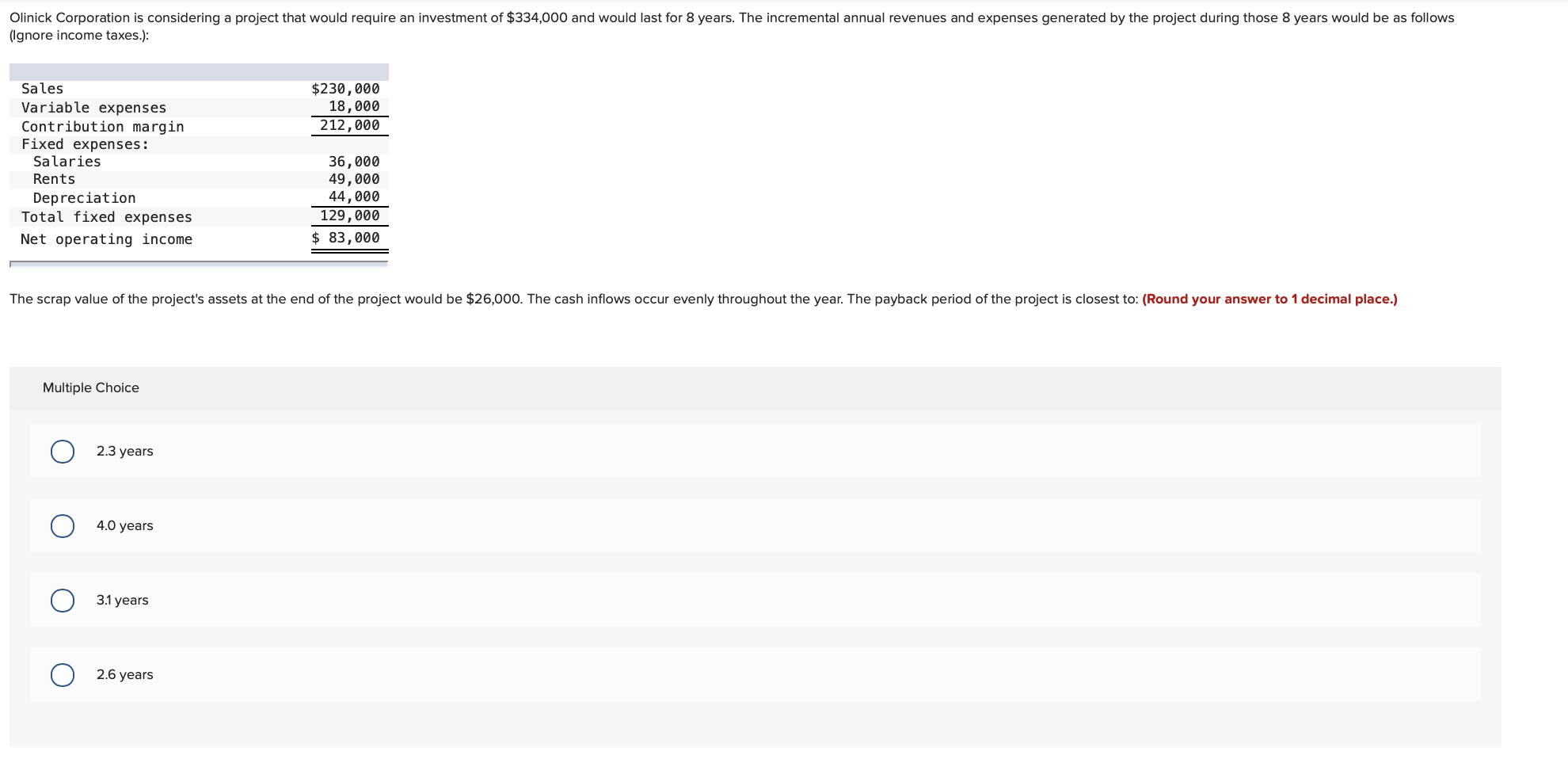

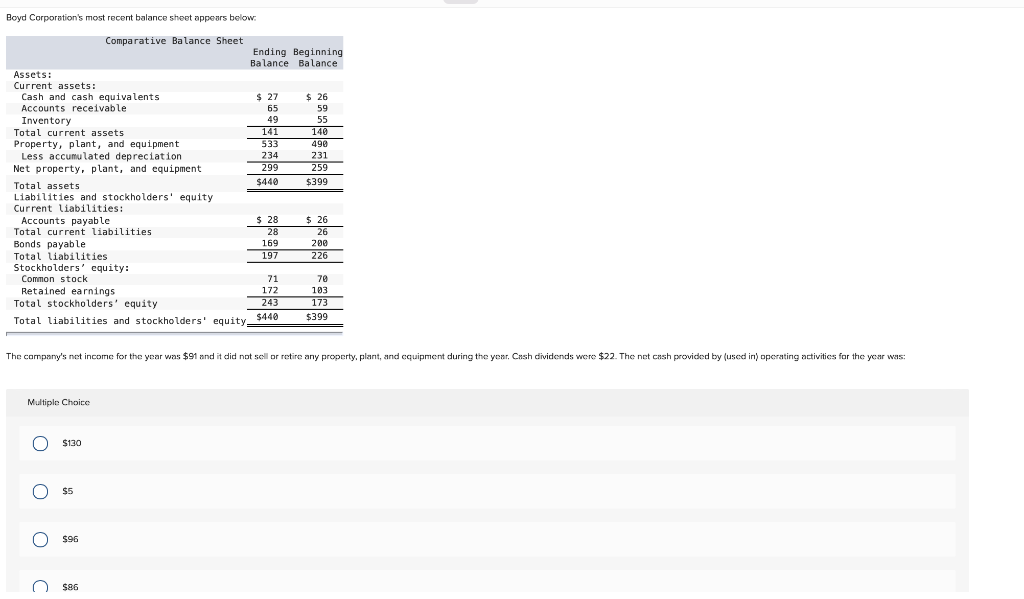

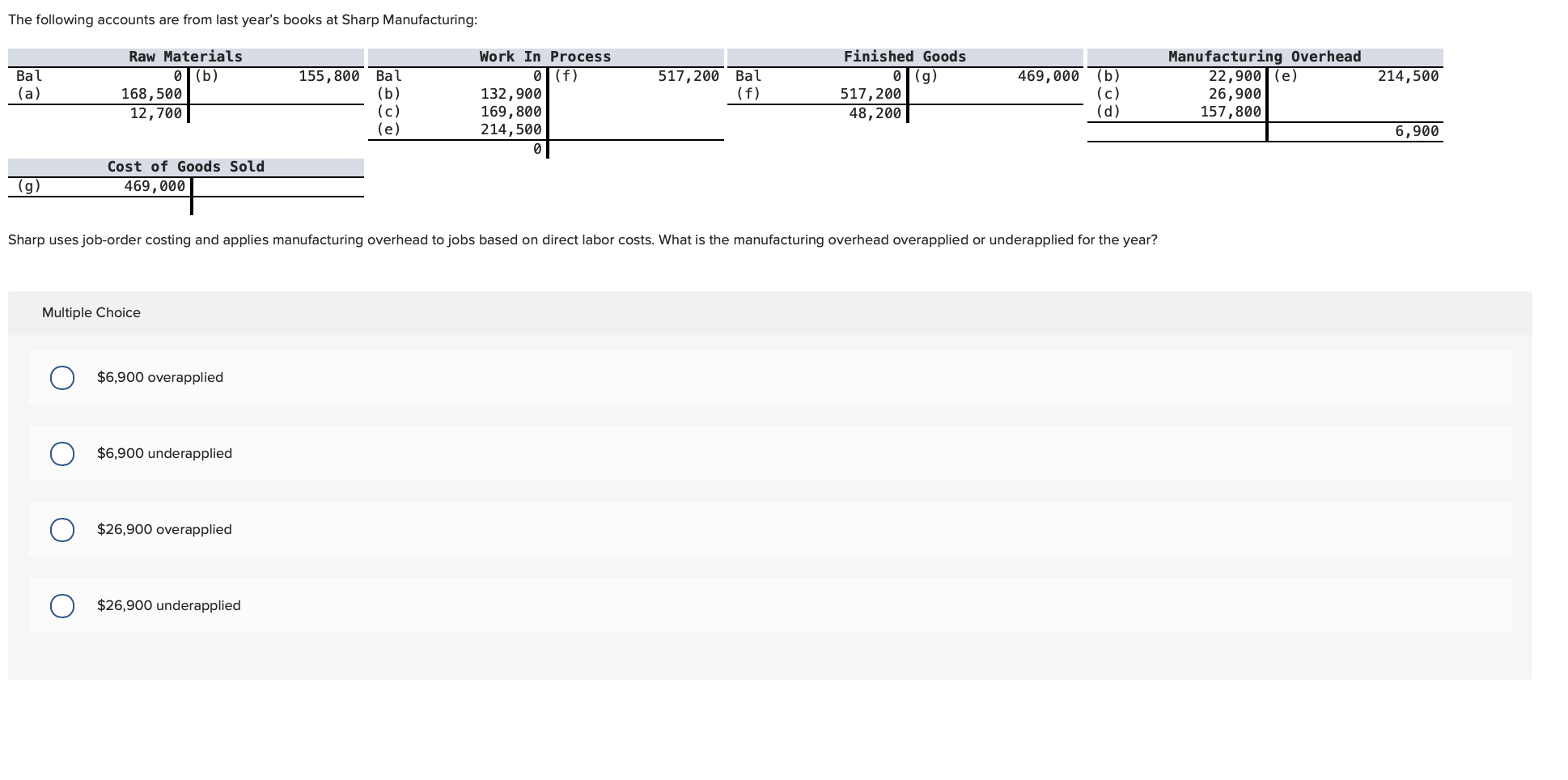

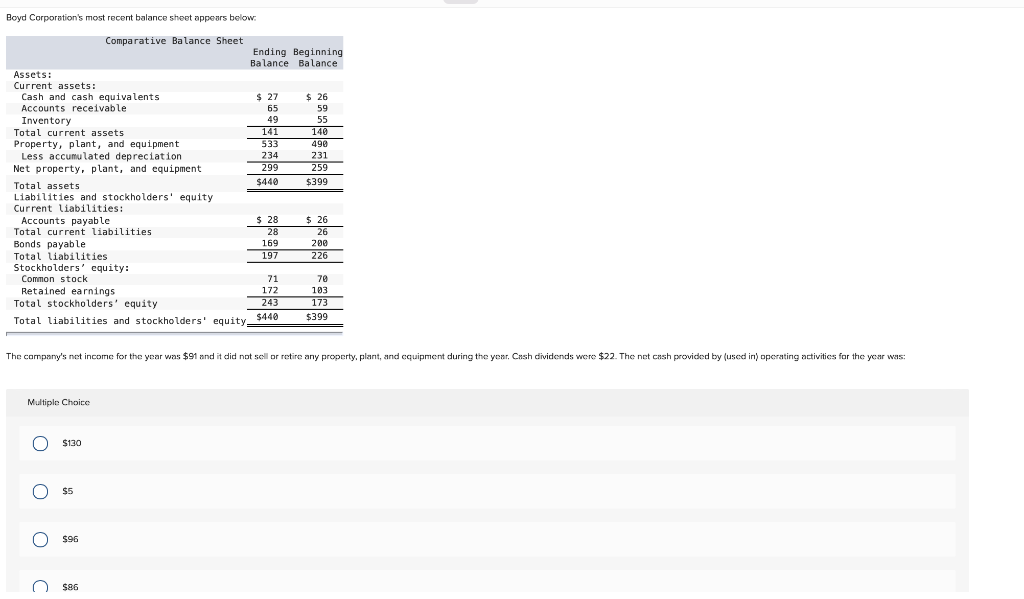

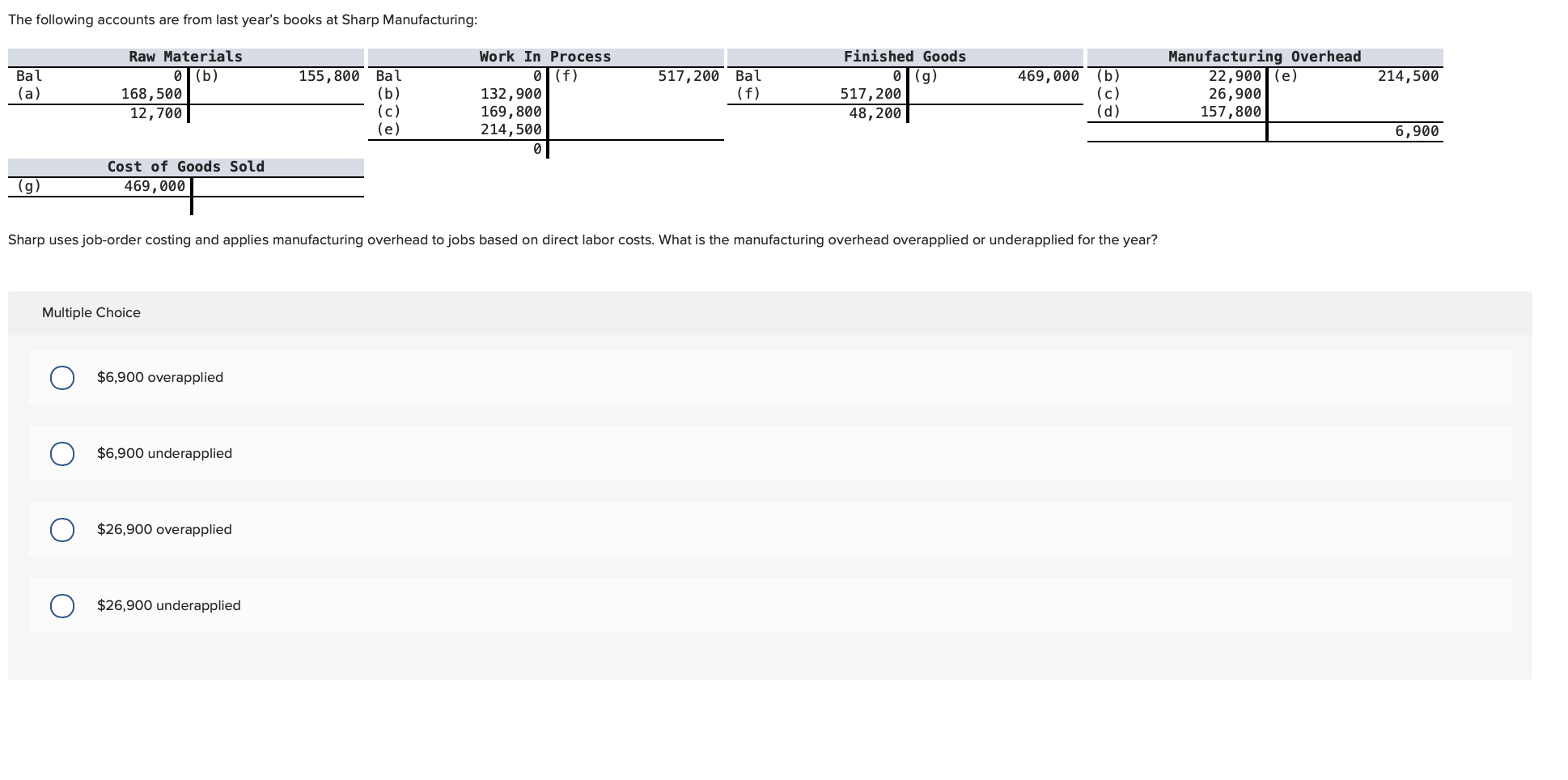

Olinick Corporation is considering a project that would require an investment of $334,000 and would last for 8 years. The incremental annual revenues and expenses generated by the project during those 8 years would be as follows (Ignore income taxes.): $230,000 18,000 212,000 Sales Variable expenses Contribution margin Fixed expenses: Salaries Rents Depreciation Total fixed expenses Net operating income 36,000 