Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview please solve all the bits. A Pension fund manager is considering three mutual funds. The first is an equity fund, the second

Old MathJax webview

please solve all the bits.

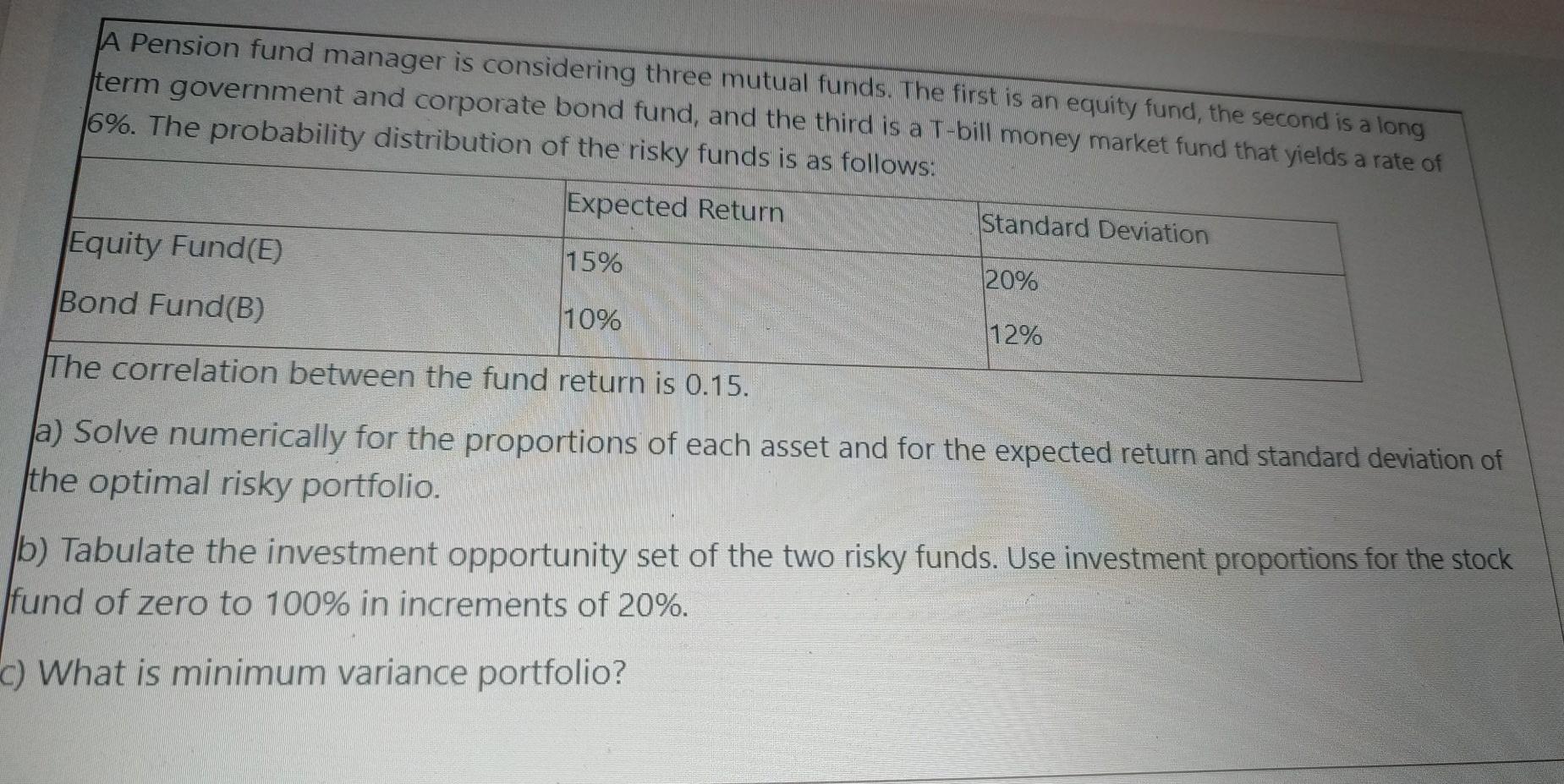

A Pension fund manager is considering three mutual funds. The first is an equity fund, the second is a long term government and corporate bond fund, and the third is a T-bill money market fund that yields a rate of 6%. The probability distribution of the risky funds is as follows: Expected Return Standard Deviation Equity Fund(E) 15% 20% Bond Fund(B) 10% 12% The correlation between the fund return is 0.15. a) Solve numerically for the proportions of each asset and for the expected return and standard deviation of the optimal risky portfolio. b) Tabulate the investment opportunity set of the two risky funds. Use investment proportions for the stock fund of zero to 100% in increments of 20%. c) What is minimum variance portfolioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started