Question

Old MathJax webview Old MathJax webview I am hoping by me asking the same question that it will not deduct from the limited amount of

Old MathJax webview

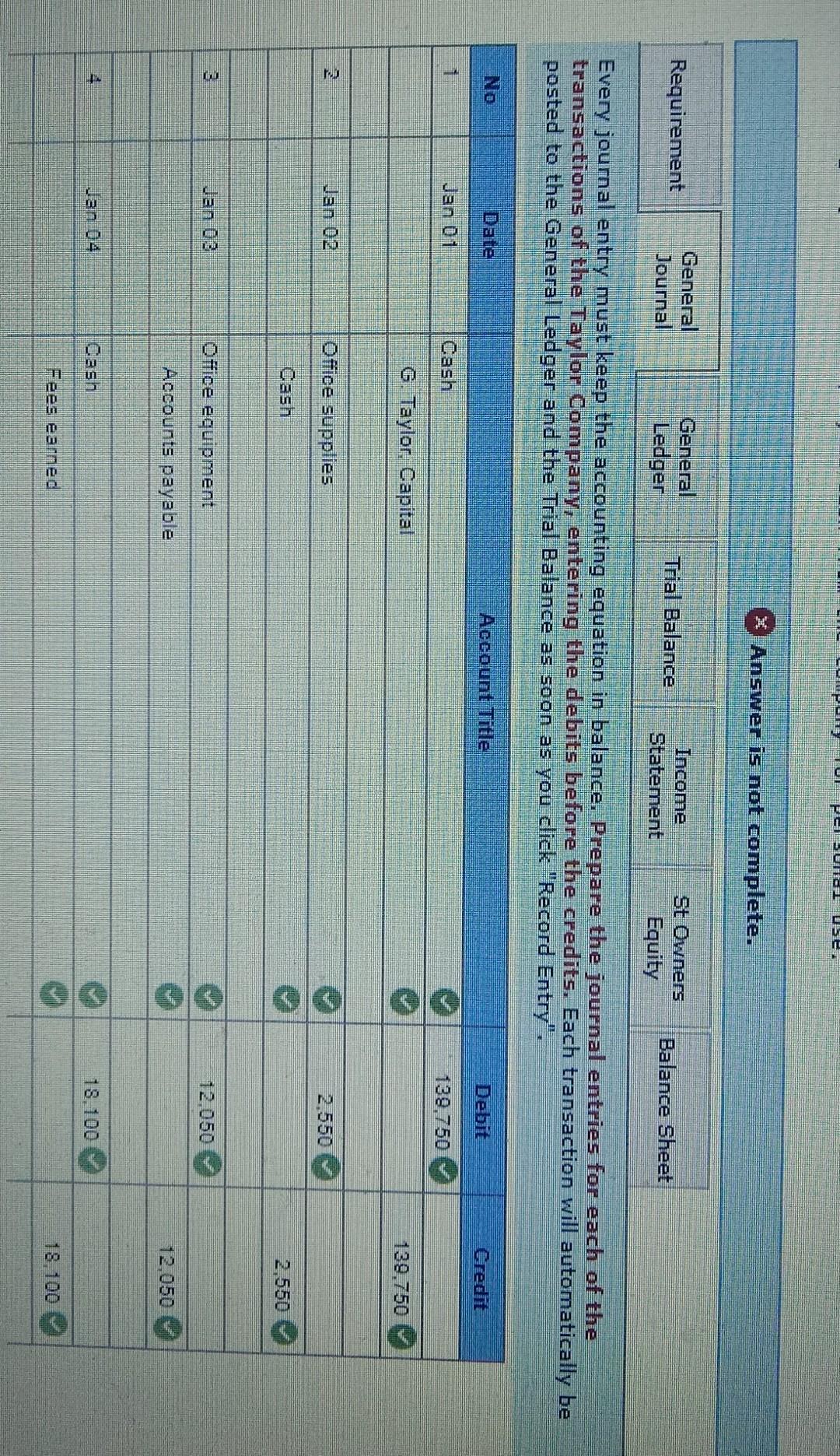

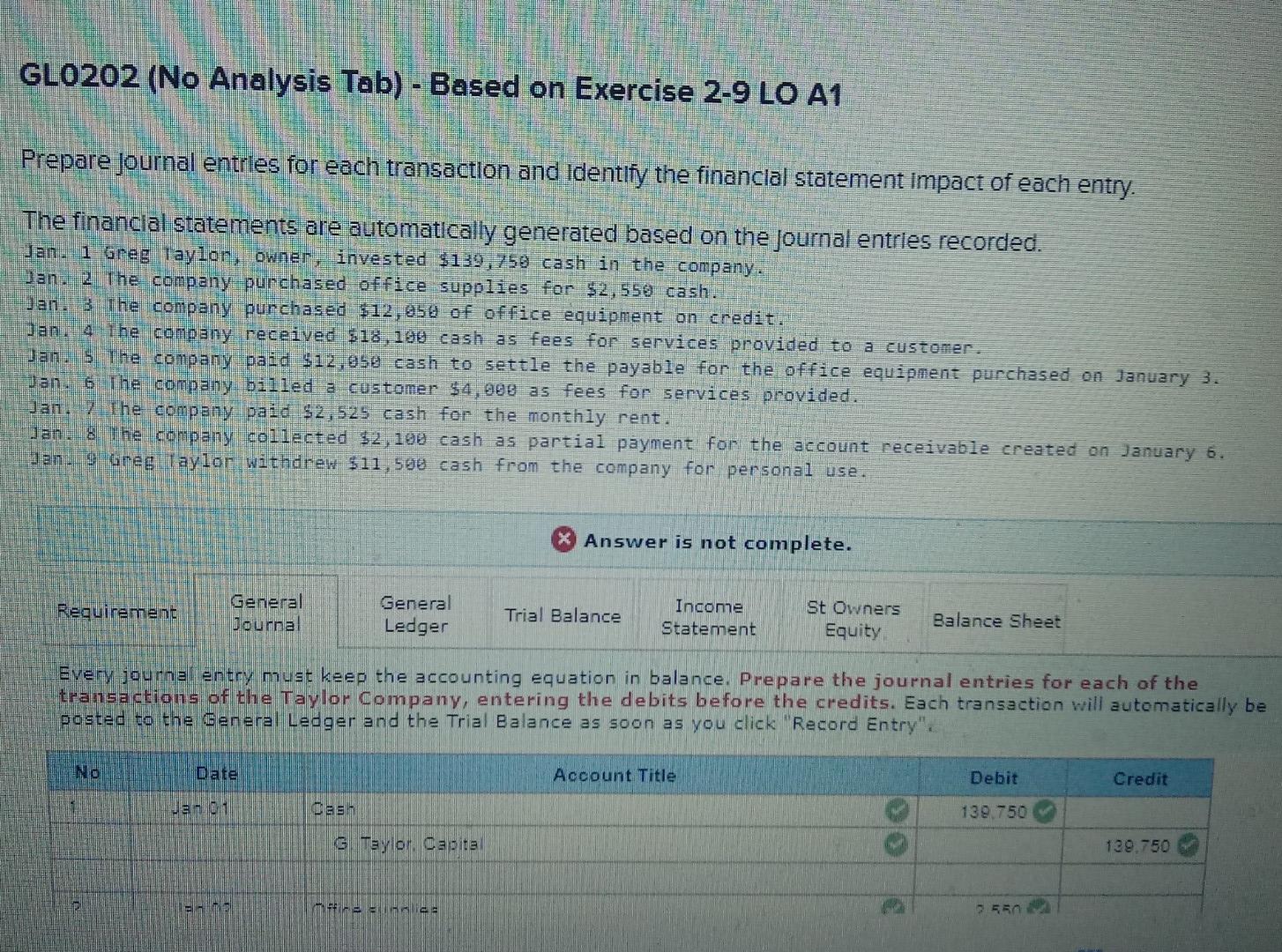

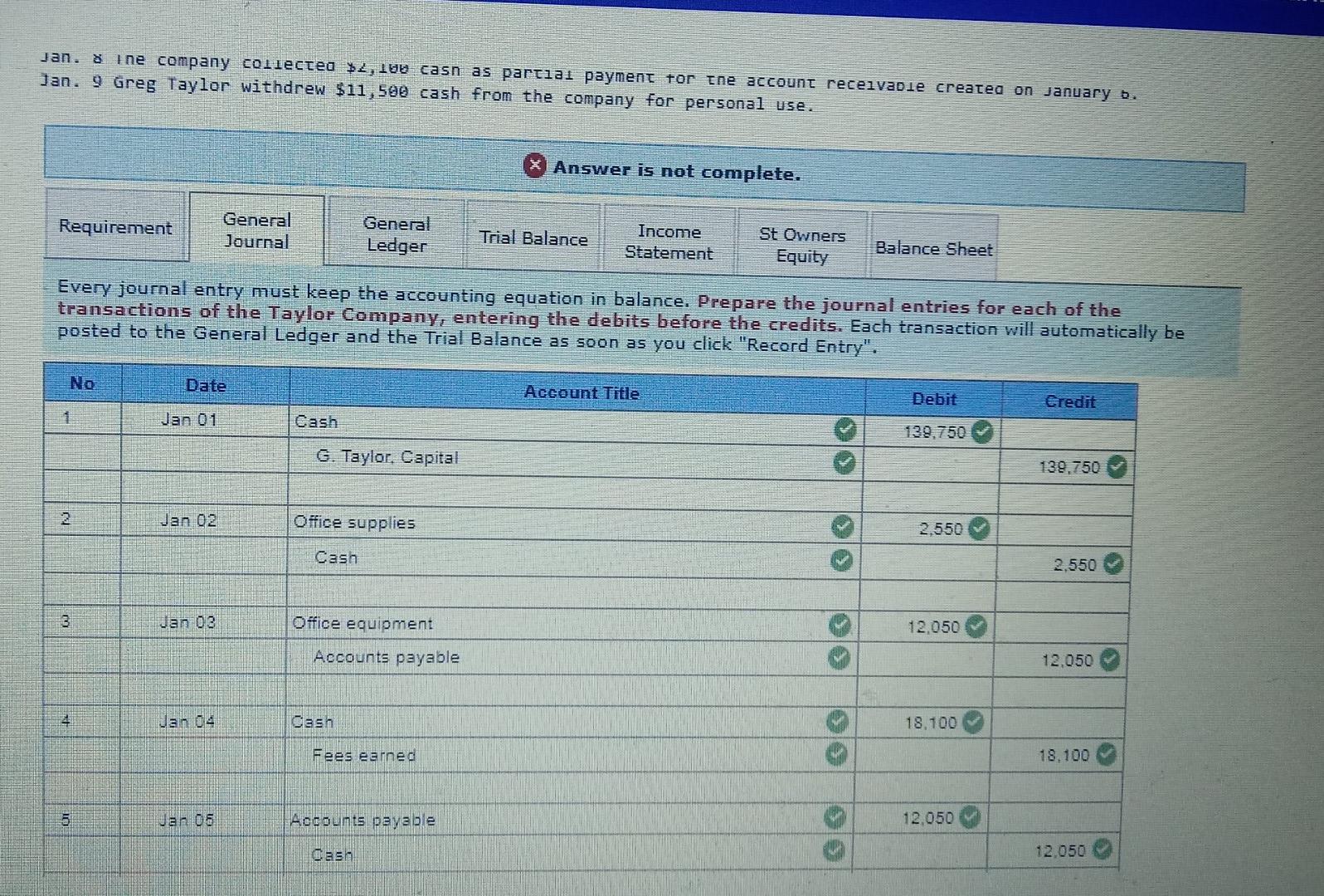

