained earnings this year, which is also available in cash. We should be able to use this year's retained earnings to finance part of the equity financing required for the project. However, we will have to issue some new ordinary shares for the remainder of the necessary equity financing. We can assume a flotation cost of about 5% for the new ordinary shares. Muhammad: There are three basic methods of calculating a firm's cost of equity when retained earnings are used as equity capital: 1) the capital asset pricing method (CAPM); 2) the discounted cash flow (DCF) approach; and, 3) the bond-yield-plus-risk-premium method. Which of these methods should we use in the calculation of our cost of retained earnings? Abdullah: Although each of these methods has its merits, I believe that the most appropriate approach for our company would be to find an average cost with the three methods. Page 3 of 8 ACFM613, Semester 1, 2021/2022 Abdullah gave only three days to Muhammad for his estimation of CHP's WACC. With the instructions he received from Abdullah, and with the help of the financial data in Exhibit 1, Muhammad began the task of estimating the company's WACC immediately. Exhibit 1: Financial data Muhammad plans to use in estimating CHP's WACC CHP's current market value optimal capital structure: RM Bonds 8,000,000 Preferred Stock 2,000,000 Ordinary Equity 10,000,000 Weight 40% 10% 50% Data to be used in the calculation of the cost of borrowing with bonds: Par value = RM1,000, non-callable Market value = RM940 Coupon interest = 8%, semi-annual payment Remaining maturity = 10 years New bonds can be privately placed without any flotation costs Data to be used in the calculation of the cost of preferred stock: Par value = RM100 Annual dividend = 9.5% of par Market value = RM95 Flotation cost = 4% Data to be used in the calculation of the cost of ordinary equity: CAPM data: CHP's beta = 1.4 The yield on T-bonds = 3.5% Market risk premium = 5% DCF data: Stock price = RM19.08 Last year's dividend (DO) = RM1.00 Expected dividend growth rate = 5% Bond-yield-plus-risk-premium: Risk premium = 3.5% - Amount of retained earnings available Amount of new ordinary stock to be issued = RM160,000 = (RM720,000) (50%) - RM160,000 = RM200,000 This exhibit shows the data needed to estimate the firm's WACC. Specifically, it first presents CHP's current market value optimal capital structure used to determine the weights in the WACC calculation. It then provides the data required to calculate the cost of debt, the cost of preference share, and ordinary share. The amount of new ordinary shares to be issued is provided at the end of the exhibit. Abdullah knew that estimating the company's cost of capital was the first critical step in the capital budgeting process. Without this analysis, it would not be possible to determine if the new coffee maker would be a worthwhile investment for CHP. That is why he had asked Muhammad to estimate the company's WACC. Page 4 of 8 QUESTION 2 (20 MARKS) Assess the CHP's Weighted Average Cost of Capital (WACC) using the data in Exhibit 1. Your assessment shall include: (a) Cost of debt, [4 Marks] (b) Cost of preference share, [3 Marks] (c) Cost of ordinary share using (i) CAPM, (ii) DCF, and Own-Bond Yield-Plus-Risk Premium, and [9 Marks] (d) Weighted Average Cost of Capital (WACC) [4 Marks] ANALYSIS OF THE PROFITABILITY VS CASHFLOW OF THE PROJECT Abdullah was delighted when he received Muhammad's calculation results and the WACC estimate. He thought that he had made a good decision in hiring Muhammad. For further analysis, Abdullah and Muhammad had the following conversation regarding how they should evaluate the potential profitability of the project. Muhammad: With the sales and cost estimates, I have obtained from the marketing and accounting departments in Exhibit 2, we should be able to estimate the project's cash flows for the four-year horizon. Abdullah: Excellent! Since we are in the beverage business, all our sales are in cash, and we settle all the expenses in the month incurred. How are we going to evaluate the project's profitability to determine if it is feasible? Muhammad: The Net Present Value (NPV) and Internal Rate of Return (IRR) methods are generally used to evaluate project. The financial goal of a firm is to maximize market value. The NPV of a project shows its contribution to the market value of the firm. Abdullah: Correct! However, the NPV is a dollar amount. It is difficult to explain the profitability of a project as a dollar amount to the company's shareholders. It is easier to compare the project's IRR with the firm's WACC to convince the shareholders that we can earn a higher percentage return on the investment than what it would cost to finance it. Muhammad: Currently, our company's WACC is around 10%. It is inappropriate to use the WACC as the rate of return for a stand-alone project like this. It needs to have its owed required rate of return to cover the allocated cost imposed later on. Page 5 of 8 ACFM613, Semester 1, 2021/2022 Abdullah: Wow! Great understanding. Since our coffee shop is the place for people to hang out, we need a higher return for every investment we make as it also needs to cover the customers' time spent. Our policy is that any additional investment to the existing premise shall have a 200% return. I would also like to see the NPV, IRR, and discounted payback period results for the project. Muhammad: Consider it done! With the instructions he received from Abdullah, Muhammad immediately started to work on the cash flow calculations using the data in Exhibit 2 to analyze the project's profitability with the NPV, IRR and discounted payback period methods. Exhibit 2: The data Muhammad plans to use in the calculation of the cash flows for the project and in the evaluation of its profitability The Machinery's Invoice Price Shipping Charges Installation Cost Depreciable Basis RM 56,000 1,000 3,000 60,000 Depreciation Rates: Straight-line method at 25% per year Salvage Value: RM8,000 Annual revenue and cost estimates (assume 3% inflation rate): Year 1 Year 2 Year 3 Units 30,000 30,000 30,000 Unit Price (RM) 12.50 Unit Cost 6.50 Year 4 30,000 Sales RM 375,000 225,000 Costs This exhibit shows the data needed to calculate the cash flows for this project. The new production system has a useful life of 4 years, with a salvage value of RM8,000. The expresso coffee maker is expected to generate 30,000 cups of sales per year, with a unit selling price of RM12.50 and a unit a cost of RM6.50. 