Answered step by step

Verified Expert Solution

Question

1 Approved Answer

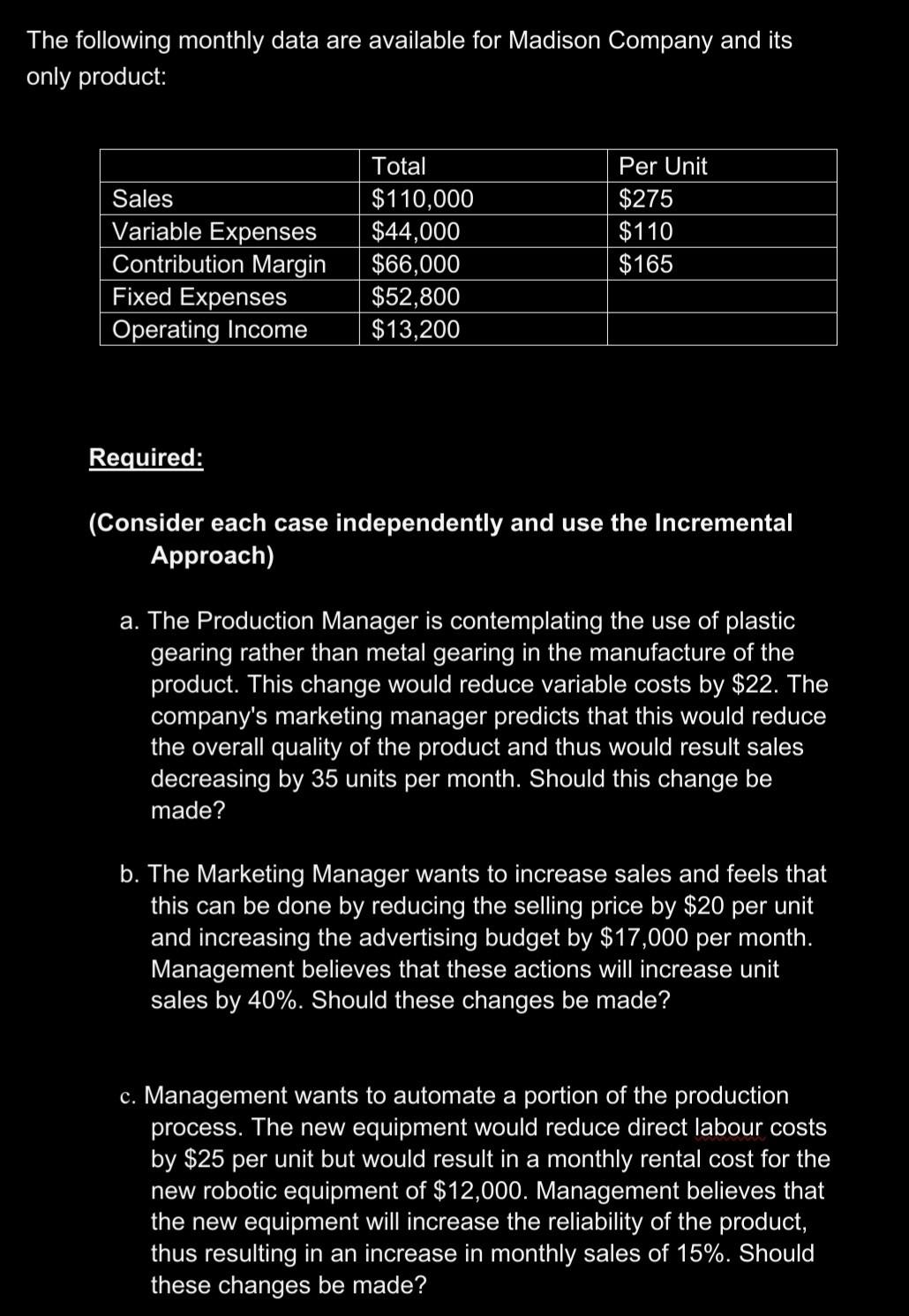

Old MathJax webview The following monthly data are available for Madison Company and its only product: Total Per Unit Sales $110,000 $44,000 $66,000 $52,800 $13,200