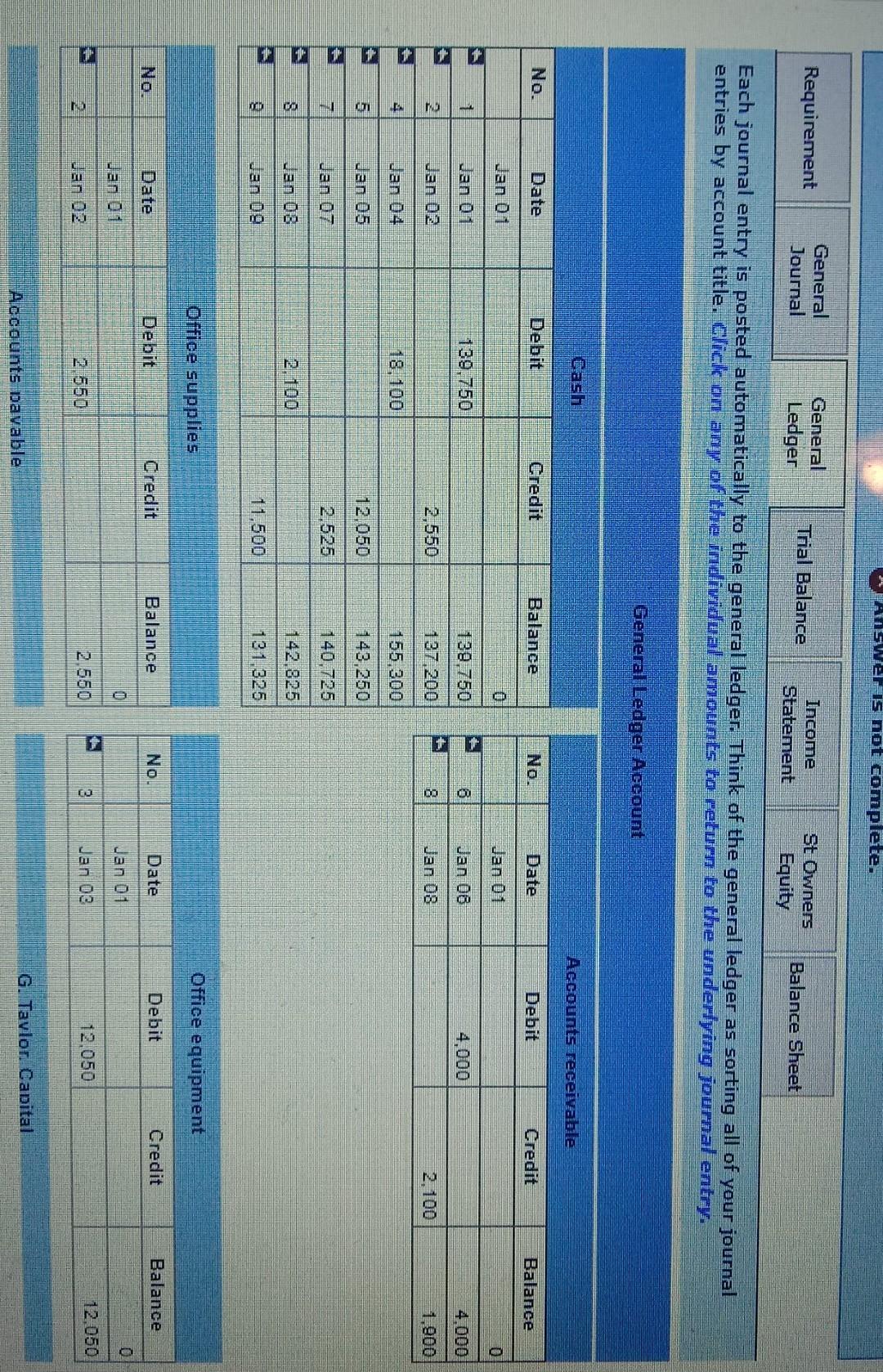

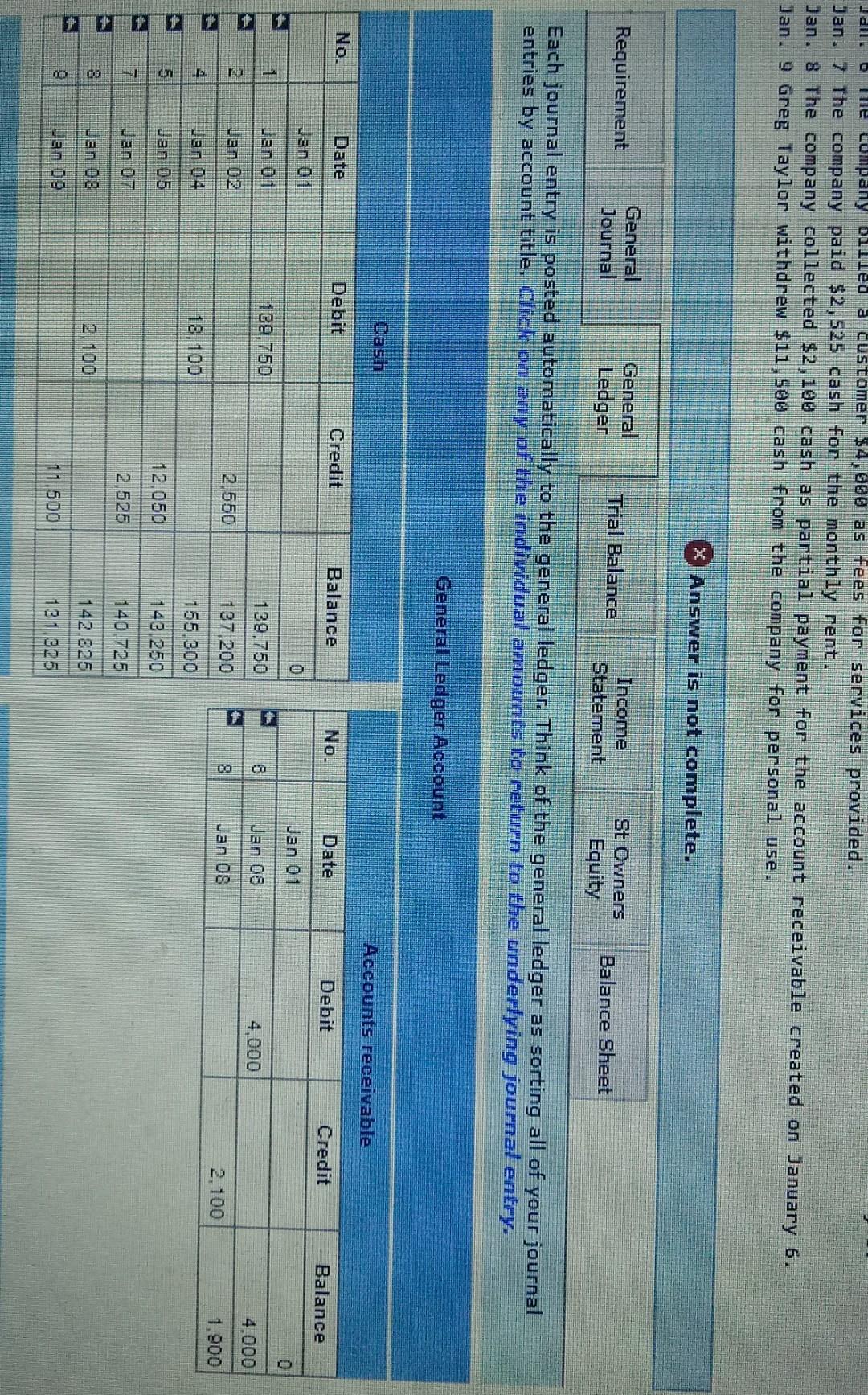

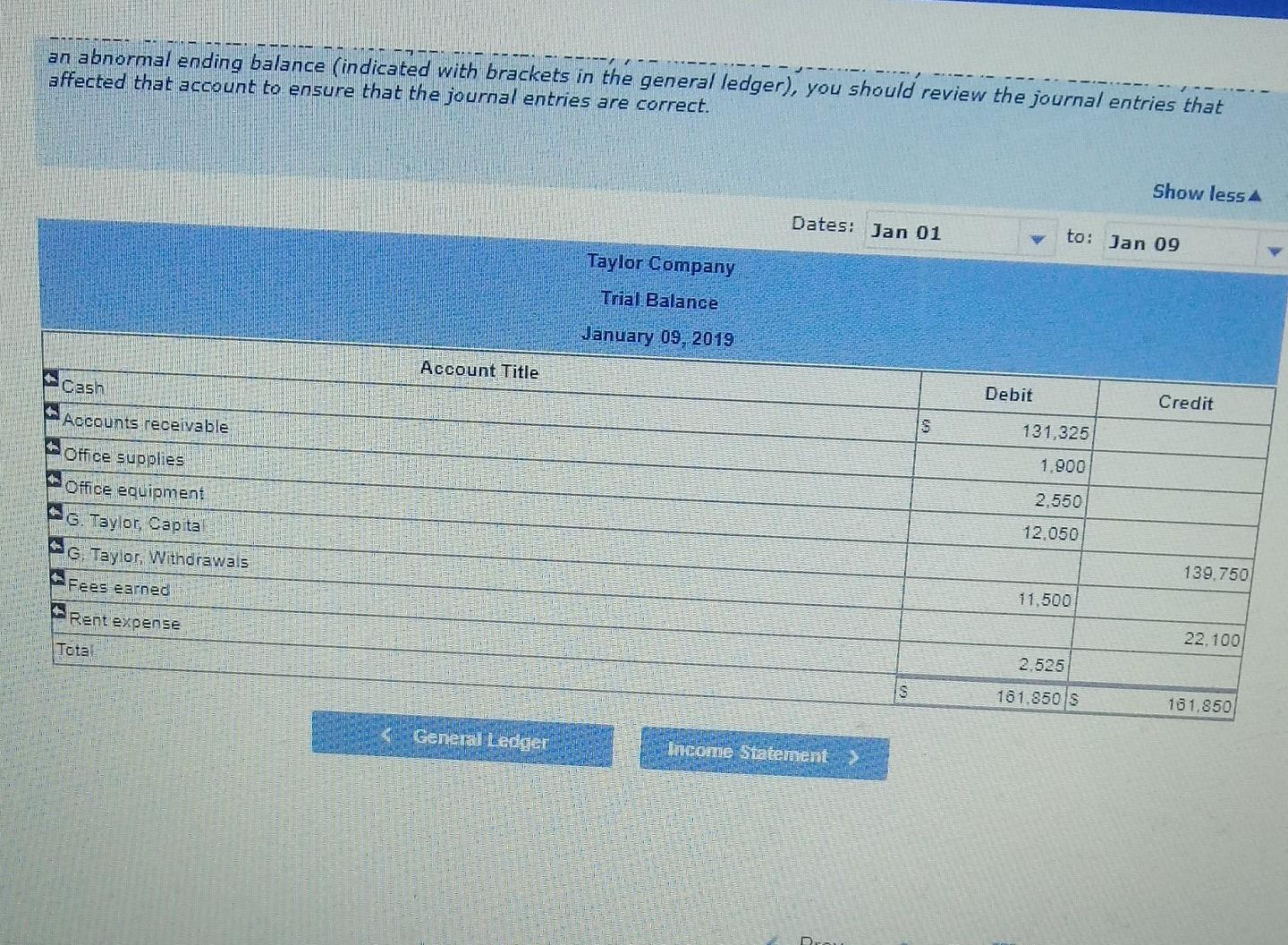

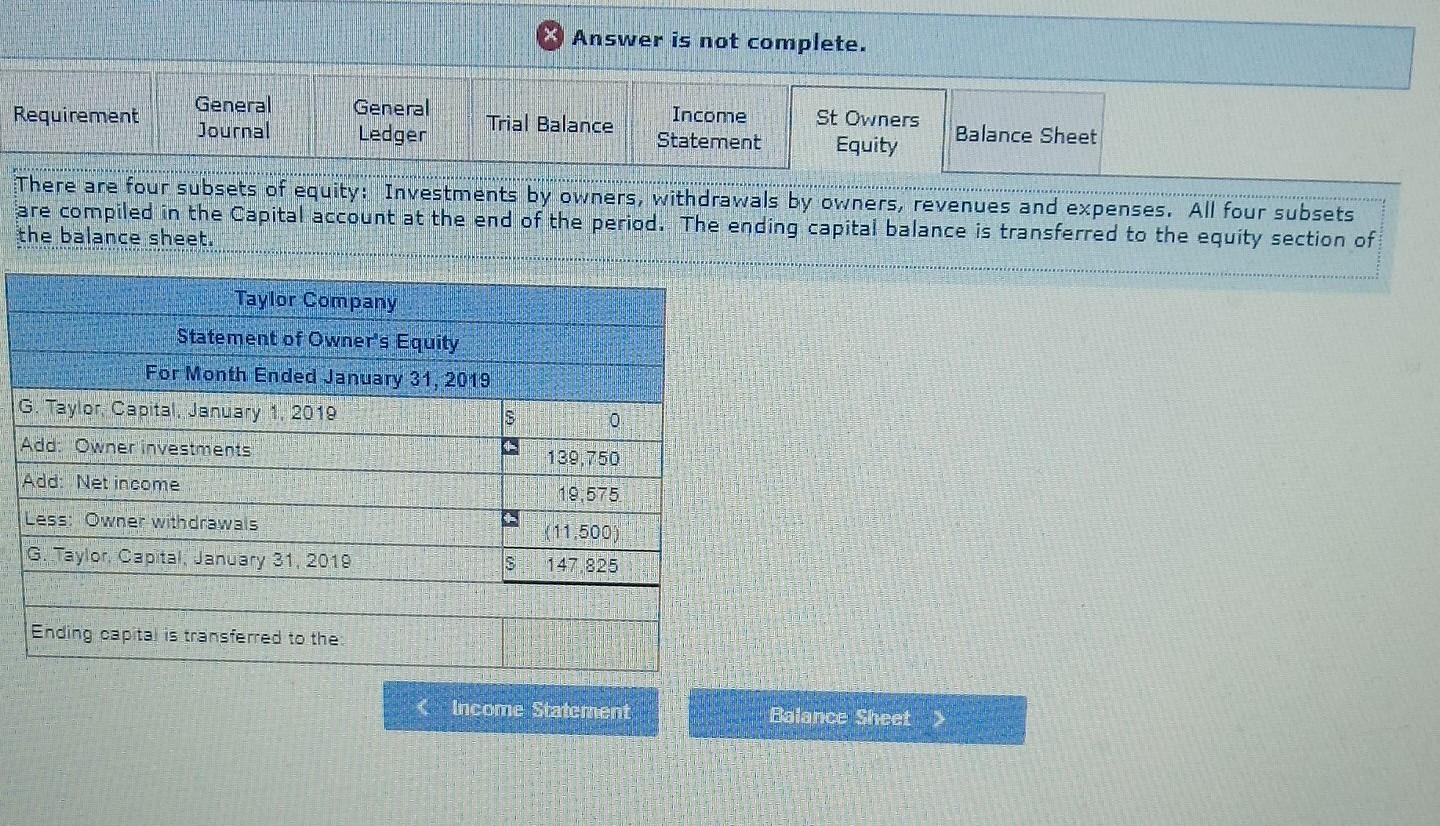

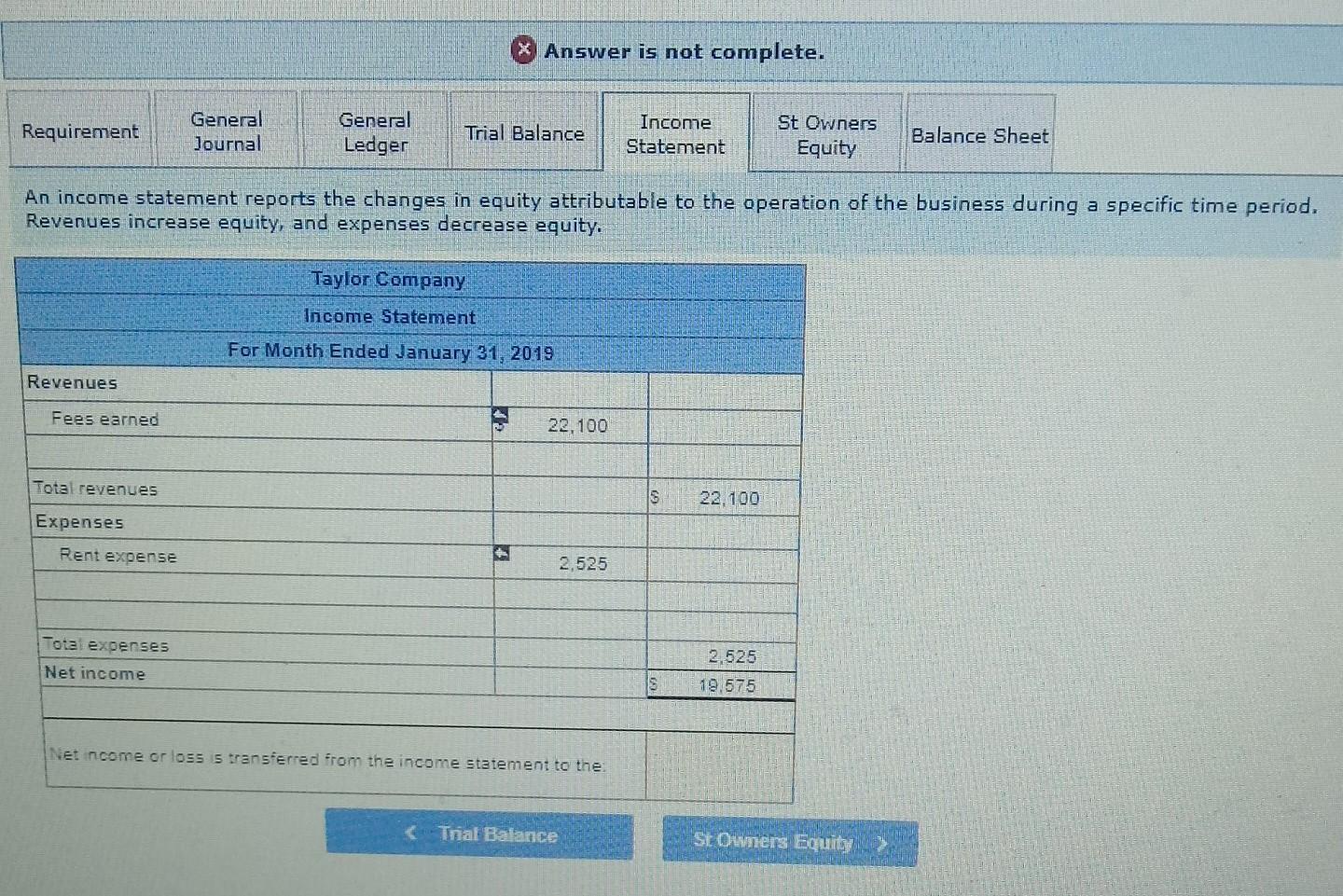

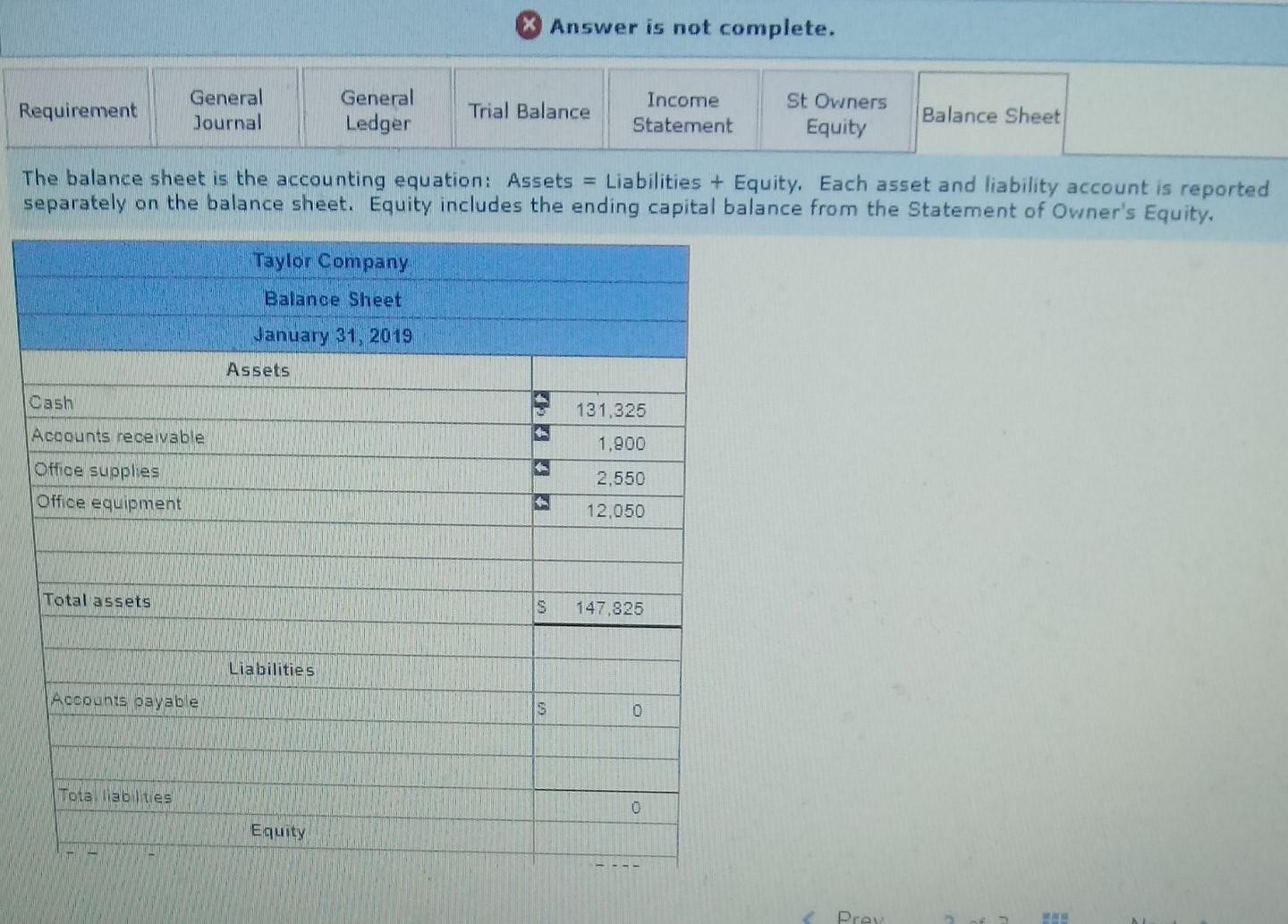

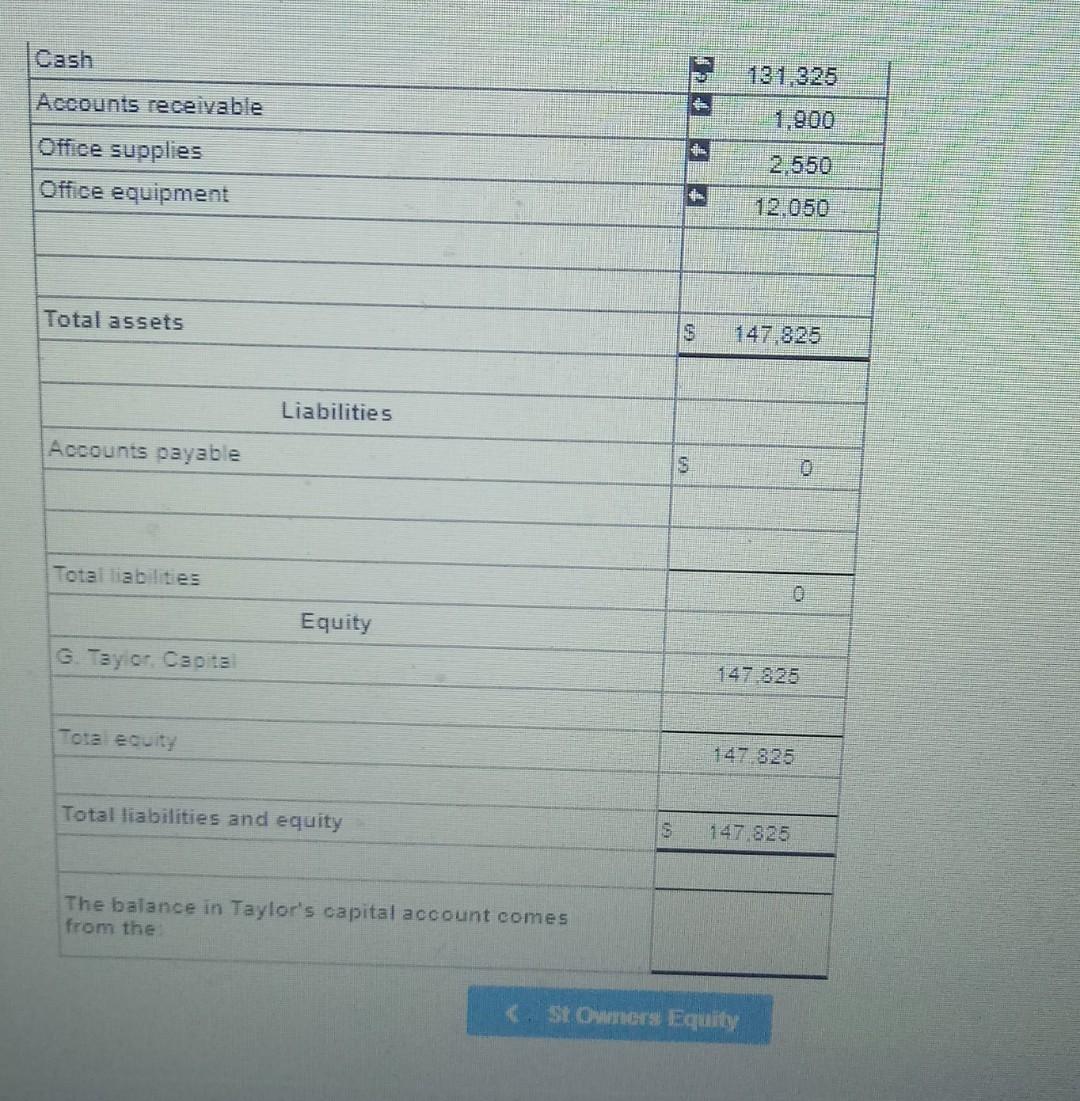

I am hoping by me asking the same question that it will not deduct from the limited amount of questions that I need to address for this month? My question is that on Journal 2 once I input cash in under office supplies, it is still showing up as "Answer is not complete." On the trial bal the debit and credit equal the same which is $161,850 a piece; The Balance sheet's total assets and total liabilities and equity equal $147,825. Everything else seems to check out, but the General Journal is still showing that message that I mentioned to you in my previous question.

Sorry about the inconvenience of not including all this info prior so you could review the whole picture. Anyway, I continue to have a problem with the message, "Answer is not complete." The problems look right, but that message continues to show on each of these problems for this problem #2 Thank you.

