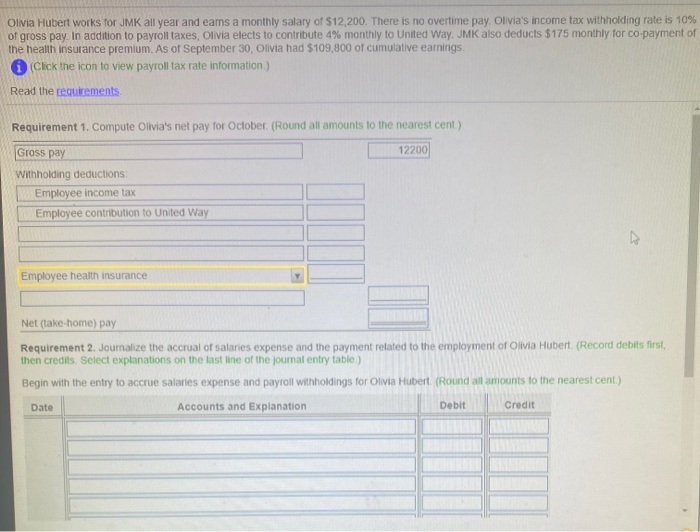

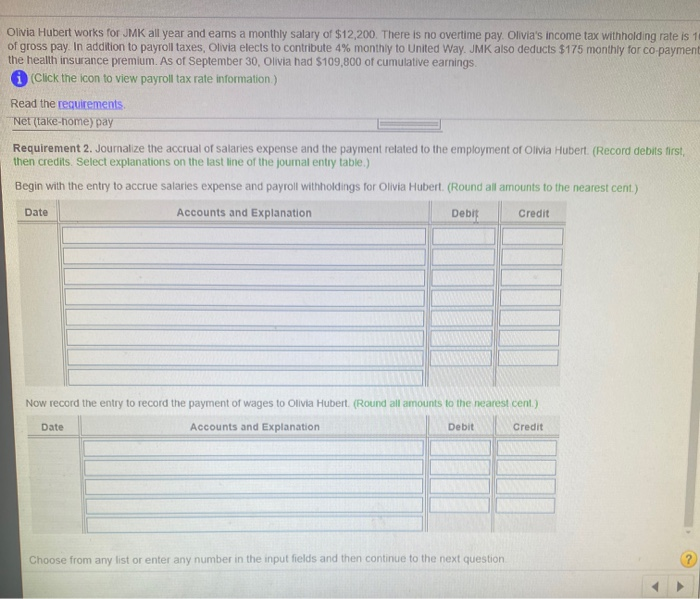

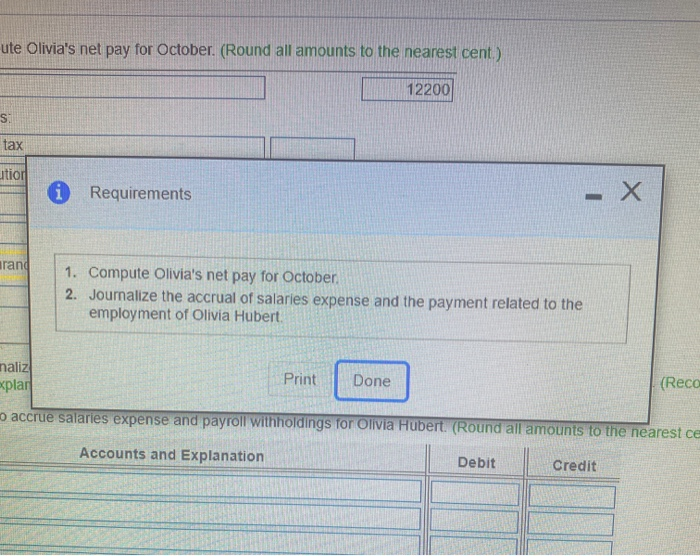

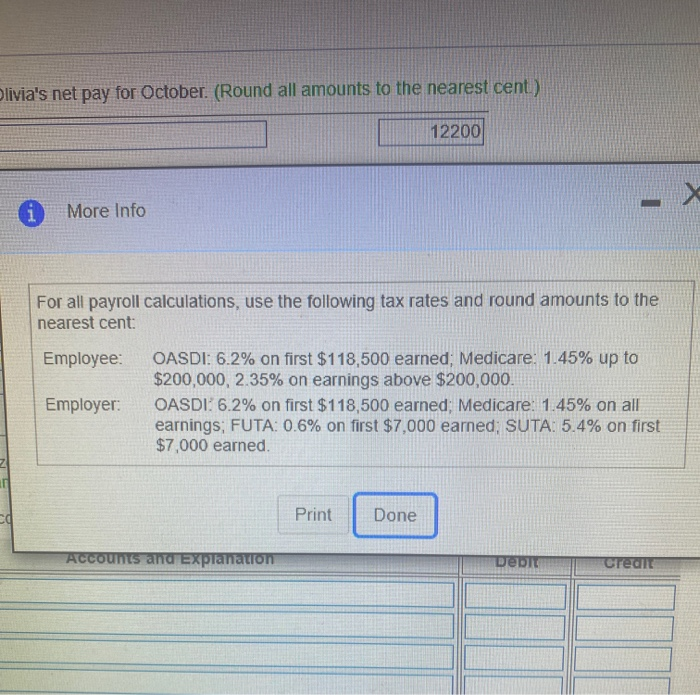

Olivia Hubert works for JMK all year and eams a monthly salary of $12,200. There is no overtime pay, Olivia's income tax withholding rate is 10% of gross pay. In addition to payroll taxes, Olivia elects to contribute 4% monthly to United Way, JMK also deducts $175 monthly for co-payment of the health insurance premium. As of September 30, Olivia had $109,800 of cumulative earnings Click the icon to view payroll tax rate information.) Read the requirements Requirement 1. Compute Olivia's net pay for October (Round all amounts to the nearest cent) Gross pay 12200 Withholding deductions: Employee income tax Employee contribution to United Way Employee health insurance Net (take-home) pay Requirement 2. Journalize the accrual of salaries expense and the payment related to the employment of Olivia Hubert (Record debits first, then credits. Select explanations on the last line of the journal entry table.) Begin with the entry to accrue salaries expense and payroll withholdings for Olivia Hubert (Round all amounts to the nearest cent.) Date Accounts and Explanation Debit Credit Olivia Hubert works for JMK all year and eams a monthly salary of $12,200. There is no overtime pay. Olivia's income tax withholding rate is 1 of gross pay. In addition to payroll taxes, Olivia elects to contribute 4% monthly to United Way. JMK also deducts $175 monthly for co-payment the health insurance premium. As of September 30, Olivia had $109,800 of cumulative earnings (Click the icon to