Question

Old MathJax webview The case study states that the project team conducted a qualitative risk assessment for the project. Summarise at least 5 reasons why

Old MathJax webview

The case study states that the project team conducted a qualitative risk assessment for the project. Summarise at least 5 reasons why the project undertook a qualitative approach for such an important decision? (5 marks) Responses must relate to the case study and should not be generic as provided in the module Quantitative risk modelling to obtain a realistic risk-adjusted project valuation A large opencast gold mining company in Africa completed a feasibility study for the expansion of the operations. The expansion would not only increase the milling (processing) capacity of the plant but would create the ability for the mine to process varying granularity of materials, which would allow flexibility to treat material more optimally by removing blending (mixing) constraints. The project team had conducted a traditional Net Present Value (NPV) project appraisal that showed a very positive project valuation. This means that the project was viable and is worth undertaking. The project team had conducted a qualitative risk assessment that identified and logged all potential project risks. It also subjectively incorporated risk via the discount rate and other assumption contingencies around gold price expectations, operating parameters and other variables. The company executive management requested that an independent project valuation be undertaken that also incorporated a quantitative view of the underlying projects risks and how this impacted the project valuation and confidence level in the valuation. Therefore, an independent quantitative risk modelling approach was adopted to obtain a better understanding of the impact of risk on the overall project valuation and confidence level in the final valuation. The independent assessment of project valuation must include a quantitative assessment of the underlying project risks associated with the operational, project, and external price parameters. A detailed project valuation model was configured in the Carbon Modelling Technology and the stochastic modelling module used to perform the Monte Carlo simulations. Analysis of historical operational performance data relating to actual achievements versus planned and budget determined the historical variability of the underlying parameters as well as variance to budget. This was done at a detailed level for mining rates and costs, processing rate, costs and recovery, and other operational efficiency measures. External market assumptions relating to gold price, exchange rate, and inflation were modelled and the dependency between them modelled using a copula. The Model The project team had undertaken a traditional NPV-based project valuation where the underlying production, operational, capital, and external market assumption variables were combined into a mathematical model to generate a cash flow forecast that was discounted using an agreed hurdle rate to calculate an NPV. Operational inputs into the model included Life-of-mine tonnage profile and associated grades incorporating expected deviations from the plan within specific parameters, mining activity costs, labour costs associated with the mining activities, plant recoveries, including the plants failure rates and consequent timing implications relating to stockpiling, processing activity costs and labour costs associated with the processing activities. The following external market parameters were modelled using a copula, which is an actuarial technique that models the dependency and non-linear relationship between variables including interest rates, exchange rates, inflation rates and commodity prices. A mathematical model of the underlying dynamics of the mining and processing activities was built to accurately depict the cash flow from the operation considering the operating parameters. This model was built and the stochastic module was utilised for the Monte Carlo simulation. A monthly model was built for the life of mine in real money terms (i.e., in todays money) and excluded any tax calculations. The final output of the model was a discounted cash flow and NPV. Results The model ran 10,000 iterations for each simulation run and the results were analysed. The results of the simulations show the risk-adjusted valuation of the current operation as well as the impact of expanding the operation and the likely range of NPV results. This would allow management to assess the effects of the expansion on the risk as well as the upside potential. In order to practically assess the level of risk associated with the project, some measures were used that can intuitively and theoretically capture the risks that management are concerned about. Three measures of risk were therefore chosen which, while they may not be completely coherent in the mathematical sense (Artzner et al., 1999), they provide intuitive quantification of the risks associated with the mine. These are:

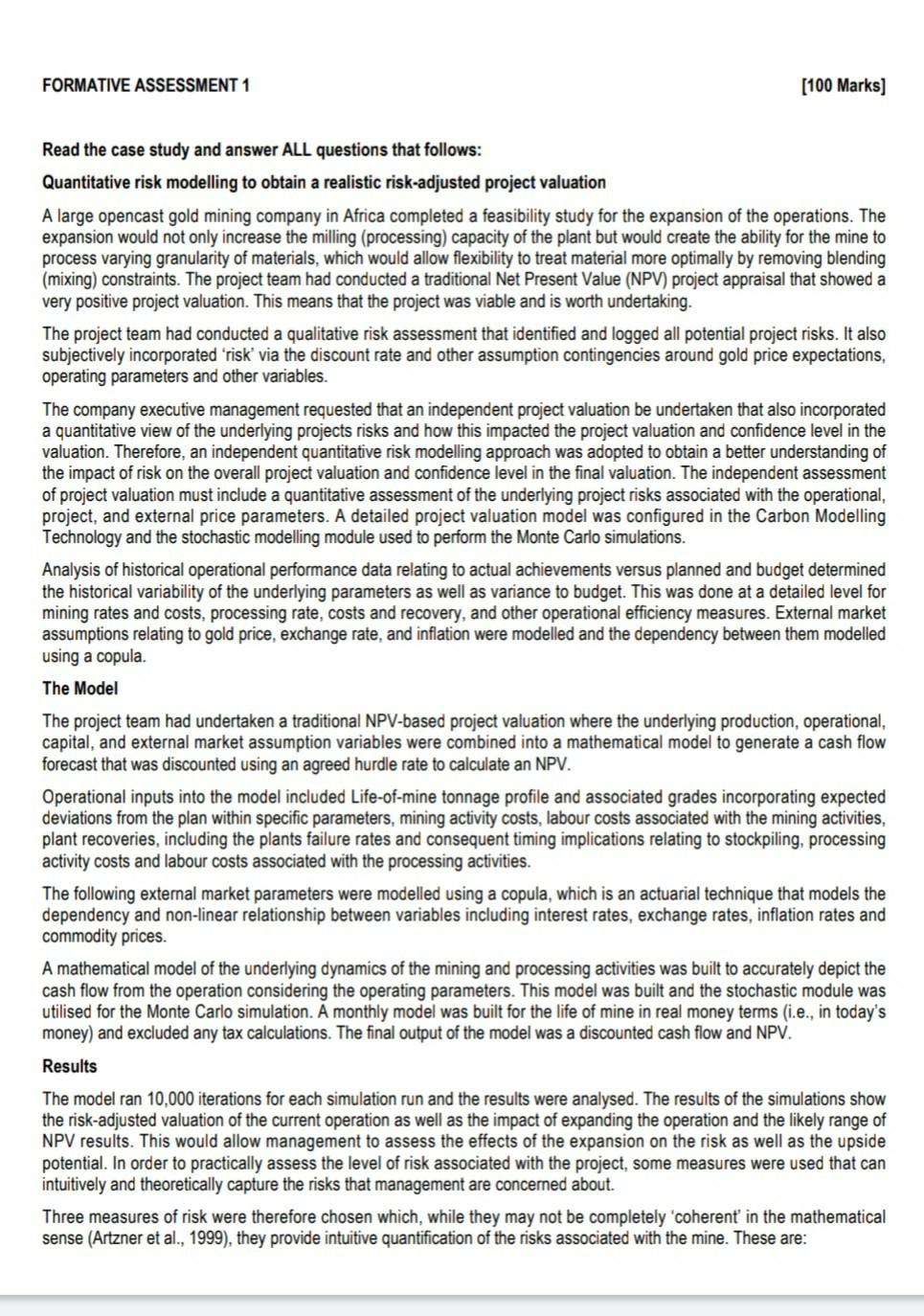

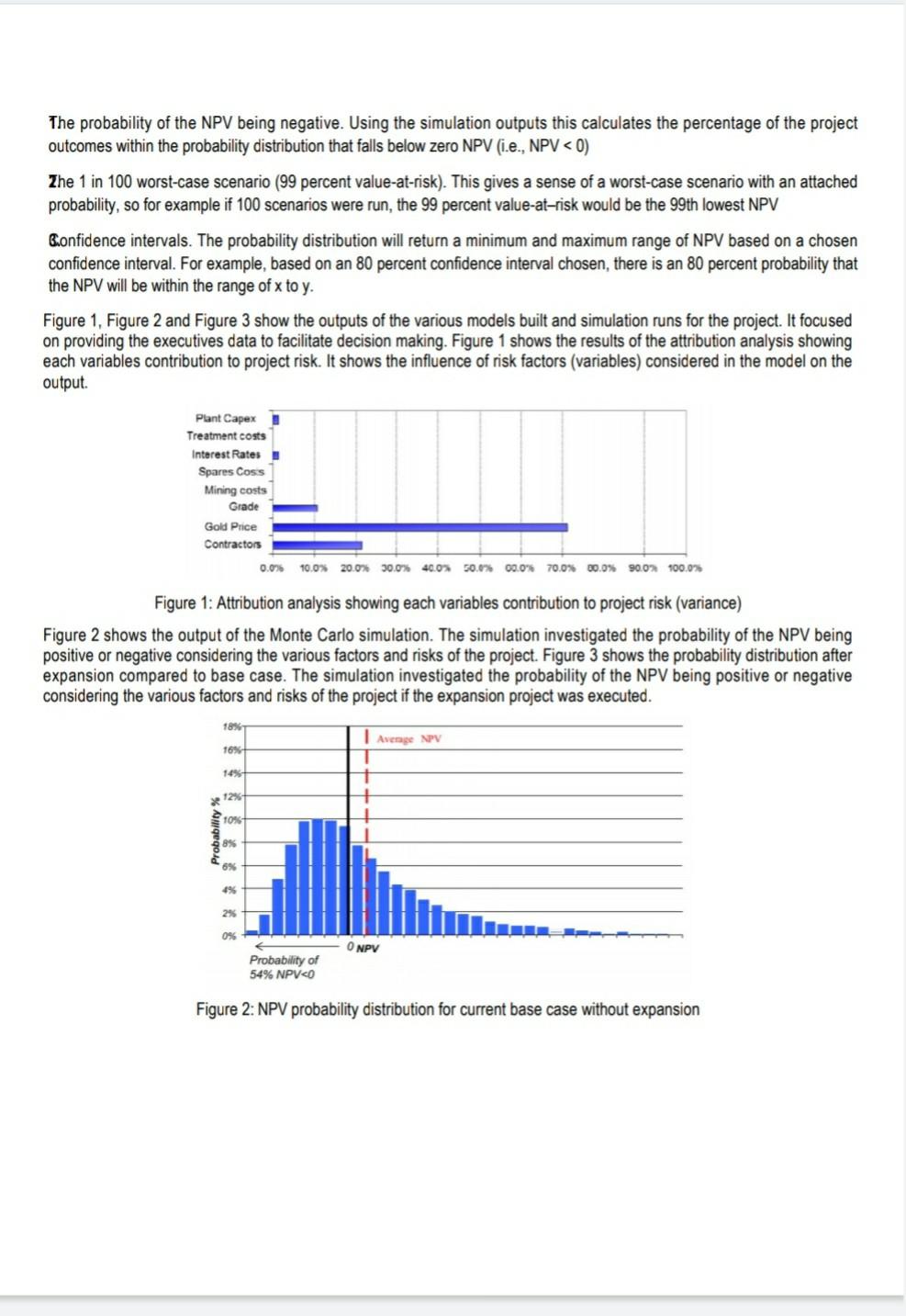

FORMATIVE ASSESSMENT 1 [100 Marks] Read the case study and answer ALL questions that follows: Quantitative risk modelling to obtain a realistic risk-adjusted project valuation A large opencast gold mining company in Africa completed a feasibility study for the expansion of the operations. The expansion would not only increase the milling (processing) capacity of the plant but would create the ability for the mine to process varying granularity of materials, which would allow flexibility to treat material more optimally by removing blending (mixing) constraints. The project team had conducted a traditional Net Present Value (NPV) project appraisal that showed a very positive project valuation. This means that the project was viable and is worth undertaking. The project team had conducted a qualitative risk assessment that identified and logged all potential project risks. It also subjectively incorporated 'risk' via the discount rate and other assumption contingencies around gold price expectations, operating parameters and other variables. The company executive management requested that an independent project valuation be undertaken that also incorporated a quantitative view of the underlying projects risks and how this impacted the project valuation and confidence level in the valuation. Therefore, an independent quantitative risk modelling approach was adopted to obtain a better understanding of the impact of risk on the overall project valuation and confidence level in the final valuation. The independent assessment of project valuation must include a quantitative assessment of the underlying project risks associated with the operational, project, and external price parameters. A detailed project valuation model was configured in the Carbon Modelling Technology and the stochastic modelling module used to perform the Monte Carlo simulations. Analysis of historical operational performance data relating to actual achievements versus planned and budget determined the historical variability of the underlying parameters as well as variance to budget. This was done at a detailed level for mining rates and costs, processing rate, costs and recovery, and other operational efficiency measures. External market assumptions relating to gold price, exchange rate, and inflation were modelled and the dependency between them modelled using a copula. The Model The project team had undertaken a traditional