Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview no need to answer first 3 parts. just answer 4th ,5th and 6th part only . 5th, 6th part only not 4

Old MathJax webview

no need to answer first 3 parts. just answer 4th ,5th and 6th part only .

5th, 6th part only not 4th

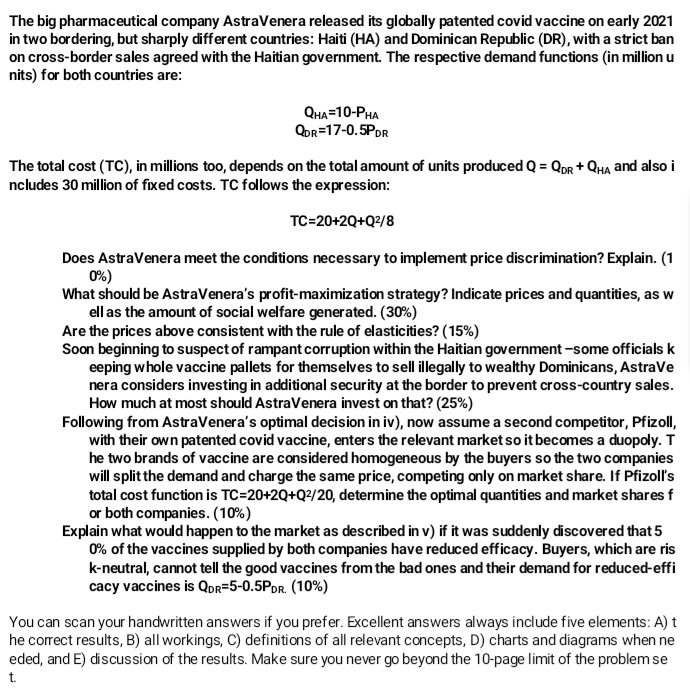

The big pharmaceutical company AstraVenera released its globally patented covid vaccine on early 2021 in two bordering, but sharply different countries: Haiti (HA) and Dominican Republic (DR), with a strict ban on cross-border sales agreed with the Haitian government. The respective demand functions (in million u nits) for both countries are: QHA=10-PHA Qor=17-0.5PDR The total cost (TC), in millions too, depends on the total amount of units produced Q = Qor + Qua and also i ncludes 30 million of fixed costs. TC follows the expression: TC=20+2Q+Q2/8 Does AstraVenera meet the conditions necessary to implement price discrimination? Explain. (1 0%) What should be AstraVenera's profit-maximization strategy? Indicate prices and quantities, as w ell as the amount of social welfare generated. (30%) Are the prices above consistent with the rule of elasticities? (15%) Soon beginning to suspect of rampant corruption within the Haitian government -some officials k eeping whole vaccine pallets for themselves to sell illegally to wealthy Dominicans, Astrave nera considers investing in additional security at the border to prevent cross-country sales. How much at most should AstraVenera invest on that? (25%) Following from AstraVenera's optimal decision in iv), now assume a second competitor, Pfizoll, with their own patented covid vaccine, enters the relevant market so it becomes a duopoly. T he two brands of vaccine are considered homogeneous by the buyers so the two companies will split the demand and charge the same price, competing only on market share. If Pfizoll's total cost function is TC=20+2Q+Q2/20, determine the optimal quantities and market shares f or both companies. (10%) Explain what would happen to the market as described in v) if it was suddenly discovered that 5 0% of the vaccines supplied by both companies have reduced efficacy. Buyers, which are ris k-neutral, cannot tell the good vaccines from the bad ones and their demand for reduced-effi cacy vaccines is Qor=5-0.5PDR. (10%) You can scan your handwritten answers if you prefer. Excellent answers always include five elements: A) t he correct results, B) all workings, C) definitions of all relevant concepts, D) charts and diagrams when ne eded, and E) discussion of the results. Make sure you never go beyond the 10-page limit of the problem se t. The big pharmaceutical company AstraVenera released its globally patented covid vaccine on early 2021 in two bordering, but sharply different countries: Haiti (HA) and Dominican Republic (DR), with a strict ban on cross-border sales agreed with the Haitian government. The respective demand functions (in million u nits) for both countries are: QHA=10-PHA Qor=17-0.5PDR The total cost (TC), in millions too, depends on the total amount of units produced Q = Qor + Qua and also i ncludes 30 million of fixed costs. TC follows the expression: TC=20+2Q+Q2/8 Does AstraVenera meet the conditions necessary to implement price discrimination? Explain. (1 0%) What should be AstraVenera's profit-maximization strategy? Indicate prices and quantities, as w ell as the amount of social welfare generated. (30%) Are the prices above consistent with the rule of elasticities? (15%) Soon beginning to suspect of rampant corruption within the Haitian government -some officials k eeping whole vaccine pallets for themselves to sell illegally to wealthy Dominicans, Astrave nera considers investing in additional security at the border to prevent cross-country sales. How much at most should AstraVenera invest on that? (25%) Following from AstraVenera's optimal decision in iv), now assume a second competitor, Pfizoll, with their own patented covid vaccine, enters the relevant market so it becomes a duopoly. T he two brands of vaccine are considered homogeneous by the buyers so the two companies will split the demand and charge the same price, competing only on market share. If Pfizoll's total cost function is TC=20+2Q+Q2/20, determine the optimal quantities and market shares f or both companies. (10%) Explain what would happen to the market as described in v) if it was suddenly discovered that 5 0% of the vaccines supplied by both companies have reduced efficacy. Buyers, which are ris k-neutral, cannot tell the good vaccines from the bad ones and their demand for reduced-effi cacy vaccines is Qor=5-0.5PDR. (10%) You can scan your handwritten answers if you prefer. Excellent answers always include five elements: A) t he correct results, B) all workings, C) definitions of all relevant concepts, D) charts and diagrams when ne eded, and E) discussion of the results. Make sure you never go beyond the 10-page limit of the problem se tStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started