Question: Old MathJax webview CASE STUDY X.X Plastic Moulders (Pty) Ltd. X.X Plastic Moulders (Pty) Ltd was founded in 2000 by Bongani. The company manufactures custom

Old MathJax webview

CASE STUDY X.X Plastic Moulders (Pty) Ltd. X.X Plastic Moulders (Pty) Ltd was founded in 2000 by Bongani. The company manufactures custom moulded plastics for small and large businesses, across all industries, in South Africa. The company was named after Bongani's two grandchildren, Xolile and Xolani. The two cousins were both four years old at the time of the company's establishment. In 2021 at aged 25, they found themselves in viable positions to take control of the companyXolile as the company's general manager, and Xolani in control of the production of moulding plastics. The company employees were willing to accept Xolile and Xolani into the new positions of responsibility in the company. This acceptance was due partly to the employees' dedication to Bongani, who is partially retired but is still closely involved in the company's day-to-day running. Beyond the involvement of Bongani in the company, Xolile and Xolani have proven themselves over the years.

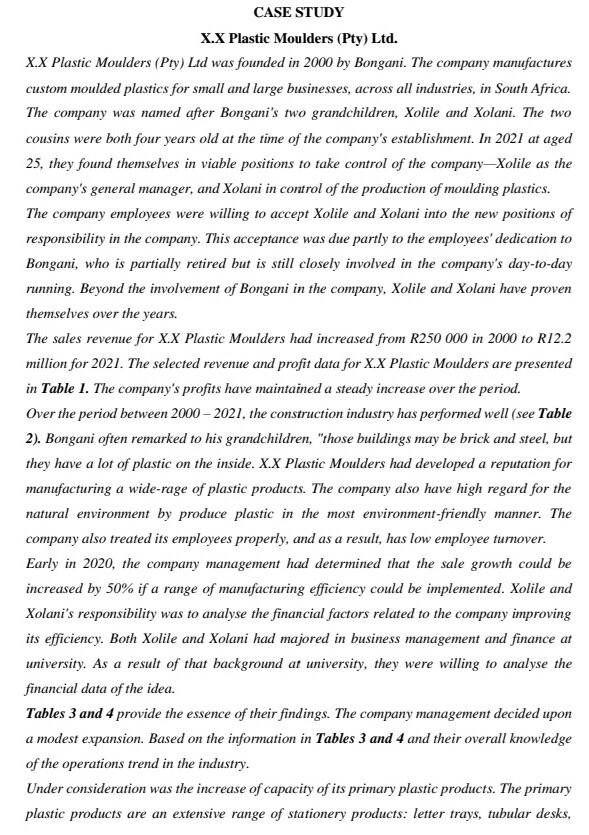

The sales revenue for X.X Plastic Moulders had increased from R250 000 in 2000 to R12.2 million for 2021. The selected revenue and profit data for X.X Plastic Moulders are presented in Table 1. The company's profits have maintained a steady increase over the period. Over the period between 2000 2021, the construction industry has performed well (see Table 2). Bongani often remarked to his grandchildren, "those buildings may be brick and steel, but they have a lot of plastic on the inside. X.X Plastic Moulders had developed a reputation for manufacturing a wide-rage of plastic products. The company also have high regard for the natural environment by produce plastic in the most environment-friendly manner. The company also treated its employees properly, and as a result, has low employee turnover. Early in 2020, the company management had determined that the sale growth could be increased by 50% if a range of manufacturing efficiency could be implemented. Xolile and Xolani's responsibility was to analyse the financial factors related to the company improving its efficiency. Both Xolile and Xolani had majored in business management and finance at university. As a result of that background at university, they were willing to analyse the financial data of the idea.

