Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview introduction to business finance Q4 Prepare a cash budget for the Ace Manufacturing Company, indicating receipts and disbursements for May, June, and

Old MathJax webview

introduction to business finance

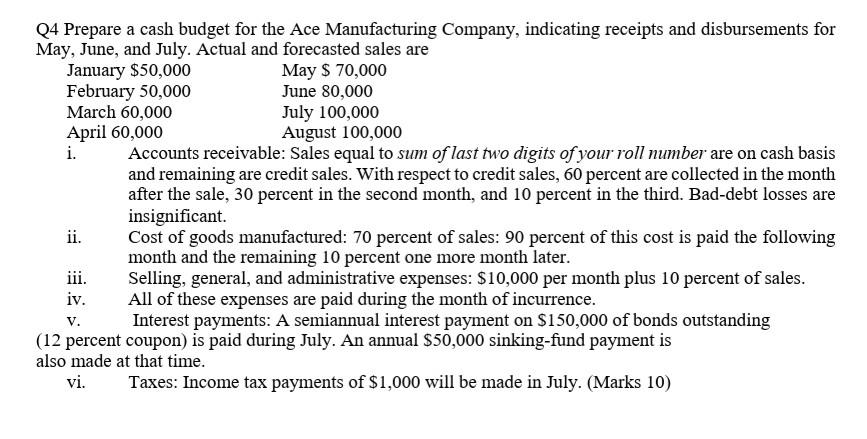

Q4 Prepare a cash budget for the Ace Manufacturing Company, indicating receipts and disbursements for May, June, and July. Actual and forecasted sales are January $50,000 May $ 70,000 February 50,000 June 80,000 March 60,000 July 100,000 April 60,000 August 100,000 i. Accounts receivable: Sales equal to sum of last two digits of your roll number are on cash basis and remaining are credit sales. With respect to credit sales, 60 percent are collected in the month after the sale, 30 percent in the second month, and 10 percent in the third. Bad-debt losses are insignificant ii. Cost of goods manufactured: 70 percent of sales: 90 percent of this cost is paid the following month and the remaining 10 percent one more month later. Selling, general, and administrative expenses: $10,000 per month plus 10 percent of sales. All of these expenses are paid during the month of incurrence. Interest payments: A semiannual interest payment on $150,000 of bonds outstanding (12 percent coupon) is paid during July. An annual $50,000 sinking-fund payment is also made at that time. vi. Taxes: Income tax payments of $1,000 will be made in July. (Marks 10) iii. iv. vStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started