1, Semester 1, 2021 QUESTION 3 (20 MARKS) Determine the accounting net profit and projected cash flows loss for the espresso coffee maker project each year until the year 4 (you can use the data and format in Exhibit 2). Your answers shall include: (a) Calculation of total sales and total cost for each year until the year 4, [5 marks) (b) Extract statement of profit or loss for the project each year until the year 4, and [9 marks] (c) Extract statement of cash flow at operating activities for the project each year until the year 4. [6 marks] QUESTION 4 (20 Marks) Applying the company policy that the expected return on additional investment to the premise shall be 200%, evaluate the decision to be taken for the project using; (a) Net Present Value (NPV) [12 marks] (b) Internal Rate of Return (IRR) the NPV, and [2 marks] (c) Discounted payback period. [3 marks] (d) Should the project be acceptable? Justify your answer. [3 marks] RISK AND SENSITIVITY ANALYSIS After Muhammad submitted the cash flow calculations and the project profitability analysis results to Abdullah, they had the following conversation regarding the risk analysis for the project. Abdullah: The NPV, IRR, and discounted payback results are quite promising. However, we should also conduct a sensitivity analysis of the project before we go ahead with it. Since the new products are in-line with our nature of business, I do not believe the new project will change its beta and its overall market risk. Therefore, it should be sufficient to evaluate the stand-alone risk of the project. What are the techniques that we can use to assess the stand-alone risk of a project? Page 7 of 8 ACFM613, Semester 1, 2021/2022 a Muhammad: Sensitivity analysis is a widely used technique to determine how much a project's NPV will change in response to a given change in an input variable. Input variables such as sales or the cost of capital are often used while holding other things constant. Abdullah: Sales figures are difficult to forecast with a high degree of accuracy. Therefore, we should conduct a sensitivity analysis concerning possible changes in the forecasted sales figures. It should be sufficient to evaluate the impact of an increase or a decrease of 20% in sales from our base forecast. Our base sales forecast that the new expresso coffee maker will employ at about 70% capacity. Therefore, the unutilized capacity of the system should enable us to accommodate a 20% increase in sales. We can assume that the fixed coat will not change with the 20% increase or decrease in sales. Muhammad: No problem. We can conduct a sensitivity analysis for the project's NPV regarding a 20% deviation from our base sales forecast. We will use scenario analysis. In this technique, the best and worst-case NPV scenarios are compared with the project's expected NPV. Do you want us to conduct a scenario analysis of the project? Abdullah: Yes. It would be a good idea. As the best-case scenario, assume that the sales forecast will be 20% higher and for the worst-case scenario, assume that the sales forecast will be 20% lower. The expected return of the project is to remain at 200%. Muhammad: No problem. I should be able to submit the risk analysis results to you this afternoon. With the instructions he received from Abdullah, Muhammad immediately started to conduct the sensitivity analysis using scenario analysis techniques. QUESTION 5 (20 Marks) Conduct the sensitivity analysis using scenario analysis techniques. (a) Prepare the statement of cash flow of operating activities and the net present value for the worst-case scenario (sales decrease by 20%), and [9 marks] (b) Develop the statement of cash flow of operating activities and the net present value for the best-case scenario (sales increase by 20%). [9 marks) (c) Based on your finding, what is your advice to the management? [2 marks] -END OF QUESTION PAPER- Page 8 of 8 ACFM613, Semester 1, 2021/2022 Muhammad: Sensitivity analysis is a widely used technique to determine how much a project's NPV will change in response to a given change in an input variable. Input variables such as sales or the cost of capital are often used while holding other things constant. Abdullah: Sales figures are difficult to forecast with a high degree of accuracy. Therefore, we should conduct a sensitivity analysis concerning possible changes in the forecasted sales figures. It should be sufficient to evaluate the impact of an increase or a decrease of 20% in sales from our base forecast. Our base sales forecast that the new expresso coffee maker will employ at about 70% capacity. Therefore, the unutilized capacity of the system should enable us to accommodate a 20% increase in sales. We can assume that the fixed coat will not change with the 20% increase or decrease in sales. Muhammad: No problem. We can conduct a sensitivity analysis for the project's NPV regarding a 20% deviation from our base sales forecast. We will use scenario analysis. In this technique, the best and worst-case NPV scenarios are compared with the project's expected NPV. Do you want us to conduct a scenario analysis of the project? Abdullah: Yes. It would be a good idea. As the best-case scenario, assume that the sales forecast will be 20% higher and for the worst-case scenario, assume that the sales forecast will be 20% lower. The expected return of the project is to remain at 200%. Muhammad: No problem. I should be able to submit the risk analysis results to you this afternoon. With the instructions he received from Abdullah, Muhammad immediately started to conduct the sensitivity analysis using scenario analysis techniques. QUESTION 5 (20 Marks) Conduct the sensitivity analysis using scenario analysis techniques. (a) Prepare the statement of cash flow of operating activities and the net present value for the worst-case scenario (sales decrease by 20%), and [9 marks] (b) Develop the statement of cash flow of operating activities and the net present value for the best-case scenario (sales increase by 20%). [9 marks] (c) Based on your finding, what is your advice to the management? [2 marks] -END OF QUESTION PAPERStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started