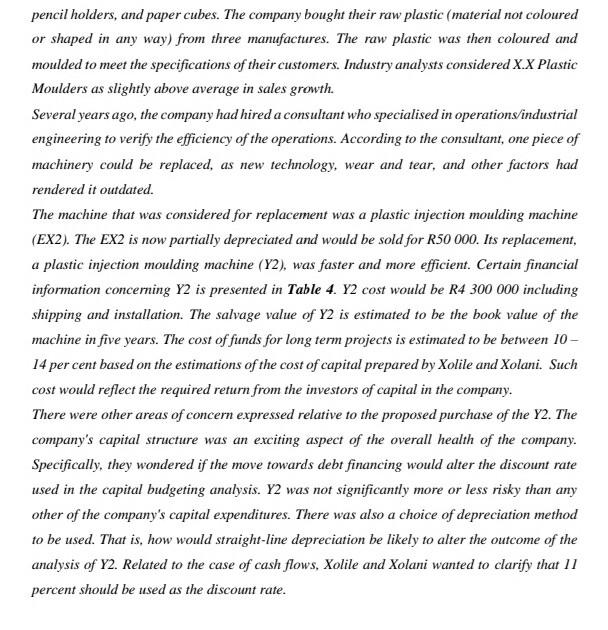

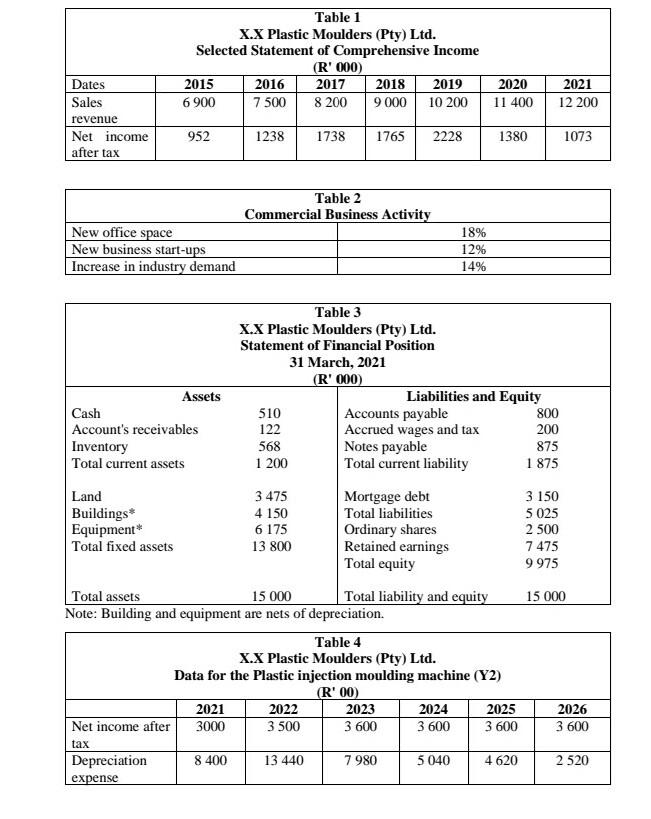

Tables 3 and 4 provide the essence of their findings. The company management decided upon a modest expansion. Based on the information in Tables 3 and 4 and their overall knowledge of the operations trend in the industry.

Under consideration was the increase of capacity of its primary plastic products. The primary plastic products are an extensive range of stationery products: letter trays, tubular desks, 5 pencil holders, and paper cubes. The company bought their raw plastic (material not coloured or shaped in any way) from three manufactures. The raw plastic was then coloured and moulded to meet the specifications of their customers. Industry analysts considered X.X Plastic Moulders as slightly above average in sales growth.

Several years ago, the company had hired a consultant who specialised in operations/industrial engineering to verify the efficiency of the operations. According to the consultant, one piece of machinery could be replaced, as new technology, wear and tear, and other factors had rendered it outdated.

The machine that was considered for replacement was a plastic injection moulding machine (EX2). The EX2 is now partially depreciated and would be sold for R50 000. Its replacement, a plastic injection moulding machine (Y2), was faster and more efficient. Certain financial information concerning Y2 is presented in Table 4. Y2 cost would be R4 300 000 including shipping and installation. The salvage value of Y2 is estimated to be the book value of the machine in five years. The cost of funds for long term projects is estimated to be between 10 14 per cent based on the estimations of the cost of capital prepared by Xolile and Xolani. Such cost would reflect the required return from the investors of capital in the company.

