Question

Old MathJax webview QUESTION 5 (20 MARKS) 5.1 REQUIRED Use the information provided below to calculate the following. Where applicable, use the present value tables

Old MathJax webview

QUESTION 5 (20 MARKS)

5.1

REQUIRED

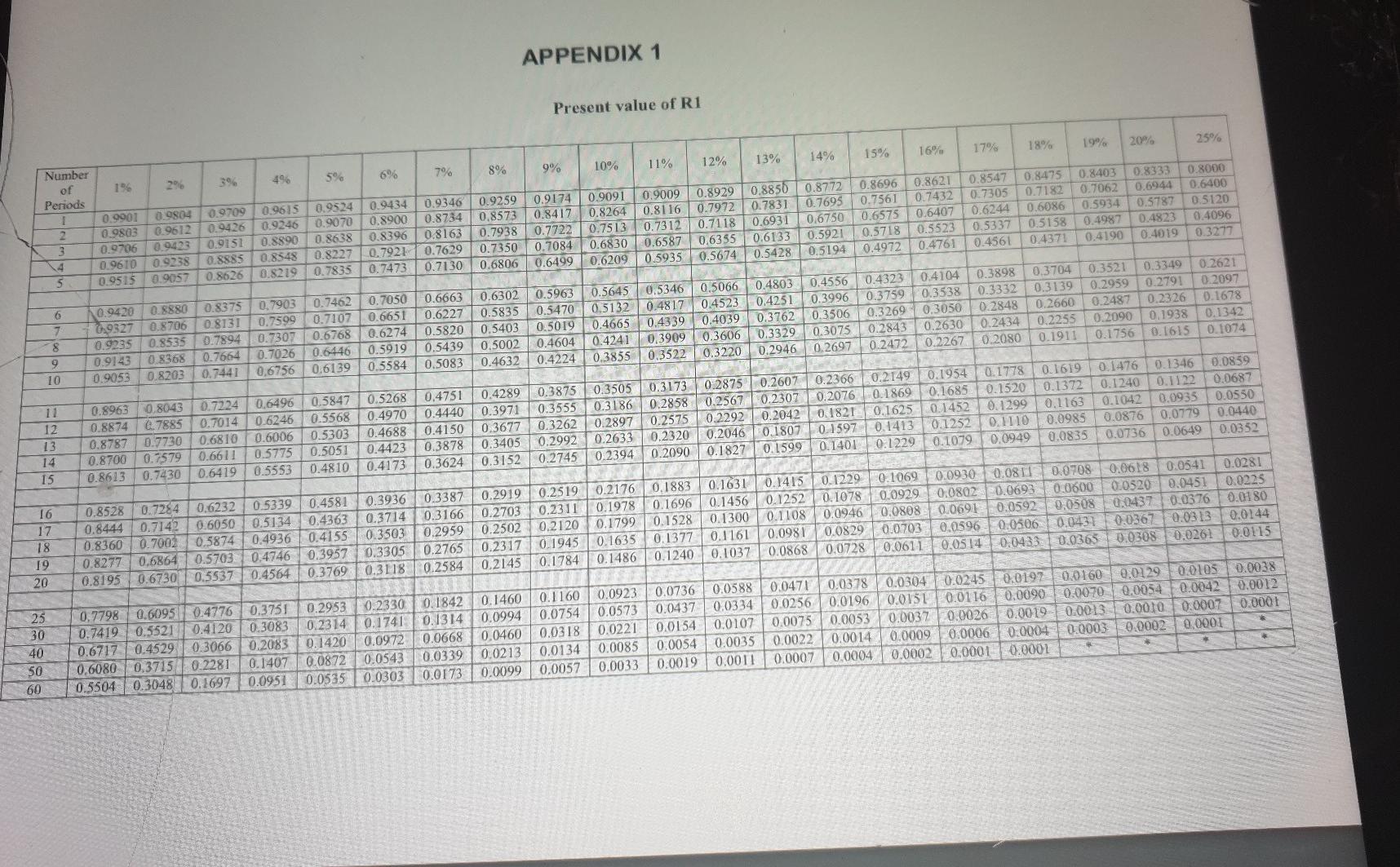

Use the information provided below to calculate the following. Where applicable, use the present value tables

provided in APPENDICES 1 and 2 that appear after QUESTION 5.

