Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview Need help with part 2 of this question! core: 2.67 of 8 pts 1 of 1 (1 complet PM7-40A (similar to) Addit

Old MathJax webview

Need help with part 2 of this question!

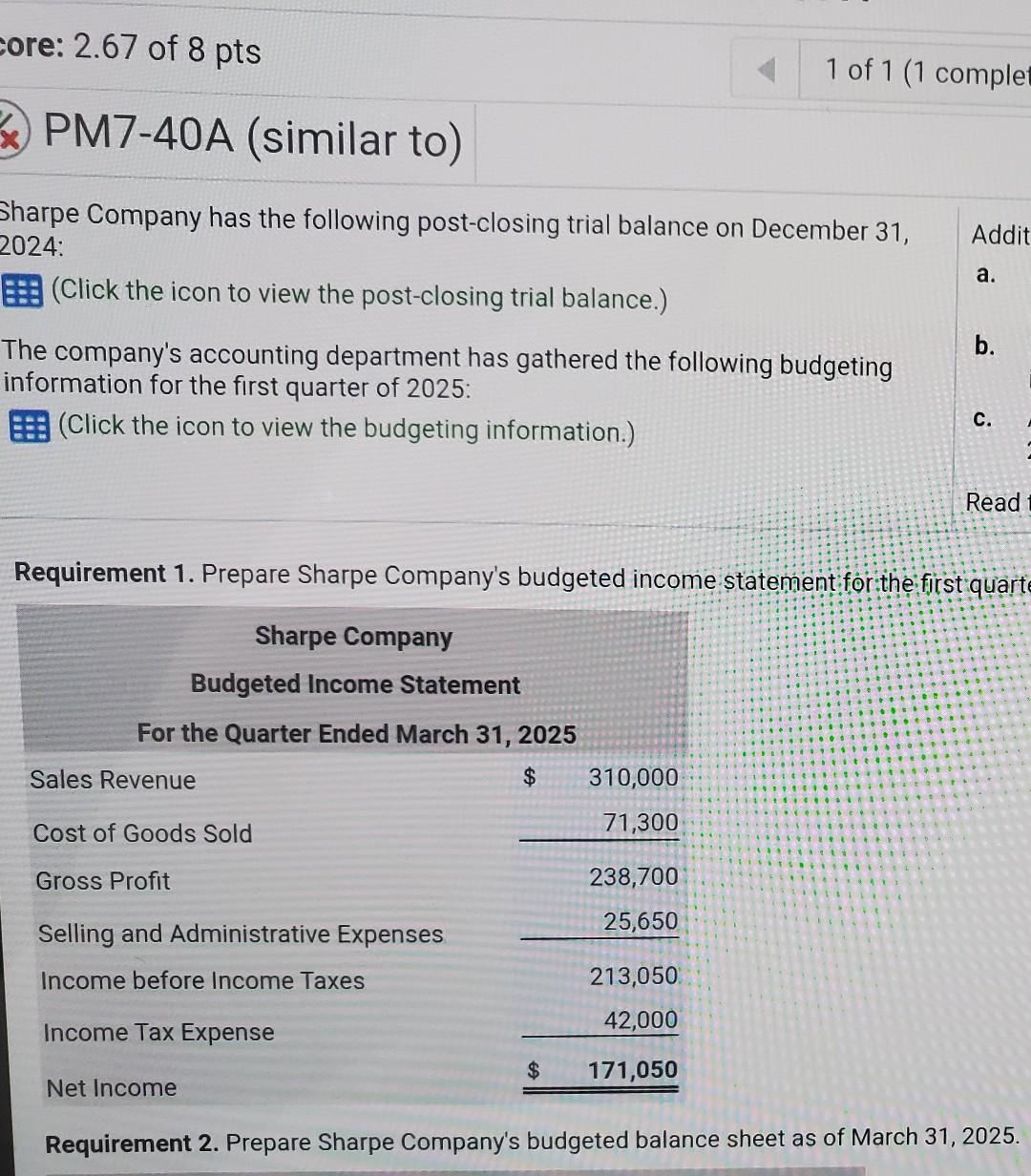

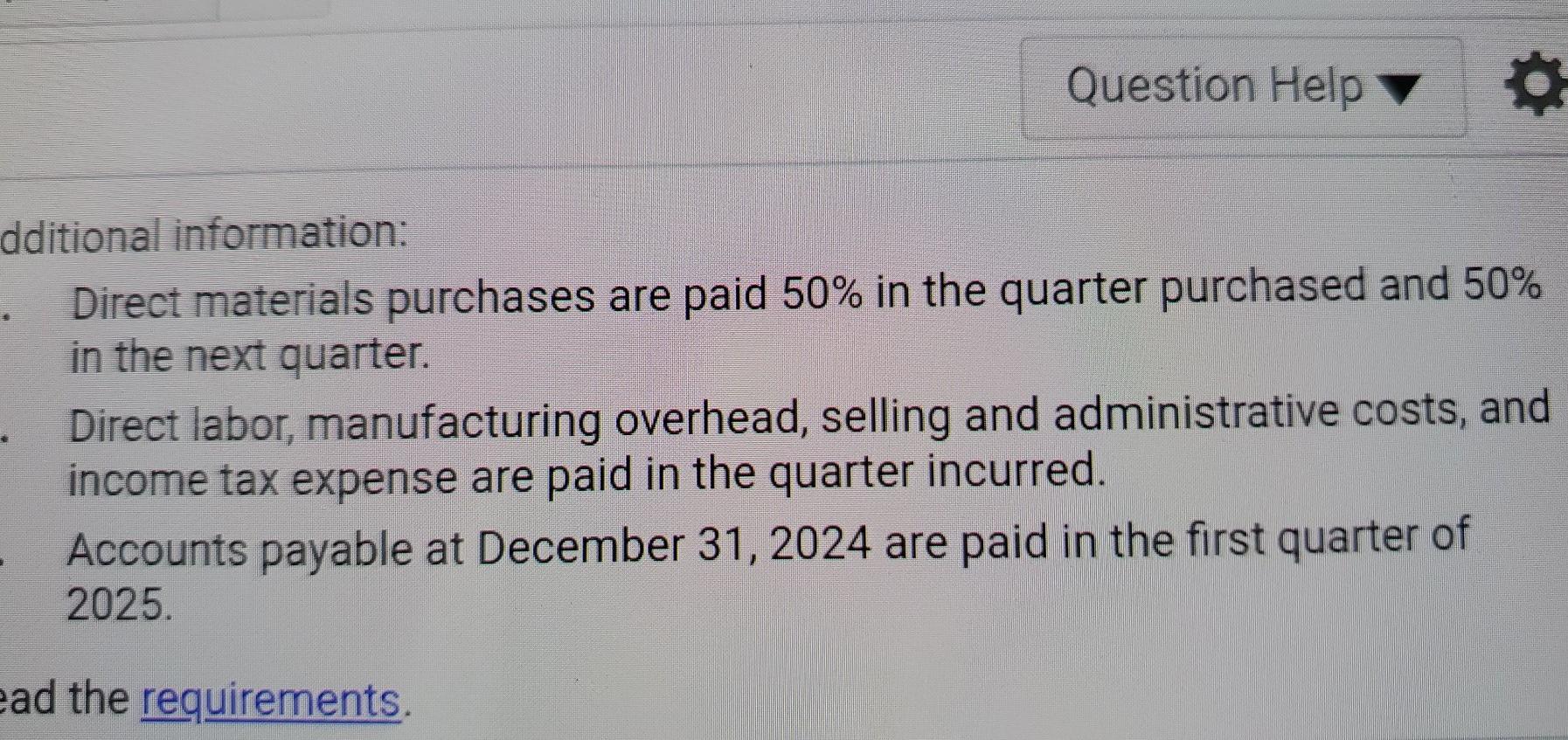

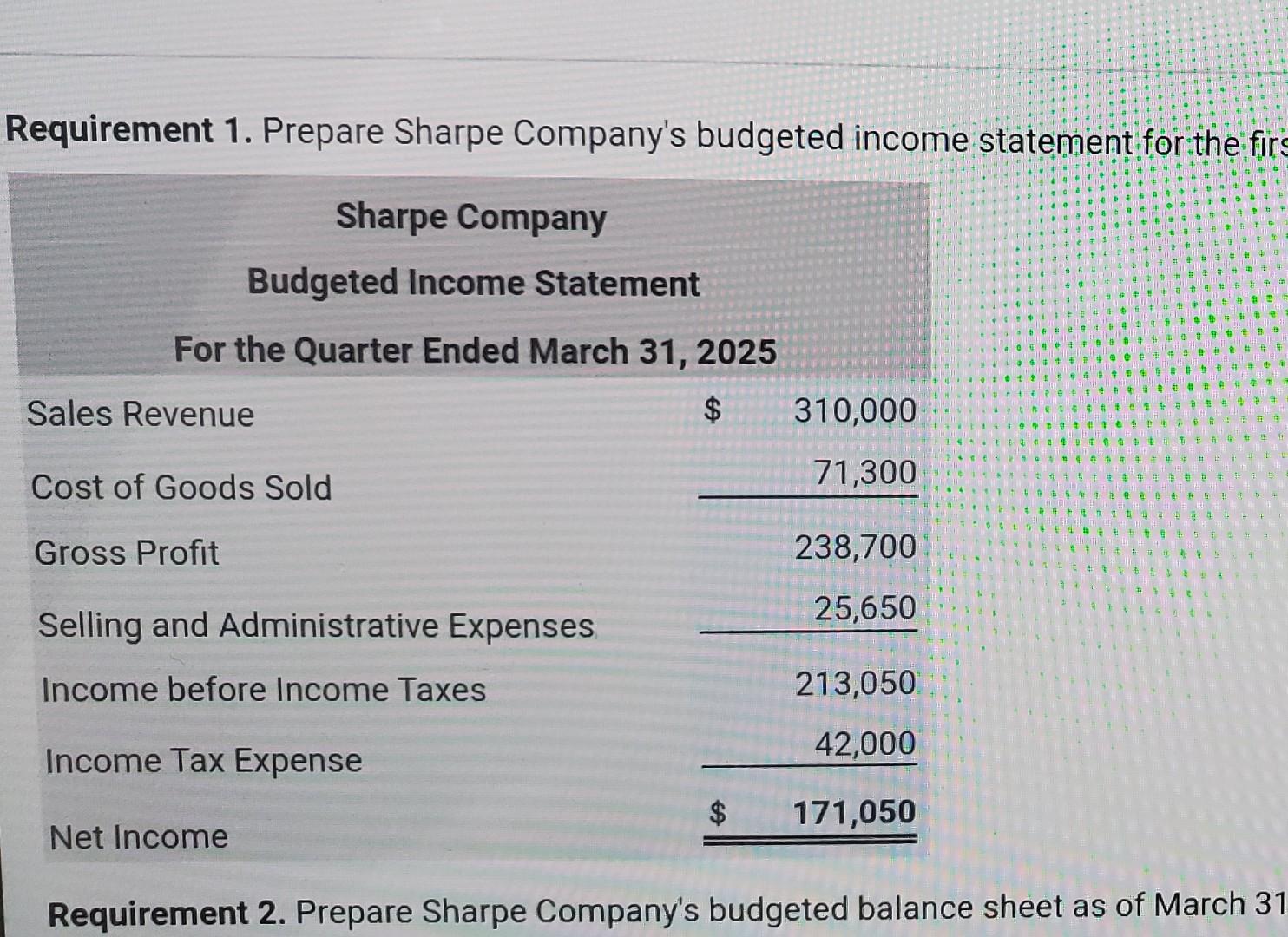

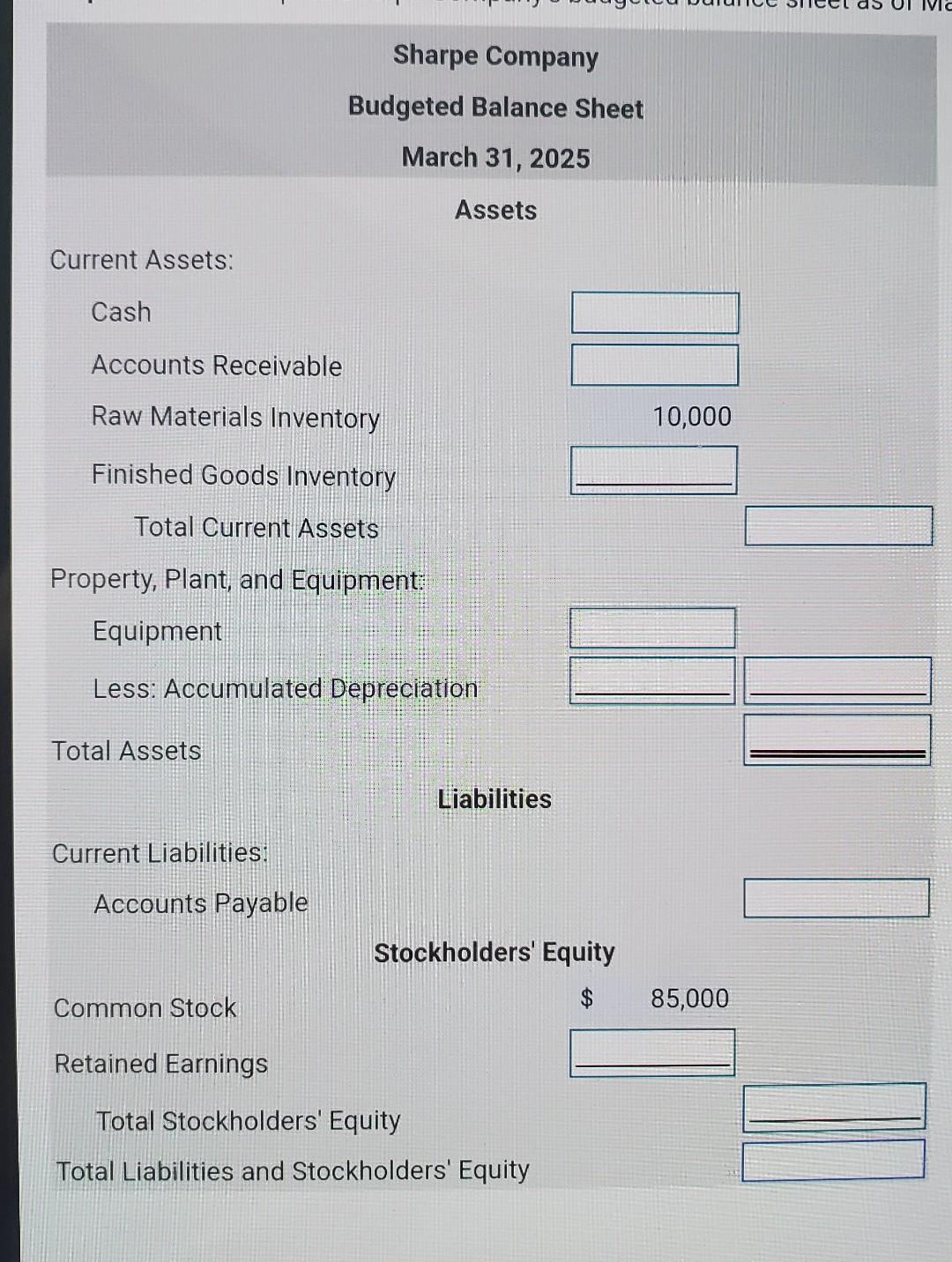

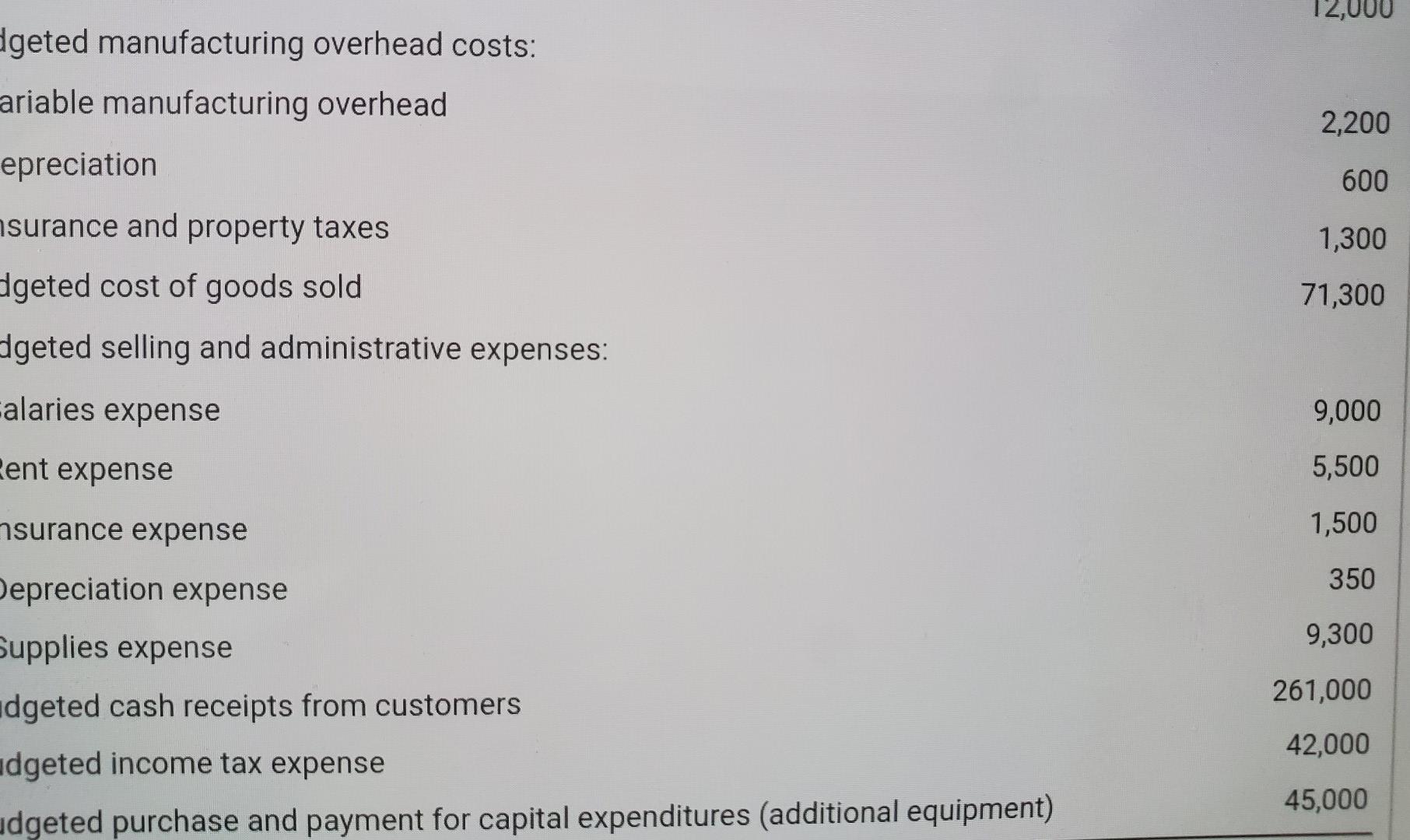

core: 2.67 of 8 pts 1 of 1 (1 complet PM7-40A (similar to) Addit Sharpe Company has the following post-closing trial balance on December 31, 2024: (Click the icon to view the post-closing trial balance.) a. b. The company's accounting department has gathered the following budgeting information for the first quarter of 2025: (Click the icon to view the budgeting information.) c. Read Requirement 1. Prepare Sharpe Company's budgeted income statement for the first quarte Sharpe Company Budgeted Income