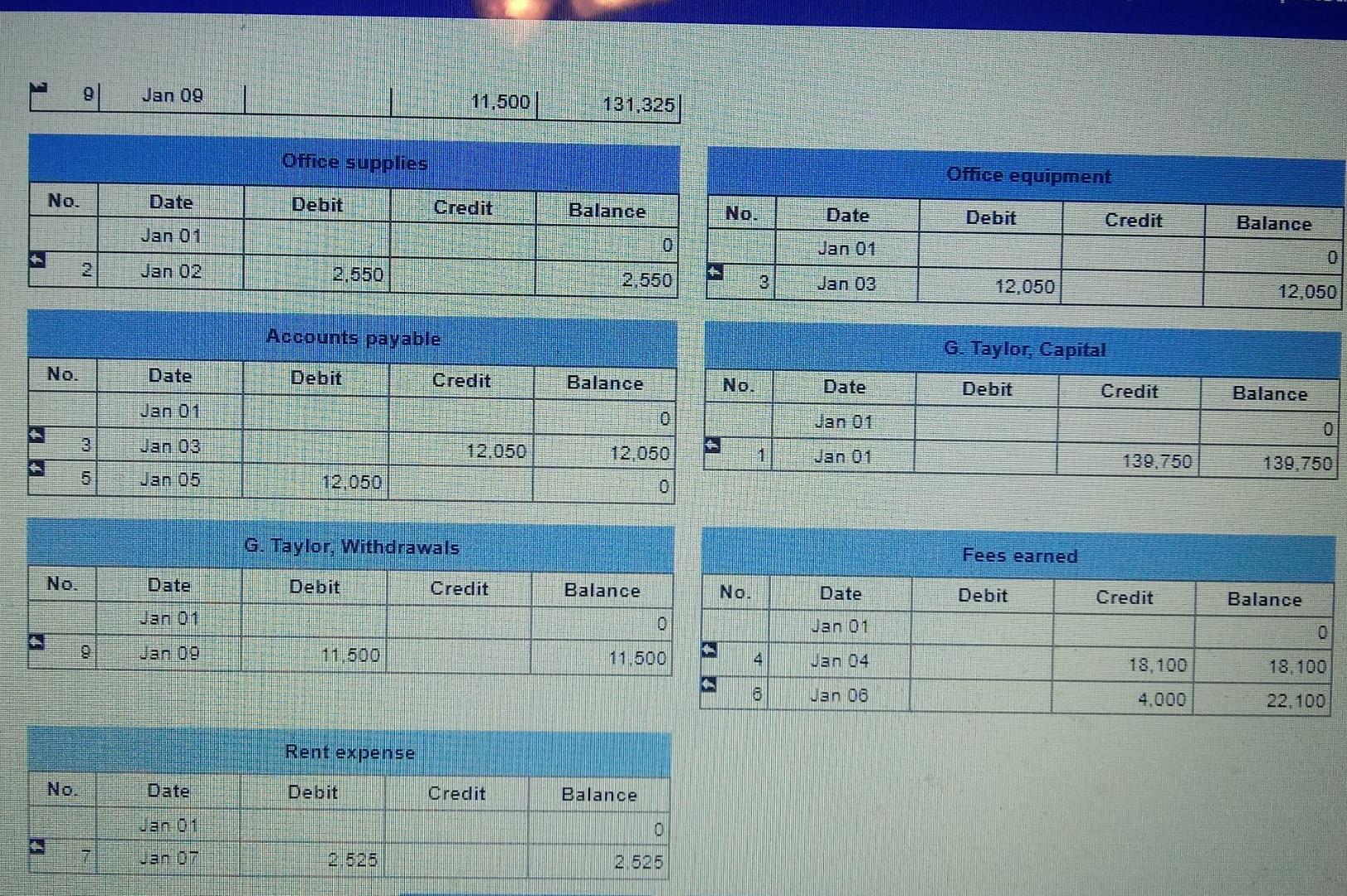

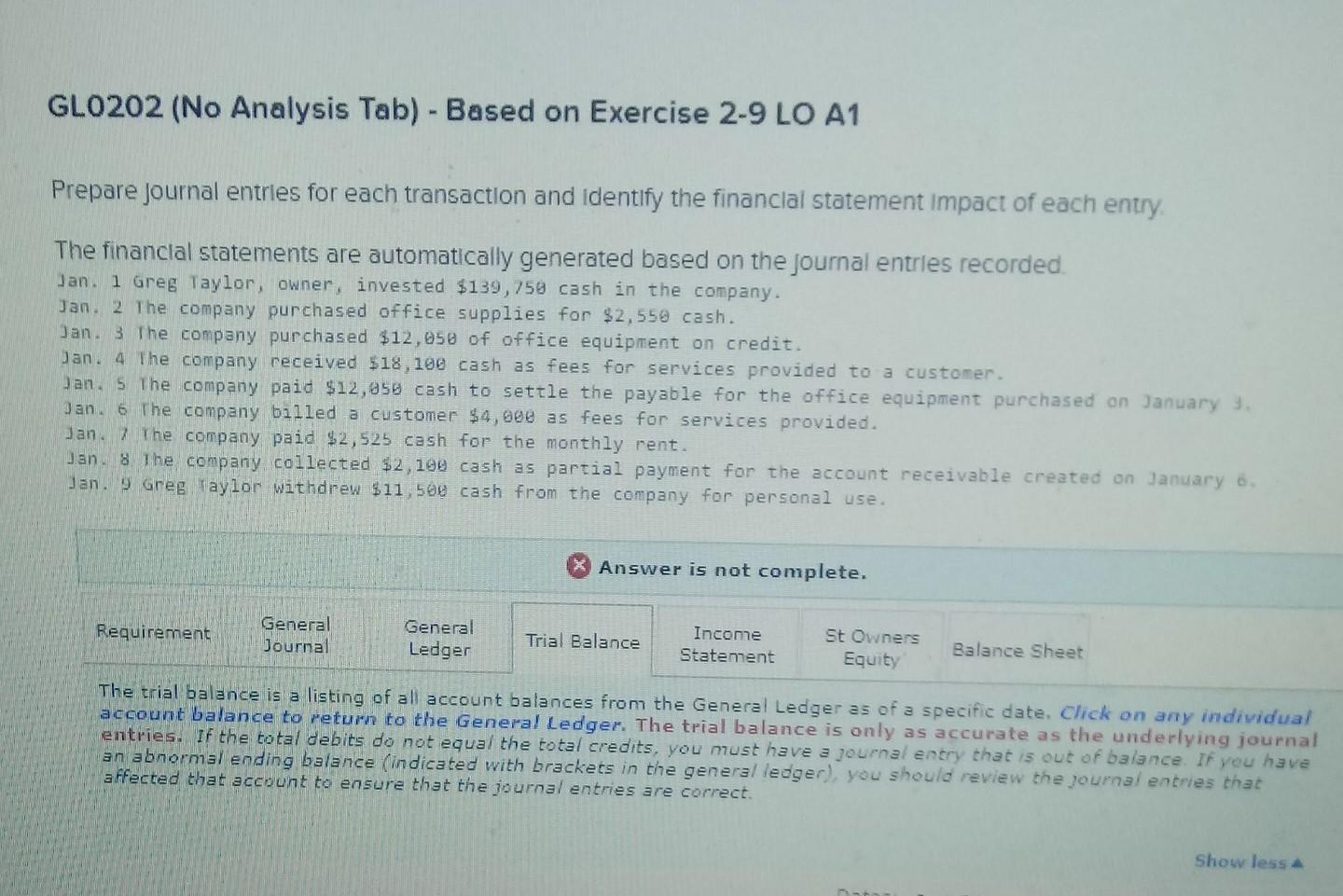

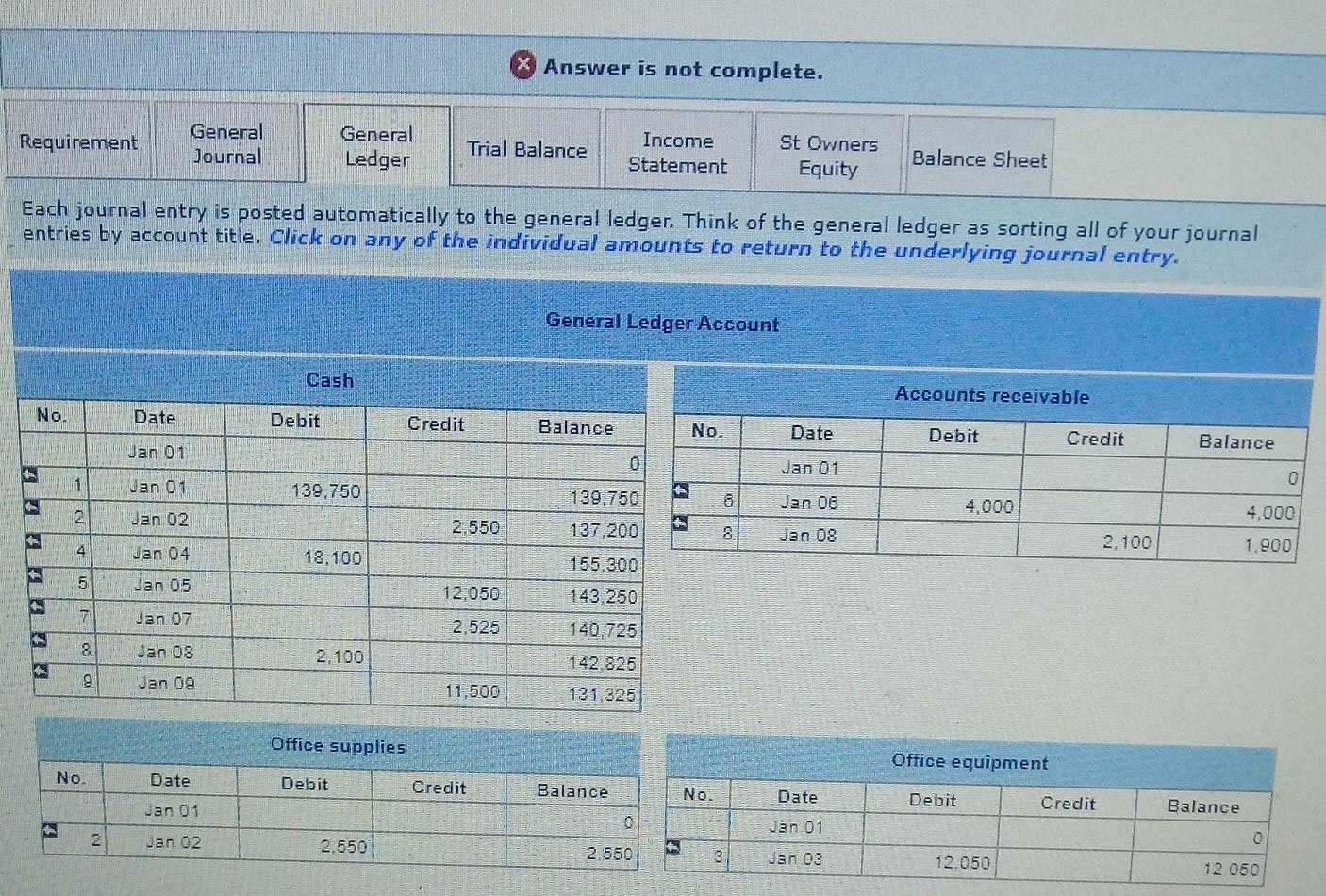

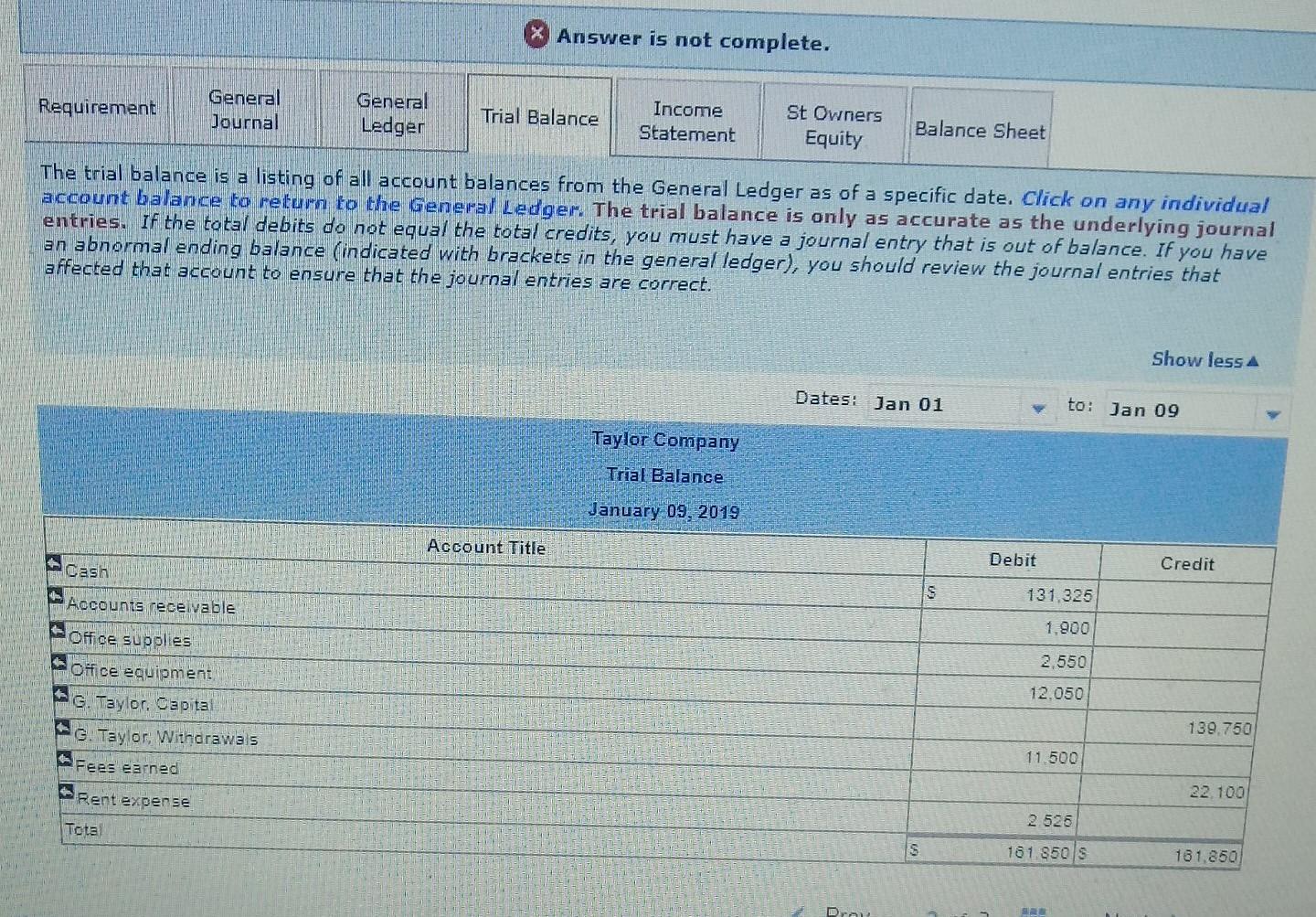

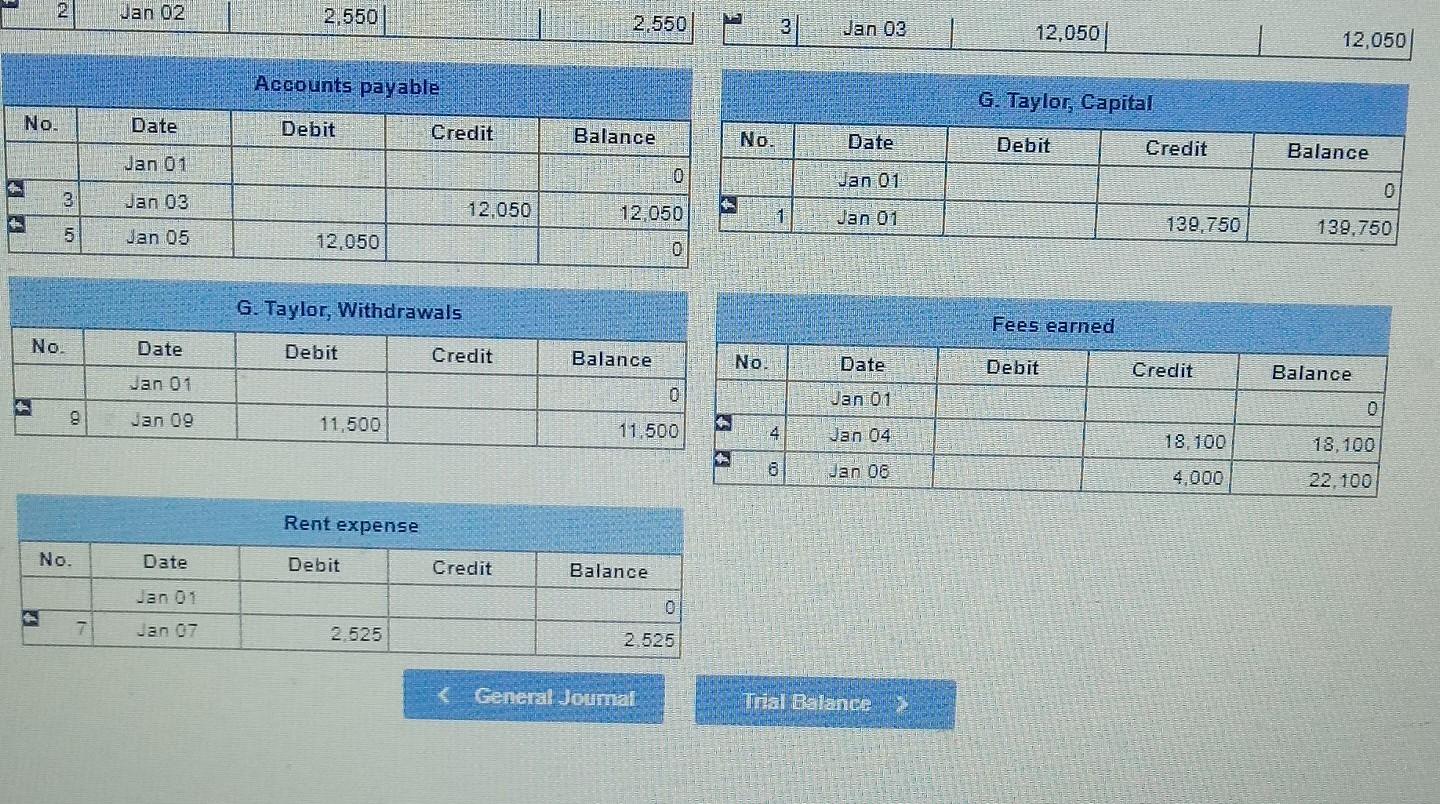

GLO202 (No Analysis Tab) - Based on Exercise 2-9 LO A1 Prepare journal entries for each transaction and Identify the financial statement impact of each entry. The financial statements are automatically generated based on the journal entries recorded. Jan. 1 Greg Taylon, owner, invested $139,750 cash in the company. Dan. 2_The company purchased office supplies for $2,558 cash. Jan. 3. The company purchased $12,050 of office equipment on credit. Jan. 4. The company received $18,199 cash as fees for services provided to a customer Jan. The company paid $12,050 cash to settle the payable for the office equipment purchased on January 3. Dan.. 6 The company billed a customer $4,000 as fees for services provided. Jan.27. The company paid $2,525 cash for the monthly rent. Jan. 8. The company collected $2,100 cash as partial payment for the account receivable created on January 6. Jan. 9 Greg Taylor withdrew $11,500 cash from the company for personal use. Answer is not complete. Requirement General Journal General Ledger Trial Balance Income Statement St Owners Equity Balance Sheet Every journa entry must keep the accounting equation in balance. Prepare the journal entries for each of the transactions of the Taylor Company, entering the debits before the credits. Each transaction will automatically be posted to the General Ledger and the Trial Balance as soon as you click "Record Entry" NO Date Account Title Debit Credit Jano Wash 139.750 Gaylor Capital 139.750 mes 2550 Jan. 8ine company collected $2,188 casn as partial payment for the account receivable created on January b. Jan. 9 Greg Taylor withdrew $11,500 cash from the company for personal use. Answer is not complete. Requirement General Journal General Ledger Trial Balance Income Statement St Owners Equity Balance Sheet Every journal entry must keep the accounting equation in balance. Prepare the journal entries for each of the transactions of the Taylor Company, entering the debits before the credits. Each transaction will automatically be posted to the General Ledger and the Trial Balance as soon as you click "Record Entry". No Date Account Title Debit Credit 1 Jan 01 Cash 139.750 G. Taylor, Capital 139.750 Jan 02 Office supplies 2.550 Cash 2.550 3 Jan 03 Office equipment 12,050 Accounts payable 12.050 2 Jan 04 dash 18.100 Fees earned 18.100 5 5 Jan 05 Accounts payable 12,050 Cash 12.050 Answer is not complete. Requirement General Journal General Ledger Trial Balance Income Statement St Owners Equity Balance Sheet Each journal entry is posted automatically to the general ledger. Think of the general ledger as sorting all of your journal entries by account title. Click on of the individual amounts to return to the underlying journal entry. General Ledger Account @ash Accounts receivable No. Date Debit Credit Balance No. Date Debit Credit Balance Jan 01 0 Jan 01 0 1 Jan 01 169.750 139.750 6 Jan 08 4,000 4.000 Jan 02 # 2,550 137 200 8 Jan 08 2.100 1.900 4 Jan 04 18.100 155.300 6 Jan 05 12.050 143,250 7 Jan 