Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Olivia Ltd is a business registered for GST and it lodges its Business Activity Statement (BAS) at the end of each quarter. For month

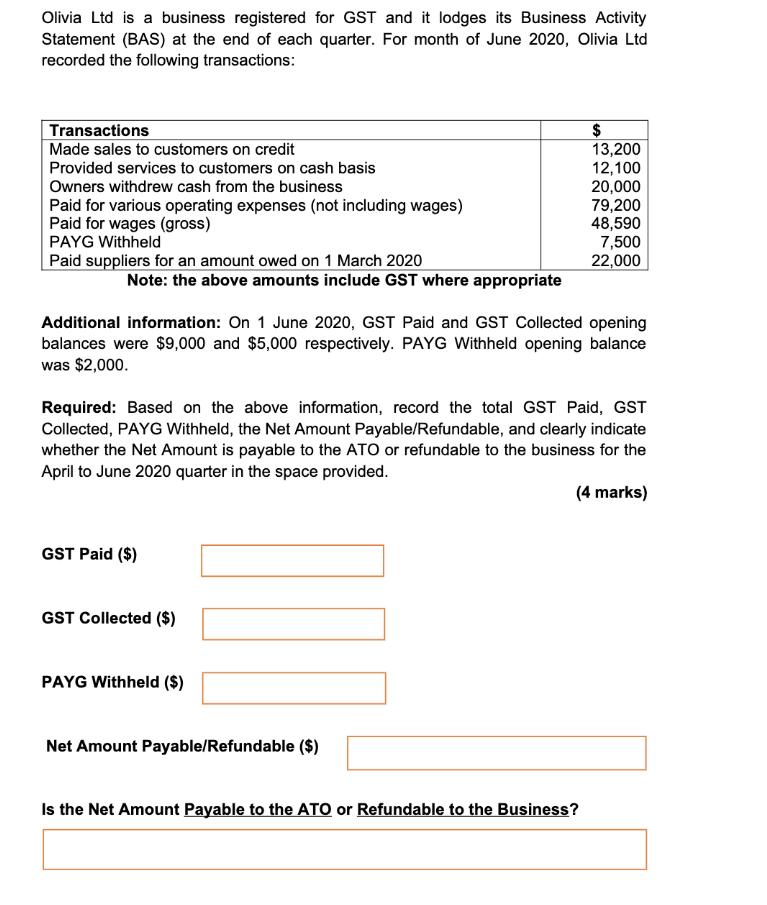

Olivia Ltd is a business registered for GST and it lodges its Business Activity Statement (BAS) at the end of each quarter. For month of June 2020, Olivia Ltd recorded the following transactions: Transactions Made sales to customers on credit Provided services to customers on cash basis Owners withdrew cash from the business Paid for various operating expenses (not including wages) Paid for wages (gross) PAYG Withheld Paid suppliers for an amount owed on 1 March 2020 Note: the above amounts include GST where appropriate Additional information: On 1 June 2020, GST Paid and GST Collected opening balances were $9,000 and $5,000 respectively. PAYG Withheld opening balance was $2,000. GST Paid ($) Required: Based on the above information, record the total GST Paid, GST Collected, PAYG Withheld, the Net Amount Payable/Refundable, and clearly indicate whether the Net Amount is payable to the ATO or refundable to the business for the April to June 2020 quarter in the space provided. (4 marks) GST Collected ($) PAYG Withheld ($) $ 13,200 12,100 20,000 Net Amount Payable/Refundable ($) 79,200 48,590 7,500 22,000 Is the Net Amount Payable to the ATO or Refundable to the Business?

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started