Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview I cropped the question to make it more visible please do it correctly will upvote Homework: Chapter 5 Homework Question 4, Problem

Old MathJax webview

I cropped the question to make it more visible please do it correctly will upvote

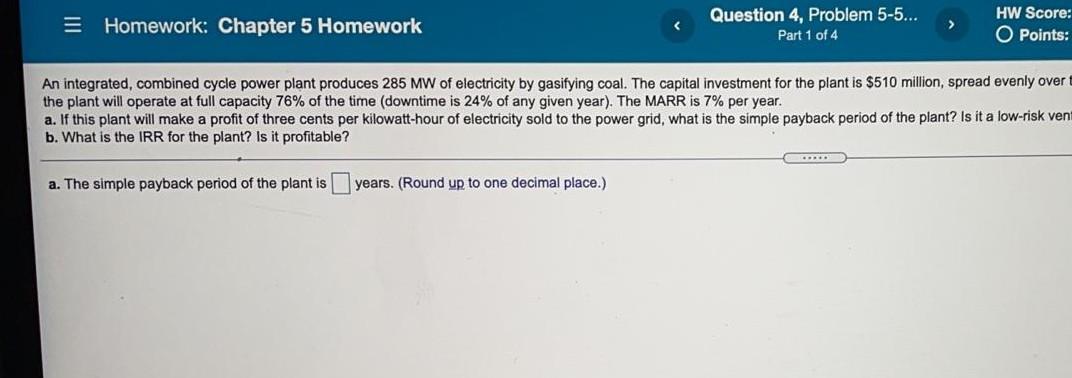

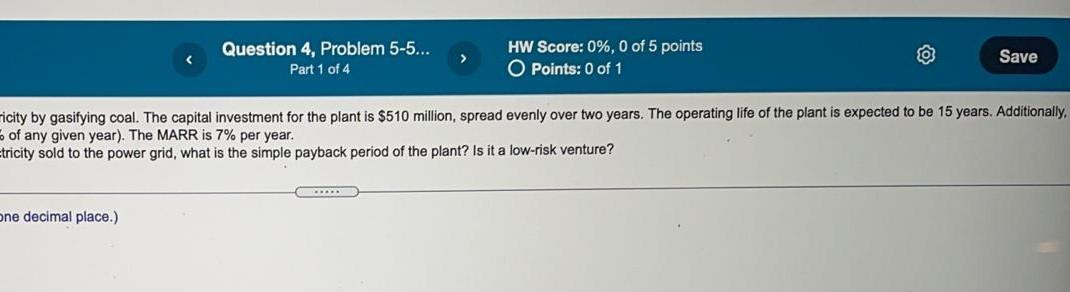

Homework: Chapter 5 Homework Question 4, Problem 5-5... Part 1 of 4 HW Score: O Points: An integrated, combined cycle power plant produces 285 MW of electricity by gasifying coal. The capital investment for the plant is $510 million, spread evenly over the plant will operate at full capacity 76% of the time (downtime is 24% of any given year). The MARR is 7% per year. a. If this plant will make a profit of three cents per kilowatt-hour of electricity sold to the power grid, what is the simple payback period of the plant? Is it a low-risk vent b. What is the IRR for the plant? Is it profitable? a. The simple payback period of the plant is years. (Round up to one decimal place.) Question 4, Problem 5-5... Part 1 of 4 HW Score: 0%, 0 of 5 points O Points: 0 of 1 Save icity by gasifying coal. The capital investment for the plant is $510 million, spread evenly over two years. The operating life of the plant is expected to be 15 years. Additionally, of any given year). The MARR is 7% per year. Etricity sold to the power grid, what is the simple payback period of the plant? Is it a low-risk venture? one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started