Answered step by step

Verified Expert Solution

Question

1 Approved Answer

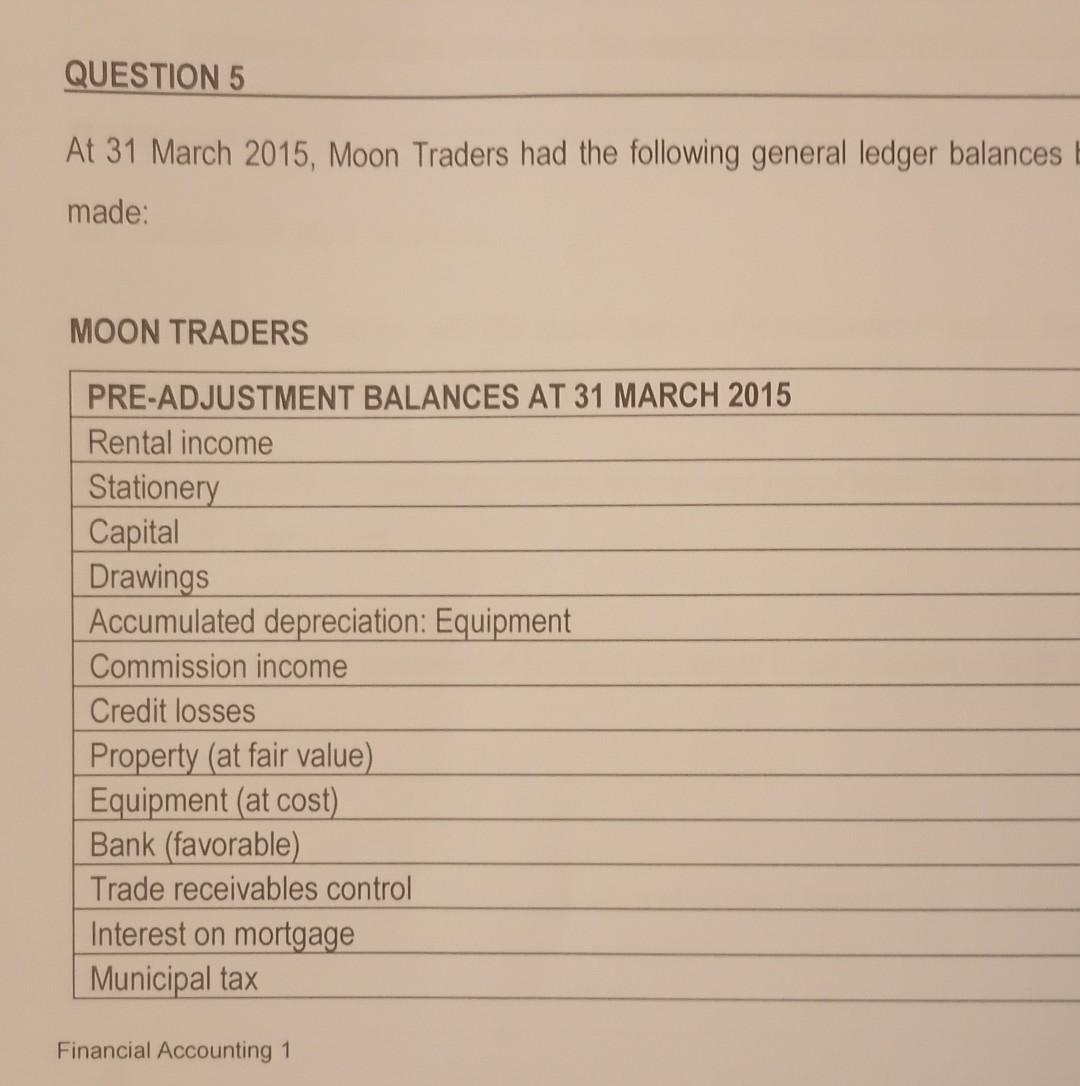

Old MathJax webview QUESTION 5 At 31 March 2015, Moon Traders had the following general ledger balances made: MOON TRADERS PRE-ADJUSTMENT BALANCES AT 31 MARCH

