Question

Old MathJax webview Old MathJax webview Tulsa Drilling Company has $1.2 million in 12 percent convertible bonds outstanding. Each bond has a $1,000 par value.

Old MathJax webview

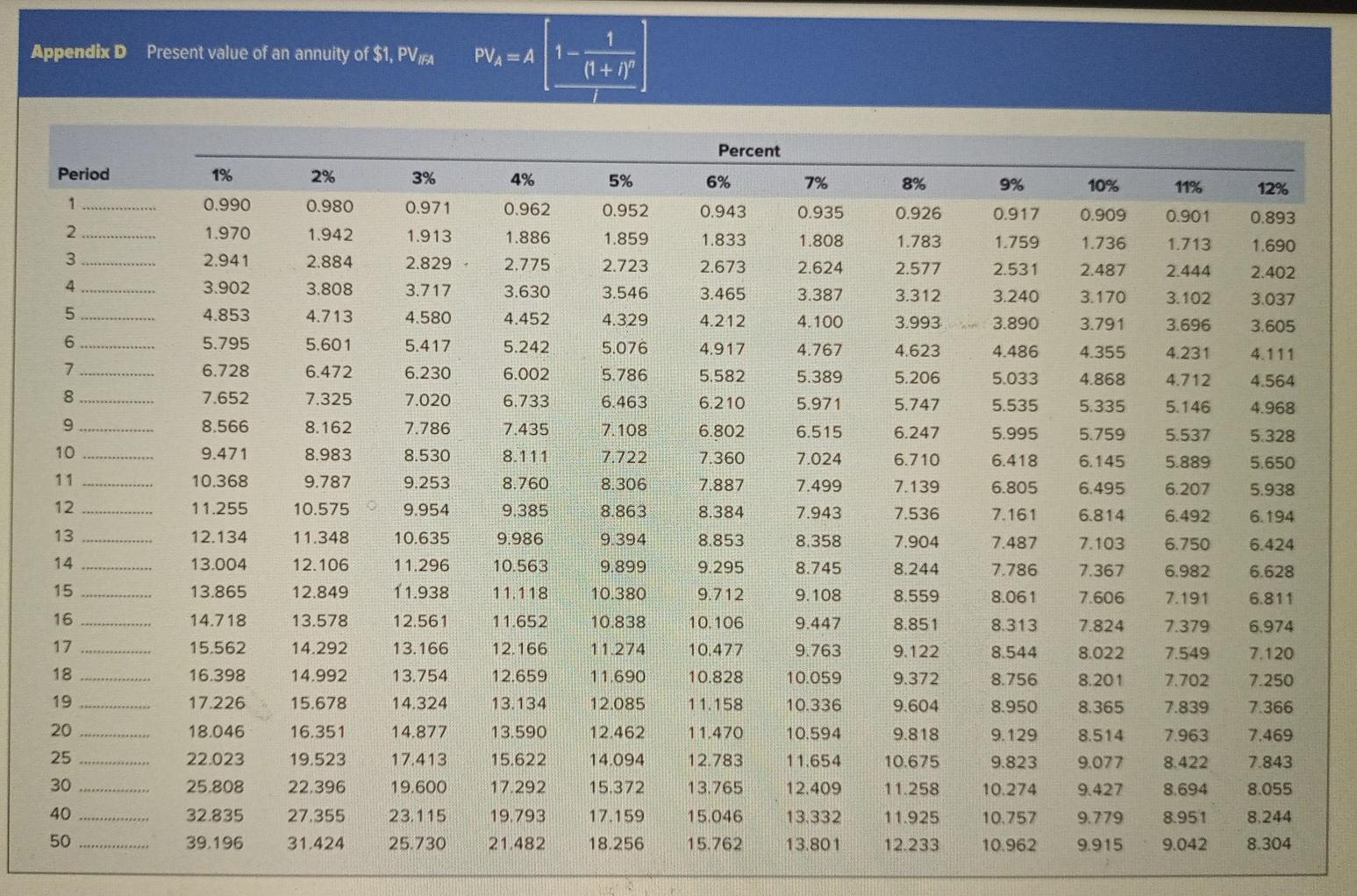

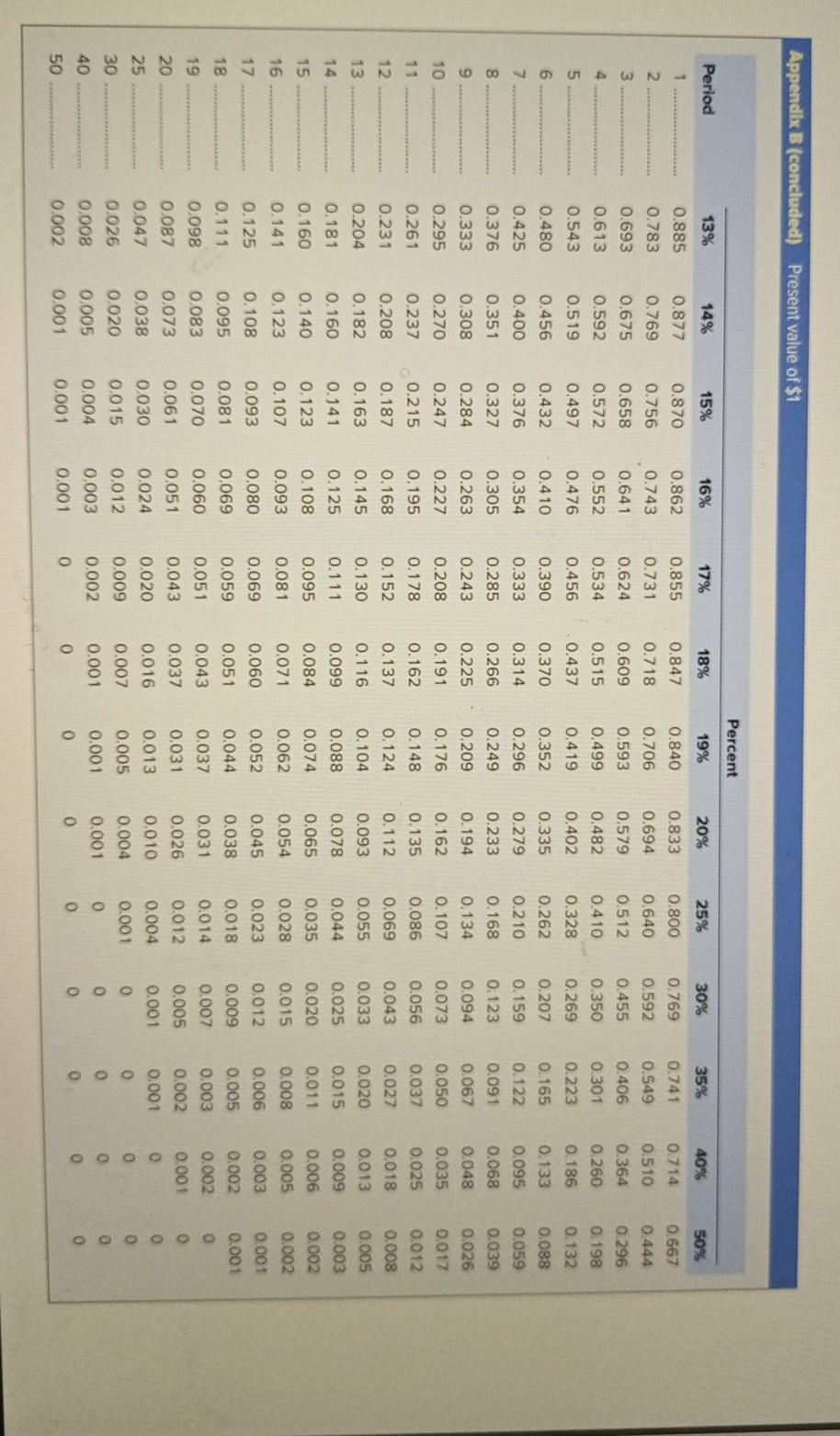

Tulsa Drilling Company has $1.2 million in 12 percent convertible bonds outstanding. Each bond has a $1,000 par value. The conversion ratio is 30, the stock price is $35, and the bonds mature in 10 years. The bonds are currently selling at a conversion premium of $70 over the conversion value. Use Appendix B and Appendix D as an approximate answer, but calculate your final answer using the formula and financial calculator methods.

a. Today, one year later, the price of Tulsa Drilling Company common stock has risen to $45. What would your rate of return be if you had purchased the convertible bond one year ago and sold it today? Assume that on the date of sale, the conversion premium has shrunk from $70 to $20. (Hint: Dont forget to include the interest payment for the first year) (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.)

b-1. Assume the yield on similar nonconvertible bonds has fallen to 10 percent at the time of sale. What would the pure bond value be at that point? (Use semiannual analysis.) (Do not round intermediate calculations. Round your final answer to 2 decimal places.)

b-2. Would the pure bond value have a significant effect on valuation then?