view payroll tax rate information) Read the requirements Net (take-home) pay Requirement 2. Journalize the accrual of salaries expense and the payment related to the employment of Olivia Hubert. (Record debits first, then credits. Select explanations on the last line of the journal entry table.) Begin with the entry to accrue salaries expense and payroll withholdings for Olivia Hubert. (Round all amounts to the nearest cent.) Date Accounts and explanation Debut Credit Now record the entry to record the payment of wages to Olivia Hubert (Round all amounts to the nearest cent.) Date Accounts and Explanation Debit Credit Choose from any list or enter any number in the input fields and then continue to the next question ute Olivia's net pay for October. (Round all amounts to the nearest cent.) 12200 S tax uitior Requirements arand 1. Compute Olivia's net pay for October 2. Journalize the accrual of salaries expense and the payment related to the employment of Olivia Hubert. naliz explar Print Done (Reco o accrue salaries expense and payroll Withholdings for Olivia Hubert (Round all amounts to the nearest ce Accounts and Explanation Debit Credit Olivia's net pay for October. (Round all amounts to the nearest cent) 12200 i More Info For all payroll calculations, use the following tax rates and round amounts to the nearest cent: Employee Employer: OASDI: 6.2% on first $118,500 earned; Medicare: 1.45% up to $200,000, 2.35% on earnings above $200,000. OASDI: 6.2% on first $118,500 earned; Medicare: 1.45% on all earnings; FUTA: 0.6% on first $7,000 earned: SUTA: 5.4% on first $7,000 earned ca Print Done Accounts and explanation Debt Credit