Answered step by step

Verified Expert Solution

Question

1 Approved Answer

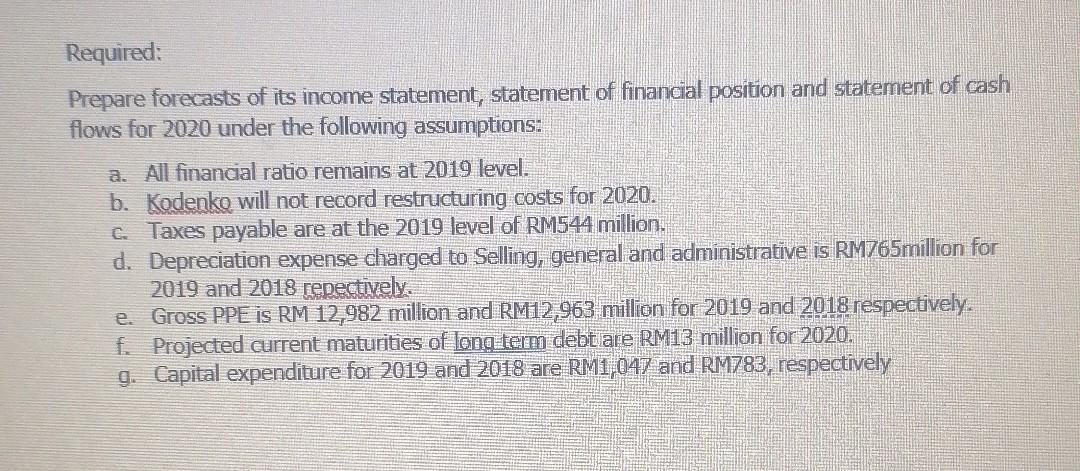

Old MathJax webview Required: Prepare forecasts of its income statement, statement of financial position and statement of cash flows for 2020 under the following assumptions:

Old MathJax webview

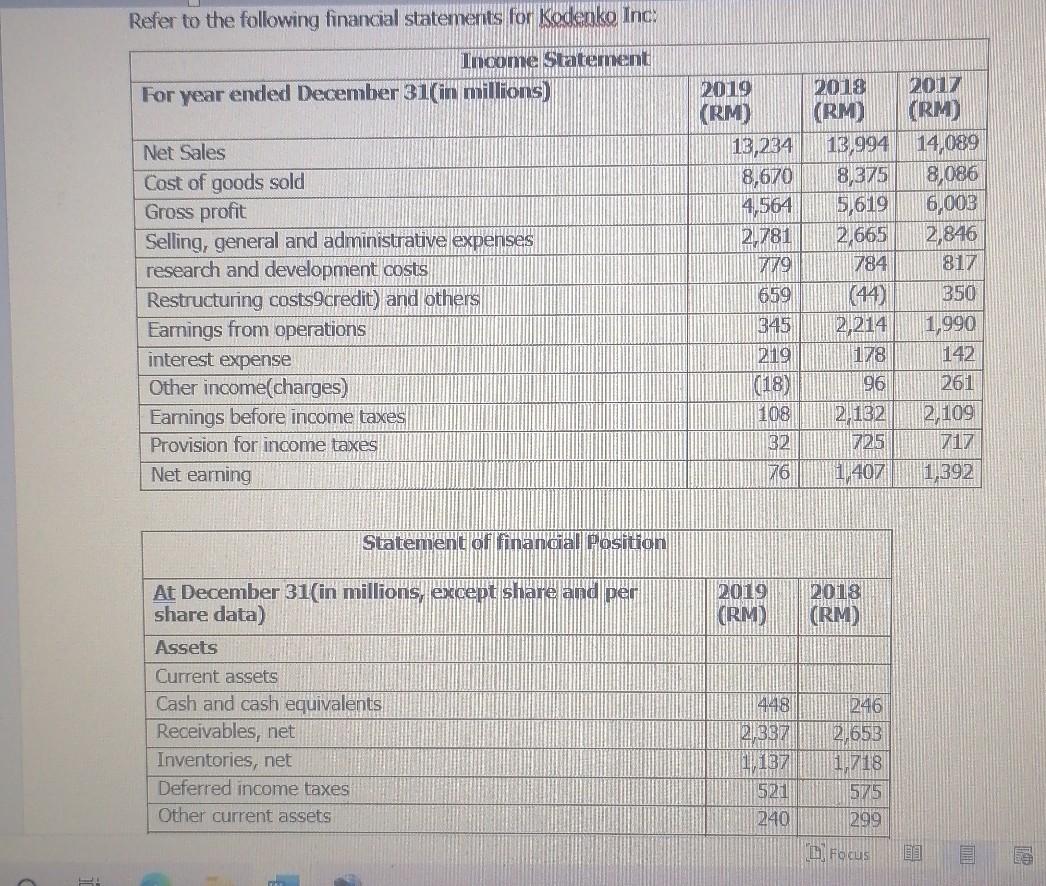

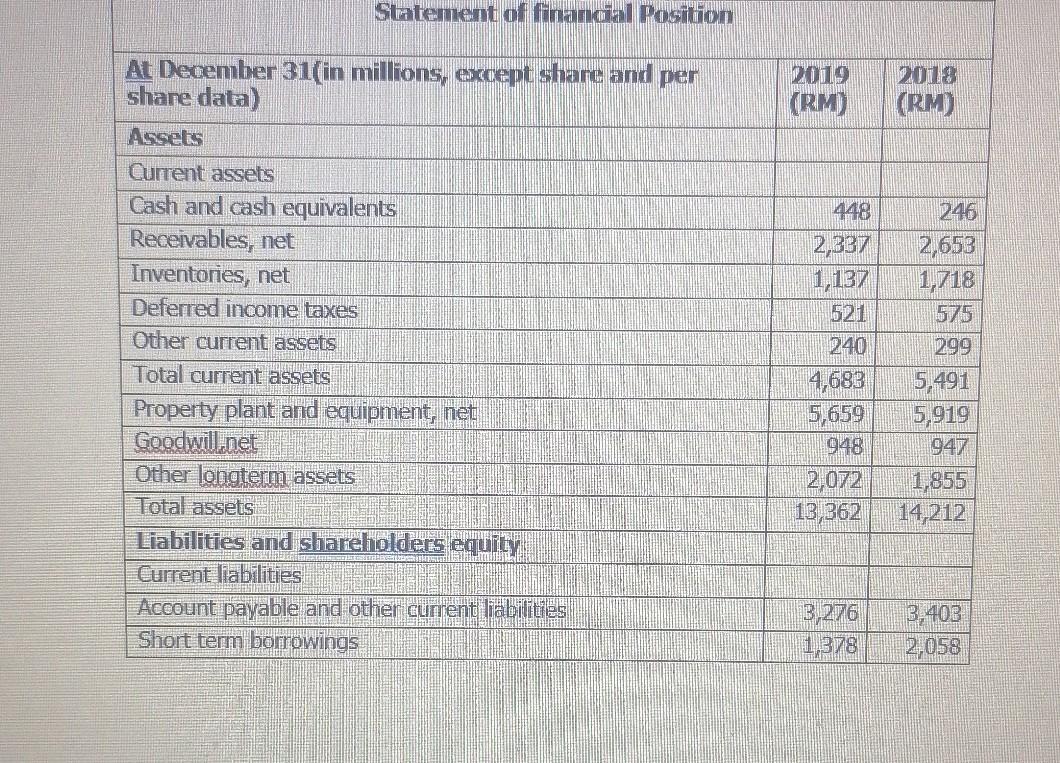

Required: Prepare forecasts of its income statement, statement of financial position and statement of cash flows for 2020 under the following assumptions: a. All financial ratio remains at 2019 level. b. Kodenko will not record restructuring costs for 2020. C. Taxes payable are at the 2019 level of RM544 million. d. Depreciation expense charged to Selling, general and administrative is RM765million for 2019 and 2018 repectively. e. Gross PPE is RM 12,982 million and RM12,963 million for 2019 and 2018 respectively. f. Projected current maturities of long term debt are RM13 million for 2020. g. Capital expenditure for 2019 and 2018 are RM1,047 and RM783, respectively Refer to the following financial statements for Kodenko Inc: Income Statement For year ended December 31(in millions) 2018 (RM) 13,994 8,375 5,619 2,665 784 Net Sales Cost of goods sold Gross profit Selling, general and administrative expenses research and development costs Restructuring costs9credit) and others Earnings from operations interest expense Other income(charges) Earnings before income taxes Provision for income taxes Net earning 2019 (RM) 13,234 8,670 4,564 2.781 779 659 345 219 (18) 108 32 76 2017 (RM) 14,089 8,086 6,003 2,846 817 350 1,990 142 261 2.109 717 1,392 (44) 2,214 178 96 2 132 725 1 407 Statement of financial Position 2019 (RM) 2018 (RM) At December 31(in millions, except share and per share data) Assets Current assets Cash and cash equivalents Receivables, net Inventories, net Deferred income taxes Other current assets 448 246 PUBBZ 2.653 1,137 11.718 521 5715 240 299 D) Focus Statement of finandal Position 2019 (RM) 2018 (RM) At December 31(in millions, except share and per share data) Assets Current assets Cash and cash equivalents Receivables, net Inventories, net Deferred income taxes Other current assets Total current assets Property plant and equipment, net Goodwill.net Other longterm assets Total assets Liabilities and shareholders equity Current liabilities Account payable and other current liabilities Short term borrowings 448 2,337 1,137 521 240 4,683 5,659 948 2,072 13,362 246 2,653 1,718 575 299 5.491 5,919 947 1,855 