Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview The question pic and supporting details provided below. Thankyou.. The figure in the excel are the same which are provided.. below Using

Old MathJax webview

The question pic and supporting details provided below. Thankyou..

The figure in the excel are the same which are provided.. below

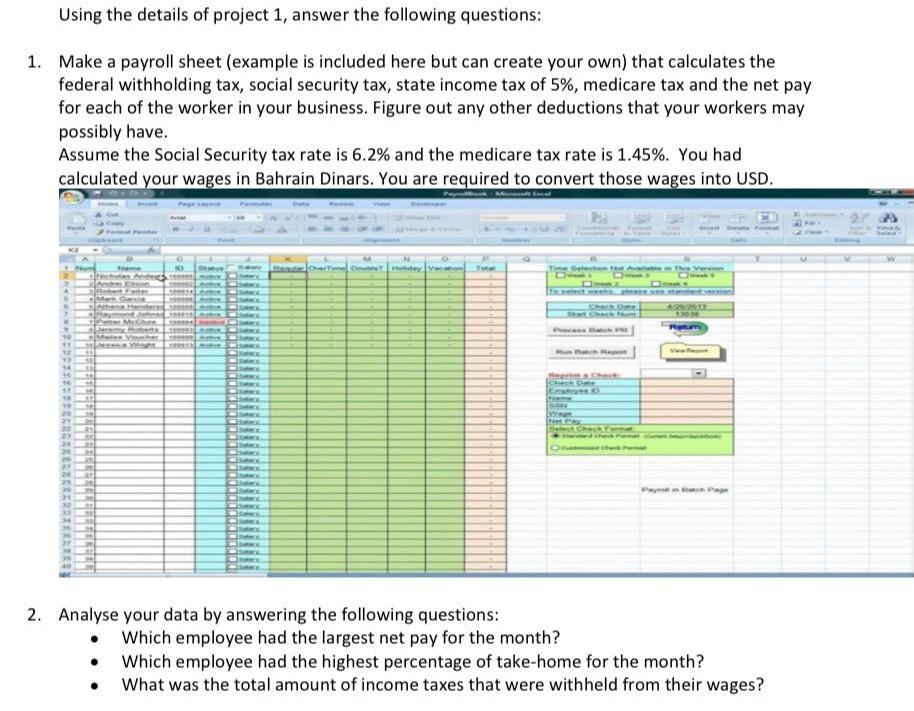

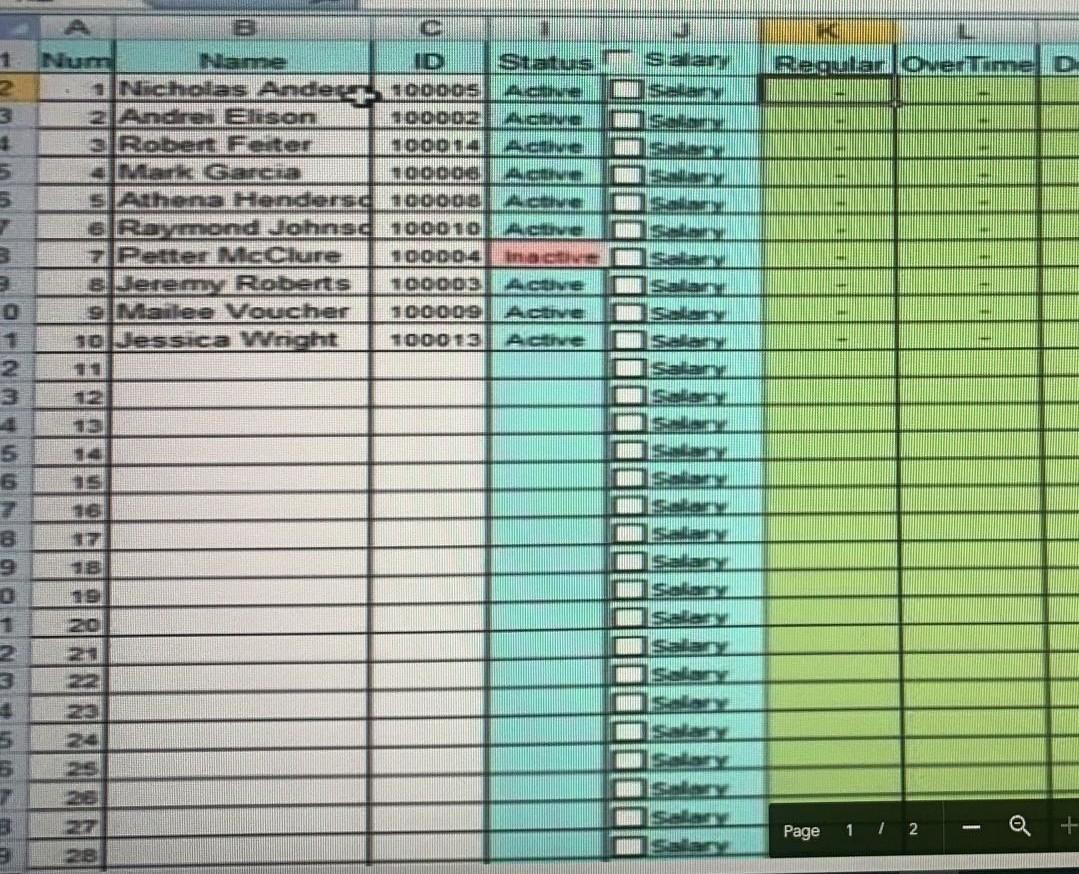

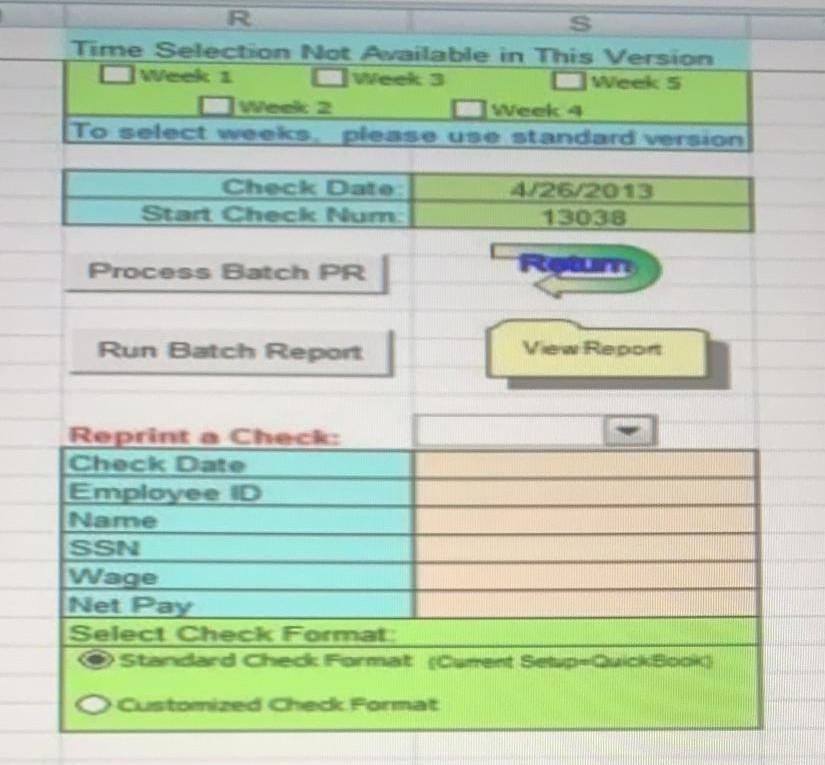

Using the details of project 1, answer the following questions: 1. Make a payroll sheet (example is included here but can create your own) that calculates the federal withholding tax, social security tax, state income tax of 5%, medicare tax and the net pay for each of the worker in your business. Figure out any other deductions that your workers may possibly have. Assume the Social Security tax rate is 6.2% and the medicare tax rate is 1.45%. You had calculated your wages in Bahrain Dinars. You are required to convert those wages into USD. PA La M + ** 22 2. Analyse your data by answering the following questions: Which employee had the largest net pay for the month? Which employee had the highest percentage of take-home for the month? What was the total amount of income taxes that were withheld from their wages? NO Regular OverTime D Num hamme ID Status salary 2 1 Nicholas Andegg 100005 Lee SEN 3 2 Andre Elisan 10000 2 Robert Ferter 10004 ACIC 5 Marlie Garcia POONOONEL 5 SLAthena Hendersd 100008 E Raymond Johnsd 100010 3 7 Peuter McClure 100004 Image 3 8 Jeremy Roberts 10001013 Ge S. 9 Mailee Voucher 100009 Ace SELAIN 10 Jessica Winght 100013 Active Selany 1. 