Question

Oliver City reported capital assets of $4,300,000 and accumulated depreciation of $2,000,000 in the governmental activities column of its government-wide statement of net position for

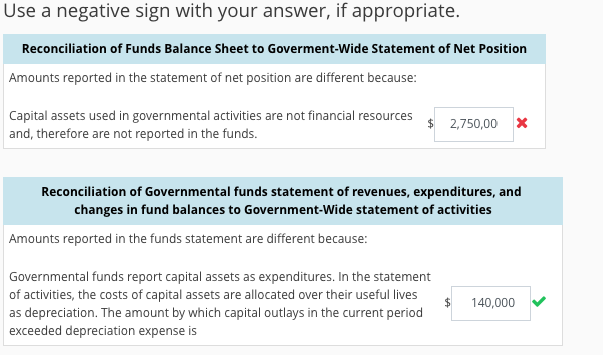

Oliver City reported capital assets of $4,300,000 and accumulated depreciation of $2,000,000 in the governmental activities column of its government-wide statement of net position for the year ended December 31, 2018. The total governmental funds column in Olivers calendar year 2019 statement of revenues, expenditures, and changes in fund balances showed that Olivers capital outlay expenditures were $340,000. Oliver Citys director of finance estimated that total depreciation for 2019 was $200,000. Based on this information, determine the reconciliation amounts reported in the two funds financial statements to the two government-wide financial statements. Use a negative sign with your answer, if appropriate. Reconciliation of Funds Balance Sheet to Goverment-Wide Statement of Net Position Amounts reported in the statement of net position are different because: Capital assets used in governmental activities are not financial resources and, therefore are not reported in the funds. $Answer 2,750,000 Reconciliation of Governmental funds statement of revenues, expenditures, and changes in fund balances to Government-Wide statement of activities Amounts reported in the funds statement are different because: Governmental funds report capital assets as expenditures. In the statement of activities, the costs of capital assets are allocated over their useful lives as depreciation. The amount by which capital outlays in the current period exceeded depreciation expense is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started