Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview I need the answers to the questions. Ja-Beau Supplies & More Trial Balance as at June 30, 2021 Dr $ Cr$ Cash

Old MathJax webview

I need the answers to the questions.

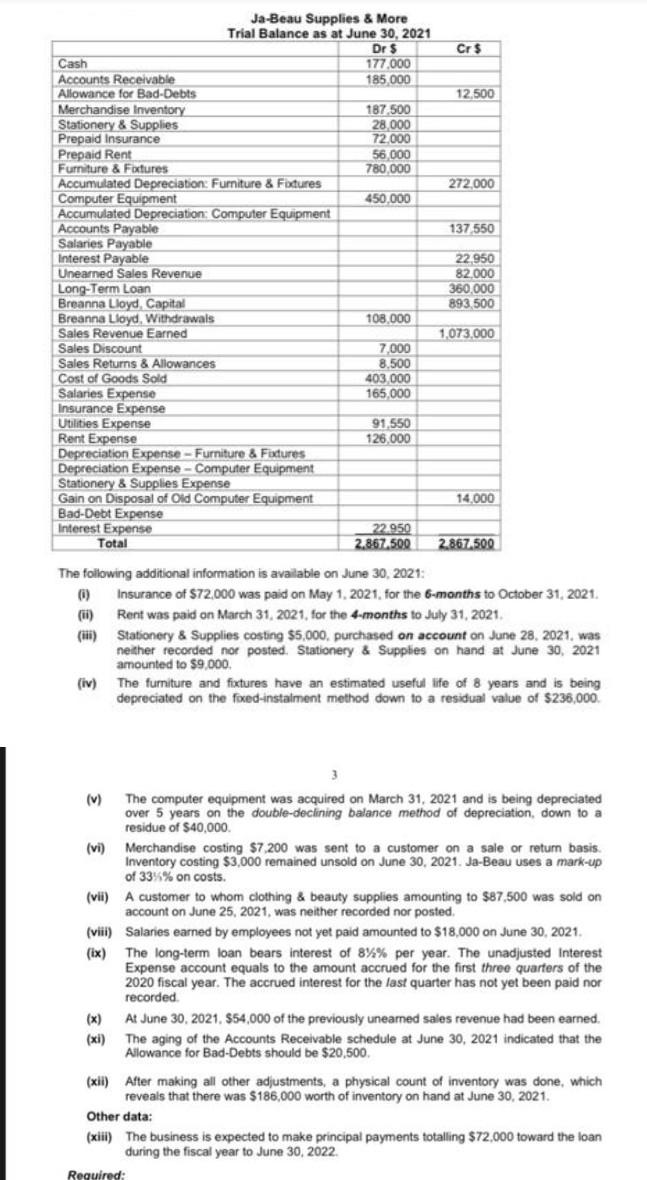

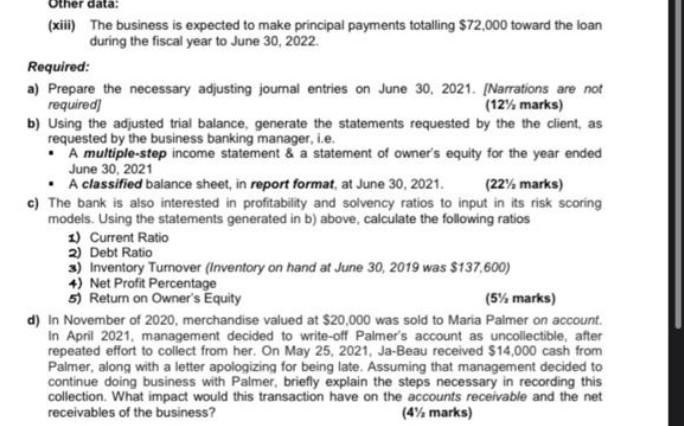

Ja-Beau Supplies & More Trial Balance as at June 30, 2021 Dr $ Cr$ Cash 177.000 Accounts Receivable 185 000 Allowance for Bad-Debts 12.500 Merchandise Inventory 187 500 Stationery & Supplies 28 000 Prepaid Insurance 72.000 Prepaid Rent 56 000 Furniture & Foxtures 780,000 Accumulated Depreciation: Furniture & Fotures 272.000 Computer Equipment 450.000 Accumulated Depreciation: Computer Equipment Accounts Payable 137550 Salaries Payable Interest Payable 22.950 Unearned Sales Revenue 82.000 Long-Term Loan 360,000 Breanna Lloyd Capital 893.500 Breanna Lloyd, Withdrawals 108.000 Sales Revenue Earned 1,073,000 Sales Discount 7.000 Sales Returns & Allowances 8,500 Cost of Goods Sold 403.000 Salaries Expense 165.000 Insurance Expense Utilities Expense 91.550 Rent Expense 126.000 Depreciation Expense - Furniture & Fixtures Depreciation Expense - Computer Equipment Stationery & Supplies Expense Gain on Disposal of Old Computer Equipment 14.000 Bad-Debt Expense Interest Expense 22.950 Total 2.867.500 2.867,500 The following additional information is available on June 30, 2021: 0 Insurance of $72,000 was paid on May 1, 2021. for the 6-months to October 31, 2021. (11) Rent was paid on March 31, 2021, for the 4-months to July 31, 2021 Stationery & Supplies costing $5.000, purchased on account on June 28, 2021. was neither recorded nor posted. Stationery & Supplies on hand at June 30, 2021 amounted to $9.000 (iv) The furniture and factures have an estimated useful life of 8 years and is being depreciated on the foxed-instalment method down to a residual value of $236.000 (v) The computer equipment was acquired on March 31, 2021 and is being depreciated over 5 years on the double-declining balance method of depreciation, down to a residue of $40,000 (vi) Merchandise costing $7.200 was sent to a customer on a sale or retum basis. Inventory costing $3,000 remained unsold on June 30, 2021. Ja-Beau uses a mark-up of 33%% on costs. (vii) A customer to whom clothing & beauty supplies amounting to $87,500 was sold on account on June 25, 2021, was neither recorded nor posted. (viii) Salaries earned by employees not yet paid amounted to $18,000 on June 30, 2021 (ix) The long-term loan bears interest of 8%% per year. The unadjusted Interest Expense account equals to the amount accrued for the first three quarters of the 2020 fiscal year. The accrued interest for the last quarter has not yet been paid nor recorded (x) At June 30, 2021. $54,000 of the previously uneared sales revenue had been earned. (xi) The aging of the Accounts Receivable schedule at June 30, 2021 indicated that the Allowance for Bad-Debts should be $20,500 (xii) After making all other adjustments, a physical count of inventory was done, which reveals that there was $186,000 worth of inventory