Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview SAMA's Distributors has appointed a new warehouse manager to assist with the re-organising of their infrastructure to increase their competitiveness. The firm's

Old MathJax webview

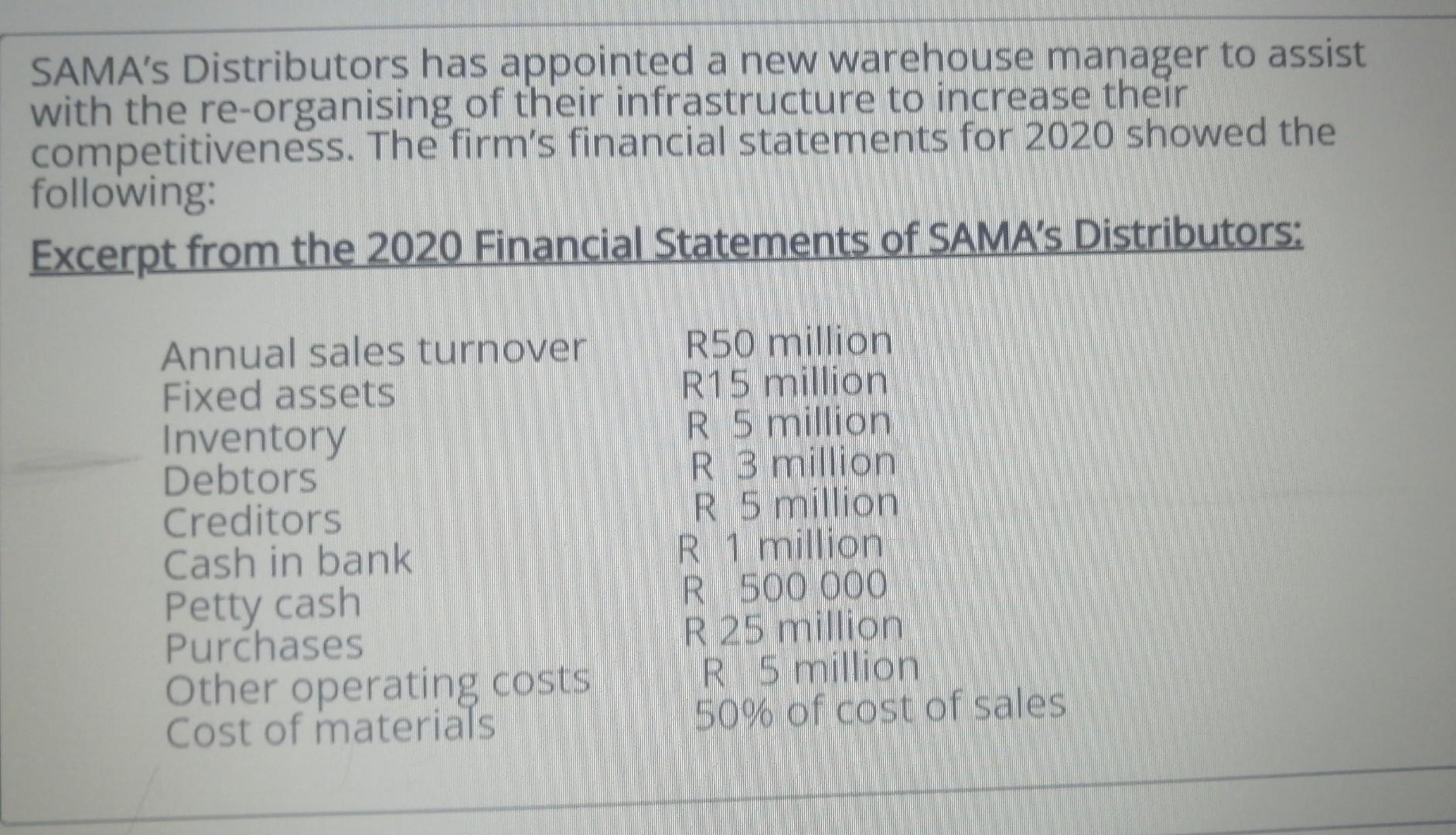

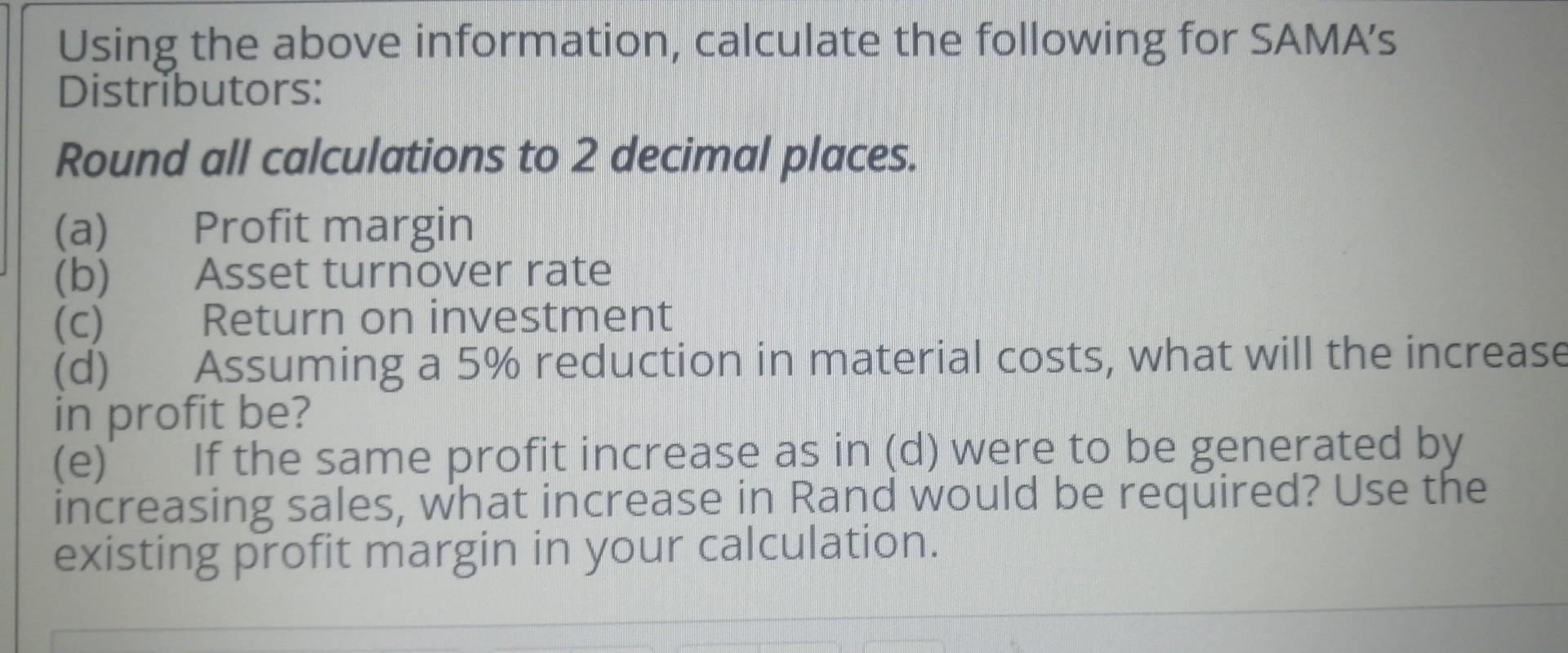

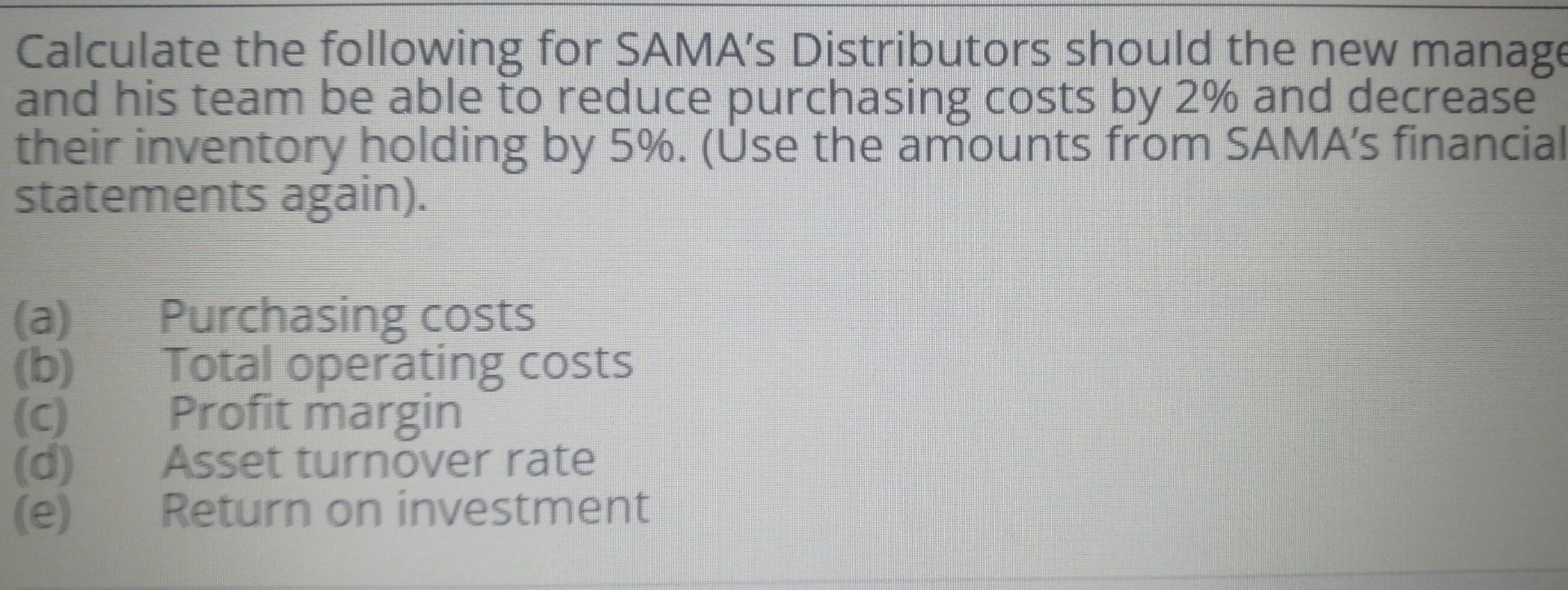

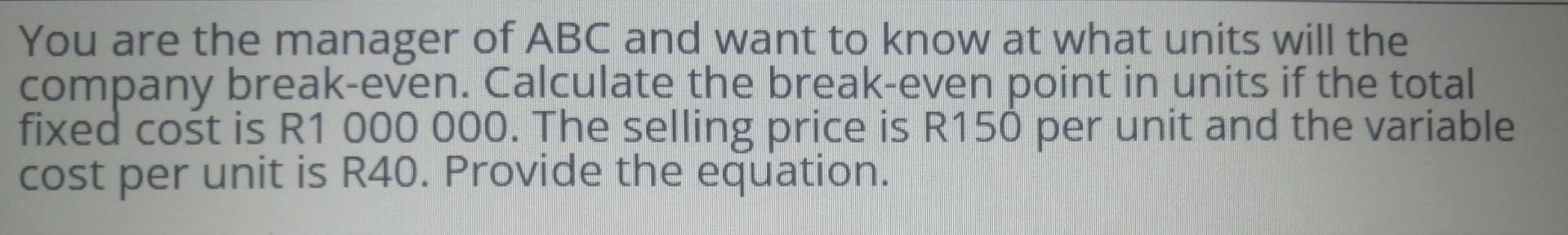

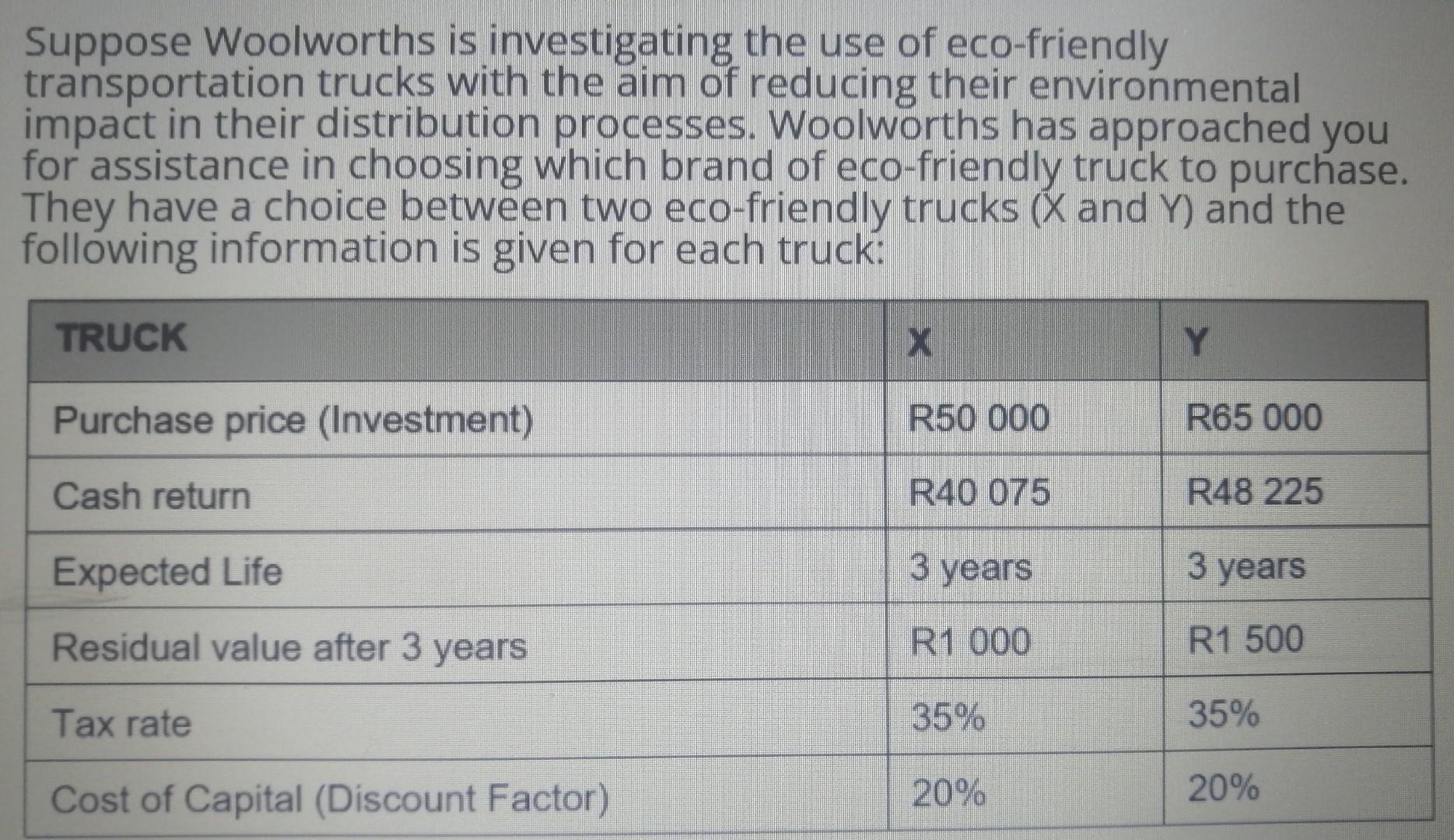

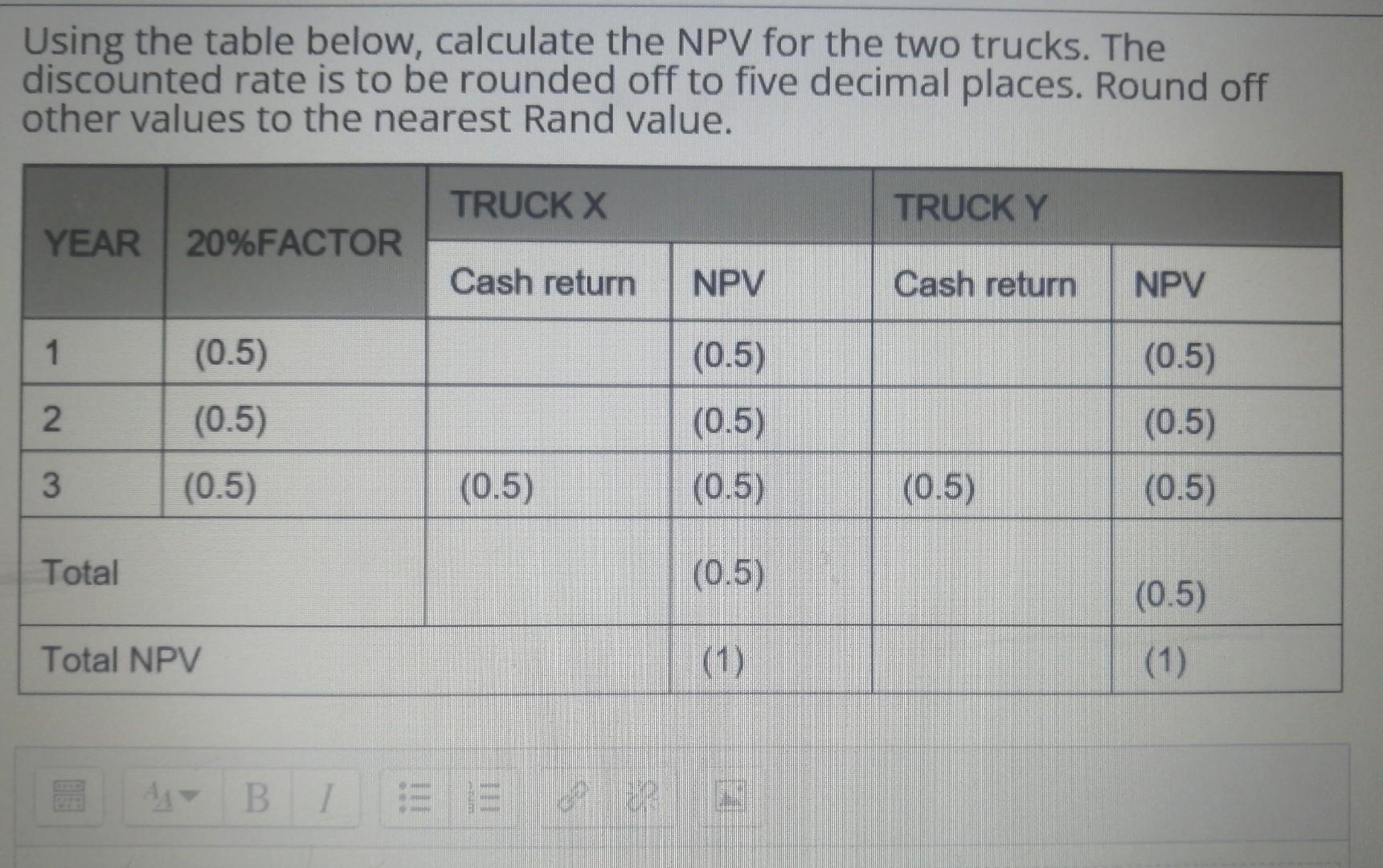

SAMA's Distributors has appointed a new warehouse manager to assist with the re-organising of their infrastructure to increase their competitiveness. The firm's financial statements for 2020 showed the following: Excerpt from the 2020 Financial Statements of SAMA's Distributors: Annual sales turnover Fixed assets Inventory Debtors Creditors Cash in bank Petty cash Purchases Other operating costs Cost of materials R50 million R15 million R 5 million