5.1.1 Payback Period (expressed in years, months and days) (3 marks)

5.1.2 Accounting Rate of Return, on average investment (expressed to two decimal places) (4 marks)

5.1.3 Internal Rate of Return (expressed to two decimal places) (6 marks)

INFORMATION

Redd Ltd intends purchasing a machine. The following details relate to this machine:

Purchase price R1 200 000

Expected useful life 4 years

Minimum required rate of return 12%

Scrap value R0

Depreciation Straight-line method

Net profit per year:

1

st year R40 000

2

nd year R100 000

3

rd year R130 000

4

th year R150 000

5.2

REQUIRED

Use the information provided below to answer the following questions:

5.2.1 Calculate the Net Present Value. (6 marks)

5.2.2 Should the project be considered for acceptance? Why? (1 mark)

INFORMATION

Schroder Limited is looking at the possibility of investing in a new project. The project would cost R1 000 000,

and its cash operating expenses would total R210 000 per year. On the benefit side, it is estimated that the

new project would generate cash revenues of R470 000 per year. The project will have a useful life of five

years and is expected to have a scrap value of R90 000. The cost of capital is 12%.

QUESTION 5 (20 MARKS)

5.1

REQUIRED

Use the information provided below to calculate the following. Where applicable, use the present value tables

provided in APPENDICES 1 and 2 that appear after QUESTION 5.

5.1.1 Payback Period (expressed in years, months and days) (3 marks)

5.1.2 Accounting Rate of Return, on average investment (expressed to two decimal places) (4 marks)

5.1.3 Internal Rate of Return (expressed to two decimal places) (6 marks)

INFORMATION

Redd Ltd intends purchasing a machine. The following details relate to this machine:

Purchase price R1 200 000

Expected useful life 4 years

Minimum required rate of return 12%

Scrap value R0

Depreciation Straight-line method

Net profit per year:

1

st year R40 000

2

nd year R100 000

3

rd year R130 000

4

th year R150 000

5.2

REQUIRED

Use the information provided below to answer the following questions:

5.2.1 Calculate the Net Present Value. (6 marks)

5.2.2 Should the project be considered for acceptance? Why? (1 mark)

INFORMATION

Schroder Limited is looking at the possibility of investing in a new project. The project would cost R1 000 000,

and its cash operating expenses would total R210 000 per year. On the benefit side, it is estimated that the

new project would generate cash revenues of R470 000 per year. The project will have a useful life of five

years and is expected to have a scrap value of R90 000. The cost of capital is 12%.

QUESTION 5 (20 MARKS)

5.1

REQUIRED

Use the information provided below to calculate the following. Where applicable, use the present value tables

provided in APPENDICES 1 and 2 that appear after QUESTION 5.

5.1.1 Payback Period (expressed in years, months and days) (3 marks)

5.1.2 Accounting Rate of Return, on average investment (expressed to two decimal places) (4 marks)

5.1.3 Internal Rate of Return (expressed to two decimal places) (6 marks)

INFORMATION

Redd Ltd intends purchasing a machine. The following details relate to this machine:

Purchase price R1 200 000

Expected useful life 4 years

Minimum required rate of return 12%

Scrap value R0

Depreciation Straight-line method

Net profit per year:

1

st year R40 000

2

nd year R100 000

3

rd year R130 000

4

th year R150 000

5.2

REQUIRED

Use the information provided below to answer the following questions:

5.2.1 Calculate the Net Present Value. (6 marks)

5.2.2 Should the project be considered for acceptance? Why? (1 mark)

INFORMATION

Schroder

QUESTION 5 (20 MARKS)

5.1

REQUIRED

Use the information provided below to calculate the following. Where applicable, use the present value tables

provided in APPENDICES 1 and 2 that appear after QUESTION 5.

