Answered step by step

Verified Expert Solution

Question

1 Approved Answer

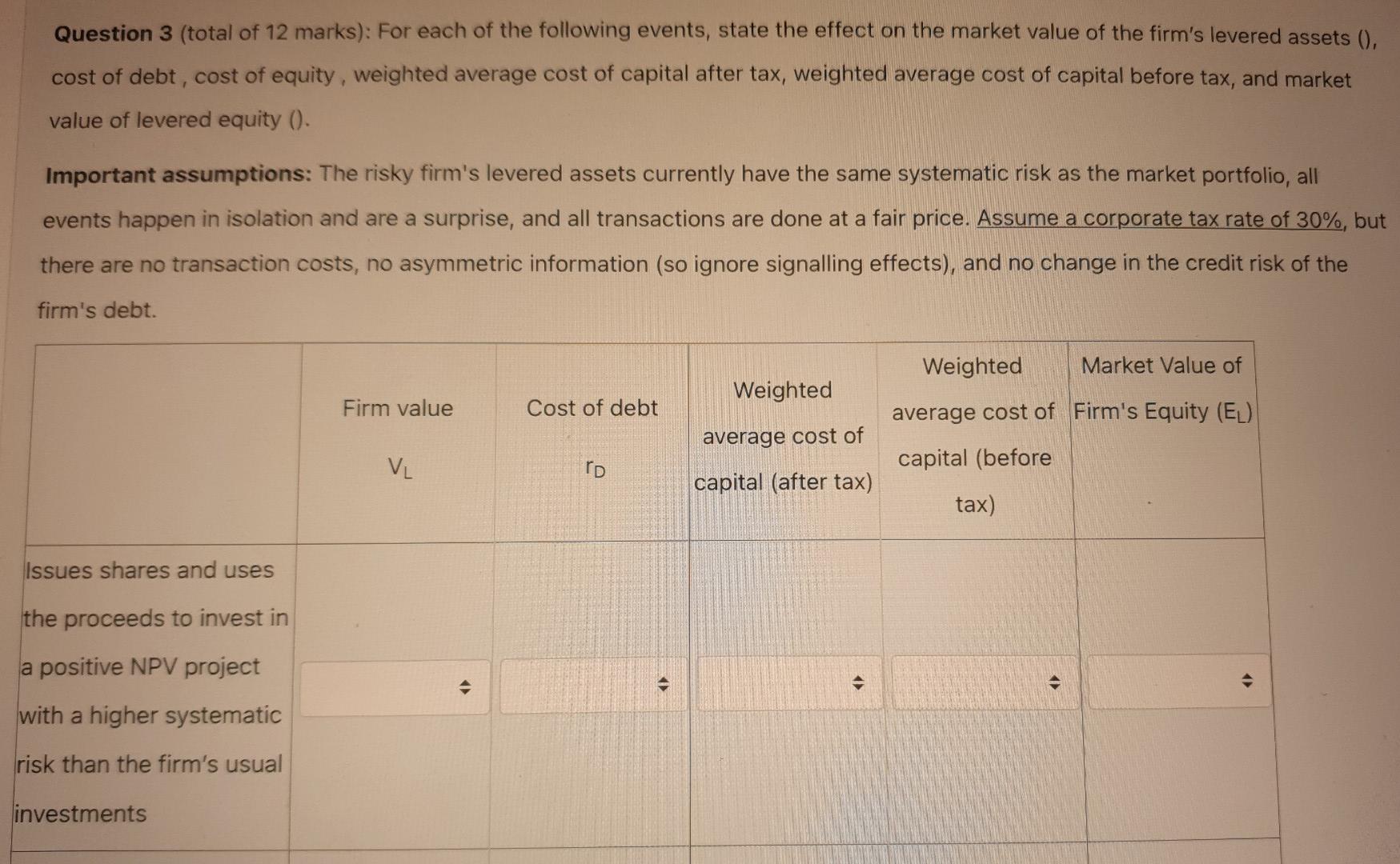

Old MathJax webview Question 3 (total of 12 marks): For each of the following events, state the effect on the market value of the firm's

