Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview please do all parts in 50 minutes please urgently... I'll give you up thumb definitely please do both parts A and B

Old MathJax webview

please do all parts in 50 minutes please urgently... I'll give you up thumb definitely

please do both parts A and B

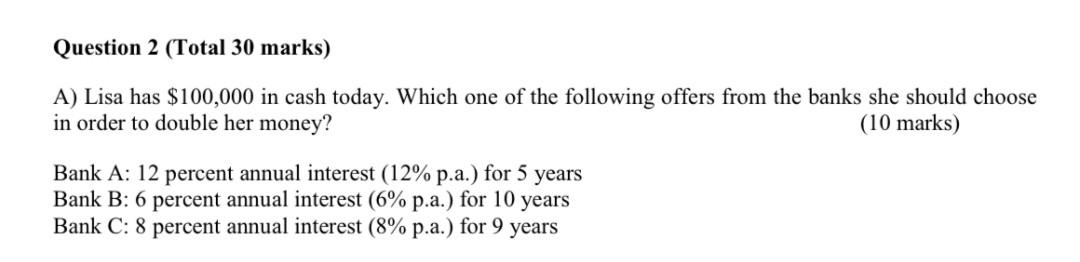

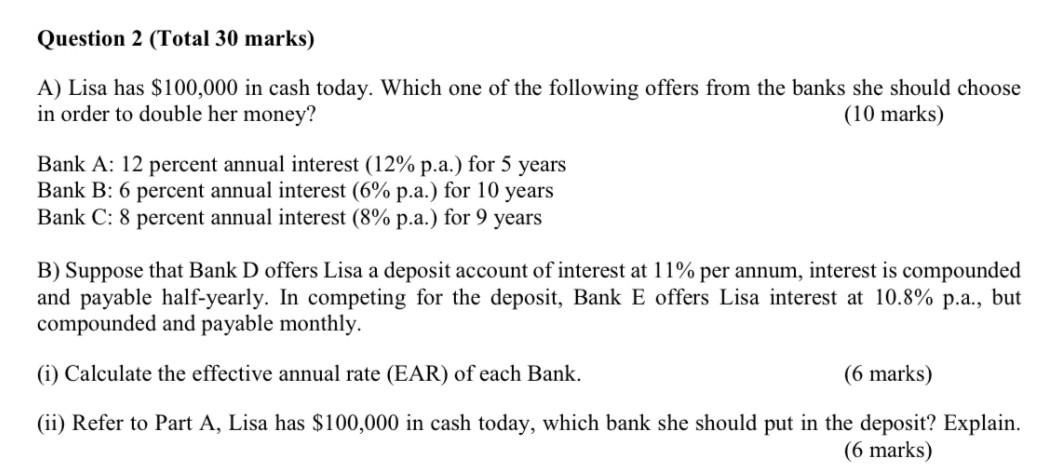

Question 2 (Total 30 marks) A) Lisa has $100,000 in cash today. Which one of the following offers from the banks she should choose in order to double her money? (10 marks) Bank A: 12 percent annual interest (12% p.a.) for 5 years Bank B: 6 percent annual interest (6% p.a.) for 10 years Bank C: 8 percent annual interest (8% p.a.) for 9 years Question 2 (Total 30 marks) A) Lisa has $100,000 in cash today. Which one of the following offers from the banks she should choose in order to double her money? (10 marks) Bank A: 12 percent annual interest (12% p.a.) for 5 years Bank B: 6 percent annual interest (6% p.a.) for 10 years Bank C: 8 percent annual interest (8% p.a.) for 9 years 8 B) Suppose that Bank D offers Lisa a deposit account of interest at 11% per annum, interest is compounded and payable half-yearly. In competing for the deposit, Bank E offers Lisa interest at 10.8% p.a., but compounded and payable monthly. (i) Calculate the effective annual rate (EAR) of each Bank. (6 marks) (ii) Refer to Part A, Lisa has $100,000 in cash today, which bank she should put in the deposit? Explain. (6 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started