Old MathJax webview

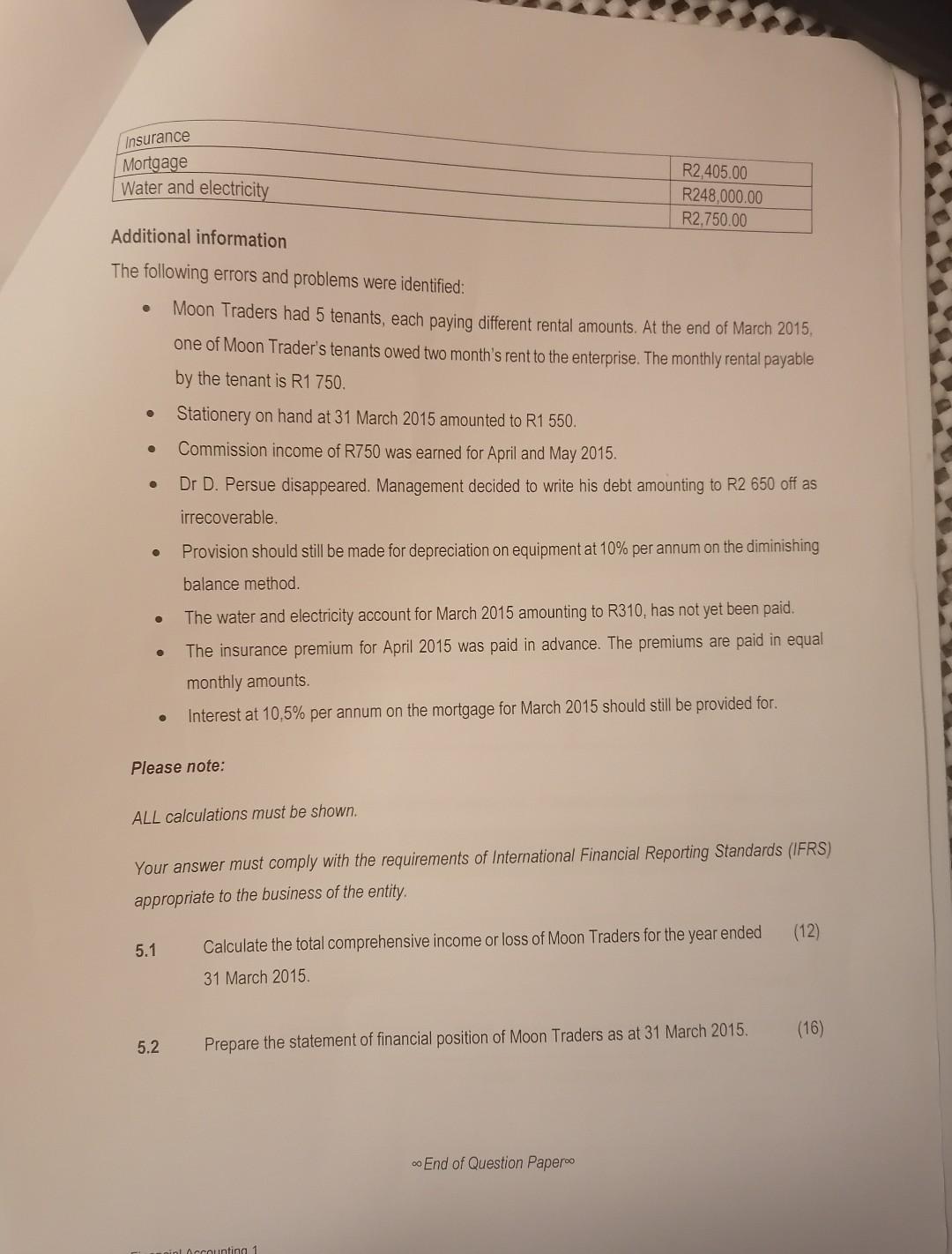

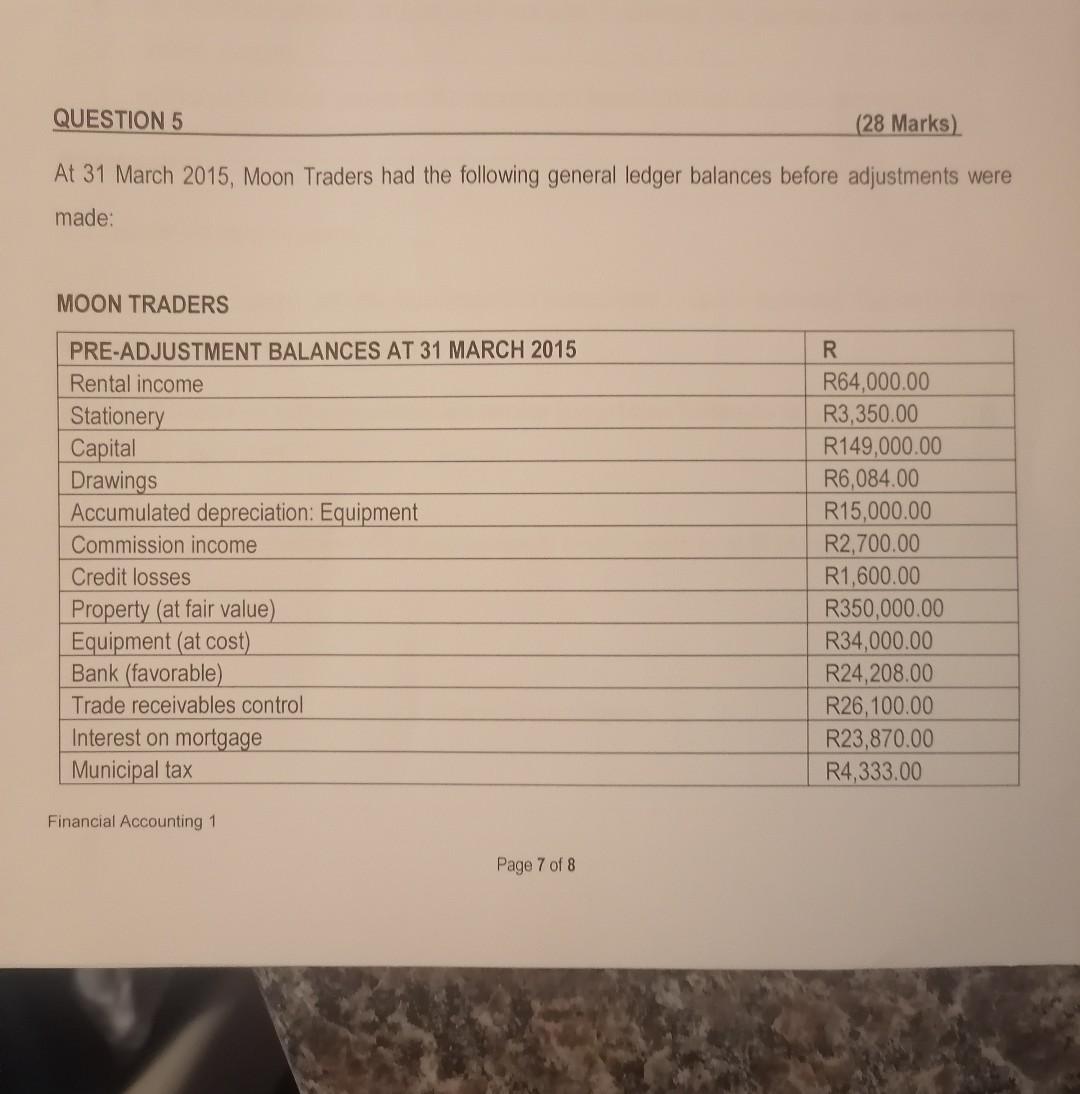

QUESTION 5 At 31 March 2015, Moon Traders had the following general ledger balances made: MOON TRADERS PRE-ADJUSTMENT BALANCES AT 31 MARCH 2015 Rental income Stationery Capital Drawings Accumulated depreciation: Equipment Commission income Credit losses Property (at fair value) Equipment (at cost) Bank (favorable) Trade receivables control Interest on mortgage Municipal tax Financial Accounting 1 Insurance Mortgage R2,405.00 Water and electricity R248,000.00 R2,750.00 Additional information The following errors and problems were identified: Moon Traders had 5 tenants, each paying different rental amounts. At the end of March 2015 one of Moon Trader's tenants owed two month's rent to the enterprise. The monthly rental payable by the tenant is R1 750. Stationery on hand at 31 March 2015 amounted to R1 550. Commission income of R750 was earned for April and May 2015. Dr D. Persue disappeared. Management decided to write his debt amounting to R2 650 off as irrecoverable. Provision should still be made for depreciation on equipment at 10% per annum on the diminishing . balance method. The water and electricity account for March 2015 amounting to R310, has not yet been paid. The insurance premium for April 2015 was paid in advance. The premiums are paid in equal monthly amounts. Interest at 10,5% per annum on the mortgage for March 2015 should still be provided for. Please note: ALL calculations must be shown. Your answer must comply with the requirements of International Financial Reporting Standards (IFRS) appropriate to the