Old MathJax webview

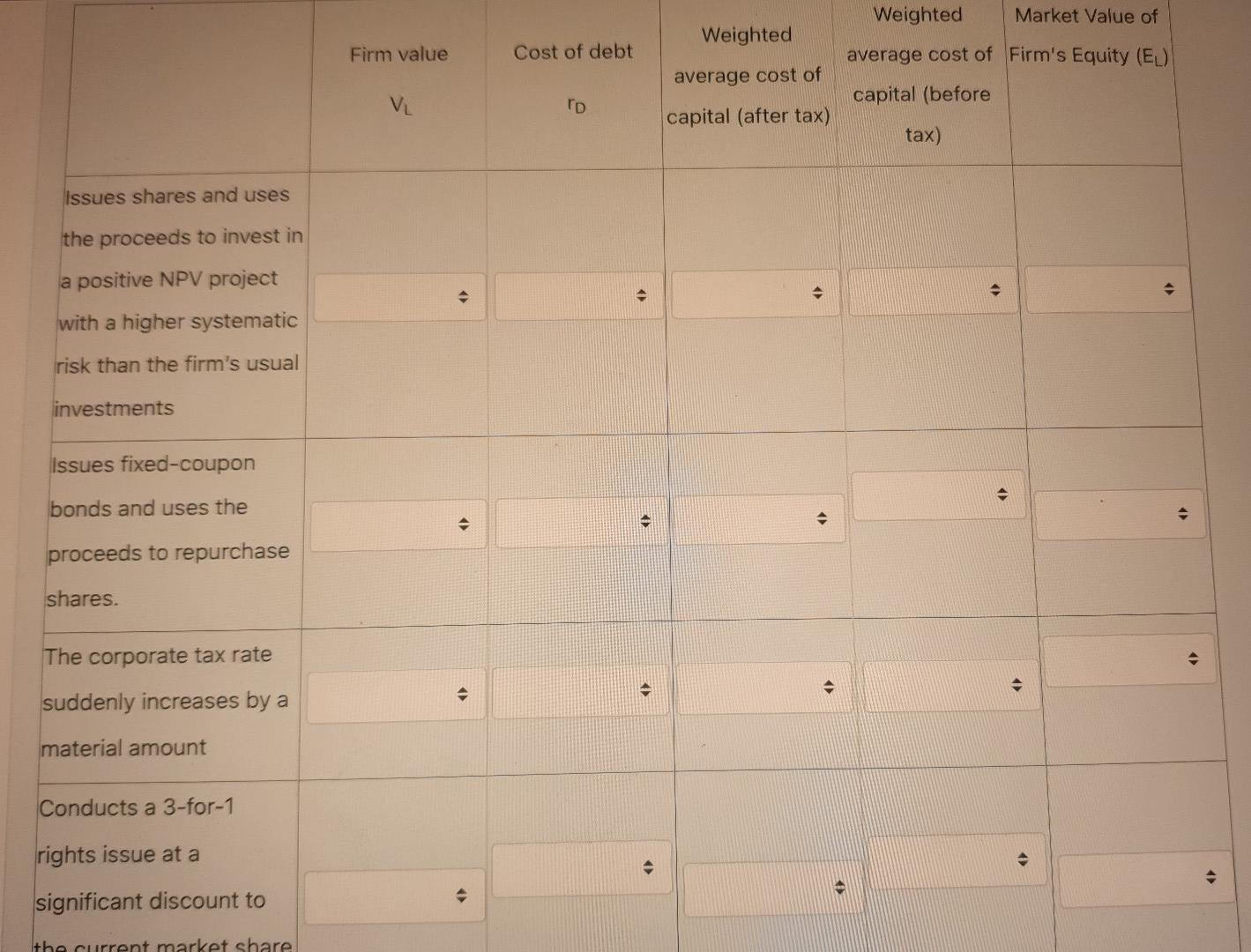

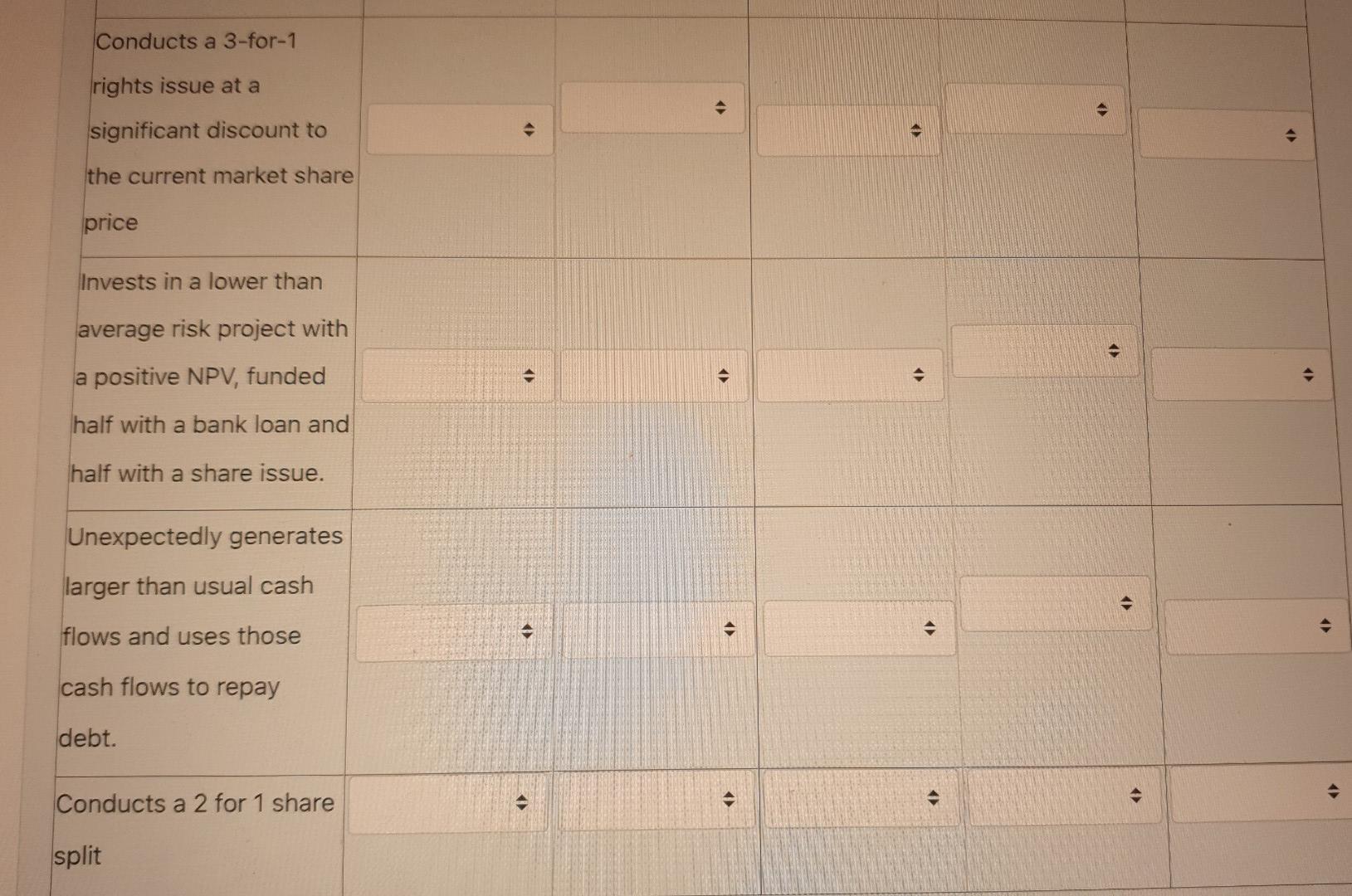

Question 3 (total of 12 marks): For each of the following events, state the effect on the market value of the firm's levered assets (). cost of debt, cost of equity, weighted average cost of capital after tax, weighted average cost of capital before tax, and market value of levered equity (). Important assumptions: The risky firm's levered assets currently have the same systematic risk as the market portfolio, all events happen in isolation and are a surprise, and all transactions are done at a fair price. Assume a corporate tax rate of 30%, but there are no transaction costs, no asymmetric information (so ignore signalling effects), and no change in the credit risk of the firm's debt. Weighted Market Value of Weighted Firm value Cost of debt average cost of average cost of Firm's Equity (EL) capital (before VL ro capital (after tax) tax) Issues shares and uses the proceeds to invest in a positive NPV project 20 with a higher systematic risk than the firm's usual investments Weighted Market Value of Weighted Firm value Cost of debt average cost of average cost of Firm's Equity (EU) capital (before VL TD capital (after tax) tax) Issues shares and uses the proceeds to invest in a positive NPV project with a higher systematic . > risk than the firm's usual investments Issues fixed-coupon bonds and uses the proceeds to repurchase shares. The corporate tax rate X . suddenly increases by a material amount Conducts a 3-for-1 rights issue at a . SA significant discount to the current market share Conducts a 3-for-1 rights issue at a . significant discount to . > the current market share price Invests in a lower than average risk project with ( a positive NPV, funded . half with a bank loan and half with a share issue. Unexpectedly generates larger than usual cash flows and uses those cash flows to repay debt. Conducts