07 2.525 140,725 go Jan 08 2.100 142 825 8 Jan 09 11.500 13 1.325 Office supplies Office equipment Debit Date No. Credit Balance No. Date Debit Balance Credit Jan 04 0 0 Jan 01 2 2.550 2.550 Jan 02 12.050 2 12.050 Jan 06 Accounts payable G. Tavlon Capital dll . Me company Dilled a customer $4,000 as fees for services provided. Jan. 7 The company paid $2,525 cash for the monthly rent. Jan. 8 The company collected $2,100 cash as partial payment for the account receivable created on January 6. Jan. 9 Greg Taylor withdrew $11,500 cash from the company for personal use. X Answer is not complete. Requirement General Journal General Ledger Trial Balance Slacement St Owners Equity Balance Sheet Each journal entry is posted automatically to the general ledger. Think of the general ledger as sorting all of your journal entries by account title. Click on any of the individual amounts to return to the underlying journal entry. General Ledger Account Cash Accounts receivable No. Date Debit Credit Balance NO. Date Debit Credit Balance Jan 01 Jan 01 0 1 van 01 189.750 139.750 Oo o 8 Jan 08 4,000 4.000 Jan 02 2.550 u ra 187 200 8 Jan 08 2.100 1.900 Jan 04 18, 100 155 000 5 Jan 05 12.0.50 143 250 Jan 07 2.525 140.725 Jan 08 2.100 00 00 142.8.25 Jan 09 500 18 1 325 g Jan 09 11,500 | 131,325 Office supplies Office equipment No. Date Debit Credit Balance No. Date Debit Credit Balance Jan 01 Jan 01 0 Jan 02 2.550 2.550 3 Jan 03 12.050 12,050 Accounts payable G. Taylor, Capital No. Date Debit Credit Balance No. Date Debit Credit Balance Jan 01 Jan 01 0 Jan 03 OLD 12.050 12.050 1 Jan 01 139.750 139.750 Jan 0.5 12.050 0 G. Taylor: Withdrawals Fees earned Ne. Date Debit Credit Balance No. Date Debit Credit Balance Jan 01 0 Jan 01 1 9 Jan 09 11. 500 11.500 4 Jan 04 18,100 18.100 Jan 06 22,100 Rent expense No Date Debit Credit Balance van 0 1 0 van 07 2.525 2.526 GLO202 (No Analysis Tab) - Based on Exercise 2-9 LO A1 Prepare journal entries for each transaction and identify the financial statement impact of each entry The financial statements are automatically generated based on the journal entries recorded Jan. 1 Greg Taylor, owner, invested $139,750 cash in the company. Jan. 2 The company purchased office supplies for $2,550 cash. Jan. 3 The company purchased $12,050 of office equipment on credit. Jan. 4 The company received $18, 100 cash as fees for services provided to a customer. Jan. 5 The company paid $12,050 cash to settle the payable for the office equipment purchased on January Jan. 6 The company billed a customer $4,600 as fees for services provided. Jan. 7 The company paid $2,525 cash for the monthly rent. Jan. 8. The company collected $2,100 cash as partial payment for the account receivable created on January 6 Jan. 9 Greg Taylor withdrew $11,500 cash from the company for personal use. X Answer is not complete. Requirement General Journal General Ledger Trial Balance Income Statement St Owners Equity Balance Sheet The trial balance is a listing of all account balances from the General Ledger as of a specific date. Click on any individual account balance to return to the General Ledger. The trial balance is only as accurate as the underlying journal entries. If the total