Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview please answer as soon as possible for my revision formula Salesco Ltd Reported the following Income Statement and Balance Sheet for 2019

Old MathJax webview

please answer as soon as possible for my revision

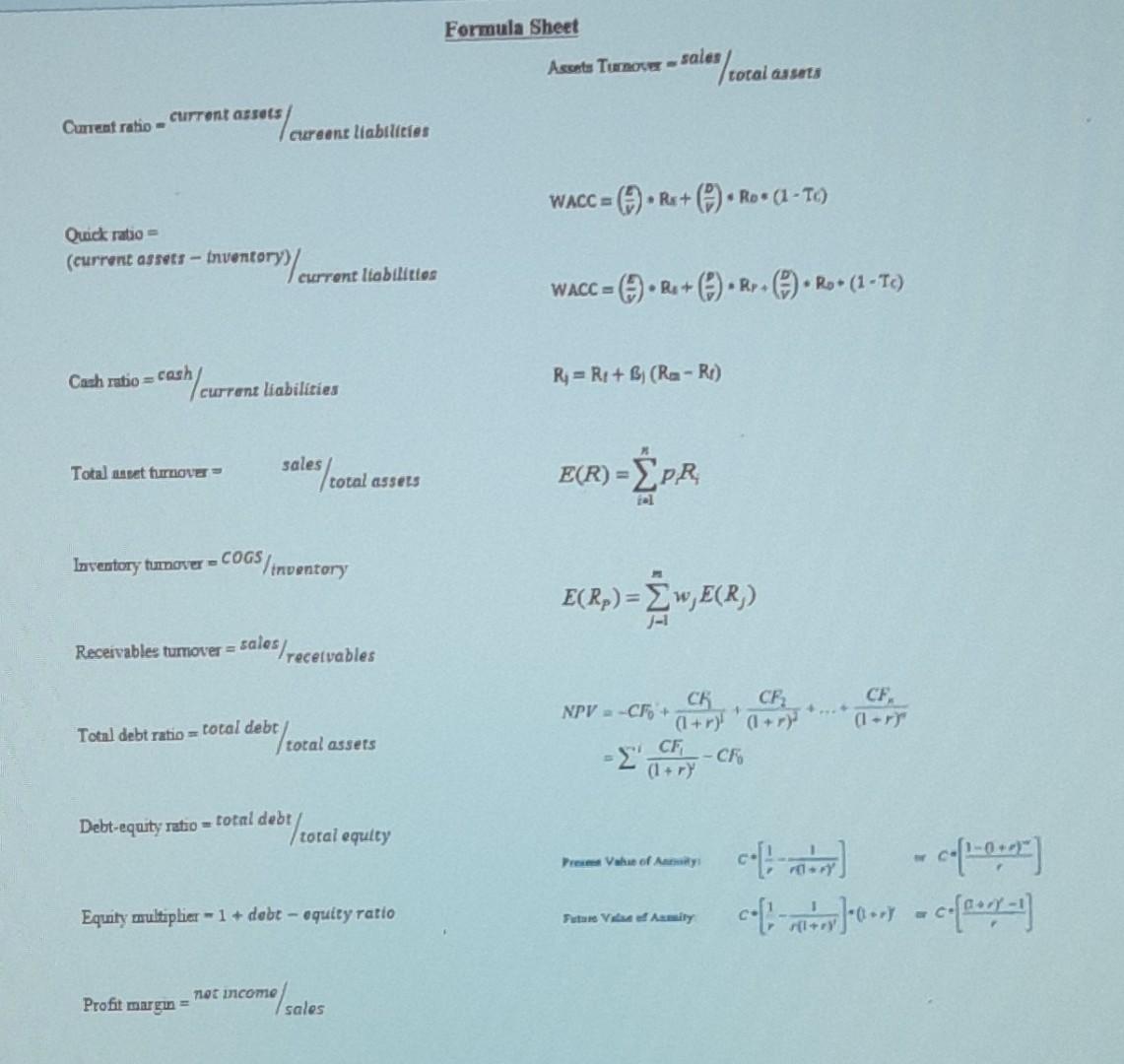

formula

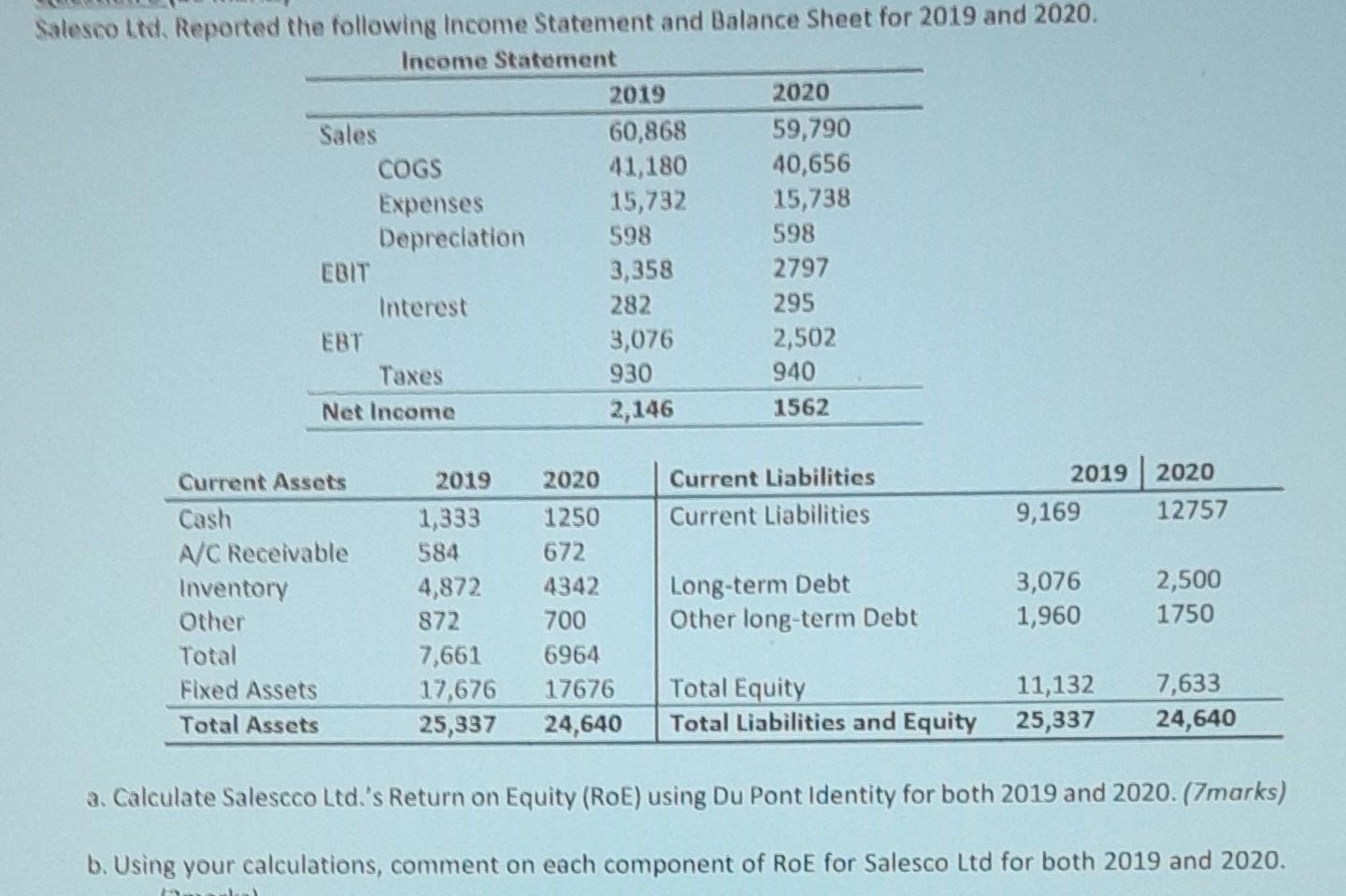

Salesco Ltd Reported the following Income Statement and Balance Sheet for 2019 and 2020. Income Statement 2019 2020 Sales 60,868 59,790 COGS 41,180 40,656 Expenses 15,732 15,738 Depreciation 598 598 EBIT 3,358 2797 Interest 282 295 EBT 3,076 2,502 Taxes 930 940 Net Income 2,146 1562 2020 Current Liabilities Current Liabilities 2019 2020 9,169 12757 Current Assets Cash A/C Receivable Inventory Other Total Fixed Assets Total Assets 2019 1,333 584 4,872 872 7,661 17,676 25,337 1250 672 4342 700 6964 17676 24,640 Long-term Debt Other long-term Debt 3,076 1,960 2,500 1750 Total Equity 11,132 Total Liabilities and Equity 25,337 7,633 24,640 a. Calculate Salescco Ltd.'s Return on Equity (ROE) using Du Pont Identity for both 2019 and 2020. (7marks) b. Using your calculations, comment on each component of RoE for Salesco Ltd for both 2019 and 2020. Formula Sheet Acosta Tuote-sales "/coral assets Current ratio- current assets aureone liabilities WACC - R+ + ). Ro* (1-T6) Quick ratio (current assets - Inventory) ory/current liabilities WACC = Rs + Rr. (7) + Ra+ (1 -T) . Cash ratio cash sh/current liabilities R;= R + B (Ra-R) Total set turva sales/ total assets E(R) = -EPR ol Inventory turnover - COGS /inventory E_R,) = {w,E(8) -1 Receivables tumover = sales, I receivables CF 1 Total debt ratio total debt total assets NPV - CF + CE (1+r)! + ) CF - CF Debt-equity ratio = total debt/ ""/coral equlty Prva of - cofom col-x-.- co[/] Equnty multiplier - 1 + debt - equity ratio Putar Vimity not income Profit margin- 1 salesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started