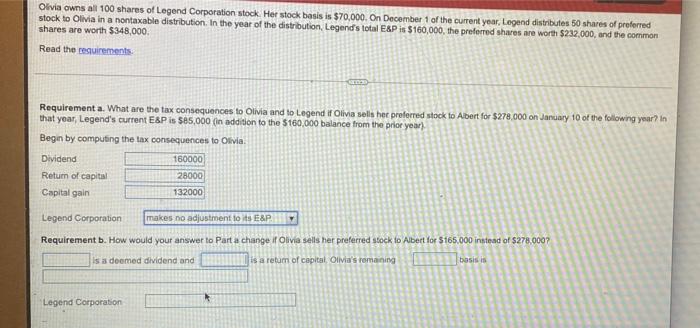

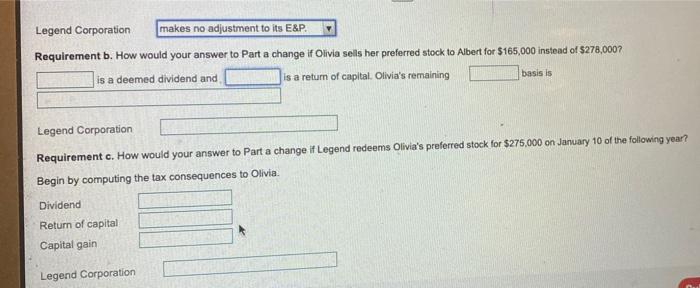

Olivia owns all 100 shares of Legend Corporation stock. Her stock basis is $70,000. On December 1 of the current year, Legend distributos 50 shares of proferred stock to Olivia in a nontaxable distribution. In the year of the distribution, Legend's total E&P is $160,000, the preferred shares are worth $232,000, and the common shares are worth $348,000. Read the resuirements Requirement a. What are the tax consequences to Olivia and to Legend of Olivia sells her preferred stock to Albert for $278,000 on January 10 of the following year? in that year, Legend's current ESP is $85,000 (in addition to the $160,000 balance from the prior year) Begin by computing the tax consequences to Olivia Dividend 160000 Return of capital 28000 Capital gain 132000 Legend Corporation makes no adjustment to its E&P Requirement b. How would your answer to Part a change it Olivia sells her preferred stock to Albert for $165.000 instead of $278.000? is a doomed dividend and is a retum of capital Olivia's remaining basis is Legend Corporation Legend Corporation makes no adjustment to its E&P. Requirement b. How would your answer to Part a change if Olivia sells her preferred stock to Albert for $165,000 instead of $278,000? is a deemed dividend and is a retum of capital. Olivia's remaining basis is Legend Corporation Requirement c. How would your answer to Part a change if Legend redeems Olivia's preferred stock for $275,000 on January 10 of the following year? Begin by computing the tax consequences to Olivia. Dividend Return of capital Capital gain Legend Corporation Olivia owns all 100 shares of Legend Corporation stock. Her stock basis is $70,000. On December 1 of the current year, Legend distributos 50 shares of proferred stock to Olivia in a nontaxable distribution. In the year of the distribution, Legend's total E&P is $160,000, the preferred shares are worth $232,000, and the common shares are worth $348,000. Read the resuirements Requirement a. What are the tax consequences to Olivia and to Legend of Olivia sells her preferred stock to Albert for $278,000 on January 10 of the following year? in that year, Legend's current ESP is $85,000 (in addition to the $160,000 balance from the prior year) Begin by computing the tax consequences to Olivia Dividend 160000 Return of capital 28000 Capital gain 132000 Legend Corporation makes no adjustment to its E&P Requirement b. How would your answer to Part a change it Olivia sells her preferred stock to Albert for $165.000 instead of $278.000? is a doomed dividend and is a retum of capital Olivia's remaining basis is Legend Corporation Legend Corporation makes no adjustment to its E&P. Requirement b. How would your answer to Part a change if Olivia sells her preferred stock to Albert for $165,000 instead of $278,000? is a deemed dividend and is a retum of capital. Olivia's remaining basis is Legend Corporation Requirement c. How would your answer to Part a change if Legend redeems Olivia's preferred stock for $275,000 on January 10 of the following year? Begin by computing the tax consequences to Olivia. Dividend Return of capital Capital gain Legend Corporation