5.1.1 Payback Period (expressed in years, months and days) (3 marks)

5.1.2 Accounting Rate of Return, on average investment (expressed to two decimal places) (4 marks)

5.1.3 Internal Rate of Return (expressed to two decimal places) (6 marks)

INFORMATION

Redd Ltd intends purchasing a machine. The following details relate to this machine:

Purchase price R1 200 000

Expected useful life 4 years

Minimum required rate of return 12%

Scrap value R0

Depreciation Straight-line method

Net profit per year:

1

st year R40 000

2

nd year R100 000

3

rd year R130 000

4

th year R150 000

5.2

REQUIRED

Use the information provided below to answer the following questions:

5.2.1 Calculate the Net Present Value. (6 marks)

5.2.2 Should the project be considered for acceptance? Why? (1 mark)

INFORMATION

Schroder Limited is looking at the possibility of investing in a new project. The project would cost R1 000 000,

and its cash operating expenses would total R210 000 per year. On the benefit side, it is estimated that the

new project would generate cash revenues of R470 000 per year. The project will have a useful life of five

years and is expected to have a scrap value of R90 000. The cost of capital is 12%.

Limited is looking at the possibility of investing in a new project. The project would cost R1 000 000,

and its cash operating expenses would total R210 000 per year. On the benefit side, it is estimated that the

new project would generate cash revenues of R470 000 per year. The project will have a useful life of five

years and is expected to have a scrap value of R90 000. The cost of capital is 12%.