multiple choice

-

Yes

-

No

1 Appendix D Present value of an annuity of $1, PVFA PVA= A 1- (1 + i)" Percent Period 1% 2% 3% 4% 5% 7% 8% 9% 11% 12% 1 0.980 0.971 0.935 0.917 2 1.913 0.962 1.886 2.775 0.952 1.859 2.723 3.546 6% 0.943 1.833 2.673 3.465 4.212 0.901 1.713 2.444 1.759 2.531 3 0.893 1.690 2.402 3.037 2.829 3.717 4.580 4 3.630 5 4.452 4.329 3.605 6 4.111 5.417 6.230 7.020 3.102 3.696 4.231 4.712 5.242 6.002 6.733 5.076 5.786 7 1.808 2.624 3.387 4.100 4.767 5.389 5.971 6.515 7.024 0.990 1.970 2.941 3.902 4.853 5.795 6.728 7.652 8.566 9.471 10.368 11.255 12.134 13.004 13.865 4.917 5.582 6.210 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 4.564 8 6.463 10% 0.909 1.736 2.487 3.170 3.791 4.355 4.868 5.335 5.759 6.145 6.495 6.814 7.103 7.367 7.606 5.146 4.968 9 7.786 7.108 10 8.530 7.435 8.111 8.760 9.385 7.722 3.240 3.890 4.486 5.033 5.535 5.995 6.418 6.805 7.161 7.487 7.786 8.061 6.802 7.360 7.887 5.537 5.889 6.207 5.328 5.650 11 9.253 8.306 12 7.499 7.943 9.954 1.942 2.884 3.808 4.713 5.601 6.472 7.325 8.162 8.983 9.787 10.575 11.348 12.106 12.849 13.578 14.292 14.992 15.678 16.351 19.523 22.396 27.355 31.424 8.863 8.384 13 9.986 9.394 8.853 8.358 8.745 5.938 6.194 6.424 6.628 6.811 14 6.492 6.750 6.982 7.191 10.563 11.118 15 8.244 8.559 9.108 16 9.447 8.851 7.379 11.652 12.166 12.659 17 18 9.899 10.380 10.838 11.274 11.690 12.085 14.718 15.562 16.398 17.226 9.295 9.712 10.106 10.477 10.828 11.158 8.313 8.544 8.756 7.824 8.022 7.549 10.635 11.296 11.938 12.561 13.166 13.754 14.324 14.877 17.413 19.600 23.115 25.730 6.974 7.120 7.250 7.366 8.201 19 13.134 8.950 8.365 9.763 10.059 10.336 10.594 11.654 12.409 9.122 9.372. 9.604 9.818 10.675 11.258 12.462 8.514 20 25 30 40 50 7.469 18.046 22.023 25.808 32.835 39.196 13.590 15.622 17.292 19.793 21.482 7.702 7.839 7.963 8.422 8.694 11.470 12.783 13.765 14.094 15.372 9.129 9.823 10.274 10.757 10.962 9.077 9.427 7.843 8.055 17.159 15.046 13.332 11.925 12.233 9.779 9.915 8.951 9.042 8.244 8.304 18.256 15.762 13.801 Appendix B (concluded) Present value of $1 Percent Period 13% 14% 15% 16% 17% 18% 19% 20% 25% 30% 35% 40% 50% 1 0.885 0.870 0.862 0.840 0.833 0.800 0.741 2. 0.756 0.706 0.694 0.640 0.783 0.693 0.613 0.877 0.769 0.675 0.592 0.519 0.855 0.731 0.624 0.534 3 0.743 0.641 0.552 0.769 0.592 0.455 0.847 0.718 0.609 0.515 0.437 0.714 0.510 0.364 0.549 0.406 0.658 0.593 0.579 0.512 0.410 0.667 0.444 0.296 0.198 0.132 4 0.482 0.350 0.260 0.572 0.497 0.499 0.419 0.301 0.223 5 0.476 0.456 0.402 0.328 0.269 0.186 0.543 0.480 6 0.456 0.432 0.410 0.370 0.352 0.262 0.207 0.390 0.333 0.335 0.279 7 0.088 0.059 0.425 0.400 0.376 0.354 0.314 0.296 0.165 0.122 0.091 0.210 0.168 0.133 0.095 0.068 8. 0.376 0.351 0.327 0.284 0.305 0.263 9 0.308 0.285 0.243 0.208 0.039 0.026 0.266 0.225 0.191 0.233 0.194 0.162 0.333 0.295 0.261 0.067 0.048 10 0.270 0.247 0.215 0.227 0.195 0.249 0.209 0.176 0.148 0.124 0.104 0.134 0.107 0.086 0.035 0.025 11 12 0.135 0.112 0.017 0.012 0.008 0.005 0.162 0.137 0.116 0.231 0.159 0.123 0.094 0.073 0.056 0.043 0.033 0.025 0.020 0.015 0.187 0.168 0.069 0.055 0.018 0.013 13 0.204 0.145 0.093 0.078 14 0.050 0.037 0.027 0.020 0.015 0.011 0.008 0.006 0.181 0.099 0.088 0.003 0.044 0.178 0.152 0.130 0.111 0.095 0.081 0.069 0.059 15 0.160 0.084 0.237 0.208 0.182 0.160 0.140 0.123 0.108 0.095 0.083 0.073 0.038 0.065 0.163 0.141 0.123 0.107 0.093 0.081 0.070 16 0.141 0.125 0.071 0.054 0.125 0.108 0.093 0.080 0.069 0.060 0.074 0.062 0.052 0.044 0.002 0.002 0.001 0.001 17 0.012 0.009 18 0.009 0.006 0.005 0.003 0.002 0.002 0.001 0 0.111 0.060 0.051 0.043 0.037 0.016 0.051 0.035 0.028 0.023 0.018 0.014 0.012 0.004 0.001 0 0.098 0.037 19 0.005 0.003 0.002 0.061 0.043 0.007 0.005 0.001 0.031 0.013 20 25 0.045 0.038 0.031 0.026 0.010 0.004 0.001 0 0.001 0.030 0.051 0.024 0.012 0.003 0.087 0.047 0.026 0.008 0.002 0 0.007 30 0.020 0.009 0.002 0.005 0.001 0.015 0.004 0.001 0.020 0.005 0.001 0 0.001 40 0 0 0 0.001 50

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started