Statement For the Quarter Ended March 31, 2025 Sales Revenue $ 310,000 71,300 Cost of Goods Sold Gross Profit 238,700 Selling and Administrative Expenses 25,650 Income before Income Taxes 213,050 42,000 Income Tax Expense $ 171,050 Net Income Requirement 2. Prepare Sharpe Company's budgeted balance sheet as of March 31, 2025. Question Help dditional information: Direct materials purchases are paid 50% in the quarter purchased and 50% in the next quarter. Direct labor, manufacturing overhead, selling and administrative costs, and income tax expense are paid in the quarter incurred. Accounts payable at December 31, 2024 are paid in the first quarter of 2025. ead the requirements. Requirement 1. Prepare Sharpe Company's budgeted income statement for the firs 0 + ... t- Sharpe Company . T + + + ao $ t + Budgeted Income Statement #e For the Quarter Ended March 31, 2025 # e 9 $ # # # Sales Revenue $ 310,000 [ 4 + Et 1 71,300 Cost of Goods Sold ti Gross Profit 238,700 Selling and Administrative Expenses 25,650 Income before Income Taxes 213,050 Income Tax Expense 42,000 171,050 Net Income Requirement 2. Prepare Sharpe Company's budgeted balance sheet as of March 31 Ivic Sharpe Company Budgeted Balance Sheet March 31, 2025 Assets Current Assets: Cash Accounts Receivable Raw Materials Inventory 10,000 Finished Goods Inventory Total Current Assets Property, Plant, and Equipment: Equipment Less: Accumulated Depreciation Total Assets Liabilities Current Liabilities: Accounts Payable Stockholders' Equity $ Common Stock 85,000 Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity 12,000 geted manufacturing overhead costs: ariable manufacturing overhead 2.200 epreciation 600 nsurance and property taxes 1,300 dgeted cost of goods sold 71,300 dgeted selling and administrative expenses: calaries expense 9,000 Cent expense 5,500 nsurance expense 1,500 Depreciation expense 