Answered step by step

Verified Expert Solution

Question

1 Approved Answer

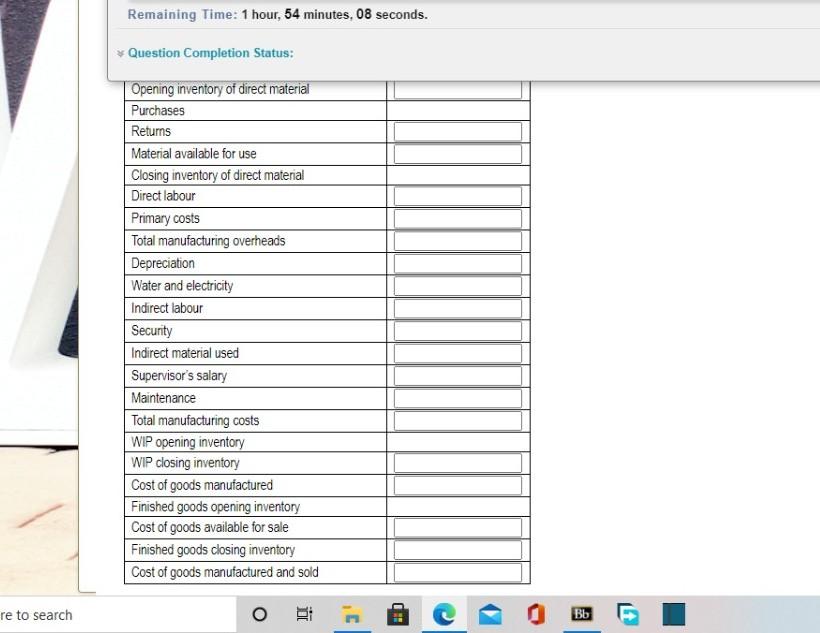

Old MathJax webview Remaining Time: 1 hour, 54 minutes, 08 seconds. Question Completion Status: Opening inventory of direct material Purchases Returns Material available for use

