Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview Question 1 An all equity firm is evaluating the benefits of debt. The firm has Rs 5000 as its earning before interest

Old MathJax webview

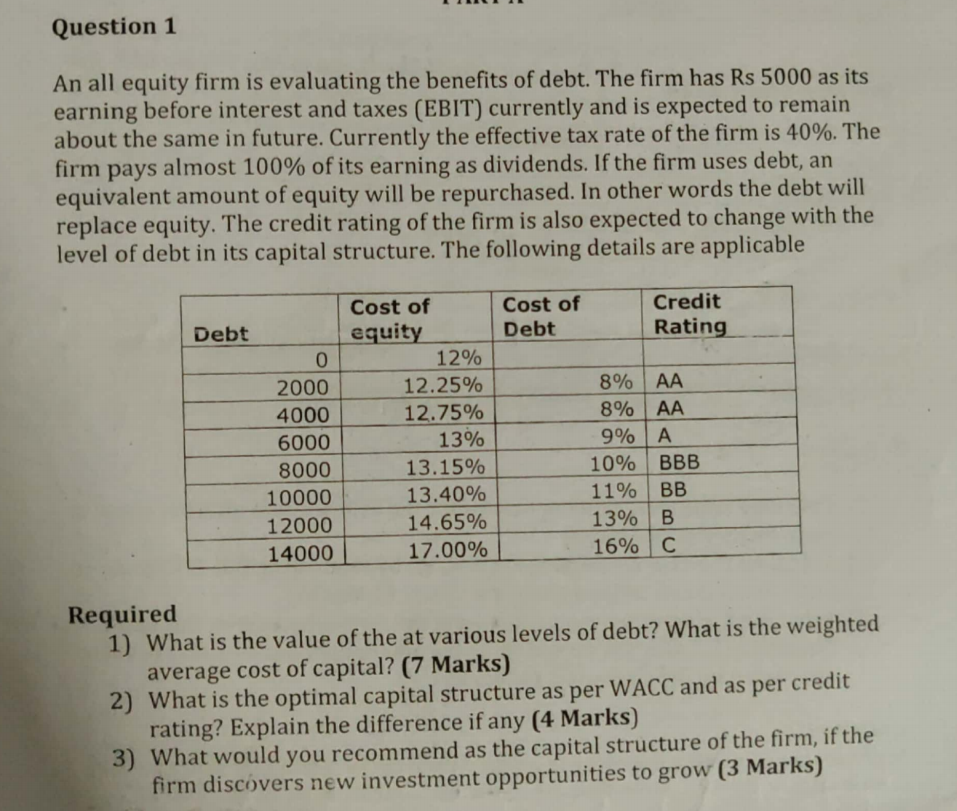

Question 1 An all equity firm is evaluating the benefits of debt. The firm has Rs 5000 as its earning before interest and taxes (EBIT) currently and is expected to remain about the same in future. Currently the effective tax rate of the firm is 40%. The firm pays almost 100% of its earning as dividends. If the firm uses debt, an equivalent amount of equity will be repurchased. In other words the debt will replace equity. The credit rating of the firm is also expected to change with the level of debt in its capital structure. The following details are applicable Cost of Debt Credit Rating Debt 0 2000 4000 6000 8000 10000 12000 14000 Cost of equity 12% 12.25% 12.75% 13% 13.15% 13.40% 14.65% 17.00% 8% AA 8% AA 9% A 10% BBB 11% BB 13% B 16% C Required 1) What is the value of the at various levels of debt? What is the weighted average cost of capital? (7 Marks) 2) What is the optimal capital structure as per WACC and as per credit rating? Explain the difference if any (4 Marks) 3) What would you recommend as the capital structure of the firm, if the firm discovers new investment opportunities to grow

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started