Answered step by step

Verified Expert Solution

Question

1 Approved Answer

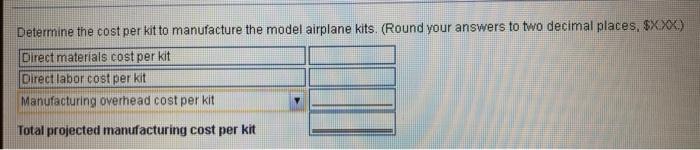

Oliver Inc manufactures model airplane kits. Direct materials are 2 ounces of plastic per kit and the plastic costs $2 per ounce. Indirect materials aren't

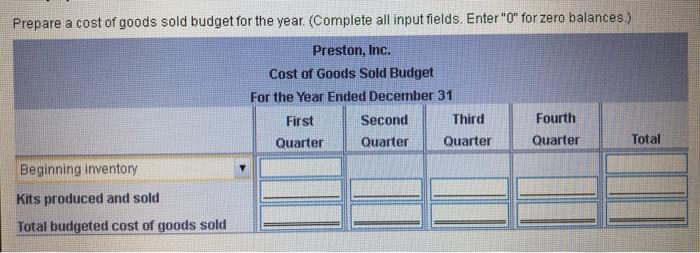

Oliver Inc manufactures model airplane kits. Direct materials are 2 ounces of plastic per kit and the plastic costs $2 per ounce. Indirect materials aren't included in the budgeting process. Each kit requires 0.75 hours of direct labor at an average cost of $15 per hour. Manufactering overhead is allocated using direct labor hours as the allocation base.

Oliver projects sales of 300, 100, 700, and 100 kits for the next four quarters. Oliver has no kits in the beginning inventory. Determine the cost per kit to manufacture the model airplane kits.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started