350 Supplies expense 9,300 261,000 42,000 udgeted cash receipts from customers dgeted income tax expense udgeted purchase and payment for capital expenditures (additional equipment) 45,000 core: 2.67 of 8 pts 1 of 1 (1 complet PM7-40A (similar to) Addit Sharpe Company has the following post-closing trial balance on December 31, 2024: (Click the icon to view the post-closing trial balance.) a. b. The company's accounting department has gathered the following budgeting information for the first quarter of 2025: (Click the icon to view the budgeting information.) c. Read Requirement 1. Prepare Sharpe Company's budgeted income statement for the first quarte Sharpe Company Budgeted Income Statement For the Quarter Ended March 31, 2025 Sales Revenue $ 310,000 71,300 Cost of Goods Sold Gross Profit 238,700 Selling and Administrative Expenses 25,650 Income before Income Taxes 213,050 42,000 Income Tax Expense $ 171,050 Net Income Requirement 2. Prepare Sharpe Company's budgeted balance sheet as of March 31, 2025. Question Help dditional information: Direct materials purchases are paid 50% in the quarter purchased and 50% in the next quarter. Direct labor, manufacturing overhead, selling and administrative costs, and income tax expense are paid in the quarter incurred. Accounts payable at December 31, 2024 are paid in the first quarter of 2025. ead the requirements. Requirement 1. Prepare Sharpe Company's budgeted income statement for the firs 0 + ... t- Sharpe Company . T + + + ao $ t + Budgeted Income Statement #e For the Quarter Ended March 31, 2025 # e 9 $ # # # Sales Revenue $ 310,000 [ 4 + Et 1 71,300 Cost of Goods Sold ti Gross Profit 238,700 Selling and Administrative Expenses 25,650 Income before Income Taxes 213,050 Income Tax Expense 42,000 171,050 Net Income Requirement 2. Prepare Sharpe Company's budgeted balance sheet as of March 31 Ivic Sharpe Company Budgeted Balance Sheet March 31, 2025 Assets Current Assets: Cash Accounts Receivable Raw Materials Inventory 10,000 Finished Goods Inventory Total Current Assets Property, Plant, and Equipment: Equipment Less: Accumulated Depreciation Total Assets Liabilities Current Liabilities: Accounts Payable Stockholders' Equity $ Common Stock 85,000 Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity 12,000 geted manufacturing overhead costs: ariable manufacturing overhead 2.200 epreciation 600 nsurance and property taxes 1,300 dgeted cost of goods sold 71,300 dgeted selling and administrative expenses: calaries expense 9,000 Cent expense 5,500 nsurance expense 1,500 Depreciation expense 350 Supplies expense 9,300 261,000 42,000 udgeted cash receipts from customers dgeted income tax expense udgeted purchase and payment for capital expenditures (additional equipment) 45,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started