Old MathJax webview

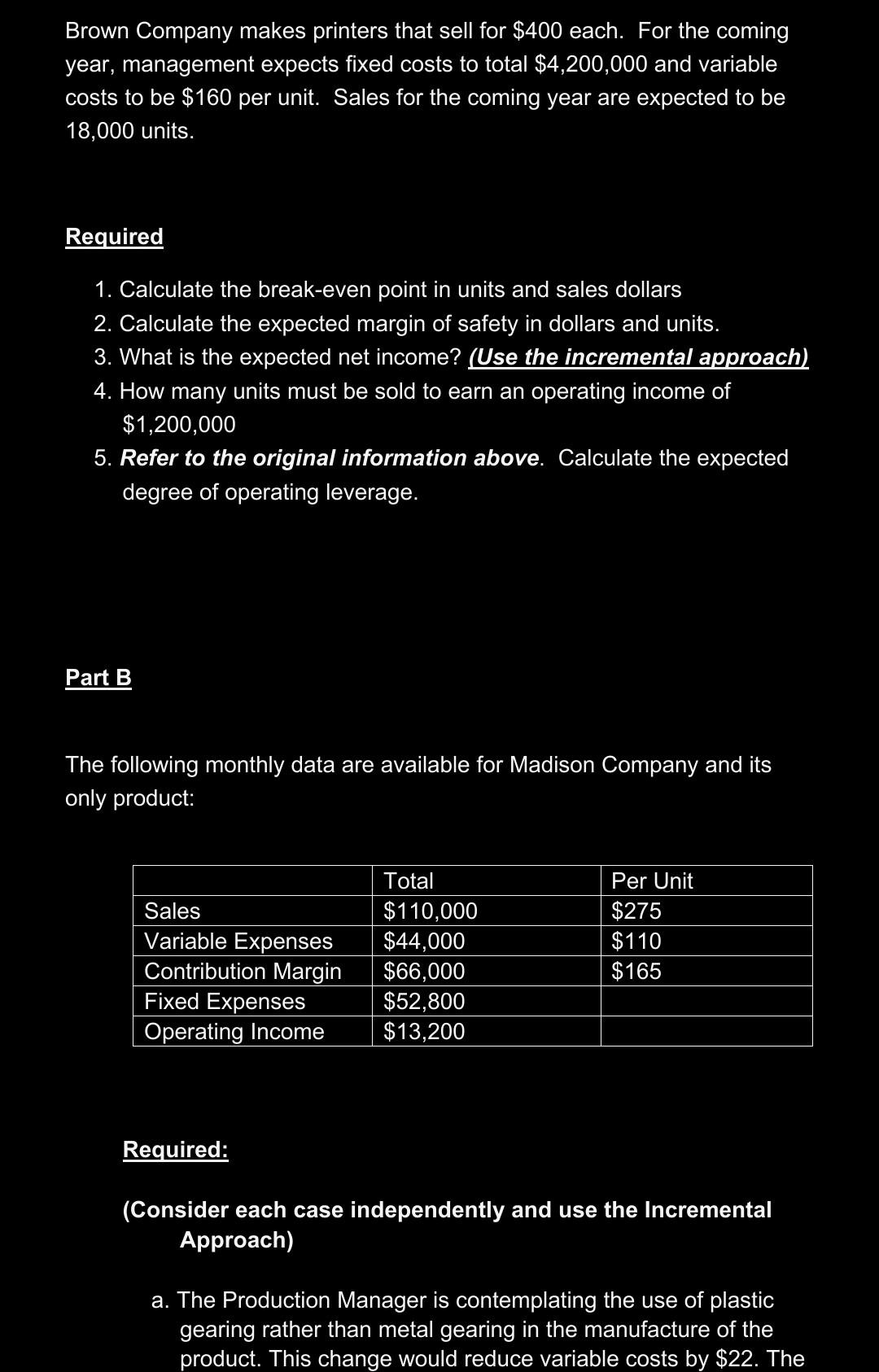

The following monthly data are available for Madison Company and its only product: Total Per Unit Sales $110,000 $44,000 $66,000 $52,800 $13,200 $275 $110 $165 Variable Expenses Contribution Margin Fixed Expenses Operating Income Required: (Consider each case independently and use the Incremental Approach) a. The Production Manager is contemplating the use of plastic gearing rather than metal gearing in the manufacture of the product. This change would reduce variable costs by $22. The company's marketing manager predicts that this would reduce the overall quality of the product and thus would result sales decreasing by 35 units per month. Should this change be made? b. The Marketing Manager wants to increase sales and feels that this can be done by reducing the selling price by $20 per unit and increasing the advertising budget by $17,000 per month. Management believes that these actions will increase unit sales by 40%. Should these changes be made? c. Management wants to automate a portion of the production process. The new equipment would reduce direct labour costs by $25 per unit but would result in a monthly rental cost for the new robotic equipment of $12,000. Management believes that the new equipment will increase the reliability of the product, thus resulting in an increase in monthly sales of 15%. Should these changes be made? Brown Company makes printers that sell for $400 each. For the coming year, management expects fixed costs to total $4,200,000 and variable costs to be $160 per unit. Sales for the coming year are expected to be 18,000 units. Required 1. Calculate the break-even point in units and sales dollars 2. Calculate the expected margin of safety in dollars and units. 3. What is the expected net income? (Use the incremental approach) 4. How many units must be sold to earn an operating income of $1,200,000 5. Refer to the original information above. Calculate the expected degree of operating leverage. Part B The following monthly data are available for Madison Company and its only product: Total Sales Per Unit $275 $110 $165 $110,000 $44,000 $66,000 $52,800 $13,200 Variable Expenses Contribution Margin Fixed Expenses Operating Income Required: (Consider each case independently and use the Incremental Approach) a. The Production Manager is contemplating the use of plastic gearing rather than metal gearing in the manufacture of the product. This change would reduce variable costs by $22. The

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started