Old MathJax webview

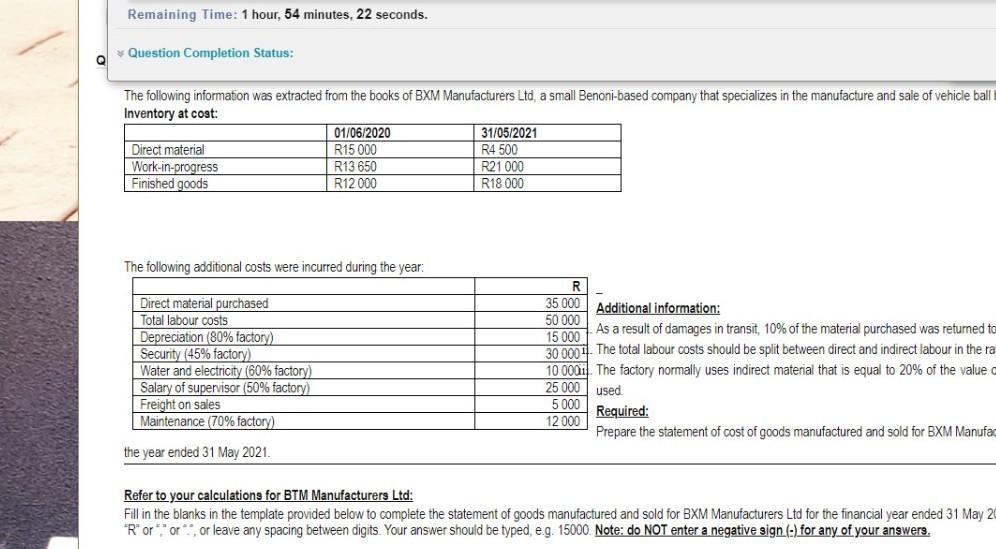

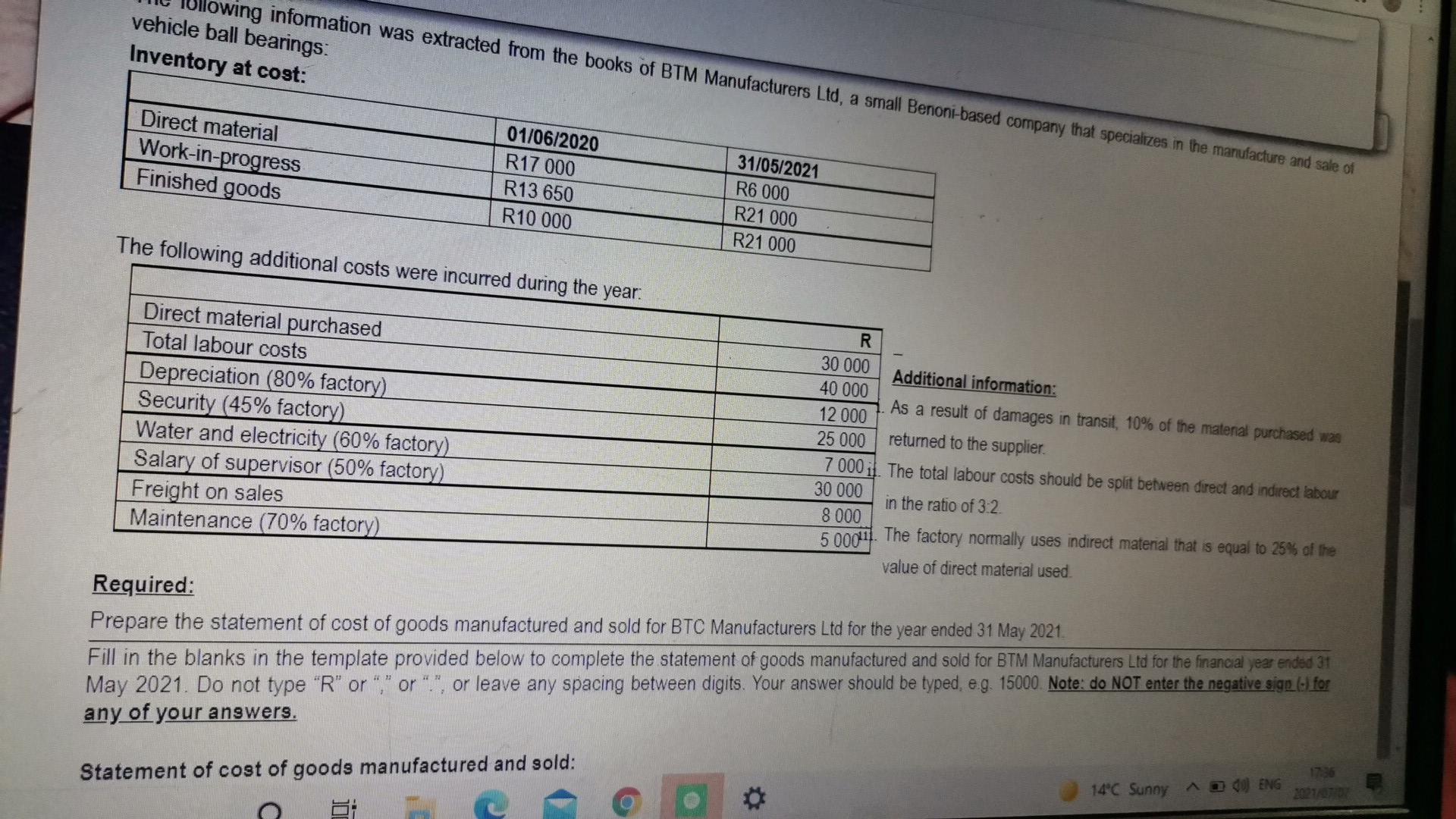

Remaining Time: 1 hour, 54 minutes, 08 seconds. Question Completion Status: Opening inventory of direct material Purchases Returns Material available for use Closing inventory of direct material Direct labour Primary costs Total manufacturing overheads Depreciation Water and electricity Indirect labour Security Indirect material used Supervisor's salary Maintenance Total manufacturing costs WIP opening inventory WIP closing inventory Cost of goods manufactured Finished goods opening inventory Cost of goods available for sale Finished goods closing inventory Cost of goods manufactured and sold re to search Bb Remaining Time: 1 hour, 54 minutes, 22 seconds. Question Completion Status: The following information was extracted from the books of BXM Manufacturers Ltd a small Benoni-based company that specializes in the manufacture and sale of vehicle ball Inventory at cost: 01/06/2020 31/05/2021 Direct material R15 000 R4 500 Work-in-progress R13 650 R21 000 Finished goods R12000 R18 000 The following additional costs were incurred during the year 50 000 Direct material purchased Total labour costs Depreciation (80% factory) Security (45% factory) Water and electricity (60% factory) Salary of supervisor (50% factory) Freight on sales Maintenance (70% factory) R 35 000 Additional information: 15 000 As a result of damages in transit, 10% of the material purchased was returned to 30 0001 The total labour costs should be split between direct and indirect labour in the ra 10 0001). The factory normally uses indirect material that is equal to 20% of the value o 25 000 used 5 000 Required: 12 000 Prepare the statement of cost of goods manufactured and sold for BXM Manufa the year ended 31 May 2021. Refer to your calculations for BTM Manufacturers Ltd: Fill in the blanks in the template provided below to complete the statement of goods manufactured and sold for BXM Manufacturers Ltd for the financial year ended 31 May 2 "R" or "or, or leave any spacing between digits. Your answer should be typed, e.g. 15000 Note: do NOT enter a negative sign (-) for any of your answers. ving information was extracted from the books of BTM Manufacturers Ltd, a small Benon-based company that specializes in the manufacture and sale of vehicle ball bearings: Inventory at cost: 01/06/2020 31/05/2021 Direct material R17 000 R6 000 Work-in-progress R13 650 R21 000 Finished goods R10 000 R21 000 The following additional costs were incurred during the year. Direct material purchased Total labour costs Depreciation (80% factory) Security (45% factory) Water and electricity (60% factory) Salary of supervisor (50% factory) Freight on sales Maintenance 70% factory) R 30 000 Additional information: 40 000 As a result of damages in transit, 10% of the matenal purchased was 12 000 25 000 returned to the supplier. 7000 il. The total labour costs should be split between direct and indirect labour 30 000 in the ratio of 3.2 8 000 50001. The factory normally uses indirect material that is equal to 25% of the value of direct material used. Required: Prepare the statement of cost of goods manufactured and sold for BTC Manufacturers Ltd for the year ended 31 May 2021 Fill in the blanks in the template provided below to complete the statement of goods manufactured and sold for BTM Manufacturers Ltd for the financial year ended 31 May 2021. Do not type "R" or "," or ".", or leave any spacing between digits. Your answer should be typed, e.g. 15000. Note: do NOT enter the negative sige (-) for any of your answers. Statement of cost of goods manufactured and sold: 1736 14C Sunny A) ENG

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started