on hand at June 30, 2021 Other data: (xiii) The business is expected to make principal payments totalling $72,000 toward the loan during the fiscal year to June 30, 2022 Required: (xiii) The business is expected to make principal payments totalling $72,000 toward the loan during the fiscal year to June 30, 2022. Required: a) Prepare the necessary adjusting journal entries on June 30, 2021. [Narrations are not required (12% marks) b) Using the adjusted trial balance, generate the statements requested by the the client, as requested by the business banking manager, i.e. A multiple-step income statement & a statement of owner's equity for the year ended June 30, 2021 A classified balance sheet, in report format, at June 30, 2021. (22% marks) c) The bank is also interested in profitability and solvency ratios to input in its risk scoring models. Using the statements generated in b) above, calculate the following ratios 1) Current Ratio 2) Debt Ratio 3) Inventory Turnover (Inventory on hand at June 30, 2019 was $137,600) +) Net Profit Percentage 5) Return on Owner's Equity (5% marks) d) In November of 2020, merchandise valued at $20,000 was sold to Maria Palmer on account. In April 2021, management decided to write-off Palmer's account as uncollectible, after repeated effort to collect from her. On May 25, 2021, Ja-Beau received $14,000 cash from Palmer, along with a letter apologizing for being late. Assuming that management decided to continue doing business with Palmer, briefly explain the steps necessary in recording this collection. What impact would this transaction have on the accounts receivable and the net receivables of the business? (4% marks) Ja-Beau Supplies & More Trial Balance as at June 30, 2021 Dr $ Cr$ Cash 177.000 Accounts Receivable 185 000 Allowance for Bad-Debts 12.500 Merchandise Inventory 187 500 Stationery & Supplies 28 000 Prepaid Insurance 72.000 Prepaid Rent 56 000 Furniture & Foxtures 780,000 Accumulated Depreciation: Furniture & Fotures 272.000 Computer Equipment 450.000 Accumulated Depreciation: Computer Equipment Accounts Payable 137550 Salaries Payable Interest Payable 22.950 Unearned Sales Revenue 82.000 Long-Term Loan 360,000 Breanna Lloyd Capital 893.500 Breanna Lloyd, Withdrawals 108.000 Sales Revenue Earned 1,073,000 Sales Discount 7.000 Sales Returns & Allowances 8,500 Cost of Goods Sold 403.000 Salaries Expense 165.000 Insurance Expense Utilities Expense 91.550 Rent Expense 126.000 Depreciation Expense - Furniture & Fixtures Depreciation Expense - Computer Equipment Stationery & Supplies Expense Gain on Disposal of Old Computer Equipment 14.000 Bad-Debt Expense Interest Expense 22.950 Total 2.867.500 2.867,500 The following additional information is available on June 30, 2021: 0 Insurance of $72,000 was paid on May 1, 2021. for the 6-months to October 31, 2021. (11) Rent was paid on March 31, 2021, for the 4-months to July 31, 2021 Stationery & Supplies costing $5.000, purchased on account on June 28, 2021. was neither recorded nor posted. Stationery & Supplies on hand at June 30, 2021 amounted to $9.000 (iv) The