Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview Old MathJax webview s . b A-2- he bolds at least 2017 of the c Perks-Taxable in Specified Cases Only (Section 17/2X111)

Old MathJax webview

Old MathJax webview

s

.

b

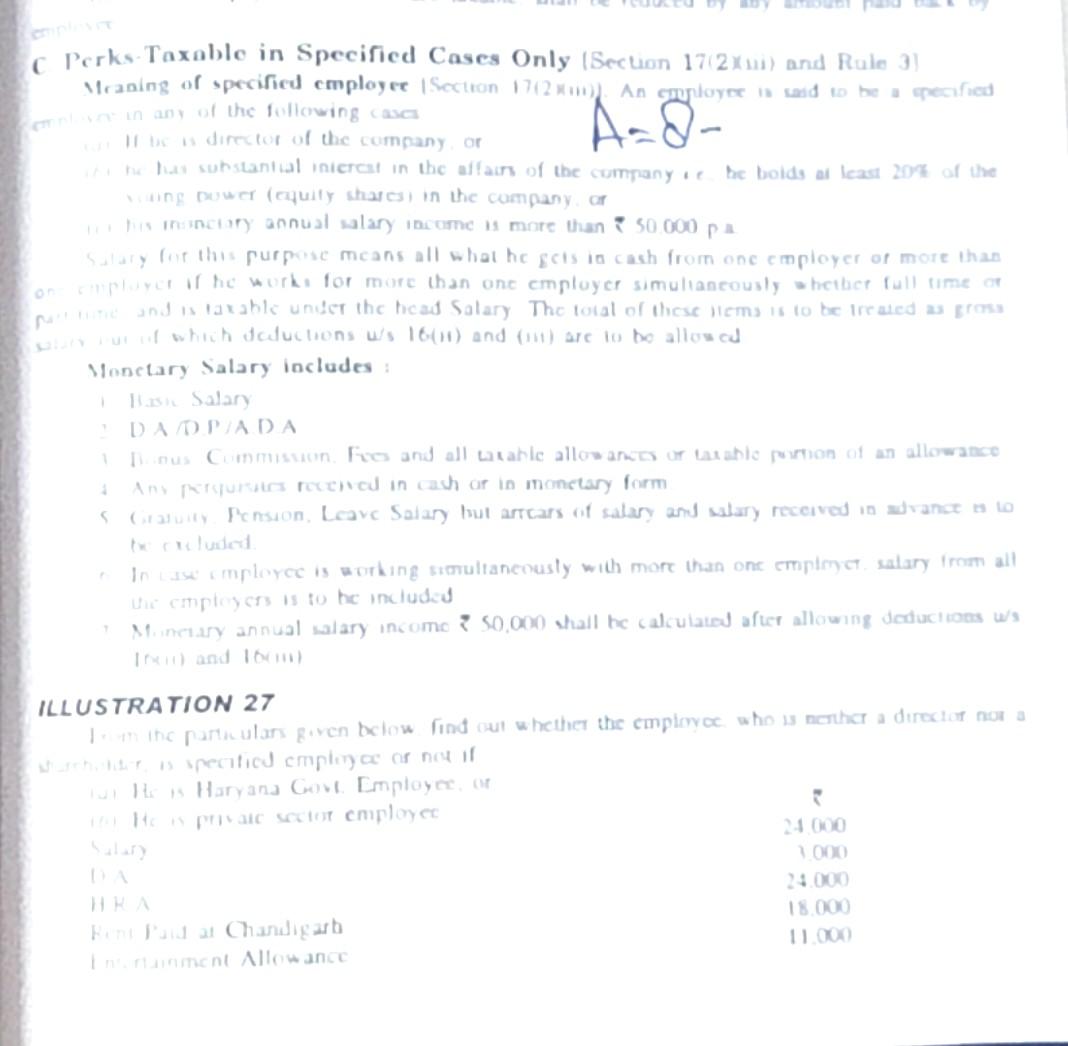

A-2- he bolds at least 2017 of the c Perks-Taxable in Specified Cases Only (Section 17/2X111) and Rule 3) Meaning of specified employer Section 17/2 *). An stunlayer is said to be o qpecified in any of the following case Is director of the company or te u substantial incercat in the affairs of the companyie ng puw (quily shares in the company or the mancary annual salary income more than 50.000 px Salary for this purpose means all what he gets in cash from one employer of more than on player in he work for more than ont employer simultaneously whether full time of me and is taxable under the head Salary The total of diese Wema is to be treated as grass call of which deductions u's 1601) and (m) are to be allowed Monetary Salary includes: Is Salary DAD PADA Imus Cummission to and all Laranle allowance or tablo pion of an allowance Any Nu rocche in cash or in monetary form staty Pension. Leave Salary but arrears of salary and salary received in advance to In se employee is working simultaneously with more than one empimyc salary from all the cmpe is to he includes Minetary annual salary income? 50,000 shall be calculated after allowing deduci tans ws TR) and 1 ILLUSTRATION 27 In the particulars given below find out whether the employee who is nothar a director nok a with specific cmployee or noul He Haryana Gost. Employee Hepat sector cmployed 1000 1000 20.000 18.000 Home Dona Chandigarh Inment Allowance 11.000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started