Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview please scroll to the last page. the question is complete. the first picture is supposed to be followed by the third before

Old MathJax webview

please scroll to the last page. the question is complete. the first picture is supposed to be followed by the third before the second

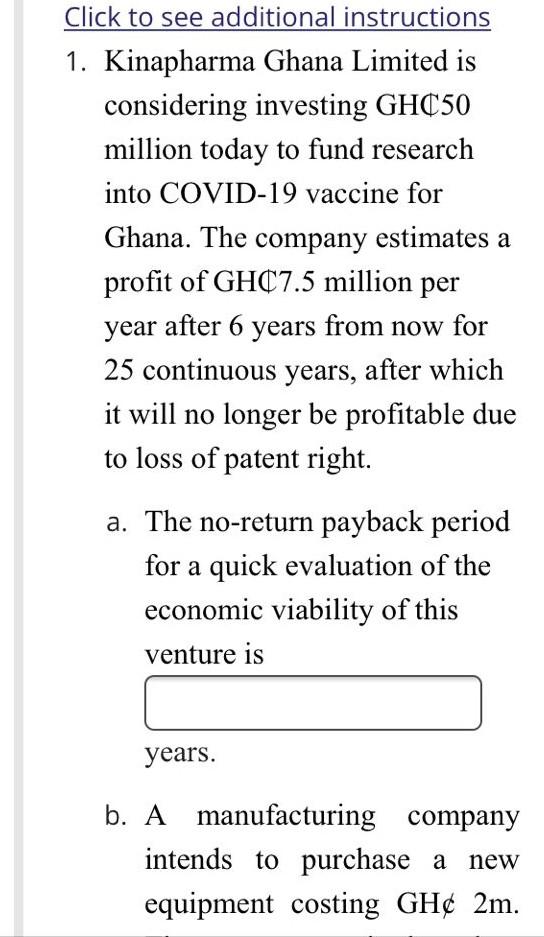

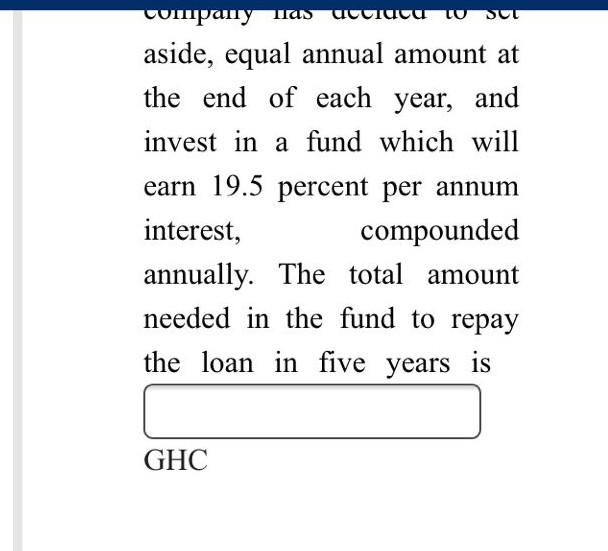

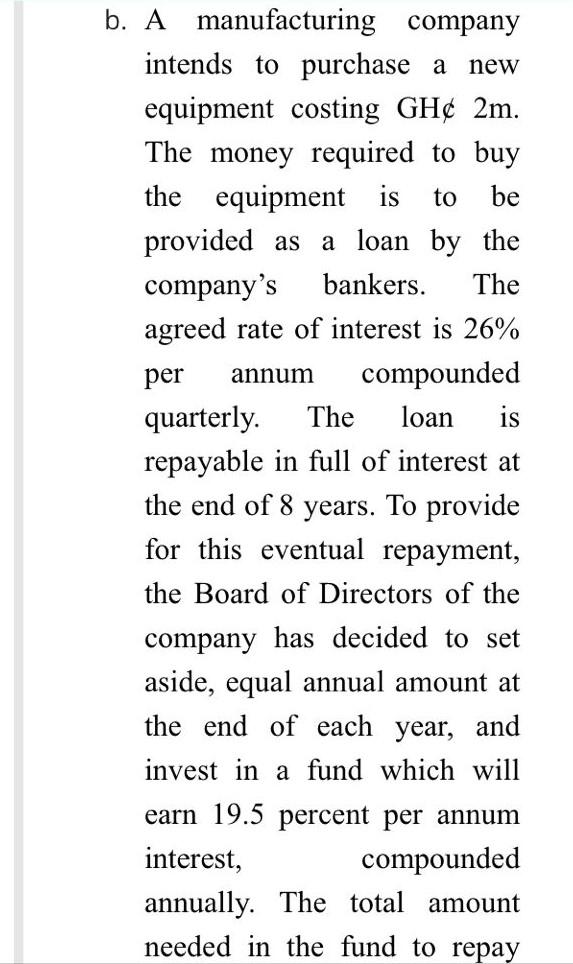

Click to see additional instructions 1. Kinapharma Ghana Limited is considering investing GHC50 million today to fund research into COVID-19 vaccine for Ghana. The company estimates a profit of GHC7.5 million per year after 6 years from now for 25 continuous years, after which it will no longer be profitable due to loss of patent right. a. The no-return payback period for a quick evaluation of the economic viability of this venture is years. b. A manufacturing company intends to purchase a new equipment costing GH 2m. SUU company has aside, equal annual amount at the end of each year, and invest in a fund which will earn 19.5 percent per annum interest, compounded annually. The total amount needed in the fund to repay the loan in five years is GHC annum b. A manufacturing company intends to purchase a new equipment costing GH 2m. The money required to buy the equipment is to be provided as a loan by the company's bankers. The agreed rate of interest is 26% per compounded quarterly. The loan is repayable in full of interest the end of 8 years. To provide for this eventual repayment, the Board of Directors of the company has decided to set aside, equal annual amount at the end of each year, and invest in a fund which will earn 19.5 percent per annum interest, compounded annually. The total amount needed in the fund to repayStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started