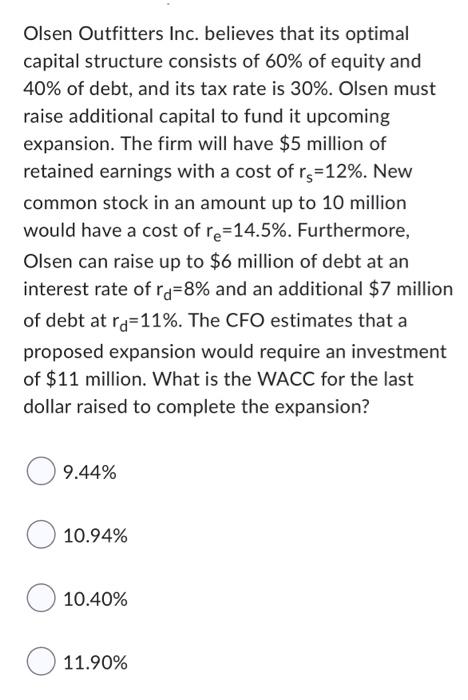

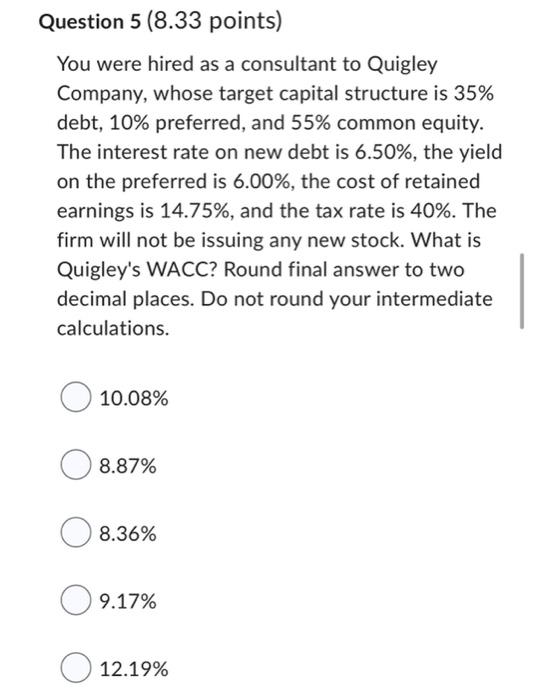

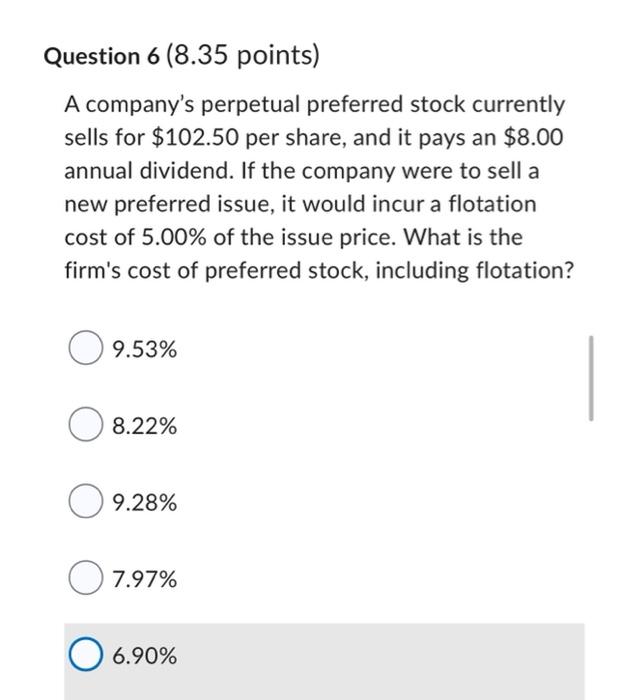

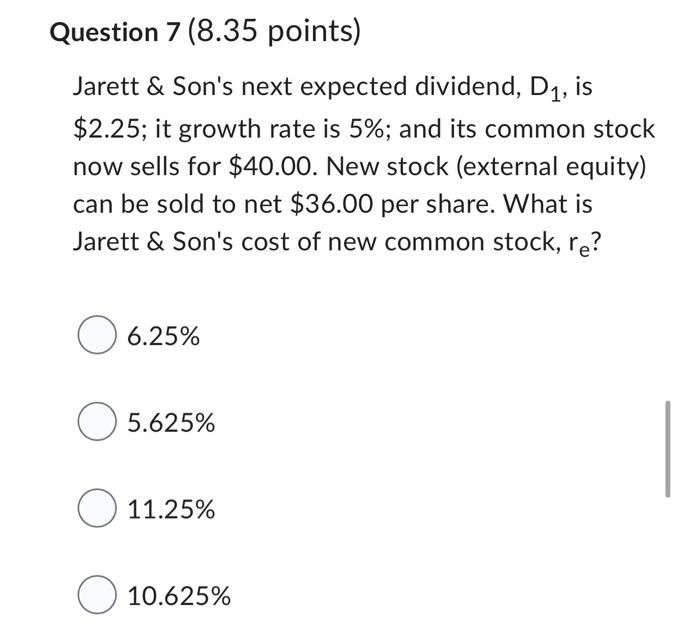

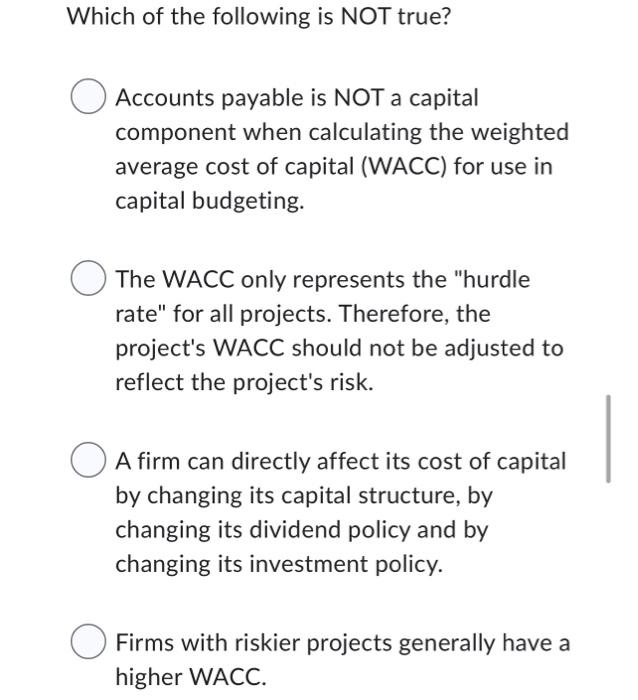

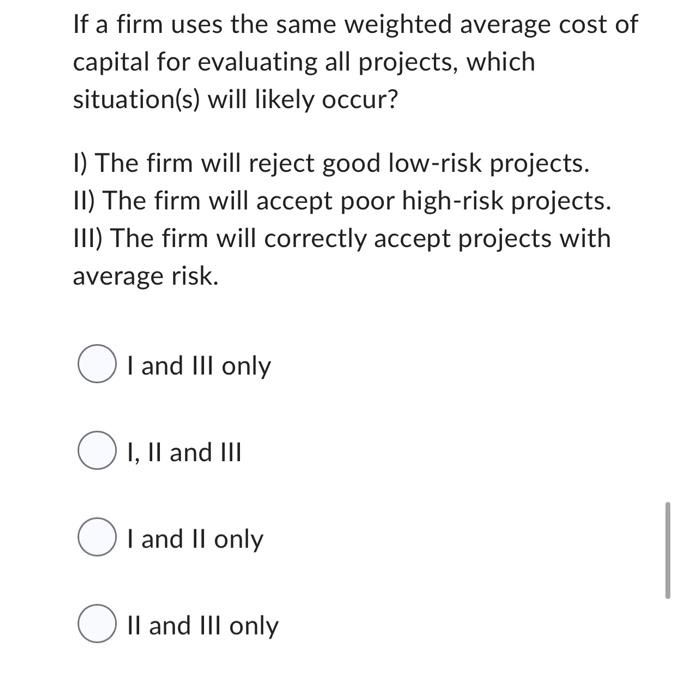

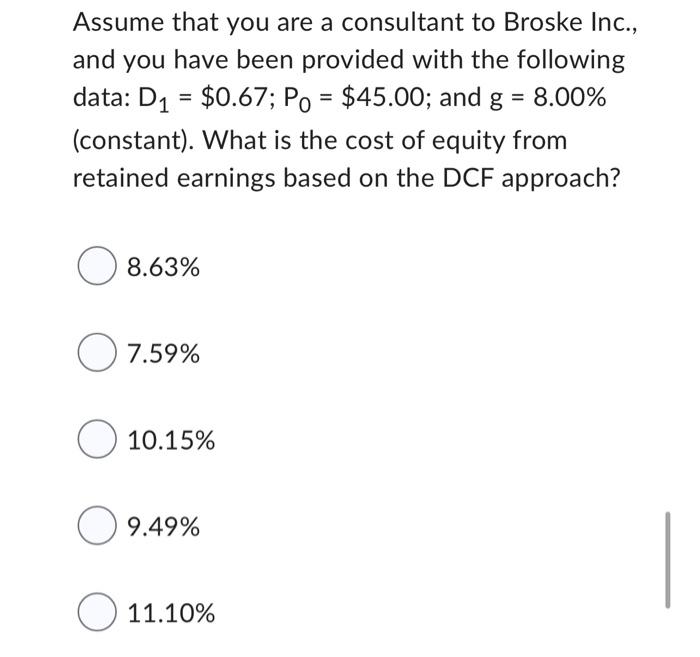

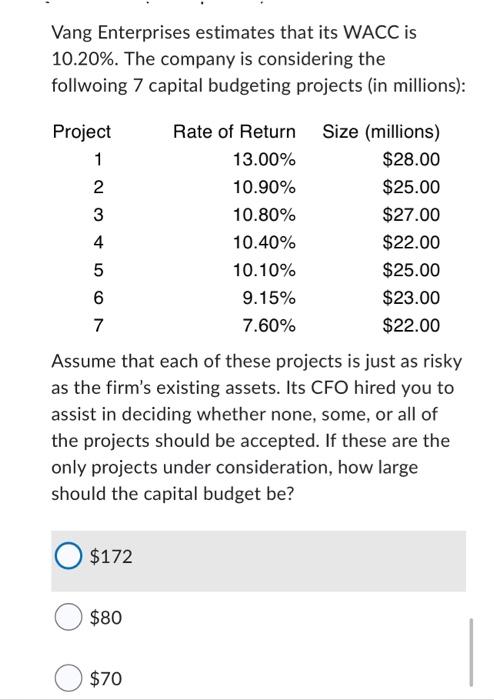

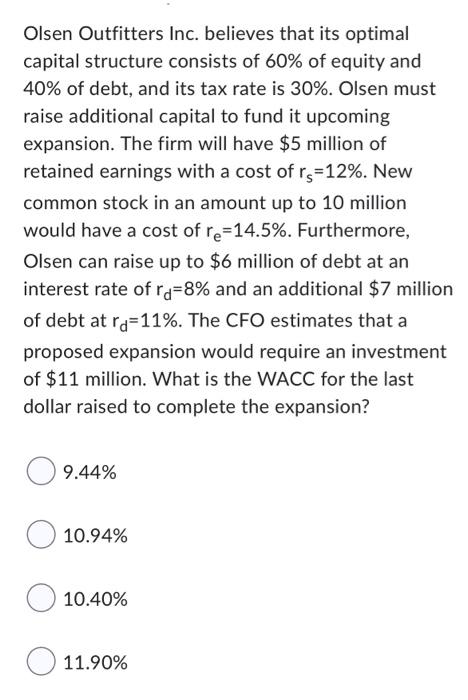

Olsen Outfitters Inc. believes that its optimal capital structure consists of 60% of equity and 40% of debt, and its tax rate is 30%. Olsen must raise additional capital to fund it upcoming expansion. The firm will have $5 million of retained earnings with a cost of rs-12%. New common stock in an amount up to 10 million would have a cost of re-14.5%. Furthermore, Olsen can raise up to $6 million of debt at an interest rate of r=8% and an additional $7 million of debt at rd=11%. The CFO estimates that a proposed expansion would require an investment of $11 million. What is the WACC for the last dollar raised to complete the expansion? 