R 3 million R 5 million R 1 million R 500 000 R 25 million R 5 million 50% of cost of sales Using the above information, calculate the following for SAMA's Distributors: Round all calculations to 2 decimal places. (a) Profit margin (b) Asset turnover rate (C) Return on investment (d) Assuming a 5% reduction in material costs, what will the increase in profit be? (e) If the same profit increase as in (d) were to be generated by increasing sales, what increase in Rand would be required? Use the existing profit margin in your calculation. Calculate the following for SAMA's Distributors should the new manage and his team be able to reduce purchasing costs by 2% and decrease their inventory holding by 5%. (Use the amounts from SAMA's financial statements again). (a) (b) (c) (d) (e) Purchasing costs Total operating costs Profit margin Asset turnover rate Return on investment You are the manager of ABC and want to know at what units will the company break-even. Calculate the break-even point in units if the total fixed cost is R1 000 000. The selling price is R150 per unit and the variable cost per unit is R40. Provide the equation. Suppose Woolworths is investigating the use of eco-friendly transportation trucks with the aim of reducing their environmental impact in their distribution processes. Woolworths has approached you for assistance in choosing which brand of eco-friendly truck to purchase. They have a choice between two eco-friendly trucks ( and Y) and the following information is given for each truck: TRUCK x Y Purchase price (Investment) R50 000 R65 000 Cash return R40 075 R48 225 Expected Life 3 years 3 years Residual value after 3 years R1 000 R1 500 Tax rate 35% 35% Cost of Capital (Discount Factor) 20% 20% Using the table below, calculate the NPV for the two trucks. The discounted rate is to be rounded off to five decimal places. Round off other