14,212 3,403 2,058 1,378 Required: Prepare forecasts of its income statement, statement of financial position and statement of cash flows for 2020 under the following assumptions: a. All financial ratio remains at 2019 level. b. Kodenko will not record restructuring costs for 2020. C. Taxes payable are at the 2019 level of RM544 million. d. Depreciation expense charged to Selling, general and administrative is RM765million for 2019 and 2018 repectively. e. Gross PPE is RM 12,982 million and RM12,963 million for 2019 and 2018 respectively. f. Projected current maturities of long term debt are RM13 million for 2020. g. Capital expenditure for 2019 and 2018 are RM1,047 and RM783, respectively Refer to the following financial statements for Kodenko Inc: Income Statement For year ended December 31(in millions) 2018 (RM) 13,994 8,375 5,619 2,665 784 Net Sales Cost of goods sold Gross profit Selling, general and administrative expenses research and development costs Restructuring costs9credit) and others Earnings from operations interest expense Other income(charges) Earnings before income taxes Provision for income taxes Net earning 2019 (RM) 13,234 8,670 4,564 2.781 779 659 345 219 (18) 108 32 76 2017 (RM) 14,089 8,086 6,003 2,846 817 350 1,990 142 261 2.109 717 1,392 (44) 2,214 178 96 2 132 725 1 407 Statement of financial Position 2019 (RM) 2018 (RM) At December 31(in millions, except share and per share data) Assets Current assets Cash and cash equivalents Receivables, net Inventories, net Deferred income taxes Other current assets 448 246 PUBBZ 2.653 1,137 11.718 521 5715 240 299 D) Focus Statement of finandal Position 2019 (RM) 2018 (RM) At December 31(in millions, except share and per share data) Assets Current assets Cash and cash equivalents Receivables, net Inventories, net Deferred income taxes Other current assets Total current assets Property plant and equipment, net Goodwill.net Other longterm assets Total assets Liabilities and shareholders equity Current liabilities Account payable and other current liabilities Short term borrowings 448 2,337 1,137 521 240 4,683 5,659 948 2,072 13,362 246 2,653 1,718 575 299 5.491 5,919 947 1,855 14,212 3,403 2,058 1,378

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started