Answered step by step

Verified Expert Solution

Question

1 Approved Answer

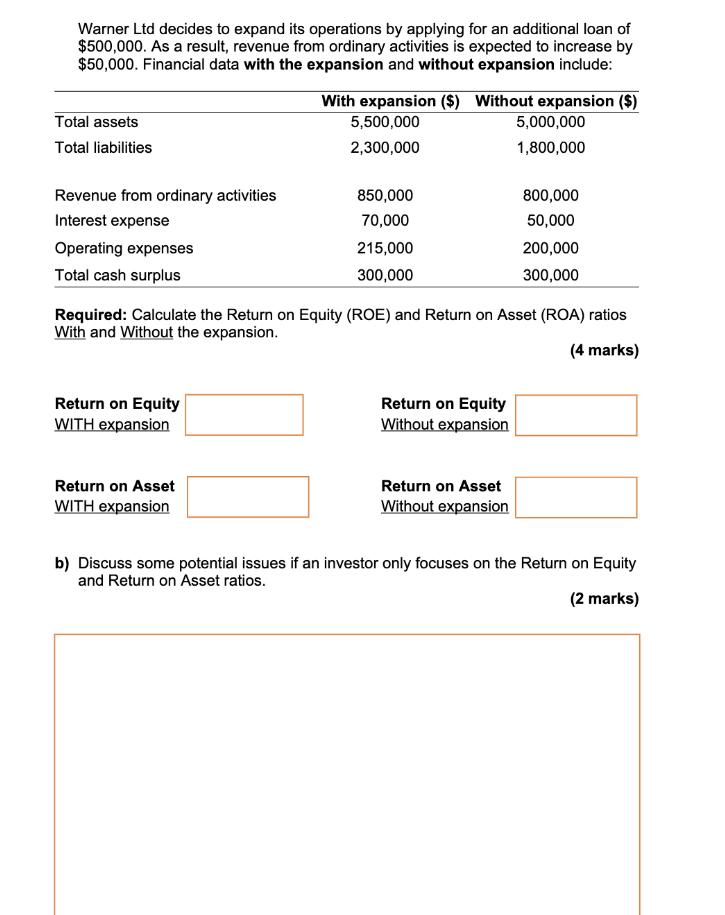

Warner Ltd decides to expand its operations by applying for an additional loan of $500,000. As a result, revenue from ordinary activities is expected

Warner Ltd decides to expand its operations by applying for an additional loan of $500,000. As a result, revenue from ordinary activities is expected to increase by $50,000. Financial data with the expansion and without expansion include: Total assets Total liabilities Revenue from ordinary activities Interest expense Operating expenses Total cash surplus Return on Equity WITH expansion With expansion ($) Without expansion ($) 5,500,000 2,300,000 Return on Asset WITH expansion 850,000 70,000 215,000 300,000 Required: Calculate the Return on Equity (ROE) and Return on Asset (ROA) ratios With and Without the expansion. (4 marks) Return on Equity Without expansion 5,000,000 1,800,000 Return on Asset Without expansion 800,000 50,000 200,000 300,000 b) Discuss some potential issues if an investor only focuses on the Return on Equity and Return on Asset ratios. (2 marks)

Step by Step Solution

★★★★★

3.60 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started