debits do not equal the total credits, you must have a journal entry that is out of balance. If you have an abnormal ending balance indicated with brackets in the general ledger), you should review the journal entries that affected that account to ensure that the journal entries are correct. Show less an abnormal ending balance (indicated with brackets in the general ledger), you should review the journal entries that affected that account to ensure that the journal entries are correct. --- Show less Dates: Jan 01 to: Jan 09 Taylor Company Trial Balance January 09, 2019 Account Title , Cash Debit Credit Accounts receivable 131,325 Office supplies 1.900 2.550 Office equipment G. Taylor, Capita G. Taylor. Withdrawals 12.050 139.750 Fees earned 11,500 Rent expense 22.100 Total 2.525 S 101.850 S 151.850 General Ledger Income Statement Answer is not complete. Requirement General Journal General Ledger Trial Balance Income Statement St Owners Equity Balance Sheet Each journal entry is posted automatically to the general ledger. Think of the general ledger as sorting all of your journal entries by account title. Click on any of the individual amounts to return to the underlying journal entry. General Ledger Account Cash Accounts receivable No. Date Debit Credit Balance No. Date Debit Credit Balance Jan 01 0 Jan 01 0 11 Jan 01 139.750 139.750 6 Jan 06 4,000 2 Jan 02 4.000 2.550 137,200 8 Jan 08 2.100 4 1,900 Jan 04 18,100 155.300 5 Jan 05 12,050 143 250 7 Jan 07 2.525 140.725 8 Jan 08 2.100 142 825 Jan 09 11.500 131 325 Office supplies Office equipment No. Date Debit Credit Balance No. Date Debit Credit can 01 Balance 0 Jan 01 2 Jan 02 0 2.550 2 550 3 dan 03 12.050 12 050 Answer is not complete. Requirement General Journal General Ledger Trial Balance Income Statement St Owners Equity Balance Sheet The trial balance is a listing of all account balances from the General Ledger as of a specific date. Click on any individual account balance to return to the General Ledger. The trial balance is only as accurate as the underlying journal entries. If the total debits do not equal the total credits, you must have a journal entry that is out of balance. If you have an abnormal ending balance (indicated with brackets in the general ledger), you should review the journal entries that affected that account to ensure that the journal entries are correct. Show less Dates: Jan 01 to: Jan 09 Taylor Company Trial Balance January 09, 2019 Account Title Debit Credit Cash S 131.325 Accounts receivable 1,900 TT 11 Office supplies Office equipment 2.550 12.050 G. Taylor, Capital C. Taylor: Withdrawals 139.750 11.500 Fees earned Rent expense 22 100 2 526 Tota 161 850 / 181.850 Dra Jan 02 2,550 2.550 3 Jan 03 12,050 12,050 Accounts payable G. Taylor, Capital No. Date Debit Credit Balance No. Date Debit Credit Balance Jan 01 0 Jan 01 3 Jan 03 12.050 12. 050 Jan 01 139.750 139.750 5 Jan 05 12,050 0 G. Taylor, Withdrawals Fees earned No. Date Debit Credit Balance No. Date Debit Credit Balance Jan 01 0 TI Jan 01 9 Jan 09 11,500 7 11.500 4 Jan 04 18.100 18,100 Jan 06 4.000 22.100 Rent expense No. Date Debit Credit Balance Jan 07 2.525 2.525Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started