9.44% 10.94% 10.40% 11.90% Question 5 (8.33 points) You were hired as a consultant to Quigley Company, whose target capital structure is 35% debt, 10% preferred, and 55% common equity. The interest rate on new debt is 6.50%, the yield on the preferred is 6.00%, the cost of retained earnings is 14.75%, and the tax rate is 40%. The firm will not be issuing any new stock. What is Quigley's WACC? Round final answer to two decimal places. Do not round your intermediate calculations. 10.08% 8.87% 8.36% 9.17% 12.19% Question 6 (8.35 points) A company's perpetual preferred stock currently sells for $102.50 per share, and it pays an $8.00 annual dividend. If the company were to sell a new preferred issue, it would incur a flotation cost of 5.00% of the issue price. What is the firm's cost of preferred stock, including flotation? 9.53% 8.22% 9.28% 7.97% 6.90% Question 7 (8.35 points) Jarett & Son's next expected dividend, D, is $2.25; it growth rate is 5%; and its common stock now sells for $40.00. New stock (external equity) can be sold to net $36.00 per share. What is Jarett & Son's cost of new common stock, re? O 6.25% O 5.625% O 11.25% O 10.625% Which of the following is NOT true? Accounts payable is NOT a capital component when calculating the weighted average cost of capital (WACC) for use in capital budgeting. The WACC only represents the "hurdle rate" for all projects. Therefore, the project's WACC should not be adjusted to reflect the project's risk. A firm can directly affect its cost of capital by changing its capital structure, by changing its dividend policy and by changing its investment policy. Firms with riskier projects generally have a higher WACC. If a firm uses the same weighted average cost of capital for evaluating all projects, which situation(s) will likely occur? 1) The firm will reject good low-risk projects. II) The firm will accept poor high-risk projects. III) The firm will correctly accept projects with average risk. I and III only O I, II and III I and II only II and III only Assume that you are a consultant to Broske Inc., and you have been provided with the following data: D = $0.67; Po = $45.00; and g = 8.00% (constant). What is the cost of equity from retained earnings based on the DCF approach? 8.63% 7.59% 10.15% 9.49% O 11.10% Vang Enterprises estimates that its WACC is 10.20%. The company is considering the follwoing 7 capital budgeting projects (in millions): Project 1 2 3 4567 $80 Rate of Return Size (millions) 13.00% $28.00 10.90% $25.00 10.80% $27.00 10.40% $22.00 10.10% $25.00 $23.00 $22.00 Assume that each of these projects is just as risky as the firm's existing assets. Its CFO hired you to assist in deciding whether none, some, or all of the projects should be accepted. If these are the only projects under consideration, how large should the capital budget be? O $172 $70 9.15% 7.60% Olsen Outfitters Inc. believes that its optimal capital structure consists of 60% of equity and 40% of debt, and its tax rate is 30%. Olsen must raise additional capital to fund it upcoming expansion. The firm will have $5 million of retained earnings with a cost of rs-12%. New common stock in an amount up to 10 million would have a cost of re-14.5%. Furthermore, Olsen can raise up to $6 million of debt at an interest rate of r=8% and an additional $7 million of debt at rd=11%. The CFO estimates that a proposed expansion would require an investment of $11 million. What is the WACC for the last dollar raised to complete the expansion? 9.44% 10.94% 10.40% 11.90%