Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview This is not shown as a complete answer. please post it again Answer The first three months of any business are n

Old MathJax webview

This is not shown as a complete answer. please post it again

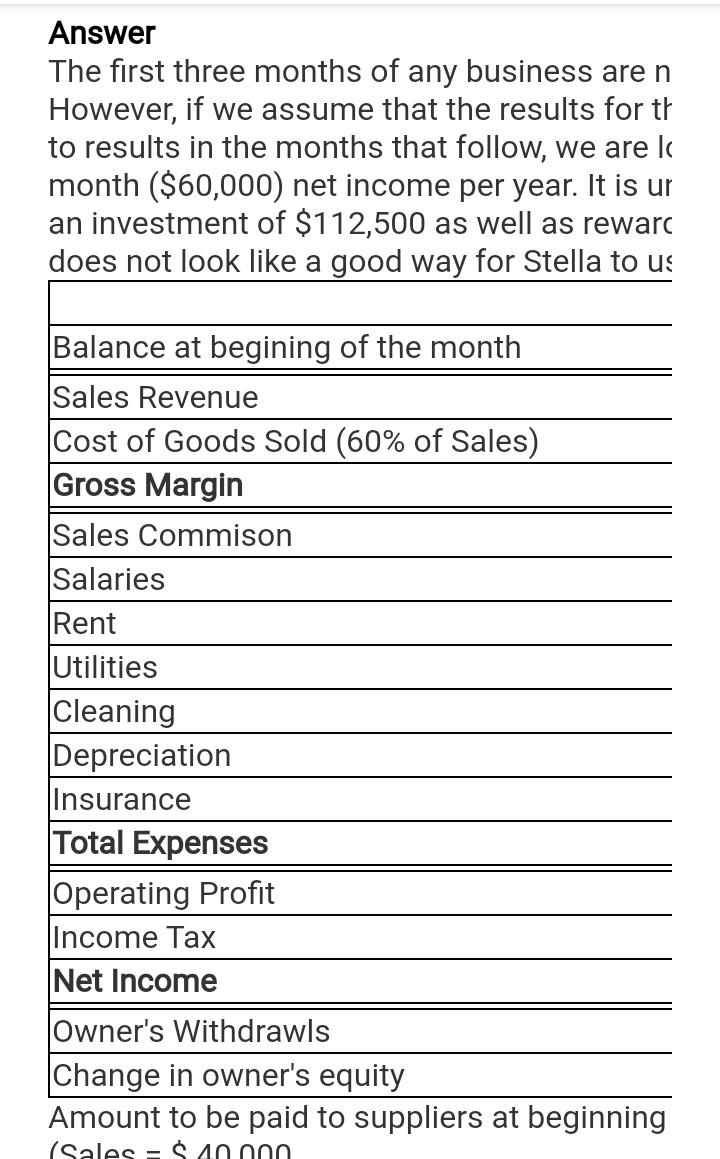

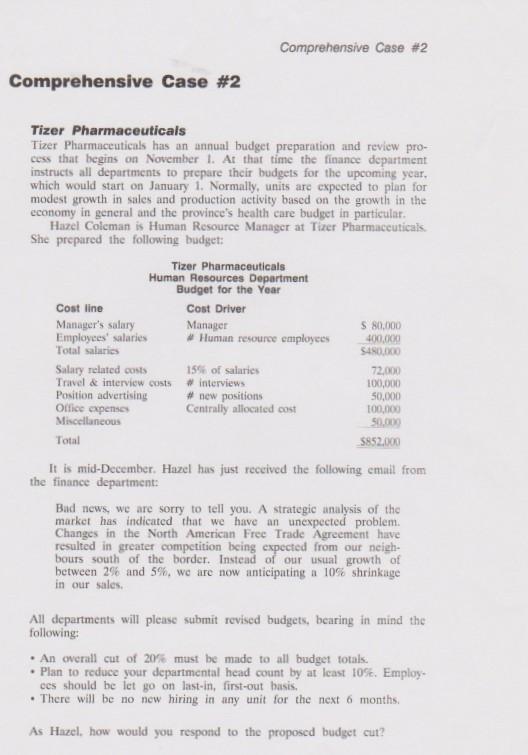

Answer The first three months of any business are n However, if we assume that the results for th to results in the months that follow, we are k month ($60,000) net income per year. It is ur an investment of $112,500 as well as reward does not look like a good way for Stella to us Balance at begining of the month Sales Revenue Cost of Goods Sold (60% of Sales) Gross Margin Sales Commison Salaries Rent Utilities Cleaning Depreciation Insurance Total Expenses Operating Profit Income Tax Net Income Owner's Withdrawls Change in owner's equity Amount to be paid to suppliers at beginning (Sales = $40.000 Comprehensive Case #2 Comprehensive Case #2 Tizer Pharmaceuticals Tizer Pharmaceuticals has an annual budget preparation and review pro- cess that begins on November 1. At that time the finance department instructs all departments to prepare their budgets for the upcoming year, which would start on January 1. Normally, units are expected to plan for modest growth in sales and production activity based on the growth in the economy in general and the province's health care budget in particular Hazel Coleman is Human Resource Manager at Tizer Pharmaceuticals She prepared the following budget: Tizer Pharmaceuticals Human Resources Department Budget for the Year Cost line Cost Driver Manager's salary Manager $ 80,000 Employees' salaries Human resource employees 400,000 Total salaries S480.000 Salary related costs 15% of salaries 72,000 Travel & interview costs interviews 100,000 Position advertising # new positions 50,000 Office expenses Centrally allocated cost 100,000 Miscellaneous 50.000 Total 5852.000 It is mid-December. Hazel has just received the following email from the finance departments Bad news, we are sorry to tell you. A strategic analysis of the market has indicated that we have an unexpected problem. Changes in the North American Free Trade Agreement have resulted in greater competition being expected from our neigh- bours south of the border. Instead of our usual growth of between 29 and 5%, we are now anticipating a 10% shrinkage in our sales All departments will please submit revised budgets, bearing in mind the following: An overall cut of 20% must be made to all budget totals. Plan to reduce your departmental head count by at least 10%. Emplos. ces should be let go on last-in, first-out basis. There will be no now hiring in any unit for the next 6 months. As Hazel, how would you respond to the proposed budget cut

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started