Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview I need help with the whole assesment FNSACC311 assessment 3 task 1 2 and 3 need answers to the following FNSACC311_2_3_Assessment_1 -

Old MathJax webview

I need help with the whole assesment FNSACC311 assessment 3 task 1

2 and 3

need answers to the following

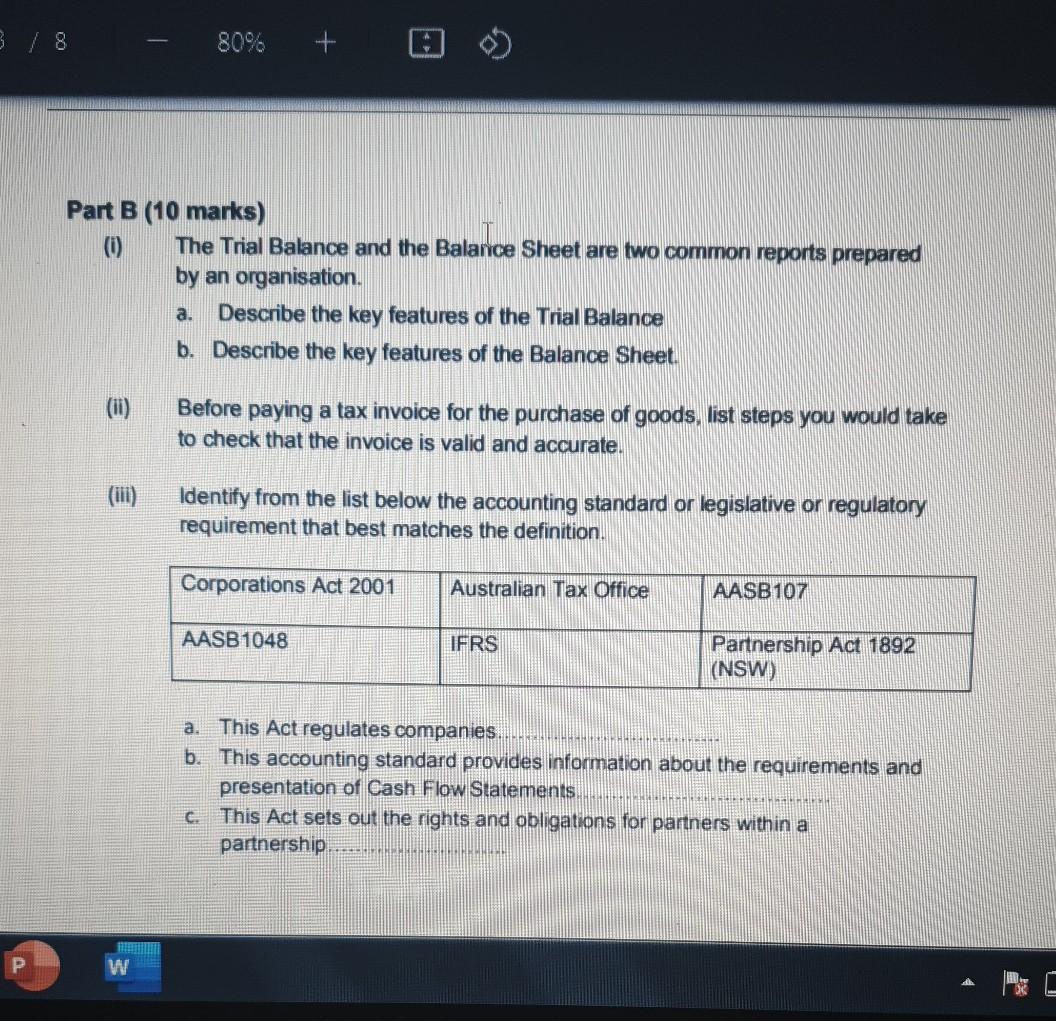

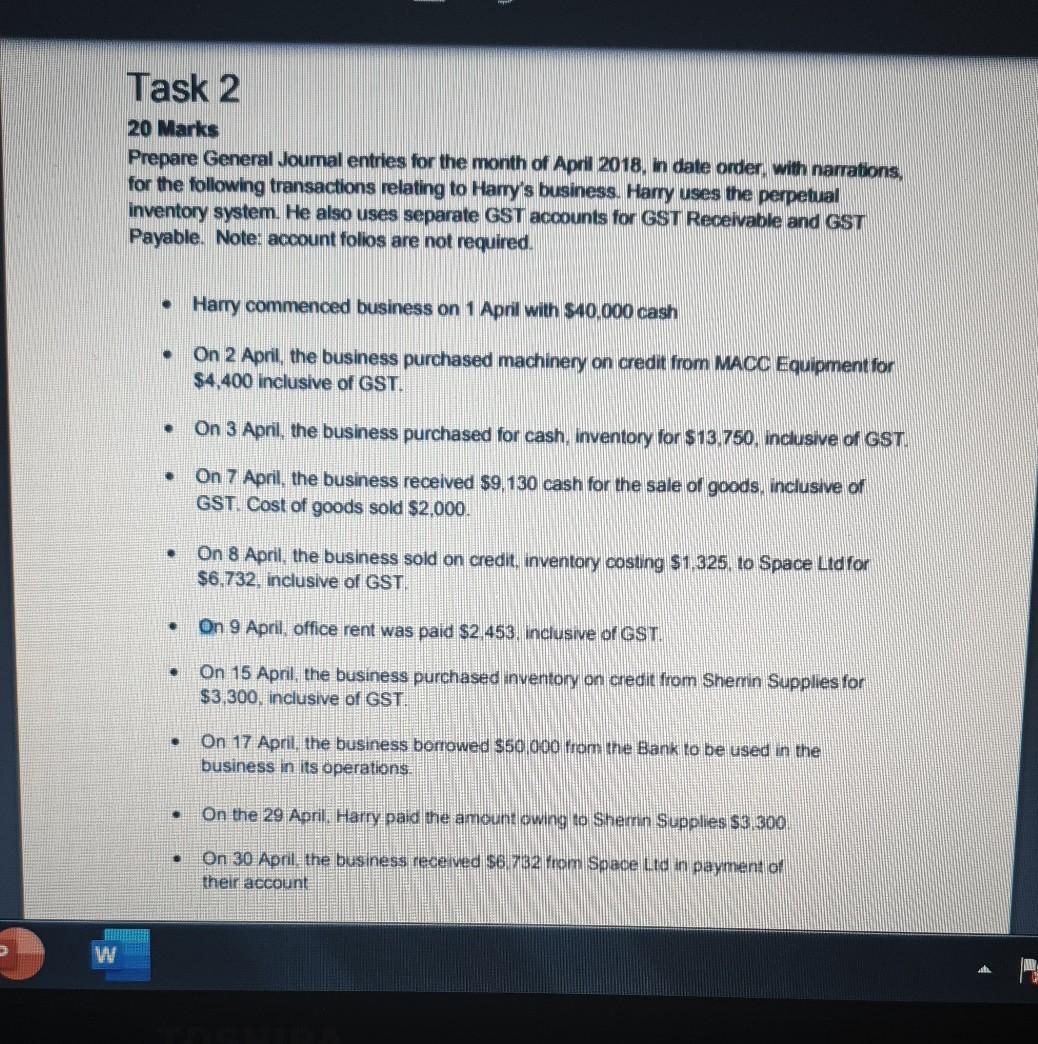

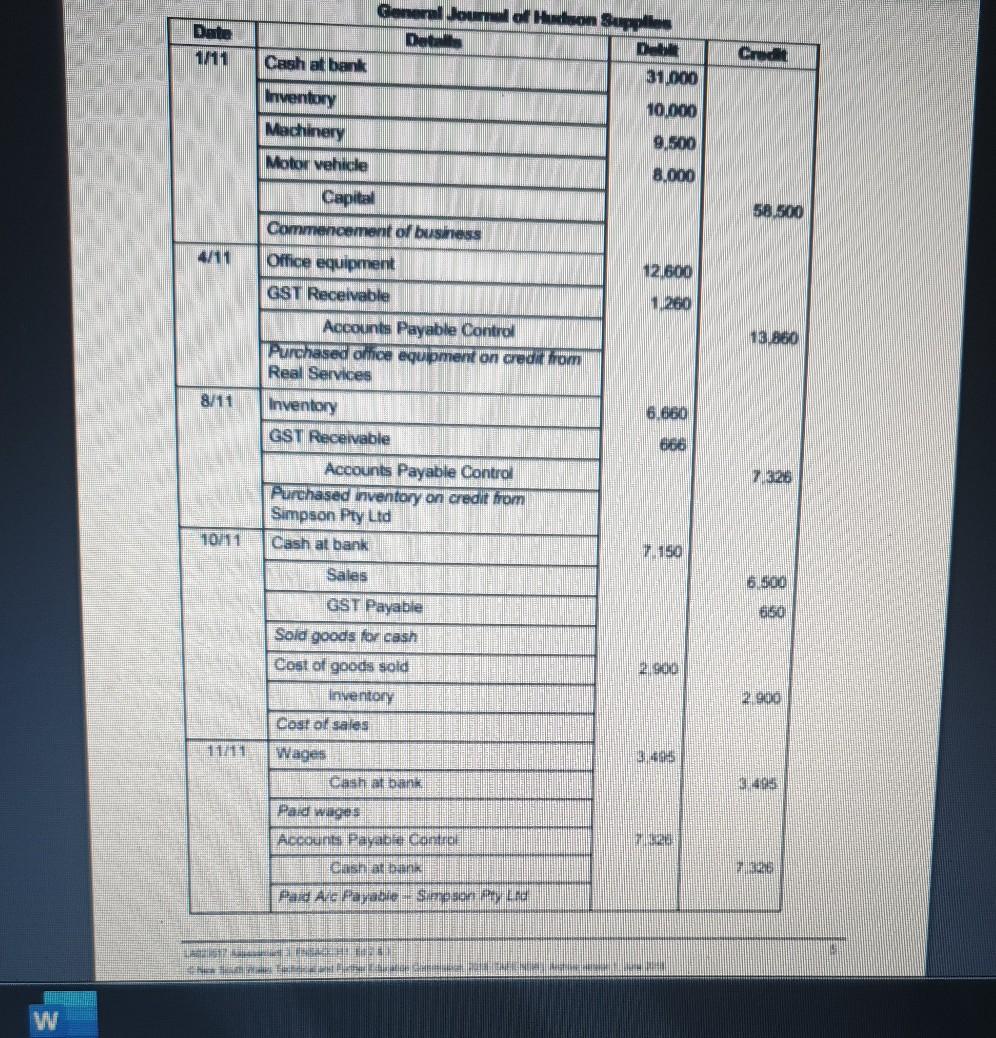

FNSACC311_2_3_Assessment_1 - LA023515 ENSACC311_2_3_Assessment_2 - LA023516 ENSACC311_2_3_Assessment_3 INFO DOWNLOAC - LA023517 FNSACC311_2_3_Assessment_4 - LA023518 FNSACC311_2_3_Assessment_5 0 INFO DOWNLOAD - LAO23519 FNS30317_Oral Communications assessment - INFO DOWNLOAD LA023521 3 18 80% + Part B (10 marks) () The Trial Balance and the Balance Sheet are two common reports prepared by an organisation. Describe the key features of the Trial Balance b. Describe the key features of the Balance Sheet. a. Before paying a tax invoice for the purchase of goods, list steps you would take to check that the invoice is valid and accurate. (ili) Identify from the list below the accounting standard or legislative