APPENDIX 1 Present value of R1 25% 19% 20% 18% 16% 17% 15% 14% 13% 11% 12% 10% 9% 8% 7% 69% 496 ++ Number of 29% 396 Periods 0.9901 0.9804 0.9709 2 0.9803 0.9612 0.9426 3 0.9706 0.9423 0.9151 0.9610 0.9238 0.8885 5 0.9515 0.9057 0.8626 0.9434 0.9346 0.8900 0.8734 0.8396 0.8163 0.7921 0.7629 2.7473 0.7130 0.9524 0.9070 0.8638 0.8227 0.7835 0.9615 0.9246 0.8890 0.8548 0.8219 0.8475 0.7182 0.6086 0.5158 0.9259 0.9174 0.9091 0.9009 0.8929 0.8850 0.8573 0.8417 0.8264 0.8116 0.7972 0.7831 0.7938 0.7722 0.7513 0.7312 0.7118 0.6931 0.7350 0.7084 0.6830 0.6587 0.6355 0.6133 0.6806 0.6499 0.6209 0.5935 0.5674 0.5428 HHHH 0.8772 0.7695 0.6750 0.5921 0.5194 0.8696 0.8621 0.7561 0.7432 0.6573 0.6407 0.5718 0.5523 0.4972 0.4761 0.8547 0.7305 0.6244 0.5337 0.4561 0.8000 0.6400 0.5120 0.4096 0.3277 0.8403 0.8333 09.7062 0.6944 0.5934 0.5787 0.4987 0.4823 0.4019 0.4371 0.4190 0.3898 0.3332 0.5963 0.5470 0.5019 0.4604 0.4224 0.7050 0.6663 0.6302 0.6651 0.6227 0.5835 0.6274 0.5820 0.5403 0.5919 0.54390,5002 0.5584 0.5083 0.4632 0.7903 0.7462 0.7599 0.7107 0.7307 0.6768 0.7026 0.6446 0,6756 0.6139 0.8375 0.8131 0.7894 0.7664 0.5645 0.5346 0.5066 0.4803 0.5132 0.4817 0.4523 0.4251 0.4665 0.4339 0.4039 0.3762 0.4241 0.3909 0.3606 0.3329 0.3855 0.3522 0.3220 0.2946 0.9420 0.8880 1.9327 0.8706 0.9235 0.8535 0.9143 0.8368 0.9053 0.8203 0.2848 0.2434 6 7 8 0.4556 0.3996 0.3506 0.3075 0.2697 0.4104 0.3538 0.3050 0.2630 0.2267 0.4323 0.3759 0.3269 0.2843 0.2472 0.2621 0.2097 0.1678 0.1342 0.1074 0.3704 0.3139 0.2660 0.2255 0.1911 0.3349 0.2791 0.2326 0.1938 0.1615 03521 0.2959 0.2487 0.2090 0.1756 0.2080 9 0.7447 10 0.2567 11 12 13 14 0.8963 0.8874 0.8787 0.8700 0.8613 0.5268 0.4970 0.4688 0.4423 0.4173 0.6496 0.5847 0.6246 0.5568 0.6006 0.5303 0.5775 0.5051 0.5553 0.4810 0.7224 0.7014 0.6810 0.6611 0.6419 0.8043 0.7885 0.7730 0.7579 0.7430 0.4751 0.4440 0.4150 0.3878 0.3624 0.4289 0.3971 0.3677 0.3405 0.3152 0.3875 0.3505 0.3173 0.2875 0.2607 0.3555 0.3186 0.2858 0.2307 0.3262 0.2897 0.2575 0.2292 0.2042 0.2992 0.2633 0.2320 0.2046 0.1807 0.2745 0.2394 0.2090 0.1827 10.1599 0.1346 0.1122 0.0935 0.0779 0.0649 0.0859 0.0687 0.0550 0.0440 0.0352 0.1476 0.1240 0.1042 0.0876 0.0736 0.2366 0.2076 0.1821 0.1597 0.1401 0.1778 0.1619 0.1520 0.1372 0.1299 0.1163 0.1110 0.0985 0.0949 0.0835 0.2149 0.1954 0.1869 0.1685 0.1625 0.1452 0.1413 0.1252 0.1229 0.1079 15 16 0.8528 0.7284 0.6232 0.8444 0.7142 0.6050 0.8360 0.7002 0.5874 0.8277 0.6864 0.5703 0.8195 0.6730 0.5537 17 18 0.5339 0.4581 0.3936 0.3387 0.5134 0.4363 0.3714 0.3166 0.4936 0.41550.3503 0.2959 0.4746 0.3957 