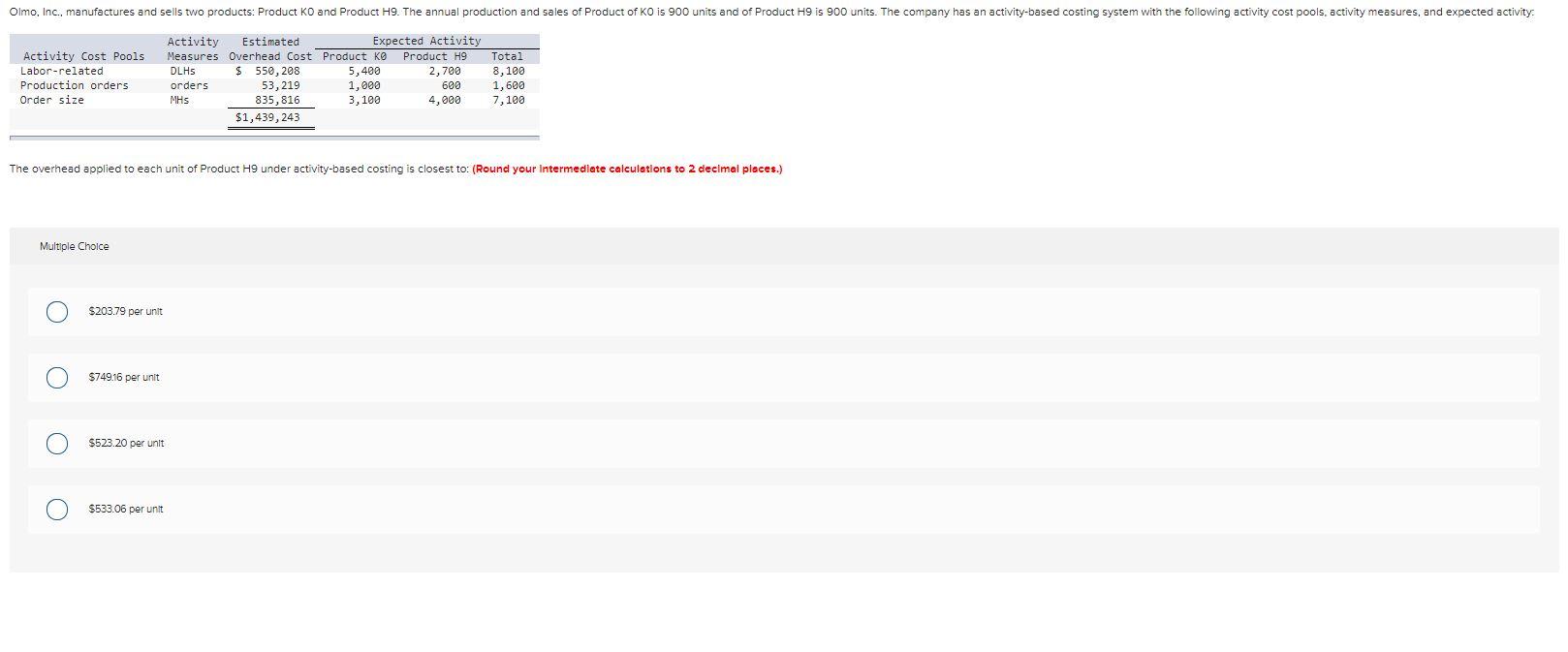

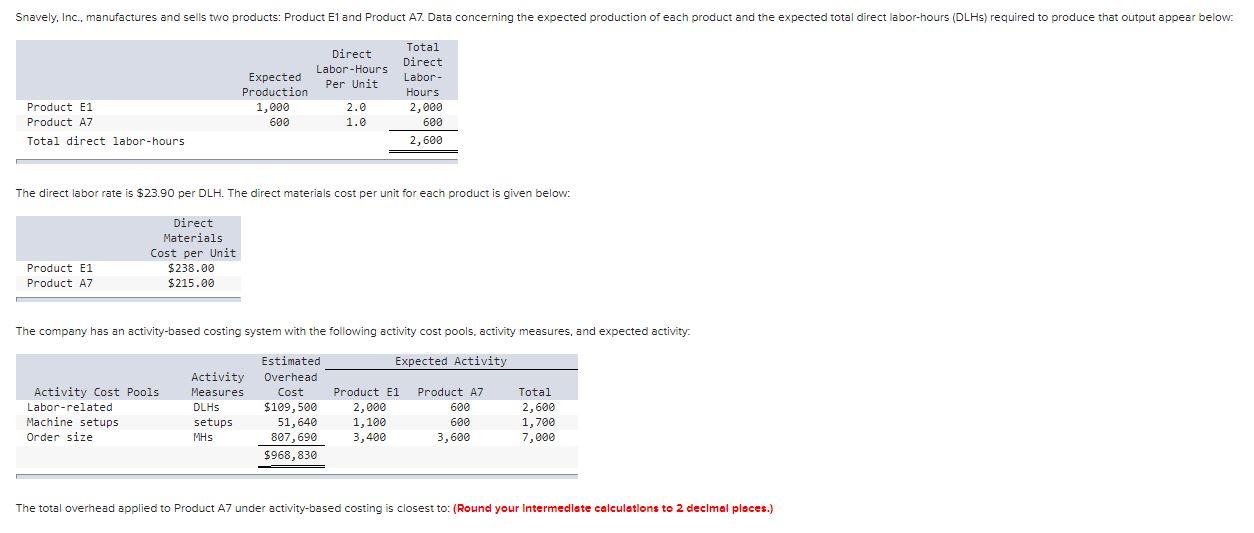

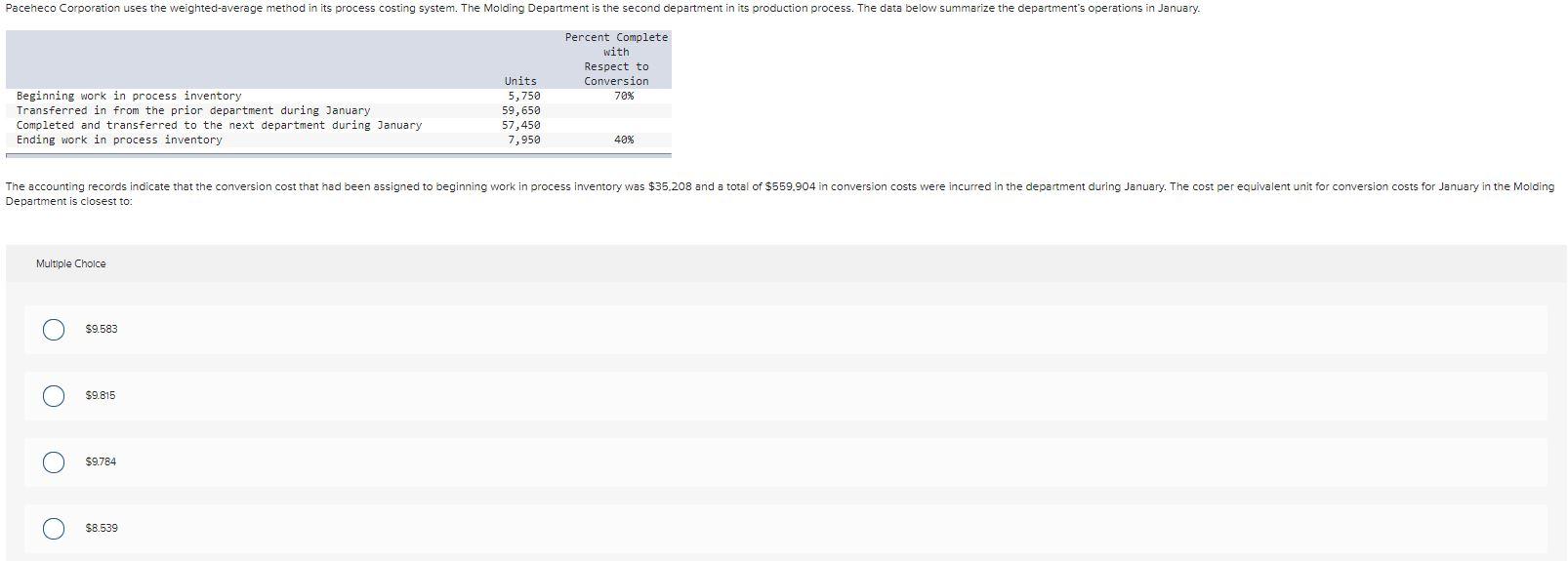

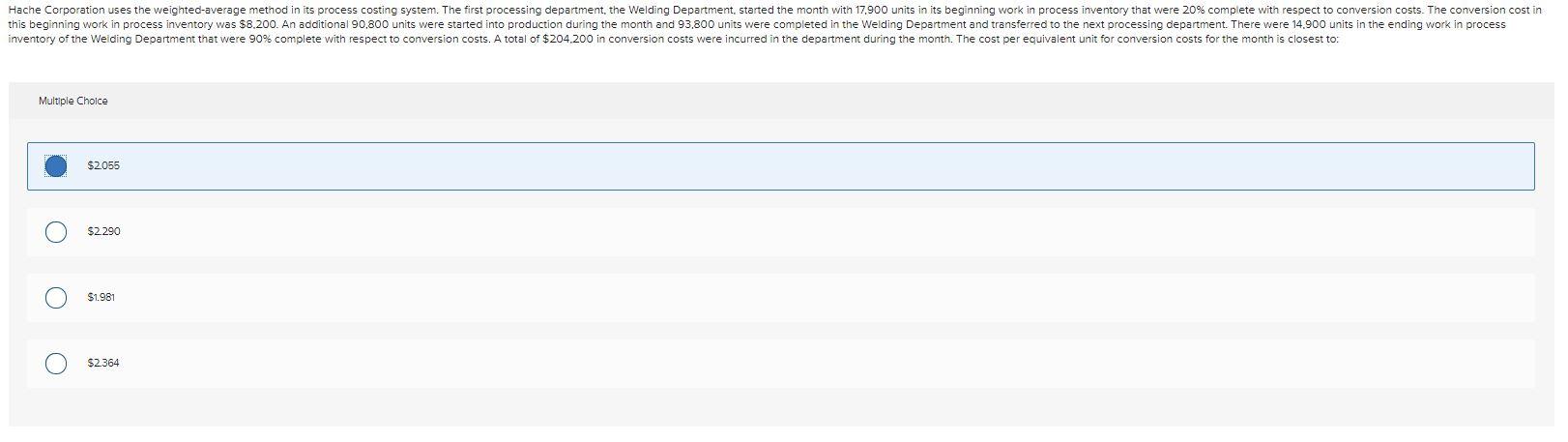

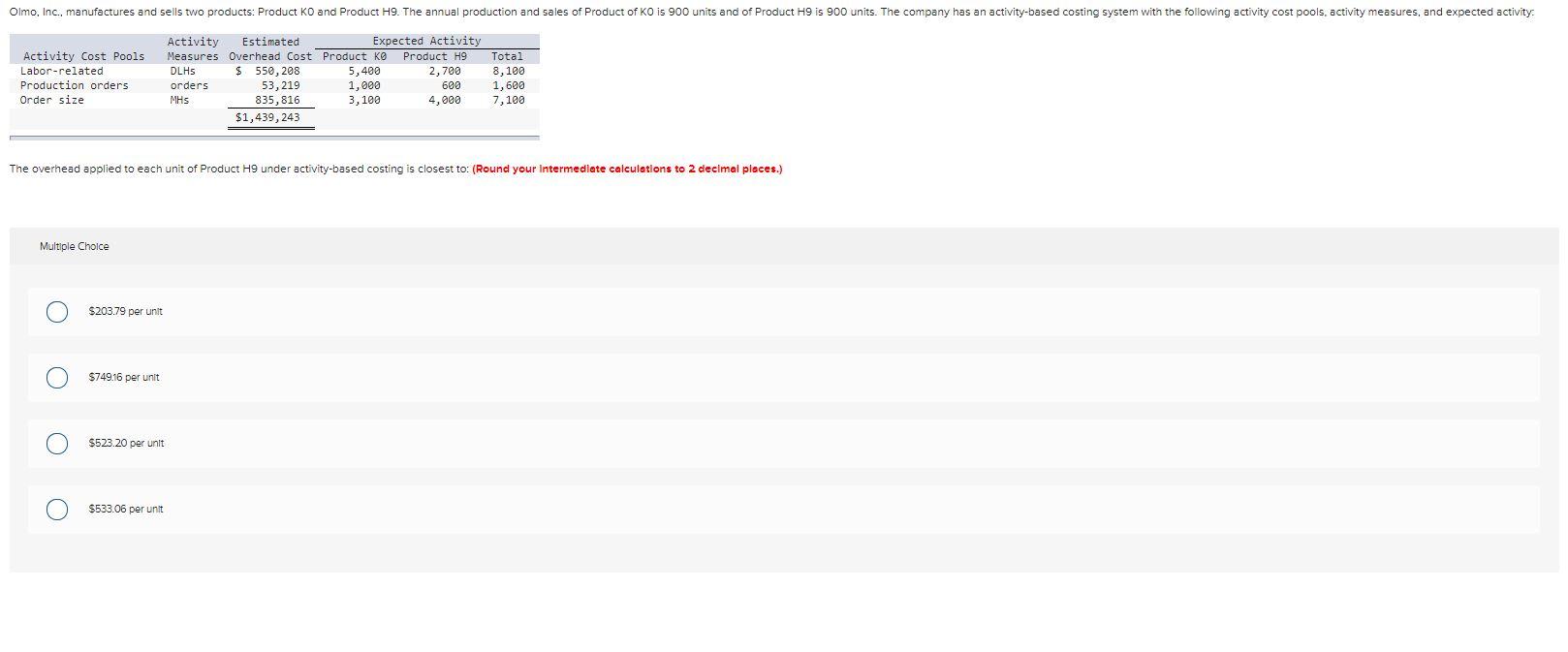

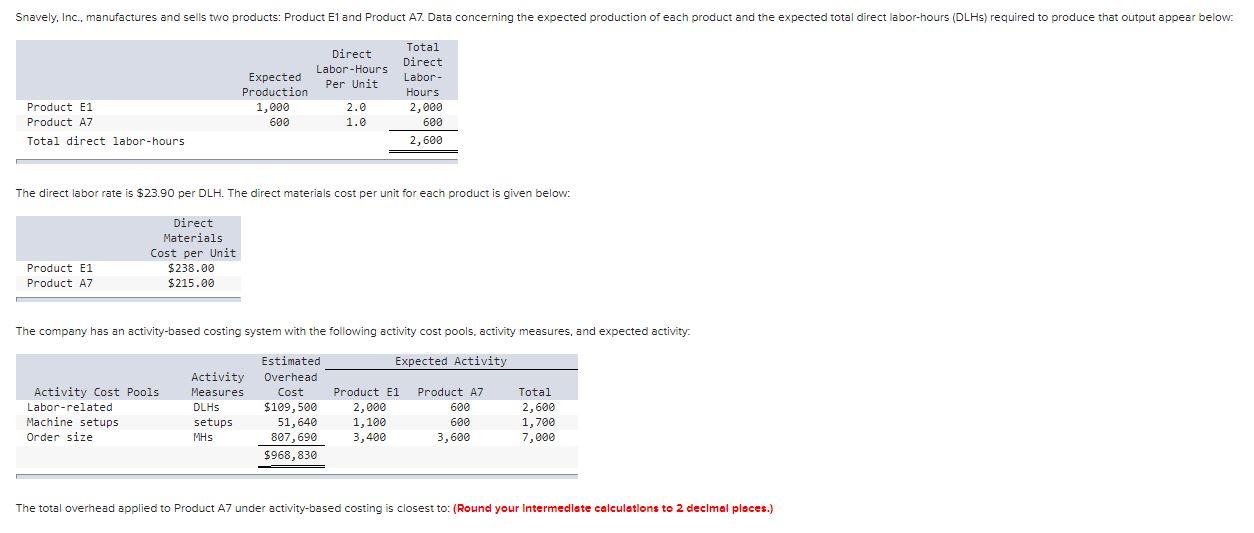

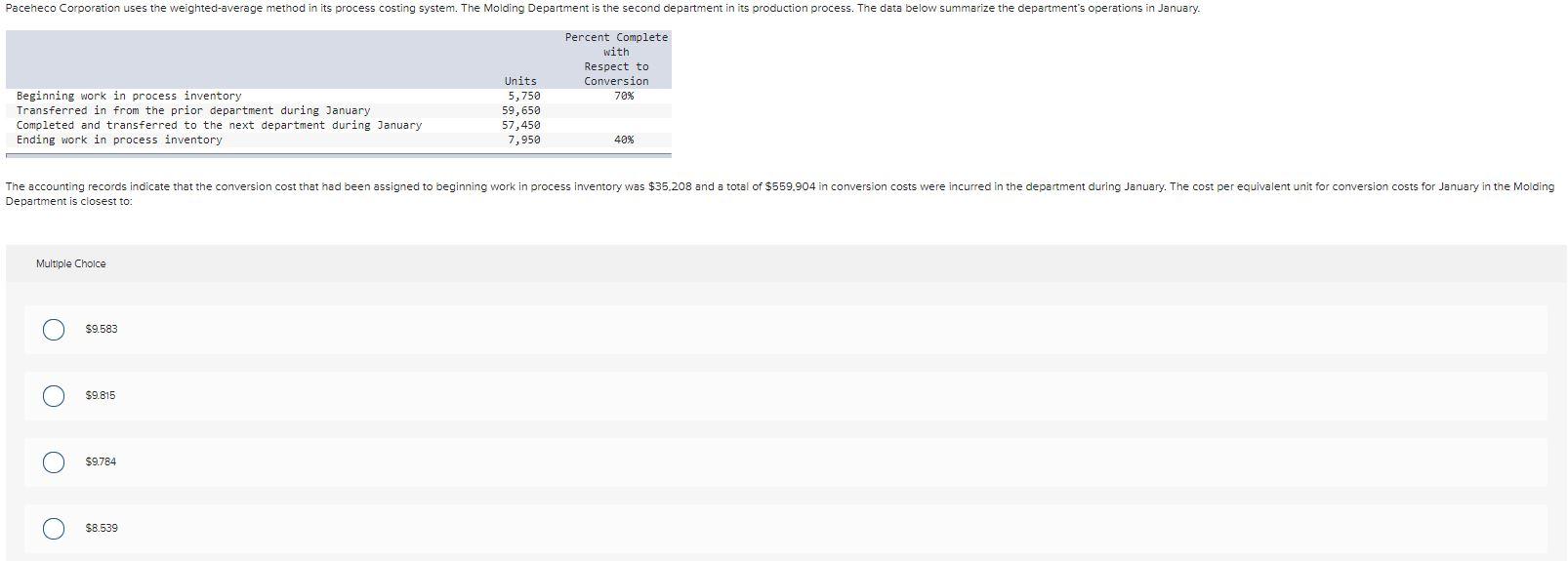

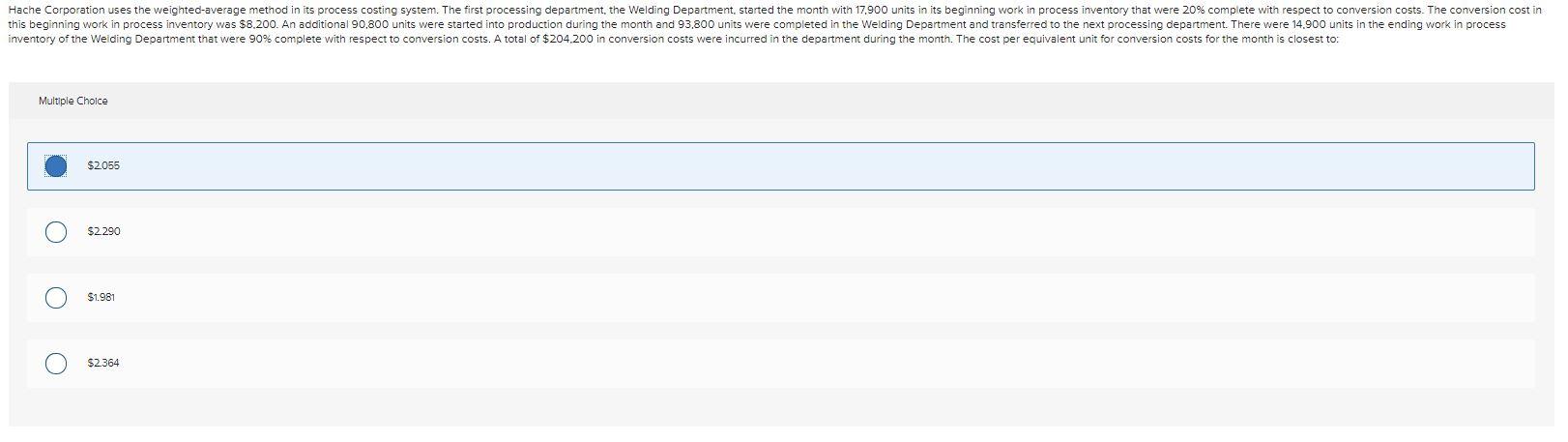

Olmo, Inc., manufactures and sells two products: Product KO and Product H9. The annual production and sales of Product of KO is 900 units and of Product H9 is 900 units. The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Activity Cost Pools Labor-related Production orders Order size