or regulatory requirement that best matches the definition. Corporations Act 2001 Australian Tax Office AASB 107 AASB1048 IFRS Partnership Act 1892 (NSW) a. This Act regulates companies. b. This accounting standard provides information about the requirements and presentation of Cash Flow Statements C. This Act sets out the rights and obligations for partners within a partnership P W Task 2 20 Marks Prepare General Joumal entries for the month of April 2018, in date order with narrations, for the following transactions relating to Harry's business. Harry uses the perpetual inventory system. He also uses separate GST accounts for GST Receivable and GST Payable. Note: account folios are not required. Hany commenced business on 1 April with $40.000 cash On 2 April, the business purchased machinery on credit from MACC Equipment for $4,400 Inclusive of GST. On 3 April, the business purchased for cash, inventory for $13.750. inclusive of GST. On 7 April, the business received $9,130 cash for the sale of goods inclusive of GST. Cost of goods sold $2,000. On 8 April, the business sold on credit, inventory cosung $1.325. to Space Ltdfor $6,732, inclusive of GST. On 9 April, office rent was paid $2 453. Inclusive of GST. On 15 April, the business purchased inventory on credit from Shemin Supplies for $3,300, inclusive of GST. On 17 April the business borrowed $50,000 from the Bank to be used in the business in its operations. On the 29 April: Harry pald the amount owing to Shemn Supplies $3.300 $ On 30 Aprile the business received $6732 om Space Lidin payment of their account w Date 1/11 Crede Gorenjoyd HomSupplies Date D. Cash at bank 31.000 Inventory 10000 Machinery 9,500 Motor vehicle 8,000 Capital Commencement of business 58.500 58.500 4/11 Office equipment GST Receivable 12.600 1260 13,860 Accounts Payable Control Purchased once equipment on credit hom Real Services 8/11 Inventory 6.660 GST Receivable 668 7 326 Accounts Payable Control Purchased Inventory on credit hom Simpson Pty Ltd Cash at bank 1011 1 150 Sales 6 500 1150 GST Payable Sold goods for cash Cost of goods sold Inventory 2.900 2 900 Cost of sales Wages 13:45 Cash at bank Paid wager Account Payabe contre Cash at bank Pad At Payadie -- Sizneson fyld 20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started