Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview please do it in 10 minutes please urgently.... I'll give you up thumb definitely Do it in 30 minutes please Question 4

Old MathJax webview

please do it in 10 minutes please urgently.... I'll give you up thumb definitely

Do it in 30 minutes please

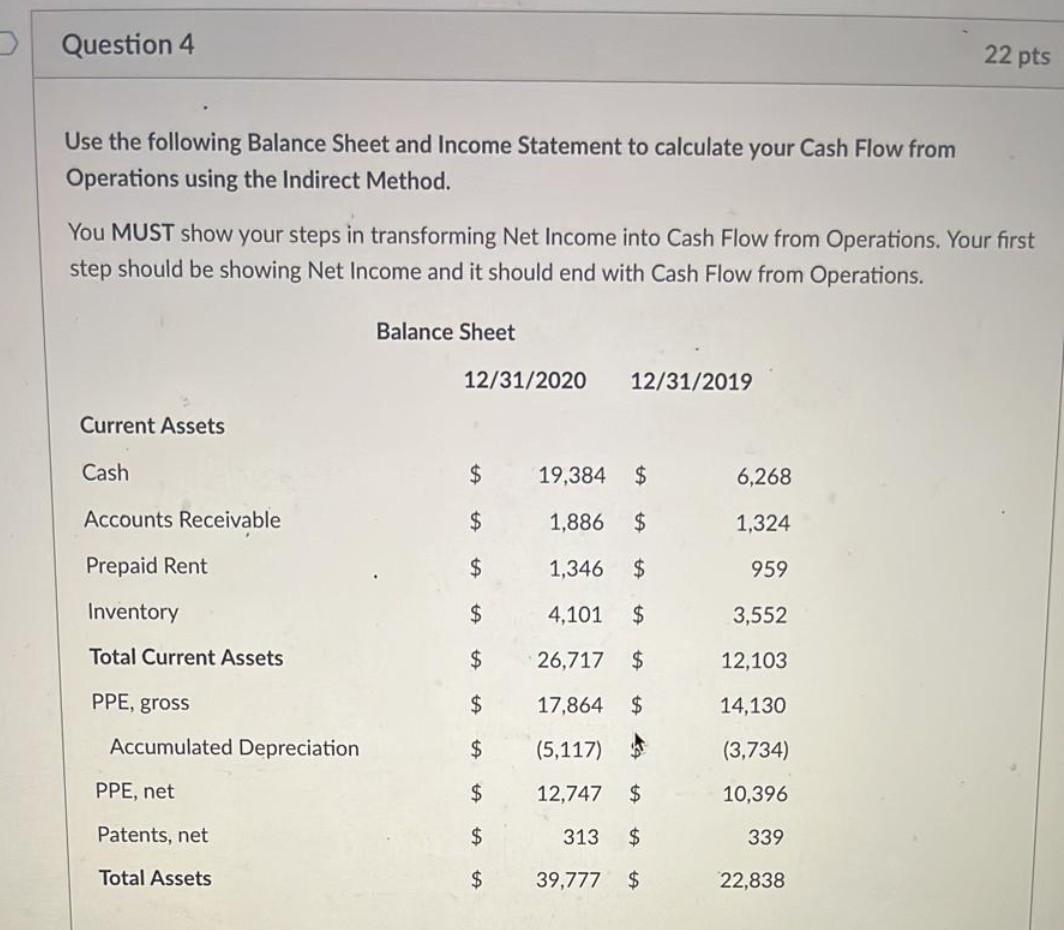

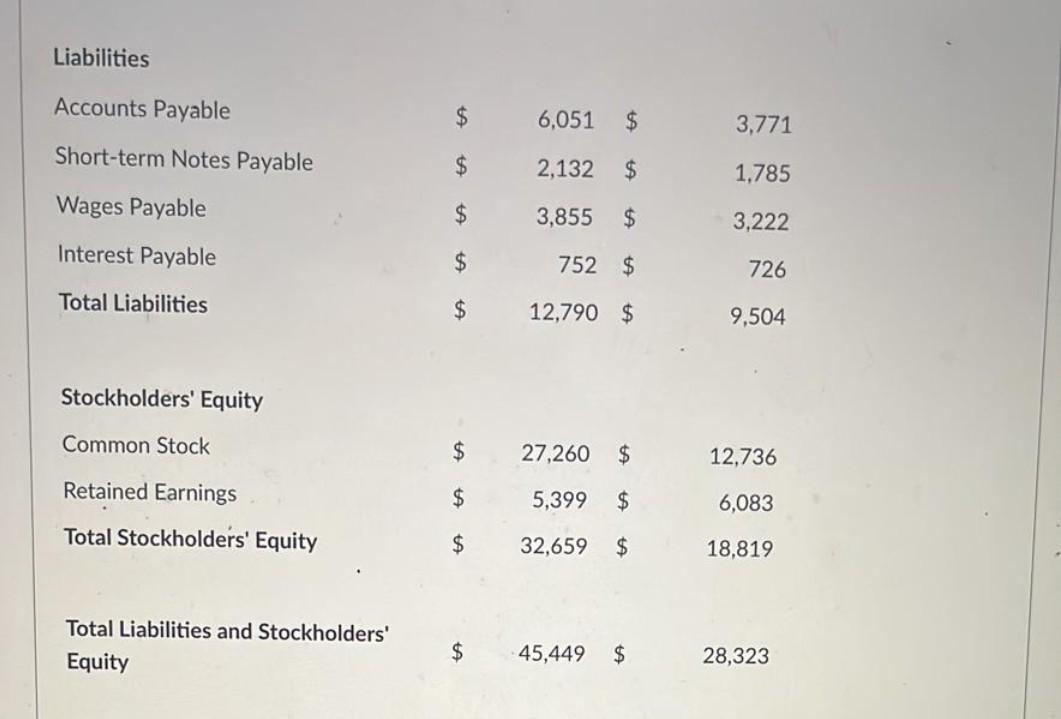

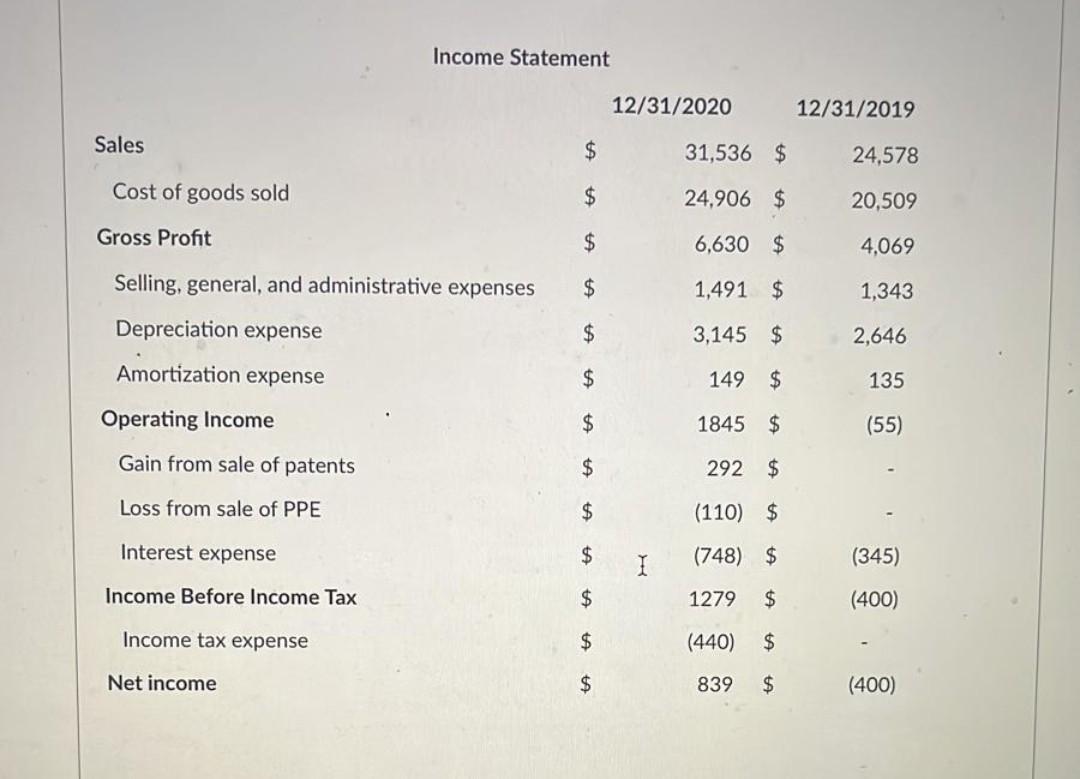

Question 4 22 pts Use the following Balance Sheet and Income Statement to calculate your Cash Flow from Operations using the Indirect Method. You MUST show your steps in transforming Net Income into Cash Flow from Operations. Your first step should be showing Net Income and it should end with Cash Flow from Operations. Balance Sheet 12/31/2020 12/31/2019 Current Assets Cash $ 19,384 $ 6,268 Accounts Receivable $ 1,886 $ 1,324 Prepaid Rent $ 1,346 $ 959 Inventory $ 4,101 $ 3,552 Total Current Assets $ 26,717 $ 12,103 PPE, gross $ 17,864 $ 14,130 Accumulated Depreciation $ (5,117) (3,734) PPE, net $ 12,747 $ 10,396 Patents, net $ 313 $ 339 Total Assets $ 39,777 $ 22,838 Liabilities Accounts Payable $ 6,051 $ 3,771 Short-term Notes Payable $ 2,132 $ 1,785 Wages Payable $ 3,855 $ 3,222 Interest Payable $ 752 $ 726 Total Liabilities $ 12,790 $ 9,504 Stockholders' Equity Common Stock $ 27,260 $ 12,736 Retained Earnings $ 5,399 $ 6,083 Total Stockholders' Equity $ 32,659 $ 18,819 Total Liabilities and Stockholders' Equity $ 45,449 $ 28,323 Income Statement 12/31/2020 12/31/2019 Sales $ 31,536 $ 24,578 Cost of goods sold $ 24,906 $ 20,509 Gross Profit $ 6,630 $ 4,069 Selling, general, and administrative expenses $ 1,491 $ 1,343 Depreciation expense $ 3,145 $ 2,646 Amortization expense $ 149 $ 135 Operating Income $ 1845 $ (55) Gain from sale of patents $ 292 $ Loss from sale of PPE $ (110) $ Interest expense $ I (748) $ (345) (400) Income Before Income Tax $ 1279 $ Income tax expense $ (440) $ Net income $ 839 $ (400)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started