Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show me the details of how to solve this questions, thank you! Question 8: Dakar Motors Inc. is determining if they want to invest

Please show me the details of how to solve this questions, thank you!

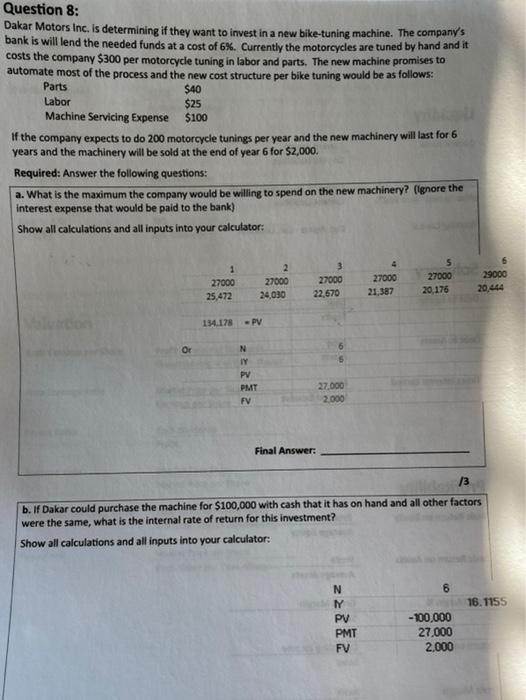

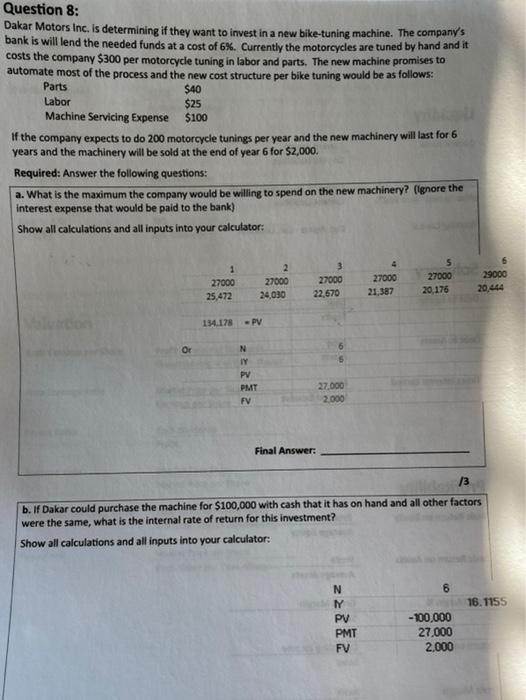

Question 8: Dakar Motors Inc. is determining if they want to invest in a new bike-tuning machine. The company's bank is will lend the needed funds at a cost of 6%. Currently the motorcycles are tuned by hand and it costs the company $300 per motorcycle tuning in labor and parts. The new machine promises to automate most of the process and the new cost structure per bike tuning would be as follows: Parts $40 Labor $25 Machine Servicing Expense $100 If the company expects to do 200 motorcycle tunings per year and the new machinery will last for 6 years and the machinery will be sold at the end of year 6 for $2,000. Required: Answer the following questions: a. What is the maximum the company would be willing to spend on the new machinery? (ignore the interest expense that would be paid to the bank) Show all calculations and all inputs into your calculator: 1 27000 25,472 2 27000 24,030 3 27000 22,670 27000 21,387 27000 20,176 29000 20.444 134.178 - PV Or N IY PV PMT FV 27.000 2.000 Final Answer: 13 b. If Dakar could purchase the machine for $100,000 with cash that it has on hand and all other factors were the same, what is the internal rate of return for this investment? Show all calculations and all inputs into your calculator: N 6

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started