Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview Please explain this Exhibit The Euro-Rupee Carry Trade Start The funds borrowed at 1.00% per annum bill need to be repaid in

Old MathJax webview

Please explain this Exhibit

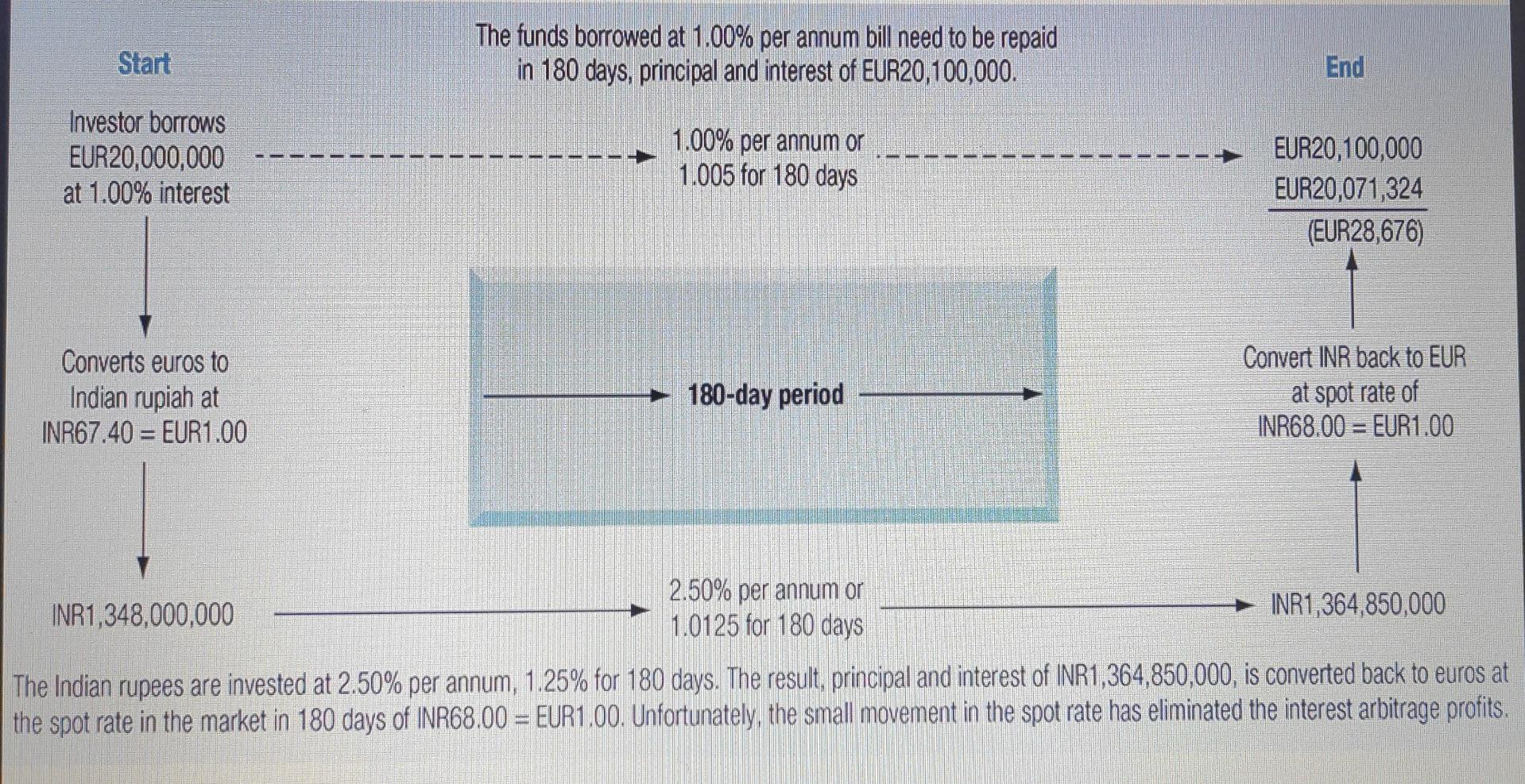

The Euro-Rupee Carry Trade

Start The funds borrowed at 1.00% per annum bill need to be repaid in 180 days, principal and interest of EUR20,100,000. End Investor borrows EUR 20,000,000 at 1.00% interest 10 1.00% per annum or 1.005 for 180 days EUR 20,100,000 EUR20,071,324 (EUR28,676) Converts euros to Indian rupiah at INR67.40 = EUR1.00 180-day period Convert INR back to EUR at spot rate of INR68.00 = EUR1.00 INR1,348,000,000 2.50% per annum or 1.0125 for 180 days INR1,364,850,000 The Indian rupees are invested at 2.50% per annum, 1.25% for 180 days. The result , principal and interest of INR1,364,850,000, is converted back to euros at the spot rate in the market in 180 days of INR68.00 = EUR1.00. Unfortunately, the small movement in the spot rate has eliminated the interest arbitrage profitsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started