There were other areas of concern expressed relative to the proposed purchase of the Y2. The company's capital structure was an exciting aspect of the overall health of the company. Specifically, they wondered if the move towards debt financing would alter the discount rate used in the capital budgeting analysis. Y2 was not significantly more or less risky than any other of the company's capital expenditures. There was also a choice of depreciation method to be used. That is, how would straight-line depreciation be likely to alter the outcome of the analysis of Y2. Related to the case of cash flows, Xolile and Xolani wanted to clarify that 11 percent should be used as the discount rate.

Table 1 X.X Plastic Moulders (Pty) Ltd. Selected Statement of Comprehensive Income (R' 000)

Dates 2015 2016 2017 2018 2019 2020 2021

Sales revenue 6 900 7 500 8 200 9 000 10 200 11 400 12 200

Net income after tax 952 1238 1738 1765 2228 1380 1073

Table 2 Commercial Business Activity

New office space 18%

New business start-ups 12%

Increase in industry demand 14%

Table 3 X.X Plastic Moulders (Pty) Ltd. Statement of Financial Position 31 March, 2021 (R' 000)

Assets Liabilities and Equity

Cash 510 Accounts payable 800

Account's receivables 122 Accrued wages and tax 200

Inventory 568 Notes payable 875

Total current assets 1 200 Total current liability 1 875

Land 3 475 Mortgage debt 3 150

Buildings* 4 150 Total liabilities 5 025

Equipment* 6 175 Ordinary shares 2 500

Total fixed assets 13 800 Retained earnings 7 475

Total equity 9 975

Total assets 15 000 Total liability and equity 15 000

Note: Building and equipment are nets of depreciation.

Table 4 X.X Plastic Moulders (Pty) Ltd. Data for the Plastic injection moulding machine (Y2) (R' 00)

2021 2022 2023 2024 2025 2026

Net income after tax 3000 3 500 3 600 3 600 3 600 3 600

Depreciation expense 8 400 13 440 7 980 5 040 4 620 2 520

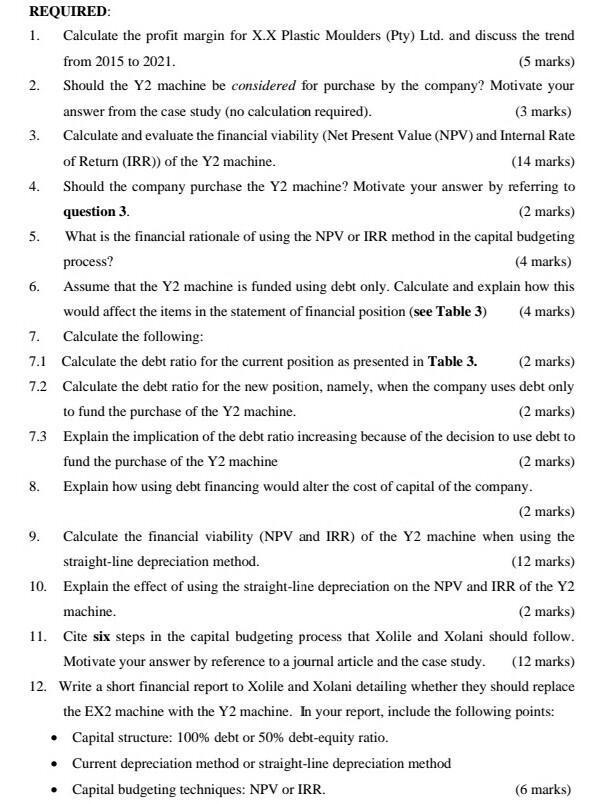

REQUIRED:

1. Calculate the profit margin for X.X Plastic Moulders (Pty) Ltd. and discuss the trend from 2015 to 2021. (5 marks)

2. Should the Y2 machine be considered for purchase by the company? Motivate your answer from the case study (no calculation required). (3 marks)

3. Calculate and evaluate the financial viability (Net Present Value (NPV) and Internal Rate of Return (IRR)) of the Y2 machine. (14 marks)

4. Should the company purchase the Y2 machine? Motivate your answer by referring to question 3. (2 marks)

5. What is the financial rationale of using the NPV or IRR method in the capital budgeting process? (4 marks)

6. Assume that the Y2 machine is funded using debt only. Calculate and explain how this would affect the items in the statement of financial position (see Table 3) (4 marks)

