Answered step by step

Verified Expert Solution

Question

1 Approved Answer

SteamPunk Ltd. sells laptops. The business retails each unit for $2,500. The forecasted sales in units for the final four months of the year

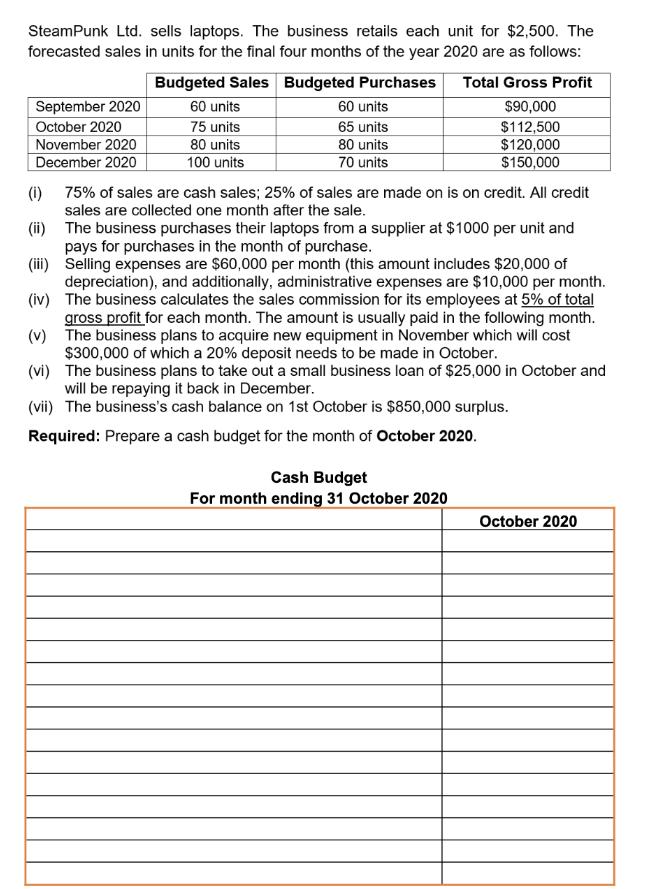

SteamPunk Ltd. sells laptops. The business retails each unit for $2,500. The forecasted sales in units for the final four months of the year 2020 are as follows: Budgeted Purchases September 2020 October 2020 November 2020 December 2020 Budgeted Sales 60 units 75 units 80 units 100 units 60 units 65 units 80 units 70 units Total Gross Profit $90,000 $112,500 $120,000 $150,000 (i) 75% of sales are cash sales; 25% of sales are made on is on credit. All credit sales are collected one month after the sale. (ii) The business purchases their laptops from a supplier at $1000 per unit and pays for purchases in the month of purchase. (iii) (iv) Selling expenses are $60,000 per month (this amount includes $20,000 of depreciation), and additionally, administrative expenses are $10,000 per month. The business calculates the sales commission for its employees at 5% of total gross profit for each month. The amount is usually paid in the following month. The business plans to acquire new equipment in November which will cost $300,000 of which a 20% deposit needs to be made in October. (v) (vi) The business plans to take out a small business loan of $25,000 in October and will be repaying it back in December. (vii) The business's cash balance on 1st October is $850,000 surplus. Required: Prepare a cash budget for the month of October 2020. Cash Budget For month ending 31 October 2020 October 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started