furniture and factures have an estimated useful life of 8 years and is being depreciated on the foxed-instalment method down to a residual value of $236.000 (v) The computer equipment was acquired on March 31, 2021 and is being depreciated over 5 years on the double-declining balance method of depreciation, down to a residue of $40,000 (vi) Merchandise costing $7.200 was sent to a customer on a sale or retum basis. Inventory costing $3,000 remained unsold on June 30, 2021. Ja-Beau uses a mark-up of 33%% on costs. (vii) A customer to whom clothing & beauty supplies amounting to $87,500 was sold on account on June 25, 2021, was neither recorded nor posted. (viii) Salaries earned by employees not yet paid amounted to $18,000 on June 30, 2021 (ix) The long-term loan bears interest of 8%% per year. The unadjusted Interest Expense account equals to the amount accrued for the first three quarters of the 2020 fiscal year. The accrued interest for the last quarter has not yet been paid nor recorded (x) At June 30, 2021. $54,000 of the previously uneared sales revenue had been earned. (xi) The aging of the Accounts Receivable schedule at June 30, 2021 indicated that the Allowance for Bad-Debts should be $20,500 (xii) After making all other adjustments, a physical count of inventory was done, which reveals that there was $186,000 worth of inventory on hand at June 30, 2021 Other data: (xiii) The business is expected to make principal payments totalling $72,000 toward the loan during the fiscal year to June 30, 2022 Required: (xiii) The business is expected to make principal payments totalling $72,000 toward the loan during the fiscal year to June 30, 2022. Required: a) Prepare the necessary adjusting journal entries on June 30, 2021. [Narrations are not required (12% marks) b) Using the adjusted trial balance, generate the statements requested by the the client, as requested by the business banking manager, i.e. A multiple-step income statement & a statement of owner's equity for the year ended June 30, 2021 A classified balance sheet, in report format, at June 30, 2021. (22% marks) c) The bank is also interested in profitability and solvency ratios to input in its risk scoring models. Using the statements generated in b) above, calculate the following ratios 1) Current Ratio 2) Debt Ratio 3) Inventory Turnover (Inventory on hand at June 30, 2019 was $137,600) +) Net Profit Percentage 5) Return on Owner's Equity (5% marks) d) In November of 2020, merchandise valued at $20,000 was sold to Maria Palmer on account. In April 2021, management decided to write-off Palmer's account as uncollectible, after repeated effort to collect from her. On May 25, 2021, Ja-Beau received $14,000 cash from Palmer, along with a letter apologizing for being late. Assuming that management decided to continue doing business with Palmer, briefly explain the steps necessary in recording this collection. What impact would this transaction have on the accounts receivable and the net receivables of the business? (4% marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started