Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview Please answer ASAP! (iii) Should Alba Eats launch the service in the Cork market? Clearly explain the answer. A UK food company,

Old MathJax webview

Please answer ASAP!

(iii) Should Alba Eats launch the service in the Cork market? Clearly explain the answer.

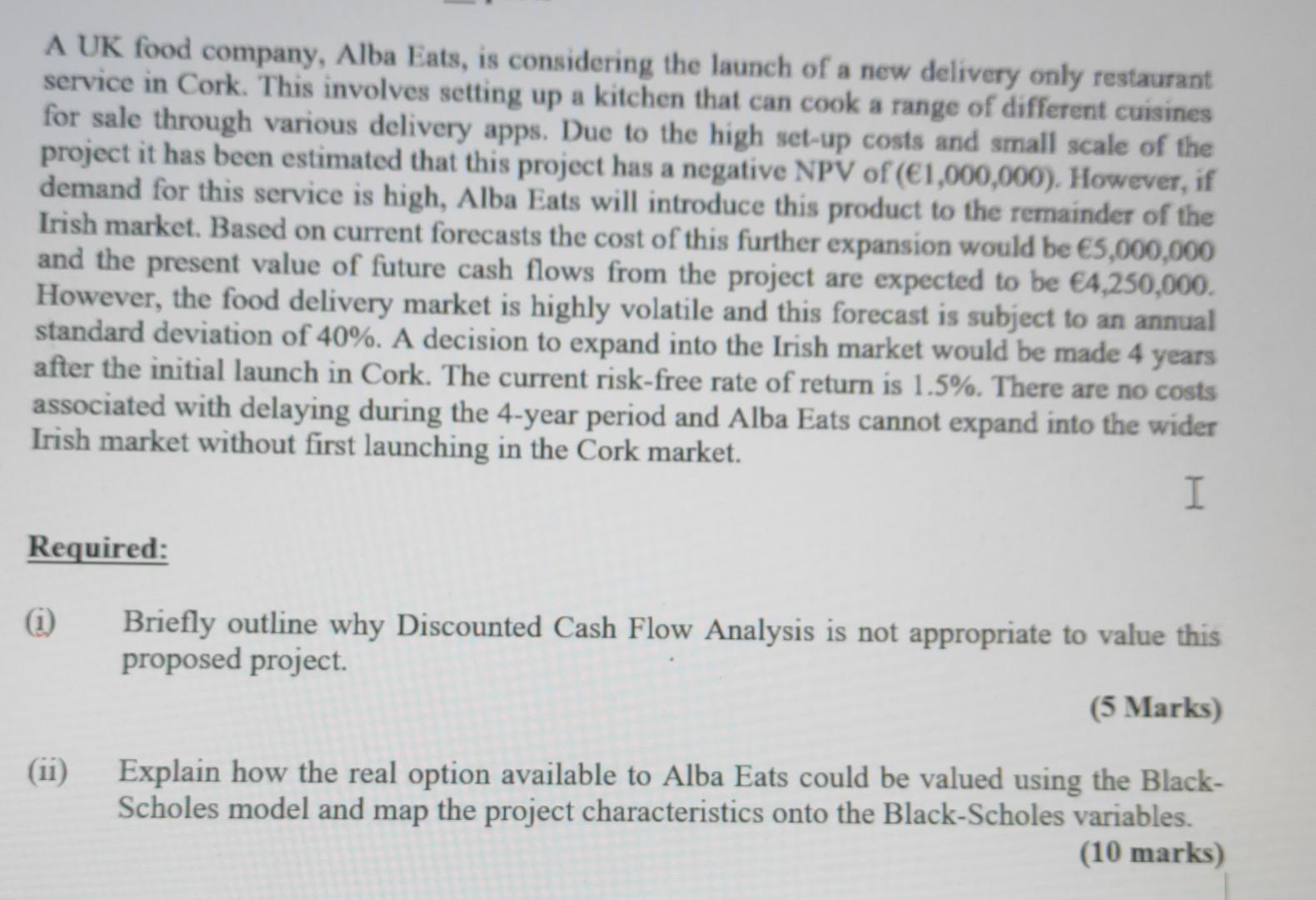

A UK food company, Alba Eats, is considering the launch of a new delivery only restaurant service in Cork. This involves setting up a kitchen that can cook a range of different cuisines for sale through various delivery apps. Due to the high set-up costs and small scale of the project it has been estimated that this project has a negative NPV of (1,000,000). However, if demand for this service is high, Alba Eats will introduce this product to the remainder of the Irish market. Based on current forecasts the cost of this further expansion would be 5,000,000 and the present value of future cash flows from the project are expected to be 4,250,000. However, the food delivery market is highly volatile and this forecast is subject to an annual standard deviation of 40%. A decision to expand into the Irish market would be made 4 years after the initial launch in Cork. The current risk-free rate of return is 1.5%. There are no costs associated with delaying during the 4-year period and Alba Eats cannot expand into the wider Irish market without first launching in the Cork market. I Required: (1) Briefly outline why Discounted Cash Flow Analysis is not appropriate to value this proposed project. (5 Marks) (ii) Explain how the real option available to Alba Eats could be valued using the Black- Scholes model and map the project characteristics onto the Black-Scholes variables. (10 marks) A UK food company, Alba Eats, is considering the launch of a new delivery only restaurant service in Cork. This involves setting up a kitchen that can cook a range of different cuisines for sale through various delivery apps. Due to the high set-up costs and small scale of the project it has been estimated that this project has a negative NPV of (1,000,000). However, if demand for this service is high, Alba Eats will introduce this product to the remainder of the Irish market. Based on current forecasts the cost of this further expansion would be 5,000,000 and the present value of future cash flows from the project are expected to be 4,250,000. However, the food delivery market is highly volatile and this forecast is subject to an annual standard deviation of 40%. A decision to expand into the Irish market would be made 4 years after the initial launch in Cork. The current risk-free rate of return is 1.5%. There are no costs associated with delaying during the 4-year period and Alba Eats cannot expand into the wider Irish market without first launching in the Cork market. I Required: (1) Briefly outline why Discounted Cash Flow Analysis is not appropriate to value this proposed project. (5 Marks) (ii) Explain how the real option available to Alba Eats could be valued using the Black- Scholes model and map the project characteristics onto the Black-Scholes variables. (10 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started