business of the entity. (12) 5.1 Calculate the total comprehensive income or loss of Moon Traders for the year ended 31 March 2015 (16) 5.2 Prepare the statement of financial position of Moon Traders as at 31 March 2015. - End of Question Paper in Accounting 1 QUESTION 5 (28 Marks) At 31 March 2015, Moon Traders had the following general ledger balances before adjustments were made: MOON TRADERS PRE-ADJUSTMENT BALANCES AT 31 MARCH 2015 Rental income Stationery Capital Drawings Accumulated depreciation: Equipment Commission income Credit losses Property (at fair value) Equipment (at cost) Bank (favorable) Trade receivables control Interest on mortgage Municipal tax R R64,000.00 R3,350.00 R149,000.00 R6,084.00 R15,000.00 R2,700.00 R1,600.00 R350,000.00 R34,000.00 R24,208.00 R26,100.00 R23,870.00 R4,333.00 Financial Accounting 1 Page 7 of 8 QUESTION 5 At 31 March 2015, Moon Traders had the following general ledger balances made: MOON TRADERS PRE-ADJUSTMENT BALANCES AT 31 MARCH 2015 Rental income Stationery Capital Drawings Accumulated depreciation: Equipment Commission income Credit losses Property (at fair value) Equipment (at cost) Bank (favorable) Trade receivables control Interest on mortgage Municipal tax Financial Accounting 1 Insurance Mortgage R2,405.00 Water and electricity R248,000.00 R2,750.00 Additional information The following errors and problems were identified: Moon Traders had 5 tenants, each paying different rental amounts. At the end of March 2015 one of Moon Trader's tenants owed two month's rent to the enterprise. The monthly rental payable by the tenant is R1 750. Stationery on hand at 31 March 2015 amounted