NPV-based project valuation where the underlying production, operational, capital, and external market assumption variables were combined into a mathematical model to generate a cash flow forecast that was discounted using an agreed hurdle rate to calculate an NPV. Operational inputs into the model included Life-of-mine tonnage profile and associated grades incorporating expected deviations from the plan within specific parameters, mining activity costs, labour costs associated with the mining activities, plant recoveries, including the plants failure rates and consequent timing implications relating to stockpiling, processing activity costs and labour costs associated with the processing activities. The following external market parameters were modelled using a copula, which is an actuarial technique that models the dependency and non-linear relationship between variables including interest rates, exchange rates, inflation rates and commodity prices. A mathematical model of the underlying dynamics of the mining and processing activities was built to accurately depict the cash flow from the operation considering the operating parameters. This model was built and the stochastic module was utilised for the Monte Carlo simulation. A monthly model was built for the life of mine in real money terms (i.e., in today's money) and excluded any tax calculations. The final output of the model was a discounted cash flow and NPV. Results The model ran 10,000 iterations for each simulation run and the results were analysed. The results of the simulations show the risk-adjusted valuation of the current operation as well as the impact of expanding the operation and the likely range of NPV results. This would allow management to assess the effects of the expansion on the risk as well as the upside potential. In order to practically assess the level of risk associated with the project, some measures were used that can intuitively and theoretically capture the risks that management are concerned about. Three measures of risk were therefore chosen which, while they may not be completely 'coherent in the mathematical sense (Artzner et al., 1999), they provide intuitive quantification of the risks associated with the mine. These are: The probability of the NPV being negative. Using the simulation outputs this calculates the percentage of the project outcomes within the probability distribution that falls below zero NPV (i.e., NPV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started