Answered step by step

Verified Expert Solution

Question

1 Approved Answer

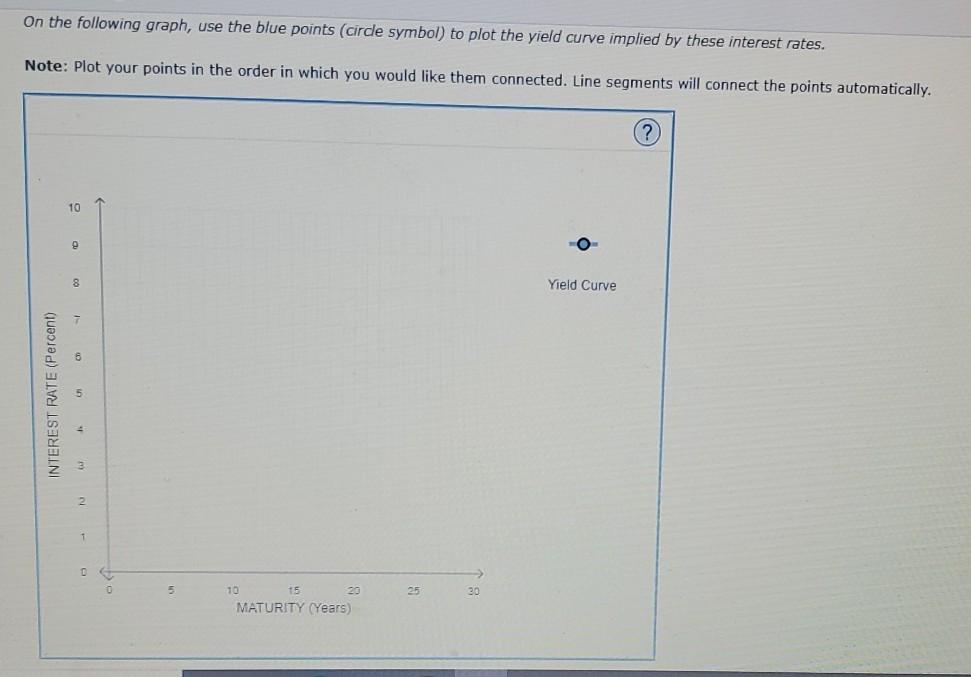

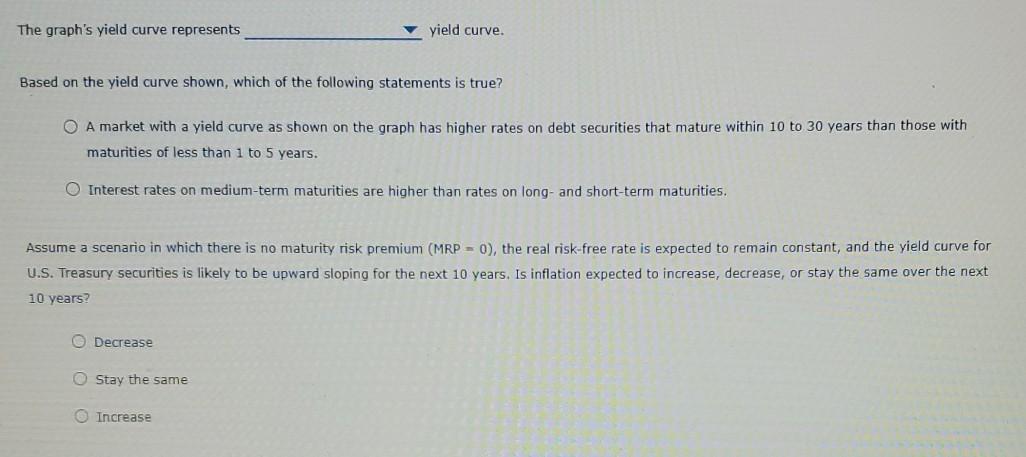

Old MathJax webview On the following graph, use the blue points (cirde symbol) to plot the yield curve implied by these interest rates. Note: Plot

Old MathJax webview

On the following graph, use the blue points (cirde symbol) to plot the yield curve implied by these interest rates. Note: Plot your points in the order in which you would like them connected. Line segments will connect the points automatically. 10 8 Yield Curve INTEREST RATE (Percent) 2 1 10 15 MATURITY (Years) The graph's yield curve represents yield curve Based on the yield curve shown, which of the following statements is true? O A market with a yield curve as shown on the graph has higher rates on debt securities that mature within 10 to 30 years than those with maturities of less than 1 to 5 years. Interest rates on medium-term maturities are higher than rates on long and short-term maturities. Assume a scenario in which there is no maturity risk premium (MRP - 0), the real risk-free rate is expected to remain constant, and the yield curve for U.S. Treasury securities is likely to be upward sloping for the next 10 years. Is inflation expected to increase, decrease, or stay the same over the next 10 years? O Decrease Stay the same Increase On the following graph, use the blue points (cirde symbol) to plot the yield curve implied by these interest rates. Note: Plot your points in the order in which you would like them connected. Line segments will connect the points automatically. 10 8 Yield Curve INTEREST RATE (Percent) 2 1 10 15 MATURITY (Years) The graph's yield curve represents yield curve Based on the yield curve shown, which of the following statements is true? O A market with a yield curve as shown on the graph has higher rates on debt securities that mature within 10 to 30 years than those with maturities of less than 1 to 5 years. Interest rates on medium-term maturities are higher than rates on long and short-term maturities. Assume a scenario in which there is no maturity risk premium (MRP - 0), the real risk-free rate is expected to remain constant, and the yield curve for U.S. Treasury securities is likely to be upward sloping for the next 10 years. Is inflation expected to increase, decrease, or stay the same over the next 10 years? O Decrease Stay the same Increase

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started