7. Calculate the following:

7.1 Calculate the debt ratio for the current position as presented in Table 3. (2 marks)

7.2 Calculate the debt ratio for the new position, namely, when the company uses debt only to fund the purchase of the Y2 machine. (2 marks)

7.3 Explain the implication of the debt ratio increasing because of the decision to use debt to fund the purchase of the Y2 machine (2 marks)

8. Explain how using debt financing would alter the cost of capital of the company. (2 marks)

9. Calculate the financial viability (NPV and IRR) of the Y2 machine when using the straight-line depreciation method. (12 marks)

10. Explain the effect of using the straight-line depreciation on the NPV and IRR of the Y2 machine. (2 marks)

11. Cite six steps in the capital budgeting process that Xolile and Xolani should follow. Motivate your answer by reference to a journal article and the case study. (12 marks)

12. Write a short financial report to Xolile and Xolani detailing whether they should replace the EX2 machine with the Y2 machine. In your report, include the following points: Capital structure: 100% debt or 50% debt-equity ratio. Current depreciation method or straight-line depreciation method Capital budgeting techniques: NPV or IRR.

CASE STUDY X.X Plastic Moulders (Pty) Ltd. X.X Plastic Moulders (Pty) Ltd was founded in 2000 by Bongani. The company manufactures custom moulded plastics for small and large businesses, across all industries, in South Africa. The company was named after Bongani's two grandchildren, Xolile and Xolani. The two cousins were both four years old at the time of the company's establishment. In 2021 at aged 25, they found themselves in viable positions to take control of the company-Xolile as the company's general manager, and Xolani in control of the production of moulding plastics. The company employees were willing to accept Xolile and Xolani into the new positions of responsibility in the company. This acceptance was due partly to the employees' dedication to Bongani, who is partially retired but is still closely involved in the company's day-to-day running. Beyond the involvement of Bongani in the company, Xolile and Xolani have proven themselves over the years. The sales revenue for X.X Plastic Moulders had increased from R250 000 in 2000 to R12.2 million for 2021. The selected revenue and profit data for X.X Plastic Moulders are presented in Table 1. The company's profits have maintained a steady increase over the period. Over the period between 2000 - 2021, the construction industry has performed well (see Table 2). Bongani often remarked to his grandchildren, "those buildings may be brick and steel, but they have a lot of plastic on the inside. X.X Plastic Moulders had developed a reputation for manufacturing a wide-rage of plastic products. The company also have high regard for the natural environment by produce plastic in the most environment-friendly manner. The company also treated its employees properly, and as a result, has low employee turnover. Early in 2020, the company management had determined that the sale growth could be increased by 50% if a range of manufacturing efficiency could be implemented. Xolile and Xolani's responsibility was to analyse the financial factors related to the company improving its efficiency. Both Xolile and Xolani had majored in business management and finance at university. As a result of that background at university, they were willing to analyse the financial data of the idea. Tables 3 and 4 provide the essence of their findings. The company management decided upon a modest expansion. Based on the information in Tables 3 and 4 and their overall knowledge of the operations trend in the industry. Under consideration was the increase of capacity of its primary plastic products. The primary plastic products are an extensive range of stationery products: letter trays, tubular desks, pencil holders, and paper cubes. The company bought their raw plastic (material not coloured or shaped in any way) from three manufactures. The raw plastic was then coloured and moulded to meet the specifications of their customers. Industry analysts considered X.X Plastic Moulders as slightly above average in sales growth. Several years ago, the company had hired a consultant who specialised in operations/industrial engineering to verify the efficiency of the operations. According to the consultant, one piece of machinery could be replaced, as new technology, wear and tear, and other factors had rendered it outdated. The machine that was considered for replacement was a plastic injection moulding machine (EX2). The EX2 is now partially depreciated and would be sold for R50 000. Its replacement, a plastic injection moulding machine (Y2), was faster and more efficient. Certain financial information concerning Y2 is presented in Table 4. Y2 cost would be R4 300 000 including shipping and installation. The salvage value of Y2 is estimated to be the book value of the machine in five years. The cost of funds for long term projects is estimated to be between 10 - 14 per cent based on the estimations of the cost of capital prepared by Xolile and Xolani. Such cost would reflect the required return from the investors of capital in the company. There were other areas of concern expressed relative to the proposed purchase of the Y2. The company's capital structure was an exciting aspect of the overall health of the company. Specifically, they wondered if the move towards debt financing would alter the discount rate used in the capital budgeting analysis. Y2 was not significantly more or less risky than any other of the company's capital expenditures. There was also a choice of depreciation method to be used. That is, how would straight-line depreciation be likely to alter the outcome of the analysis of Y2. Related to the case of cash flows, Xolile and Xolani wanted to clarify that 11 percent should be used as the discount rate. Table 1 X.X Plastic Moulders (Pty) Ltd. Selected Statement of Comprehensive Income (R' 000) 2015 2016 2017 2018 2019 6900 7 500 8 200 9 000 10 200 2020 11 400 2021 12 200 Dates Sales revenue Net income after tax 952 1238 1738 1765 2228 1380 1073 Table 2 Commercial Business Activity New office space New business start-ups Increase in industry demand 18% 12% 14% Assets Cash Account's receivables Inventory Total current assets Table 3 X.X Plastic Moulders (Pty) Ltd. Statement of Financial Position 31 March, 2021 (R' 000) Liabilities and Equity 510 Accounts payable 800 122 Accrued wages and tax 200 568 Notes payable 875 1 200 Total current liability 1 875 3 150 5 025 2 500 7475 9975 15 000 Land 3 475 Mortgage debt Buildings 4 150 Total liabilities Equipment 6 175 Ordinary shares Total fixed assets 13 800 Retained earnings Total equity Total assets 15 000 Total liability and equity Note: Building and equipment are nets of depreciation. Table 4 X.X Plastic Moulders (Pty) Ltd. Data for the Plastic injection moulding machine (Y2) (R' 00) 2021 2022 2023 2024 2025 Net income after 3000 3 500 3600 3600 3 600 2026 3 600 tax 8 400 13 440 7980 5040 4 620 2 520 Depreciation expense 4. REQUIRED: 1. Calculate the profit margin for X.X Plastic Moulders (Pty) Ltd. and discuss the trend from 2015 to 2021. (5 marks) 2. Should the Y2 machine be considered for purchase by the company? Motivate your answer from the case study (no calculation required). (3 marks) 3. Calculate and evaluate the financial viability (Net Present Value (NPV) and Internal Rate of Return (IRR)) of the Y2 machine. (14 marks) Should the company purchase the Y2 machine? Motivate your answer by referring to question 3. (2 marks) 5. What is the financial rationale of using the NPV or IRR method in the capital budgeting process? (4 marks) 6. Assume that the Y2 machine is funded using debt only. Calculate and explain how this would affect the items in the statement of financial position (see Table 3) (4 marks) 7. Calculate the following: 7.1 Calculate the debt ratio for the current position as presented in Table 3. (2 marks) 7.2 Calculate the debt ratio for the new position, namely, when the company uses debt only to fund the purchase of the Y2 machine. (2 marks) 7.3 Explain the implication of the debt ratio increasing because of the decision to use debt to fund the purchase of the Y2 machine (2 marks) Explain how using debt financing would alter the cost of capital of the company. (2 marks) 9. Calculate the financial viability (NPV and IRR) of the Y2 machine when using the straight-line depreciation method. (12 marks) 10. Explain the effect of using the straight-line depreciation on the NPV and IRR of the Y2 machine. (2 marks) 11. Cite six steps in the capital budgeting process that Xolile and Xolani should follow. Motivate your answer by reference to a journal article and the case study. (12 marks) 12. Write a short financial report to Xolile and Xolani detailing whether they should replace the EX2 machine with the Y2 machine. In your report, include the following points: Capital structure: 100% debt or 50% debt-equity ratio. Current depreciation method or straight-line depreciation method Capital budgeting techniques: NPV or IRR. (6 marks) 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts