8. Surgical Tools, Inc. Surgical Tools, Inc. of Illinois wants to set up a regular procedure for...

Question:

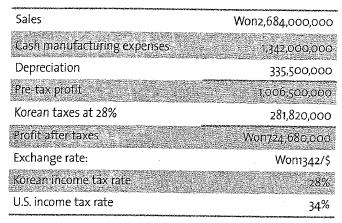

8. Surgical Tools, Inc. Surgical Tools, Inc. of Illinois wants to set up a regular procedure for transferring funds from its newly opened manufacturing subsidiary in Korea to the United States. The precedent set by the transfer method or methods is likely to pre- vail over any government objections that might otherwise arise in future years. The Korean subsidiary manufactures surgical tools for export to all Asian countries. The pro forma financial information shown in the table at the top of the next page portrays the results expected in the first full year of operations. Surgical Tool's CFO is pondering the following approaches:

a. Declare a dividend of Won362,340,000, equal to 50% of profit after taxes. The dividend would be taxable in the United States after a gross-up for Korean taxes already paid.

b. Add a license fee of Won362,340,000 to the above expenses, and remit that amount annually. The license fee would be fully taxable in the United States.

Step by Step Answer:

Fundamentals Of Multinational Finance

ISBN: 9780321541642

3rd Edition

Authors: Michael H. Moffett, Arthur I. Stonehill, David K. Eiteman