to R1 550. Commission income of R750 was earned for April and May 2015. Dr D. Persue disappeared. Management decided to write his debt amounting to R2 650 off as irrecoverable. Provision should still be made for depreciation on equipment at 10% per annum on the diminishing . balance method. The water and electricity account for March 2015 amounting to R310, has not yet been paid. The insurance premium for April 2015 was paid in advance. The premiums are paid in equal monthly amounts. Interest at 10,5% per annum on the mortgage for March 2015 should still be provided for. Please note: ALL calculations must be shown. Your answer must comply with the requirements of International Financial Reporting Standards (IFRS) appropriate to the business of the entity. (12) 5.1 Calculate the total comprehensive income or loss of Moon Traders for the year ended 31 March 2015 (16) 5.2 Prepare the statement of financial position of Moon Traders as at 31 March 2015. - End of Question Paper in Accounting 1 QUESTION 5 (28 Marks) At 31 March 2015, Moon Traders had the following general ledger balances before adjustments were made: MOON TRADERS PRE-ADJUSTMENT BALANCES AT 31 MARCH 2015 Rental income Stationery Capital Drawings Accumulated depreciation: Equipment Commission income Credit losses Property (at fair value) Equipment (at cost) Bank (favorable) Trade receivables control Interest on mortgage Municipal tax R R64,000.00 R3,350.00 R149,000.00 R6,084.00 R15,000.00 R2,700.00 R1,600.00 R350,000.00 R34,000.00 R24,208.00 R26,100.00 R23,870.00 R4,333.00 Financial Accounting 1 Page 7 of 8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started