values to the nearest Rand value. TRUCKX TRUCK Y YEAR 20%FACTOR Cash return NPV Cash return NPV 1 (0.5) (0.5) (0.5) (0.5) N (0.5) (0.5) 3 (0.5) (0.5) (0.5) () (0.5) (0.5) Total (0.5) (0.5) Total NPV (1) (1) 4 B 1 = = SAMA's Distributors has appointed a new warehouse manager to assist with the re-organising of their infrastructure to increase their competitiveness. The firm's financial statements for 2020 showed the following: Excerpt from the 2020 Financial Statements of SAMA's Distributors: Annual sales turnover Fixed assets Inventory Debtors Creditors Cash in bank Petty cash Purchases Other operating costs Cost of materials R50 million R15 million R 5 million R 3 million R 5 million R 1 million R 500 000 R 25 million R 5 million 50% of cost of sales Using the above information, calculate the following for SAMA's Distributors: Round all calculations to 2 decimal places. (a) Profit margin (b) Asset turnover rate (C) Return on investment (d) Assuming a 5% reduction in material costs, what will the increase in profit be? (e) If the same profit increase as in (d) were to be generated by increasing sales, what increase in Rand would be required? Use the existing profit margin in your calculation. Calculate the following for SAMA's Distributors should the new manage and his team be able to reduce purchasing costs by 2% and decrease their inventory holding by 5%. (Use the amounts from SAMA's financial statements again). (a) (b) (c) (d) (e) Purchasing costs Total operating costs Profit margin Asset turnover rate Return on investment You are the manager of ABC and want to know at what units will the company break-even. Calculate the break-even point in units if the total fixed cost is R1 000 000. The selling price is R150 per unit and the variable cost per unit is R40. Provide the equation. Suppose Woolworths is investigating the use of eco-friendly transportation trucks with the aim of reducing their environmental impact in their distribution processes. Woolworths has approached you for assistance in choosing which brand of eco-friendly truck to purchase. They have a choice between two eco-friendly trucks ( and Y) and the following information is given for each truck: TRUCK x Y Purchase price (Investment) R50 000 R65 000 Cash return R40 075 R48 225 Expected Life 3 years 3 years Residual value after 3 years R1 000 R1 500 Tax rate 35% 35% Cost of Capital (Discount Factor) 20% 20% Using the table below, calculate the NPV for the two trucks. The discounted rate is to be rounded off to five decimal places. Round off other values to the nearest Rand value. TRUCKX TRUCK Y YEAR 20%FACTOR Cash return NPV Cash return NPV 1 (0.5) (0.5) (0.5) (0.5) N (0.5) (0.5) 3 (0.5) (0.5) (0.5) () (0.5) (0.5) Total (0.5) (0.5) Total NPV (1) (1) 4 B 1 = =

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started