3 SD 5 6 316 ST 6 9 18 Salon See 1 22 SOLO SA Un 25 5 T UUUUUU Sy SALAT Selag Page 1 I 2 3 R S Time Selection Not Available in This Version week 1 week 3 Week 5 week 2 week To select weekes please use standard Version Check Date Start Check Num 41/25/2013 13038 Process Batch PR | um Run Batch Report View Redon Reprint a Check Check Date Employee D Name SSN Wage Net Pay Select Check Format Standard Check Format Cument Se-Ouck Customized Check Format Using the details of project 1, answer the following questions: 1. Make a payroll sheet (example is included here but can create your own) that calculates the federal withholding tax, social security tax, state income tax of 5%, medicare tax and the net pay for each of the worker in your business. Figure out any other deductions that your workers may possibly have. Assume the Social Security tax rate is 6.2% and the medicare tax rate is 1.45%. You had calculated your wages in Bahrain Dinars. You are required to convert those wages into USD. PA La M + ** 22 2. Analyse your data by answering the following questions: Which employee had the largest net pay for the month? Which employee had the highest percentage of take-home for the month? What was the total amount of income taxes that were withheld from their wages? NO Regular OverTime D Num hamme ID Status salary 2 1 Nicholas Andegg 100005 Lee SEN 3 2 Andre Elisan 10000 2 Robert Ferter 10004 ACIC 5 Marlie Garcia POONOONEL 5 SLAthena Hendersd 100008 E Raymond Johnsd 100010 3 7 Peuter McClure 100004 Image 3 8 Jeremy Roberts 10001013 Ge S. 9 Mailee Voucher 100009 Ace SELAIN 10 Jessica Winght 100013 Active Selany 1. 3 SD 5 6 316 ST 6 9 18 Salon See 1 22 SOLO SA Un 25 5 T UUUUUU Sy SALAT Selag Page 1 I 2 3 R S Time Selection Not Available in This Version week 1 week 3 Week 5 week 2 week To select weekes please use standard Version Check Date Start Check Num 41/25/2013 13038 Process Batch PR | um Run Batch Report View Redon Reprint a Check Check Date Employee D Name SSN Wage Net Pay Select Check Format Standard Check Format Cument Se-Ouck Customized Check FormatStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started