Answered step by step

Verified Expert Solution

Question

1 Approved Answer

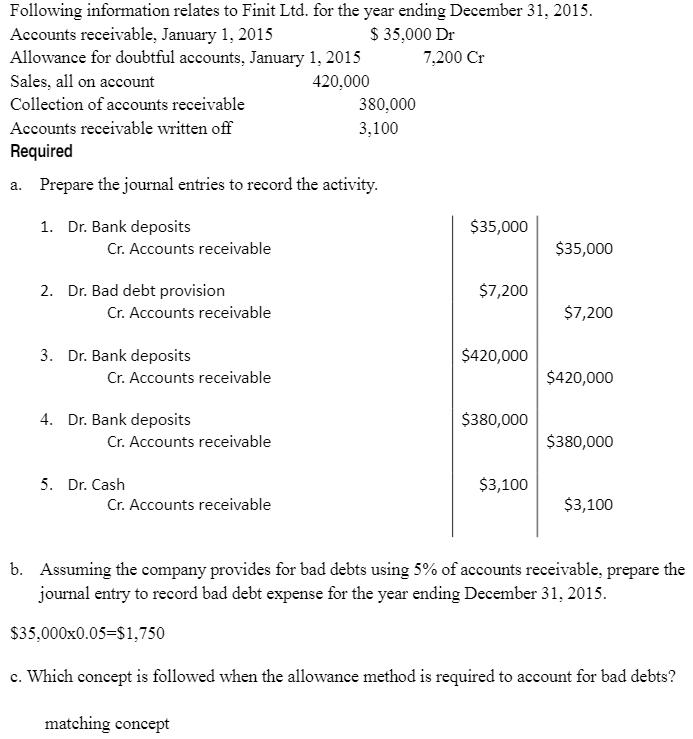

Following information relates to Finit Ltd. for the year ending December 31, 2015. Accounts receivable, January 1, 2015 Allowance for doubtful accounts, January 1,

Following information relates to Finit Ltd. for the year ending December 31, 2015. Accounts receivable, January 1, 2015 Allowance for doubtful accounts, January 1, 2015 $ 35,000 Dr 7,200 Cr Sales, all on account 420,000 380,000 3,100 Collection of accounts receivable Accounts receivable written off Required a. Prepare the journal entries to record the activity. 1. Dr. Bank deposits $35,000 Cr. Accounts receivable $35,000 2. Dr. Bad debt provision Cr. Accounts receivable $7,200 $7,200 3. Dr. Bank deposits $420,000 Cr. Accounts receivable $420,000 4. Dr. Bank deposits $380,000 Cr. Accounts receivable $380,000 5. Dr. Cash $3,100 Cr. Accounts receivable $3,100 b. Assuming the company provides for bad debts using 5% of accounts receivable, prepare the journal entry to record bad debt expense for the year ending December 31, 2015. $35,000x0.05=$1,750 c. Which concept is followed when the allowance method is required to account for bad debts? matching concept

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Debtor are shown under current assets either by deducti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started