Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old Town Entertainment has two employees. Clay earns $ 5 , 6 0 0 per month, and Philip, the manager, earns $ 1 0 ,

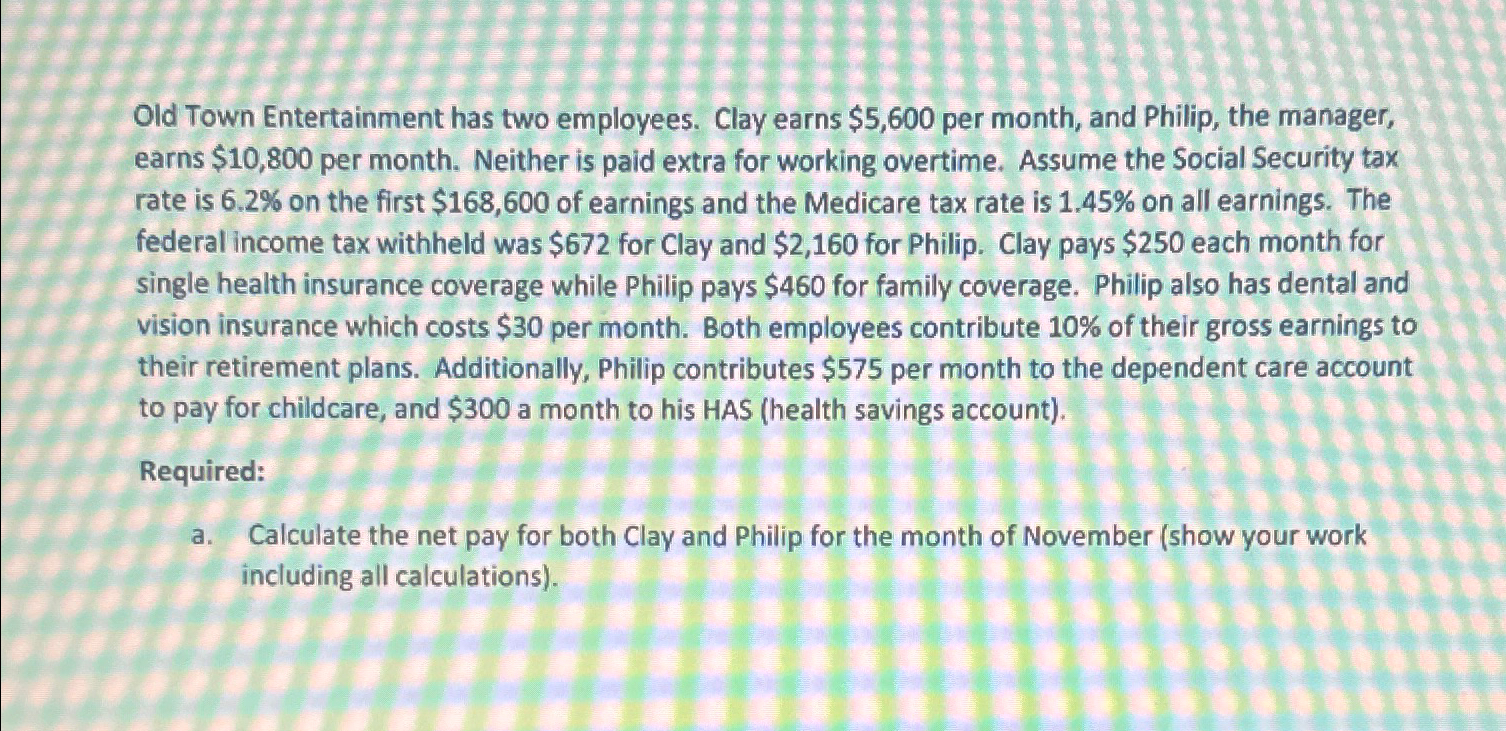

Old Town Entertainment has two employees. Clay earns $ per month, and Philip, the manager, earns $ per month. Neither is paid extra for working overtime. Assume the Social Security tax rate is on the first $ of earnings and the Medicare tax rate is on all earnings. The federal income tax withheld was $ for Clay and $ for Philip. Clay pays $ each month for single health insurance coverage while Philip pays $ for family coverage. Philip also has dental and vision insurance which costs $ per month. Both employees contribute of their gross earnings to their retirement plans. Additionally, Philip contributes $ per month to the dependent care account to pay for childcare, and $ a month to his HAS health savings account

Required:

a Calculate the net pay for both Clay and Philip for the month of November show your work including all calculations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started