Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview Old MathJax webview I still have another question that related to the answer, please how can I send it to you. for

Old MathJax webview

Old MathJax webview

I still have another question that related to the answer, please how can I send it to you. for follow up

that's everything, I mean all the Guides. personal finance

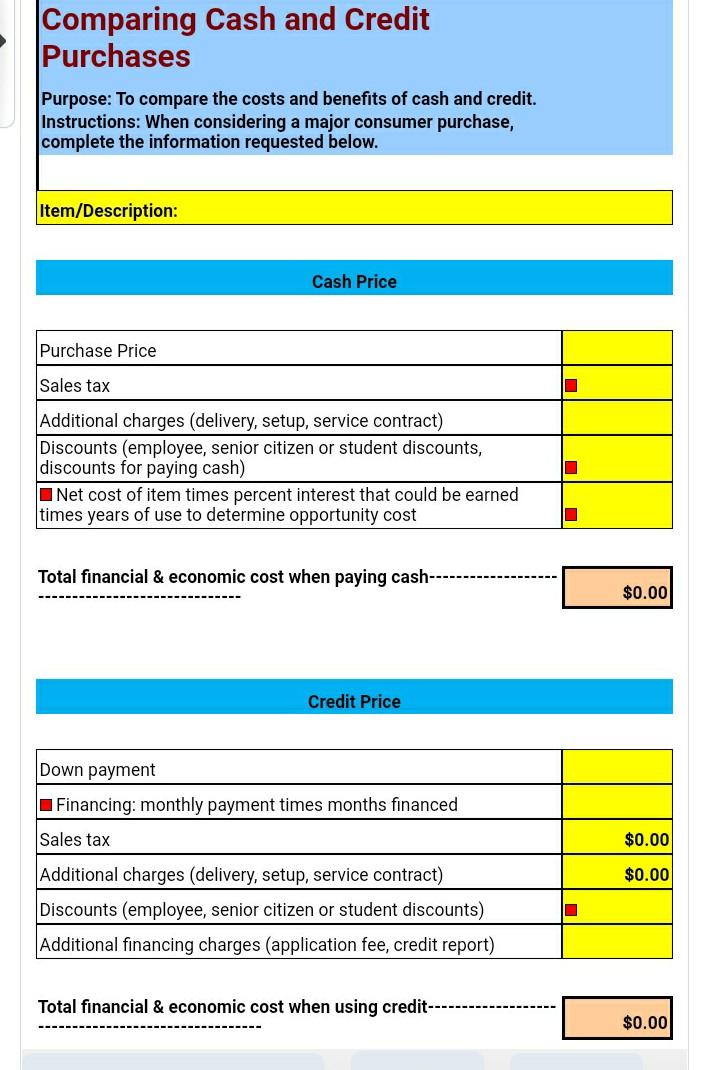

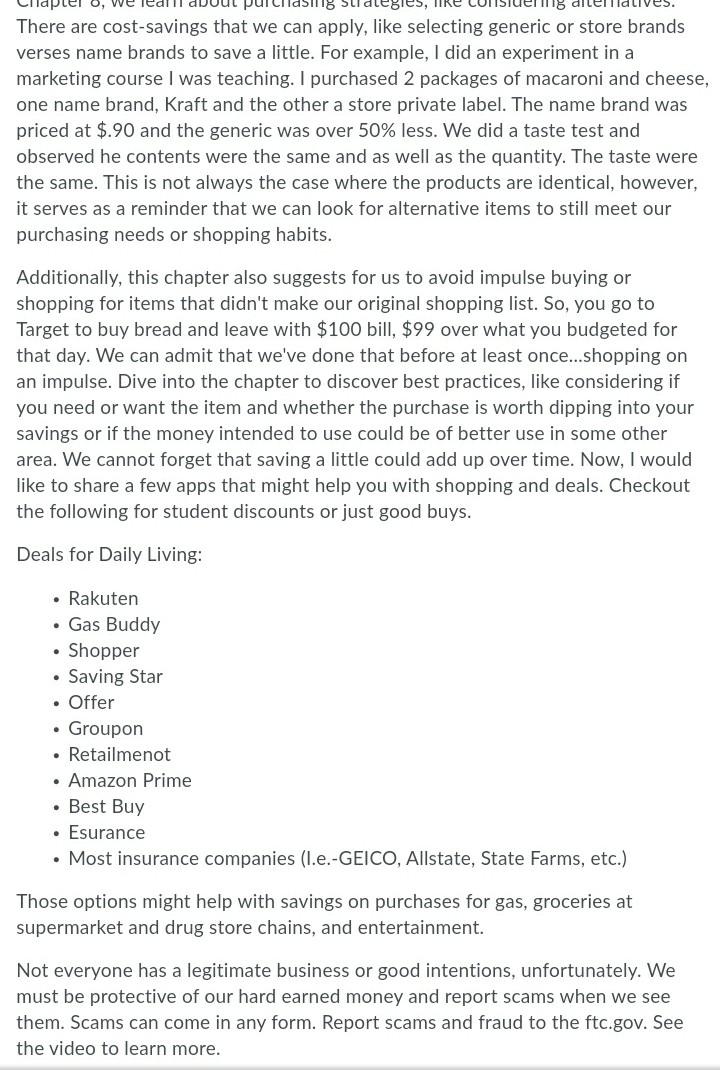

Comparing Cash and Credit Purchases Purpose: To compare the costs and benefits of cash and credit. Instructions: When considering a major consumer purchase, complete the information requested below. Item/Description: Cash Price Purchase Price Sales tax Additional charges (delivery, setup, service contract) Discounts (employee, senior citizen or student discounts, discounts for paying cash) Net cost of item times percent interest that could be earned times years of use to determine opportunity cost Total financial & economic cost when paying cash----- $0.00 Credit Price Down payment Financing: monthly payment times months financed Sales tax $0.00 $0.00 Additional charges (delivery, setup, service contract) Discounts (employee, senior citizen or student discounts) Additional financing charges (application fee, credit report) Total financial & economic cost when using credit------- $0.00 laptel o, we purchas118 There are cost-savings that we can apply, like selecting generic or store brands verses name brands to save a little. For example, I did an experiment in a marketing course I was teaching. I purchased 2 packages of macaroni and cheese, one name brand, Kraft and the other a store private label. The name brand was priced at $.90 and the generic was over 50% less. We did a taste test and observed he contents were the same and as well as the quantity. The taste were the same. This is not always the case where the products are identical, however, it serves as a reminder that we can look for alternative items to still meet our purchasing needs or shopping habits. Additionally, this chapter also suggests for us to avoid impulse buying or shopping for items that didn't make our original shopping list. So, you go to Target to buy bread and leave with $100 bill, $99 over what you budgeted for that day. We can admit that we've done that before at least once... shopping on an impulse. Dive into the chapter to discover best practices, like considering if you need or want the item and whether the purchase is worth dipping into your savings or if the money intended to use could be of better use in some other area. We cannot forget that saving a little could add up over time. Now, I would like to share a few apps that might help you with shopping and deals. Checkout the following for student discounts or just good buys. Deals for Daily Living: Rakuten Gas Buddy Shopper Saving Star Offer Groupon Retailmenot Amazon Prime Best Buy Esurance . Most insurance companies (I.e.