0.33051 0.2765 0.4564 0.3769 0.3118 0.2584 0.2919 0.2703 0.2502 0.2317 0,2145 0.0930 0.0811 0.0708 0.06E8 0.0541 0.0281 0.0802 0.0693 0.0600 0.0520 0.0451 0.0225 0.0691 0.0592 0.0508 0.0437 0.0376 0.01180 0.0596 0.0506 0.0431 0.0367 0.0313 0.0144 0.0514 0.0433 0.0363 0.0308 0.0261 -0.0115 0.2519 0.2176 0.1883 0.1631 0.1415 0.1229 0.1069 0.2311 0.1978 0.1696 0.1456 0.1252 0.1078 0.0929 0.2120 0.1799 0.15280.13000.1108 0.0946 1 0.0808 0.1945 0.1635 0.1377 0.1161 0.0981 0.0829 0.0.703 0.1784 0.1486 0.1240 0.1037 0.0868 0.0728 0.0611 19 20 25 30 0.4776 0.3751 0.4120 0.3083 0.3066 0.2083 0.2281 0.1407 0.1697 0.0951 0,7798 0.6095 0.7419 0.5521 0.6717 / 0.4529 0,6080 0.3715 0.5504 0.3048 0.2953 0.2330 0.1842 0.1460 0.2314 0.1741 0.1314 0.0994 0.1420 0.0972 0.0668 0.0460 0.0872 0.0543 0.0339 0.0213 0.0535 0.0303 0.0173 0.0099 0.1160 0.0923 0,0754 0.0573 0.0318 0.0221 0.0134 0.0085 0.0057 0.0033 0.0736 0.0588 0.0437 0.0334 0.0154 0.0107 0.0054 0.0035 0.0019 0.0011 0.0471 0.0378 0.0256 0.0196 0.0075 0.0053 0.0022 0.0014 0.0007 0.0004 0.0304 0.0245 0.0197 0.0160 0.0129 0.0105 0.0038 0.0151 0.0116 0.0090 0.0070 0.0054 0.0042 0.0012 0.0037 0.0026 0.0019 0.0013 0.0010 0.0007 0.0001 0.0009 0.0006 0.0004 0.0003 0.0002 0.0001 0.0002 0.0001 0.0001 40 50 60 APPENDIX 1 Present value of R1 25% 19% 20% 18% 16% 17% 15% 14% 13% 11% 12% 10% 9% 8% 7% 69% 496 ++ Number of 29% 396 Periods 0.9901 0.9804 0.9709 2 0.9803 0.9612 0.9426 3 0.9706 0.9423 0.9151 0.9610 0.9238 0.8885 5 0.9515 0.9057 0.8626 0.9434 0.9346 0.8900 0.8734 0.8396 0.8163 0.7921 0.7629 2.7473 0.7130 0.9524 0.9070 0.8638 0.8227 0.7835 0.9615 0.9246 0.8890 0.8548 0.8219 0.8475 0.7182 0.6086 0.5158 0.9259 0.9174 0.9091 0.9009 0.8929 0.8850 0.8573 0.8417 0.8264 0.8116 0.7972 0.7831 0.7938 0.7722 0.7513 0.7312 0.7118 0.6931 0.7350 0.7084 0.6830 0.6587 0.6355 0.6133 0.6806 0.6499 0.6209 0.5935 0.5674 0.5428 HHHH 0.8772 0.7695 0.6750 0.5921 0.5194 0.8696 0.8621 0.7561 0.7432 0.6573 0.6407 0.5718 0.5523 0.4972 0.4761 0.8547 0.7305 0.6244 0.5337 0.4561 0.8000 0.6400 0.5120 0.4096 0.3277 0.8403 0.8333 09.7062 0.6944 0.5934 0.5787 0.4987 0.4823 0.4019 0.4371 0.4190 0.3898 0.3332 0.5963 0.5470 0.5019 0.4604 0.4224 0.7050 0.6663 0.6302 0.6651 0.6227 0.5835 0.6274 0.5820 0.5403 0.5919 0.54390,5002 0.5584 0.5083 0.4632 0.7903 0.7462 0.7599 0.7107 0.7307 0.6768 0.7026 0.6446 0,6756 0.6139 0.8375 0.8131 0.7894 0.7664 0.5645 0.5346 0.5066 0.4803 0.5132 0.4817 0.4523 0.4251 0.4665 0.4339 0.4039 0.3762 0.4241 0.3909 0.3606 0.3329 0.3855 0.3522 0.3220 0.2946 0.9420 0.8880 1.9327 0.8706 0.9235 0.8535 0.9143 0.8368 