49,000 44,000 129,000 $ 83,000 The scrap value of the project's assets at the end of the project would be $26,000. The cash inflows occur evenly throughout the year. The payback period of the project is closest to: (Round your answer to 1 decimal place.) Multiple Choice 0 2.3 years 0 4.0 years 0 3.1 years 0 2.6 years Boyd Corporation's most recent balance sheet appears below: 59 49 231 Comparative Balance Sheet Ending Beginning Balance Balance Assets: Current assets: Cash and cash equivalents $ 27 $ 26 Accounts receivable 65 Inventory 55 Total current assets 141 140 Property, plant, and equipment 490 Less accumulated depreciation Net property, plant, and equipment 259 Total assets $440 $399 Liabilities and stockholders' equity Current liabilities: Accounts payable $ 26 Total current liabilities Bonds payable Total liabilities 197 226 Stockholders' equity: Common stock 71 79 Retained earnings 172 193 Total stockholders' equity 243173 Total liabilities and stockholders' equity_$440 $399 $ 28 26 169 200 The company's net income for the year was $91 and it did not sell or retire any property, plant, and cquipment during the year. Cash dividends were $22. The net cash provided by (used in) operating activities for the year was: 0 0 0 0 The following accounts are from last year's books at Sharp Manufacturing: Bal (a) Raw Materials (b) 168,500 12,700 517,200 Bal (f) 469,000 (b) Work In Process 0 (f) 132,900 169,800 214,500 214,500 155,800 Bal (b) (c) (e) Finished Goods (g) 517,200 48,200 Manufacturing Overhead 22,900(e) 26,900 157,800 (c) (d) 6,900 Cost of Goods Sold 469,000 (g) Sharp uses job-order costing and applies manufacturing overhead to jobs based on direct labor costs. What is the manufacturing overhead overapplied or underapplied for the year? Multiple Choice $6,900 overapplied $6,900 underapplied $26,900 overapplied $26,900 underapplied