-GEICO, Allstate, State Farms, etc.) Those options might help with savings on purchases for gas, groceries at supermarket and drug store chains, and entertainment. Not everyone has a legitimate business or good intentions, unfortunately. We must be protective of our hard earned money and report scams when we see them. Scams can come in any form. Report scams and fraud to the ftc.gov. See the video to learn more. Comparing Cash and Credit Purchases Purpose: To compare the costs and benefits of cash and credit. Instructions: When considering a major consumer purchase, complete the information requested below. Item/Description: Cash Price Purchase Price Sales tax Additional charges (delivery, setup, service contract) Discounts (employee, senior citizen or student discounts, discounts for paying cash) Net cost of item times percent interest that could be earned times years of use to determine opportunity cost Total financial & economic cost when paying cash----- $0.00 Credit Price Down payment Financing: monthly payment times months financed Sales tax $0.00 $0.00 Additional charges (delivery, setup, service contract) Discounts (employee, senior citizen or student discounts) Additional financing charges (application fee, credit report) Total financial & economic cost when using credit------- $0.00 laptel o, we purchas118 There are cost-savings that we can apply, like selecting generic or store brands verses name brands to save a little. For example, I did an experiment in a marketing course I was teaching. I purchased 2 packages of macaroni and cheese, one name brand, Kraft and the other a store private label. The name brand was priced at $.90 and the generic was over 50% less. We did a taste test and observed he contents were the same and as well as the quantity. The taste were the same. This is not always the case where the products are identical, however, it serves as a reminder that we can look for alternative items to still meet our purchasing needs or shopping habits. Additionally, this chapter also suggests for us to avoid impulse buying or shopping for items that didn't make our original shopping list. So, you go to Target to buy bread and leave with $100 bill, $99 over what you budgeted for that day. We can admit that we've done that before at least once... shopping on an impulse. Dive into the chapter to discover best practices, like considering if you need or want the item and whether the purchase is worth dipping into your savings or if the money intended to use could be of better use in some other area. We cannot forget that saving a little could add up over time. Now, I would like to share a few apps that might help you with shopping and deals. Checkout the following for student discounts or just good buys. Deals for Daily Living: Rakuten Gas Buddy Shopper Saving Star Offer Groupon Retailmenot Amazon Prime Best Buy Esurance . Most insurance companies (I.e.-GEICO, Allstate, State Farms, etc.) Those options might help with savings on purchases for gas, groceries at supermarket and drug store chains, and entertainment. Not everyone has a legitimate business or good intentions, unfortunately. We must be protective of our hard earned money and report scams when we see them. Scams can come in any form. Report scams and fraud to the ftc.gov. See the video to learn moreStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started