0.9053 0.8203 0.2848 0.2434 6 7 8 0.4556 0.3996 0.3506 0.3075 0.2697 0.4104 0.3538 0.3050 0.2630 0.2267 0.4323 0.3759 0.3269 0.2843 0.2472 0.2621 0.2097 0.1678 0.1342 0.1074 0.3704 0.3139 0.2660 0.2255 0.1911 0.3349 0.2791 0.2326 0.1938 0.1615 03521 0.2959 0.2487 0.2090 0.1756 0.2080 9 0.7447 10 0.2567 11 12 13 14 0.8963 0.8874 0.8787 0.8700 0.8613 0.5268 0.4970 0.4688 0.4423 0.4173 0.6496 0.5847 0.6246 0.5568 0.6006 0.5303 0.5775 0.5051 0.5553 0.4810 0.7224 0.7014 0.6810 0.6611 0.6419 0.8043 0.7885 0.7730 0.7579 0.7430 0.4751 0.4440 0.4150 0.3878 0.3624 0.4289 0.3971 0.3677 0.3405 0.3152 0.3875 0.3505 0.3173 0.2875 0.2607 0.3555 0.3186 0.2858 0.2307 0.3262 0.2897 0.2575 0.2292 0.2042 0.2992 0.2633 0.2320 0.2046 0.1807 0.2745 0.2394 0.2090 0.1827 10.1599 0.1346 0.1122 0.0935 0.0779 0.0649 0.0859 0.0687 0.0550 0.0440 0.0352 0.1476 0.1240 0.1042 0.0876 0.0736 0.2366 0.2076 0.1821 0.1597 0.1401 0.1778 0.1619 0.1520 0.1372 0.1299 0.1163 0.1110 0.0985 0.0949 0.0835 0.2149 0.1954 0.1869 0.1685 0.1625 0.1452 0.1413 0.1252 0.1229 0.1079 15 16 0.8528 0.7284 0.6232 0.8444 0.7142 0.6050 0.8360 0.7002 0.5874 0.8277 0.6864 0.5703 0.8195 0.6730 0.5537 17 18 0.5339 0.4581 0.3936 0.3387 0.5134 0.4363 0.3714 0.3166 0.4936 0.41550.3503 0.2959 0.4746 0.3957 0.33051 0.2765 0.4564 0.3769 0.3118 0.2584 0.2919 0.2703 0.2502 0.2317 0,2145 0.0930 0.0811 0.0708 0.06E8 0.0541 0.0281 0.0802 0.0693 0.0600 0.0520 0.0451 0.0225 0.0691 0.0592 0.0508 0.0437 0.0376 0.01180 0.0596 0.0506 0.0431 0.0367 0.0313 0.0144 0.0514 0.0433 0.0363 0.0308 0.0261 -0.0115 0.2519 0.2176 0.1883 0.1631 0.1415 0.1229 0.1069 0.2311 0.1978 0.1696 0.1456 0.1252 0.1078 0.0929 0.2120 0.1799 0.15280.13000.1108 0.0946 1 0.0808 0.1945 0.1635 0.1377 0.1161 0.0981 0.0829 0.0.703 0.1784 0.1486 0.1240 0.1037 0.0868 0.0728 0.0611 19 20 25 30 0.4776 0.3751 0.4120 0.3083 0.3066 0.2083 0.2281 0.1407 0.1697 0.0951 0,7798 0.6095 0.7419 0.5521 0.6717 / 0.4529 0,6080 0.3715 0.5504 0.3048 0.2953 0.2330 0.1842 0.1460 0.2314 0.1741 0.1314 0.0994 0.1420 0.0972 0.0668 0.0460 0.0872 0.0543 0.0339 0.0213 0.0535 0.0303 0.0173 0.0099 0.1160 0.0923 0,0754 0.0573 0.0318 0.0221 0.0134 0.0085 0.0057 0.0033 0.0736 0.0588 0.0437 0.0334 0.0154 0.0107 0.0054 0.0035 0.0019 0.0011 0.0471 0.0378 0.0256 0.0196 0.0075 0.0053 0.0022 0.0014 0.0007 0.0004 0.0304 0.0245 0.0197 0.0160 0.0129 0.0105 0.0038 0.0151 0.0116 0.0090 0.0070 0.0054 0.0042 0.0012 0.0037 0.0026 0.0019 0.0013 0.0010 0.0007 0.0001 0.0009 0.0006 0.0004 0.0003 0.0002 0.0001 0.0002 0.0001 0.0001 40 50 60

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started