a 2 for 1 share split Question 3 (total of 12 marks): For each of the following events, state the effect on the market value of the firm's levered assets (). cost of debt, cost of equity, weighted average cost of capital after tax, weighted average cost of capital before tax, and market value of levered equity (). Important assumptions: The risky firm's levered assets currently have the same systematic risk as the market portfolio, all events happen in isolation and are a surprise, and all transactions are done at a fair price. Assume a corporate tax rate of 30%, but there are no transaction costs, no asymmetric information (so ignore signalling effects), and no change in the credit risk of the firm's debt. Weighted Market Value of Weighted Firm value Cost of debt average cost of average cost of Firm's Equity (EL) capital (before VL ro capital (after tax) tax) Issues shares and uses the proceeds to invest in a positive NPV project 20 with a higher systematic risk than the firm's usual investments Weighted Market Value of Weighted Firm value Cost of debt average cost of average cost of Firm's Equity (EU) capital (before VL TD capital (after tax) tax) Issues shares and uses the proceeds to invest in a positive NPV project with a higher systematic . > risk than the firm's usual investments Issues fixed-coupon bonds and uses the proceeds to repurchase shares. The corporate tax rate X . suddenly increases by a material amount Conducts a 3-for-1 rights issue at a . SA significant discount to the current market share Conducts a 3-for-1 rights issue at a . significant discount to . > the current market share price Invests in a lower than average risk project with ( a positive NPV, funded . half with a bank loan and half with a share issue. Unexpectedly generates larger than usual cash flows and uses those cash flows to repay debt. Conducts a 2 for 1 share split

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started