Activity Estimated Expected Activity Measures Overhead Cost Product KO Product H9 DLHS $ 550,208 5,400 2,700 orders 53,219 1,000 600 MHS 835,816 3,100 4,000 $1,439,243 Total 8,100 1,600 7,100 The overhead applied to each unit of Product H9 under activity-based costing is closest to: (Round your Intermediate calculations to 2 decimal places.) Multiple Choice $203.79 per unit $749.16 per unit O $523.20 per unit O O $533.06 per unit Snavely, Inc., manufactures and sells two products: Product E1 and Product A7. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below. Direct Labor-Hours Per Unit Expected Production 1,000 600 Total Direct Labor- Hours 2,000 600 2,600 Product E1 Product A7 Total direct labor-hours 2.0 1.0 The direct labor rate is $23.90 per DLH. The direct materials cost per unit for each product is given below: Direct Materials Cost per Unit $238.00 $215.00 Product E1 Product A7 The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity Expected Activity Activity Cost Pools Labor-related Machine setups Order size Estimated Activity Overhead Measures Cost DLHs $109,500 setups 51,640 MHS 807,690 $968,830 Product E1 2,000 1,100 3,400 Product A7 600 600 3,600 Total 2,600 1,700 7,000 The total overhead applied to Product A7 under activity-based costing is closest to: (Round your Intermediste calculations to 2 decimal places.) Paceheco Corporation uses the weighted-average method in its process costing system. The Molding Department is the second department in its production process. The data below summarize the department's operations in January Percent Complete with Respect to Conversion 70% Beginning work in process inventory Transferred in from the prior department during January Completed and transferred to the next department during January Ending work in process inventory Units 5,750 59,650 57,450 7,950 40% The accounting records indicate that the conversion cost that had been assigned to beginning work in process inventory was $35,208 and a total of $559.904 in conversion costs were incurred in the department during January. The cost per equivalent unit for conversion costs for January in the Molding Department is closest to: Multiple Choice $9.583 O $9.815 O O $9.784 O $8.539 Hache Corporation uses the weighted-average method in its process costing system. The first processing department, the Welding Department started the month with 17,900 units in its beginning work in process inventory that were 20% complete with respect to conversion costs. The conversion cost in this beginning work in process inventory was $8.200. An additional 90,800 units were started into production during the month and 93.800 units were completed in the Welding Department and transferred to the next processing department. There were 14.900 units in the ending work in process inventory of the Welding Department that were 90% complete with respect to conversion costs. A total of $204.200 in conversion costs were incurred in the department during the month. The cost per equivalent unit for conversion costs for the month is closest to: Multiple Choice $2055 O $2290 $1.981 $2.364